PJM’s Frequency Regulation Update: What Do the Changes Mean for Large Energy Users?

Today, PJM, North America’s largest grid operator covering DC and 13 states across the Mid-Atlantic and Midwest, updated the design of Frequency Regulation. Frequency Regulation is part of PJM’s ancillary services to maintain a precise balance between electricity generation and consumption on the grid’s transmission system.

Specifically, PJM’s Frequency Regulation program is available 24/7/365, and customers are rewarded for their ability to perform quickly and keep the grid steady at 60 hertz. When demand suddenly spikes or generation drops, PJM calls on CPower’s customers with flexible resources like batteries or quick-responding generators to respond quickly and restore balance. You can think of Frequency Regulation like a car’s shock absorber, smoothing out bumps on the electric grid. Because it requires fast response and precision, Frequency Regulation is one of the highest-value grid services available to energy users who can provide it.

What’s Changing with Frequency Regulation

As of Oct. 1, 2025, PJM is rolling out Phase One of its Frequency Regulation changes to streamline dispatch and reduce complexity for participants, shifting from two signals (RegA and RegD) to one merged bidirectional signal. Frequency Regulation will also shift from hourly to 30-minute offer intervals.

Looking ahead to Oct. 1, 2026, PJM will make further changes to the Frequency Regulation program with the implementation of one signal and two products: RegUp and RegDown. CPower will keep our customers informed as we get closer.

Turning Flexibility into Profit

PJM’s Frequency Regulation changes mean that the energy assets you already own, like batteries and quick-responding generators, can generate revenue with less operational complexity. The new rules streamline how resources are dispatched and put a premium on fast, accurate response, which plays directly to the strengths of a battery and other flexible technologies. It’s also a chance to turn grid support into more reliable revenue without significant changes to your operations.

Complexity Simplified with CPower’s EnerWise

CPower has updated its EnerWise platform to align with the latest changes from PJM, helping you maintain compliance and supporting your continued participation and success in PJM’s Frequency Regulation program. EnerWise helps you increase returns without any major changes to your operations or constraints. Our role is to make market participation easier, so you can focus on your core business while your assets generate value.

PJM’s Frequency Regulation updates are part of a broader trend: flexibility is becoming central to the future of the grid. As demand patterns shift, resources that can respond quickly will be increasingly valuable.

If you’re a DER project developer or a large energy user wanting to learn more about Frequency Regulation or other programs in PJM, please contact us.

PJM State of the Market Part 2: Combating PJM Capacity Price Hikes: Strategies to Earn Back On-Bill Costs in 2025

With demand response prices in PJM at record highs—and nine times more than just a year ago—stacking flexible programs pays faster and greater than peak demand management. In the Winter 2025 edition of our State of the Market webinar series, CPower’s energy experts explore the trends behind the surging prices. We’ll also share best practices for unlocking the maximum value of your energy under the current market conditions so you can earn money back before charges hit your bill.

PJM State of the Market: Understanding the Impact of PJM’s Soaring Capacity Prices and Market Shifts

In this PJM State of the Market webinar, CPower experts will explore the latest trends and dynamics across North America’s largest wholesale energy market to help large energy users make better decisions about their energy strategy:

The webinar will educate the industry on:

-

- What sky-high PJM pricing means for revenue potential for your facility;

- How to reduce your energy bill through demand response participation;

- Explanations around PJM’s new settlement methodology and why more C&I resources are needed to stabilize the grid;

- What industries are ripe to maximize revenue from demand response;

- How customers are looking at other ways to leverage their flexibility for a broader range of grid services and revenue streams; and

- Critical steps organizations can take today to secure optimal demand response returns in PJM.

Why wait? VPPs can help PJM now

This article first appeared on Utility Dive on Aug. 14, 2024. Click here to view.

Even though PJM’s capacity prices hit record highs for 2025-26, they could go even higher or remain elevated unless the grid operator’s generation capacity can catch up with its surging demand.

PJM Interconnection’s record-high capacity prices for next year may send a build signal to generators, but the nation’s largest grid operator needs more supply to meet accelerating demand growth now — and virtual power plants can help.

A cheaper and faster-to-market alternative than building generation, VPPs use existing distributed energy resources, including batteries, EVs, smart thermostats and other controllable devices and loads, to keep the lights on when the grid is stressed. In aggregating customer DERs and dispatching them together as VPPs, we can quickly and affordably balance the grid today, without the lengthy waits and large investments needed to build physical power plants.

Costly problem

PJM attributed its sharp increase in capacity prices — from $28.92/MW-day for 2024/2025 to $269.92/MW-day for 2025/26 — to generator retirements, increased electricity demand and market reforms, while some market observers put the onus on the grid operator. Advanced Energy United, for one, blamed poor planning and insufficient electric transmission build-out by PJM.

Whatever the cause, the challenge is real. Not only are generation resources retiring faster than their capacity is being replaced, but the projected peak load is rising, due largely to AI, data centers and EVs. In addition, the market is adapting to Federal Energy Regulatory Commission-approved regulations for improved reliability risk modeling for extreme weather and accreditation that more accurately values each resource’s contribution to reliability.

With multiple factors in play and no way to bring enough new generation online in the short term to ensure grid reliability in PJM’s next delivery year, we have little choice but to consider alternatives such as VPPs, which we can quickly stand up without building physical infrastructure, or which are located on the distribution system and can be connected sooner than through the PJM process.

Proven solution

While PJM has not avoided VPPs, it could do more with them, beginning by using demand response more than it does now. A key component in VPPs, demand response accounted for only 5% of the capacity that PJM has secured for next year, despite its dependability and history of improving grid reliability.

After all, it has not yet been two years since VPPs including demand response helped keep the lights on in PJM amidst widespread failures in its generation fleet. During Winter Storm Elliott in December 2022, reducing usage and keeping load down was key to avoiding blackouts. Almost a quarter of the grid operator’s generation capacity — 47,000 MW — was on forced outages at one point when temperatures plunged during the Christmas weekend.

Long a linchpin of grid operators’ handling of peak summer loads, demand response has become a year-round solution as extreme weather events like Winter Storm Elliott have become more common and severe. With a history of handling summer heatwaves as well as winter storms, demand response is critical to ensuring a reliable grid, according to a report about grid reliability challenges co-published by Wood Mackenzie and CPower. Thus, demand response should play a greater role in PJM’s capacity markets.

Energy efficiency

PJM should similarly embrace energy efficiency, contrary to recent efforts to end its participation in the grid operator’s capacity market. Like demand response, energy efficiency is an essential part of VPPs.

The grid operator’s independent market monitor, or IMM, filed a FERC complaint in July regarding energy efficiency in PJM. The IMM wrongly argued that “PJM has been paying the capacity market clearing price to EE resources that do not meet the definition of an EE Resource,” and therefore that PJM should stop payments to resources that allegedly do not meet its criteria for energy efficiency. Further, IMM urges that EE providers (and by implication, customers) should be forced to return past payments that PJM previously approved.

Not only is the IMM’s argument contrary to PJM’s approved tariff, but it is also wrong economically. PJM’s sharply higher capacity prices for 2025/26 clearly demonstrate the need for more diversification of resources in the market, not less.

Reliable future

Even though PJM’s capacity prices hit record highs for 2025/26, they could go even higher or remain elevated unless the grid operator’s generation capacity can catch up with its surging demand.

The 8.9% decline in total capacity offered by non-energy efficiency resources in PJM’s latest capacity auction, from 148,945.7 MW in 2024/2025 to 135,692.3 MW in 2025/2026, marked the fourth consecutive year-over-year drop. Meanwhile, the peak load forecast increased by 2.2% to 153,883 MW, and the grid operator’s overall reserve margin shrunk by almost two full percentage points, from 20.4% to 18.5%.

With a total cost to load of $14.7 billion for the next delivery year due to tighter supply relative to demand, customers in PJM can ill afford to be stuck with another big bill for capacity. Yet, they may well face a double whammy with the 2026/27 capacity auction set for December. Exelon has already warned of double-digit rate increases for some of its utility subsidiaries due to the results for 2025/26.

PJM has stated that much of the struggle to bring new generation online is beyond its control, noting that 38,000 MW of resources have cleared its interconnection queue but have not been built due to external challenges, including financing, supply chain and siting/permitting issues. Thus, even if PJM has more generation capacity in 2026 than in 2025, it will not be enough to bring prices down dramatically.

So, with great time and expense needed, even if generators react to the build signal sent by the recently released capacity prices for 2025/26, not enough will be built anytime soon. Therefore, the best solution, and perhaps the only one, is to quickly scale up VPPs that include demand response and energy efficiency resources.

We may need more power generation resources, but nothing says those resources must be large, central station grid-scale power plants. Sometimes smaller and more distributed is better.

PJM Capacity Prices Prove Need for VPPs

The sharp increase in PJM capacity prices for the grid operator’s next delivery year demonstrates the value of balancing supply and demand with existing resources.

Rising more than 800%, PJM capacity prices have reached record highs as North America’s largest wholesale electricity market grapples with tightening supply and escalating demand. Generator capacity is being retired faster than it is replaced, and demand growth is accelerating as electricity usage surges for artificial intelligence, data centers and electric vehicles.

Fortunately, we can quickly and affordably balance the grid today without the lengthy waits and large investments needed to build physical power plants. Virtual power plants (VPPs) that include grid services like demand response can supply capacity now by aggregating distributed energy resources (DERs) and dispatching them together.

VPPs offer a cheaper and faster-to-market alternative because they use existing, low-cost DERs, including batteries, EVs, smart thermostats and other controllable devices and loads, to keep the lights on when the grid is stressed. If we were to triple the current scale of VPPs in the U.S. to 80-160 GW by 2030, as the U.S. Department of Energy hopes, we could reliably support load growth such as that in PJM while avoiding $10 billion in annual grid costs.

VPPs Help the Grid

PJM’s total cost to load for 2025/26 is $14.7 billion, given that capacity prices rose to $269.92/MW-day from $28.92/MW-day for 2024/2025. The grid operator attributed the sharp increase to generator retirements, increased electricity demand and market reforms, including Federal Energy Regulatory Commission (FERC)-approved regulations for improved reliability risk modeling for extreme weather and accreditation that more accurately values each resource’s contribution to reliability.

Such factors are not limited to PJM. Grid operators across the country struggle to balance supply and demand, particularly during critical conditions like extreme weather.

For example, in its 2024 Summer Reliability Assessment, the North American Electric Reliability Corporation warned that markets served by the Midcontinent Independent System Operator (MISO), ISO New England and Electric Reliability Council of Texas (ERCOT) could face summer electricity shortages in extreme summer conditions. When pressed in such instances, grid operators and utilities can use flexible customer DERs for handling grid disruptions.

With extreme weather such as heatwaves increasingly severe and frequent, VPPs can multiply the benefits of DERs by aggregating and dispatching them across types, customers and locations. VPPs including demand response have proved to be a reliable resource during grid emergencies year-round.

Customers Benefit from VPPs

VPPs also provide value for energy users who help the grid with their DERs. Customers can earn revenue, reduce energy costs and help the environment.

There are increasingly more opportunities for customers to benefit, and the potential rewards are growing as well. While grid operators have long relied on large energy users like commercial and industrial customers to reduce their loads during emergency conditions by paying them to participate in capacity markets, today’s grid must adapt to shifts in supply or demand more frequently and quickly to remain balanced and avoid blackouts.

This increasing need for flexibility shows up in all services that grid operators now use—including energy, capacity, ancillary services and bespoke programs. Although ancillary services alone rarely make economic sense for customers, once they’re participating in capacity, it often makes sense to add on ancillary services to increase rewards.

Flexible participation programs require customers to react more frequently than in the emergency capacity markets, but they can earn additional revenue streams by participating. Industries with larger, more flexible loads are particularly well suited to earning more money from flexible participation.

For example, big-box retailers with multiple sites in multiple states can widely help the grid with their flexible loads, like by adjusting their lighting or HVAC systems without interrupting operations or inconveniencing customers or employees.

Flexible interruptible computing loads are also valuable, including those for data centers, crypto miners and AI loads. Whatever the industry, the most flexible of demand response programs reward customers with more revenue for curtailing their resources in reaction to grid needs in seconds, not hours.

So, while capacity prices in PJM surge and other grip operators similarly struggle to balance rapidly changing supply and demand, existing customer DERs can efficiently improve grid reliability. Embracing VPPs saves money for grid operators, provides revenue for customers and delivers clean, affordable and more reliable energy for all.

To learn more about VPPs and how CPower can help you monetize your energy assets while supporting sustainability, improving grid reliability and increasing energy resiliency, call us at 844-276-9371 or visit CPowerEnergy.com/contact.

Seasonal Readiness 2024

Seasonal Readiness 2023

Succeeding in Demand Response in 2023 – New Year Brings New Opportunities for PJM Businesses

Join experts from CPower as we give insight into how your site can maximize energy revenue and on bill savings while receiving advance notification of potential grid emergencies and assisting with your site’s resiliency. You’ll leave the webinar with real-world examples of how businesses are being rewarded for their sustainability and resiliency initiatives and ways to automatically identify and execute the most efficient energy management strategies across the DR programs available to you.

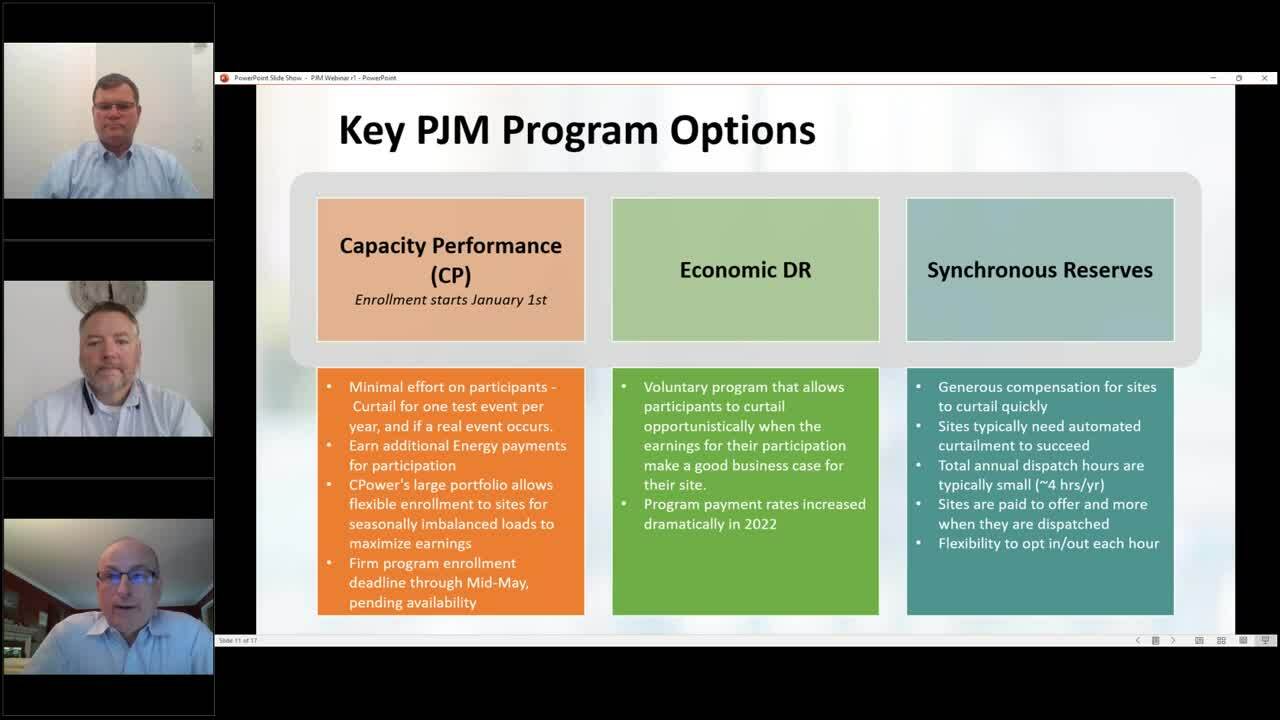

The Increased Need for Flexibility in PJM

There has never been a better time for commercial & industrial businesses with flexible capacity to provide relief to the grid in PJM. Learn how businesses are being rewarded for their sustainability and resiliency initiatives. In this webinar, CPower’s experts examine the PJM energy landscape, explain how you can generate revenue and offer real-world examples of how C&I organizations in PJM are capturing new energy value streams.