Our Blog On-Demand

Content

Knowledge Hub

Knowledge Hub

*This article first appeared on Environment+Energy Leader on Feb. 25, 2025. Click here to view.

As a blast of Arctic air swept through the U.S. on Jan. 22, PJM’s winter electricity demand reached an all-time high of 145,000 MW, breaking its 2015 record. The new record may not last 10 years though, as extreme cold and disruptive winter storms, from Uri (2021) to Elliott (2022), to Enzo (2025), have become the new norm in the U.S., increasing demand for electric heating and straining the grid when supply falters.

As our national demand for electricity surges and extreme weather intensifies, we can expect to see more winter consumption records, like that of PJM’s, broken in the coming years. We could also experience dangerous blackouts if we don’t improve the grid’s ability to handle ever-greater peaks in demand.

Intense winter weather further strains an aging grid that is already struggling to keep up with demand as utilities and grid operators retire near-end-of-life generation resources faster than they bring replacement generation online. When winter storms topple power lines and disrupt generation resources, the grid’s capacity is stretched even thinner, and this can result in higher energy costs and potentially dangerous outages when temperatures plummet.

Just a few months before experiencing its record-setting winter demand in January, PJM had expressed concern about maintaining adequate supply if extreme weather conditions were to persist this winter.

Winter grid strategies must evolve beyond the playbook of centralized generation if we are to guard against interruptions in supply as demand surges. This evolution has begun with the rise of distributed energy resources such as onsite generation and variable load (DERs), but we can—and should—do more to strengthen the grid with the DERs available to us now.

Virtual Power Plants (VPPs) offer a perfect solution due to their immediate availability and unique flexibility. A cost-efficient way to balance the grid with existing DERs, VPPs have emerged as an increasingly valuable resource for making the grid more resilient, regardless of the season.

Traditionally focused on meeting peaks only on the hottest summer days, utilities and grid operators now grapple with surging demand year-round. As weather patterns shift, the grid faces vulnerabilities from extreme cold and winter storms as well as heat waves and triple-digit temperatures.

VPP operators can cheaply and efficiently reduce consumption during any period of peak demand by aggregating DERs and collectively dispatching hundreds and thousands of megawatts of distributed energy from customer variable loads and onsite generation resources and batteries.

This decreases the reliance on gas peaker plants, which have been shown to cost 40% more than a VPP and are at risk of failing during extreme cold due to mechanical problems, fuel supply issues, downed trees, or heavy snow bringing down power lines and transformers. By eliminating the reliance on peakers, utilities can pass cost savings to customers, driving down energy bills.

Furthermore, customer-powered VPPs are an immediate way to maintain a consistent and reliable energy supply when the traditional grid is struggling to accommodate demand growth in winter weather conditions. Because of their inherent flexibility, VPPs can adjust to meet fluctuations in supply or demand. They can also be deployed locally where they’re most needed during emergencies.

VPPs have rescued the grid in previous winters. On Christmas Eve 2022, customer-powered VPPs helped prevent blackouts in the Northeast and Mid-Atlantic regions during Winter Storm Elliott. The Texas grid operator, ERCOT, has similarly turned to them for help, using the integration of VPPs and an increase in renewable energy to improve its preparations for major winter weather, after Winter Storm Uri devasted the state in 2021, leaving 4.5 million residents and businesses without power.

As pressure on grids mounts nationwide, these examples serve as blueprints for other regions to follow in leveraging VPPs to strengthen the grid’s ability to handle extreme weather.

As winter storms grow in frequency and strength, our power infrastructure weakens with age and wear. Meanwhile, the full extent of demand growth has yet to be realized. Therefore, we need innovative, flexible strategies to take us reliably into tomorrow.

One of the most flexible strategies, VPPs are an affordable and adaptable solution for managing demand response during summer and winter months and integrating DERs into the grid at any time.

Most importantly, while infrastructure upgrades and large-scale power plants will take years to deploy, VPPs can bridge the gap between our aging grid and the modern, resilient energy grid of the future.

With winters growing more severe, VPPs are ready to improve resilience.

Michael Smith is an innovative leader with more than 25 years leadership experience in the energy industry. Michael joined CPower from ForeFront Power, where he was the CEO of the company’s North American solar and energy storage business, responsible for strategy and all business areas across the U.S. and Mexico.

The energy industry faces uncertainty as 2025 draws near but key trends and issues provide some predictability.

For instance, as in 2024, demand for electricity will accelerate while generation capacity constricts. As a result, virtual power plants and other immediately available sources of clean, affordable and reliable energy will continue to expand as new generation is built.

Recognizing the importance of planning ahead to stay ahead, The Current asked CPower executives Mathew Sachs and Ken Schisler for their thoughts on the energy trends to watch in 2025. Their responses have been edited here for clarity and conciseness.

Mathew Sachs (Senior Vice President, Strategy & Product):

If it takes too long to improve the rules for VPPs or interconnections or fill in the blank with anything else that has a chance to solve our problems, the grid could move towards less-than-ideal states.

Customers in other countries are already going off the grid entirely because they don’t feel they can trust their grid and we’re starting to see that here in the U.S. too, like with data centers. Or maybe people will lose trust in the free markets and deregulated states could go back to regulated with vertically integrated utilities. So, we should focus on reducing the friction that could lead to suboptimal outcomes by making it too hard for things to work, whatever that reason may be.

Ken Schisler (Senior Vice President, Law & Policy):

Roadblocks that were erected by the regional transmission organizations (RTOs) and independent system operators (ISOs) in their efforts to facilitate participation by distributed energy resources (DERs) under FERC Order 2222 will become evident and participation will be slow.

Although you may hear that DER participation models have been approved and implemented and that participation will be starting in the next year or two, the fact is that those models are far from being perfect and fulfilling FERC’s vision. And because the RTOs’ and ISOs’ implementation of Order 2222 have fallen well short of that vision for promoting participation in VPPs, the impacts will start to be seen.

Sachs: The #1 driver for VPPs is going to be load growth driven by computing load for AI and data centers. AI is like a modern-day Manhattan Project. It’s the U.S. versus the rest of the world, particularly China. Maybe the federal government will even get involved in ensuring there is enough power for AI.

Wherever the supply comes from, we will have to deal with transmission and distribution constraints within the existing grid infrastructure. However, we can’t rapidly build out infrastructure, so we’re going to have to rely on resources we already have in the near-term. That means turning to VPPs, which can meet increases in demand now.

Schisler: Improving access to data is a key enabler of growth that is often overlooked in VPP deployment. However, data access issues have become a federal and state concern. The more that states and the Federal Energy Regulatory Commission (FERC) do to make data accessible, the more scalable VPPs will be across the country.

States such as California, Illinois and Texas have become smarter about how to give customers access to their electricity data, but it needs to be architected into systems if we are to scale. We need the ability to query 500 accounts at once instead of using unique logins for every individual customer, for example.

It’s not just a matter of making it seamless for the customer. It’s about making it seamless for energy agents too.

Sachs: Everywhere I go, the number one talking point is how data centers are driving demand growth. There will be a particular focus on making sure we stay competitive with the Chinese on AI and don’t get hampered by a scarcity of power.

Schisler: Heavy industrial makes up a significant part of U.S. load and will be an important part of national energy strategy under the new president. For, an energy strategy geared toward increasing the global competitiveness of America’s manufacturing industry may include allowing manufacturers to make their flexible loads available in electricity markets. Leveraging their flexible loads would make them more efficient and be vital to re-energizing our country’s manufacturing base.

Sachs: As much as the consumer doesn’t want electricity prices to go up, they really don’t want their grid going down—and one of those two things happening is inevitable. Higher prices signal a need for more generation and there could be a major grid failure in 2025 if we don’t take significant steps to maintain reliability amidst increasing demand.

Schisler: I expect to see electricity prices rising in the next year and then over the next several years as increasing demand from new sources of load like data centers and AI outstrips the ability to build the generation resources and transmission needed to keep up.

Schisler: If grid operators don’t fix their problems, politicians will and they’re paying attention. We saw it in the past in Texas when the leaders of its grid operator, its board members and the commissioners of the state’s regulatory board all resigned after widespread power outages during Winter Storm Uri a few years ago.

Now, governors of several states in PJM have called upon the grid operator to help cut costs because they worry about soaring electricity prices impacting consumers. Meanwhile, across the country, the governor of California has signed an executive order to curb rising costs for consumers there, like by trimming state programs that could be inflating electricity bills.

When prices get out of control, politicians will do something to change it up.

To learn more about VPPs and how CPower can help you monetize your energy assets while supporting sustainability, improving grid reliability and increasing energy resiliency, call us at 844-276-9371 or visit CPowerEnergy.com/contact.

We’re excited to have our technology partner Lithion Battery contribute this guest column for The Current.

Large energy users like commercial and industrial customers have long benefited from backup batteries that have kept their operations running when the grid goes down or electricity prices go up. Way up.

However, C&I customers, governments, hospitals and other large energy users can do more with energy storage. When energy users tie behind-the-meter batteries into virtual power plants (VPPs), they earn revenue while helping keep the lights on in their communities.

VPPs prevent power outages by balancing supply and demand with dispatchable distributed energy resources (DERs) such as batteries, which can quickly increase or decrease the power supplied or consumed when the other shifts. For example, customers can use battery energy storage systems from Lithion to make and save money by providing grid services through CPower, which is the nation’s largest VPP operator.

Batteries and other DERs are increasingly important—and valuable—as grid operators struggle to supply enough electricity to keep up with accelerating demand.

Demand for electricity has never been higher and continues to reach new heights. The drivers of the increase, like new data centers and adoption of electric vehicles, are expected to persist for decades to come. So much so that the DOE’s recent VPP Liftoff Report forecasts peak demand to grow by over 60,000 MW by 2030 alone.

Peak demand occurs during the periods when energy consumption is at its highest and is at least partially served by power plants built to supply power during just peak periods. Power from these “peaking plants,” which run less than 15% of the year, comes at a much higher cost than electricity generated by baseload power plants that usually run over 90% of the time.

In addition to driving up electricity costs, peaker plants require significant time and money to build, meaning they alone cannot alleviate the strain that surging demand growth is exerting on existing grid assets. We need significant deployment of energy storage and other demand side solutions.

Rapid growth in peak demand is especially difficult to manage for utilities and system operators and drives higher power prices during peak periods. Energy is priced in real time within wholesale markets and when demand outpaces supply, prices increase.

These fluctuations are often significant, especially during periods when heating or cooling demands are highest. This volatility creates a large difference in power pricing between peak and off-peak periods and is especially impactful to customers in deregulated energy markets (i.e., summers in Texas or winters in the Northeast).

However, the ability to shift demand around peak and off-peak pricing periods can create massive value for both utilities and energy consumers—and batteries in particular unlock this value. Unlike intermittent on-site generation like solar energy, batteries give utilities and consumers complete control of the flow of energy.

They also allow maximum flexibility around charge and discharge periods versus other storage resources like electric vehicles. And they impact consumers less by maintaining energy levels to the site versus demand curtailing options like smart thermostats.

Energy storage has always been used to create resiliency and increase reliability of the grid. At the outset of the electricity industry, energy storage was reliant on geographical factors, like hydro power or mechanical features of power plants, like flywheels. Rechargeable chemical batteries like lead acid have existed for over 150 years. However, their low energy density and power could not meet the demands of large-scale energy storage. Only with the advent of lithium batteries did large scale energy storage make practical sense. The higher energy density of lithium decreased the space requirements and lowered long-term costs which made battery storage a viable solution.

Lithium Iron Phosphate (LFP) batteries, like those incorporated into Lithion Battery’s HomeGrid residential storage and GridBox commercial and industrial storage products are generally considered the best battery chemistry for energy storage systems (ESS). This is due to multiple factors including their high-cycle life and safety features, cost effectiveness, and other environmental benefits based on readily available materials. The modularity of Lithion’s batteries also allows consumers to scale systems up or down to maximize their benefit.

Batteries have multiple grid benefits when installed in various applications. Installations can generally be categorized as either in-front-of-the-meter by utilities or power producers or behind-the-meter, which lie on site with customers.

Front-of-the-meter batteries are installed by utilities or independent power producers and tied to power plants or transmission lines. These batteries are meant to optimize the grid assets they are tied into.

Renewable power resources like solar and wind are intermittent generators. Batteries allow the smoothing of that supply by shifting demand to pull from the stored energy when wind and solar aren’t producing. Batteries installed at transmission and distribution nodes can allow quicker balancing, minimize transmission losses and provide voltage control. Even fossil fuel plants can benefit from battery storage by providing supply coverage during the time it takes to ramp up facilities and allow plants to operate at capacities where efficiency is maximized.

Being that front of meter storage is tied directly into the grid, there are potential security concerns around foreign-made batteries in the US. In response to these concerns and the growth of the energy storage market, Lithion Battery has built a facility with 2GWh of battery manufacturing capacity in Henderson, NV to provide US made batteries to customers when system or grid security is a concern.

Behind-the-meter batteries are installed at customer sites as either standalone backup power, or when accessible by a utility or aggregator as part of a Virtual Power Plant (VPP). Behind-the-meter batteries are installed on a customer electrical supply panel and not tied directly into the grid. When not tied into a VPP, batteries allow customers to peak shave (decrease consumption during expensive “peak” times) and provide backup power during outages.

Again, while these alone are beneficial, the greatest value of the stored energy is unlocked when aggregated into a VPP. Aggregation of many distributed resources allows electricity consumers to participate in several incentive programs being offered by utilities and system operators across the country. Batteries can maximize returns by making energy available for both demand response and other ancillary services sold into wholesale energy markets.

Although backup power is a good beginning, more value is to be had in VPPs.

Commercial and industrial energy users in Arizona can earn revenue and reduce costs while helping the people in their communities keep cool amidst sweltering summers.

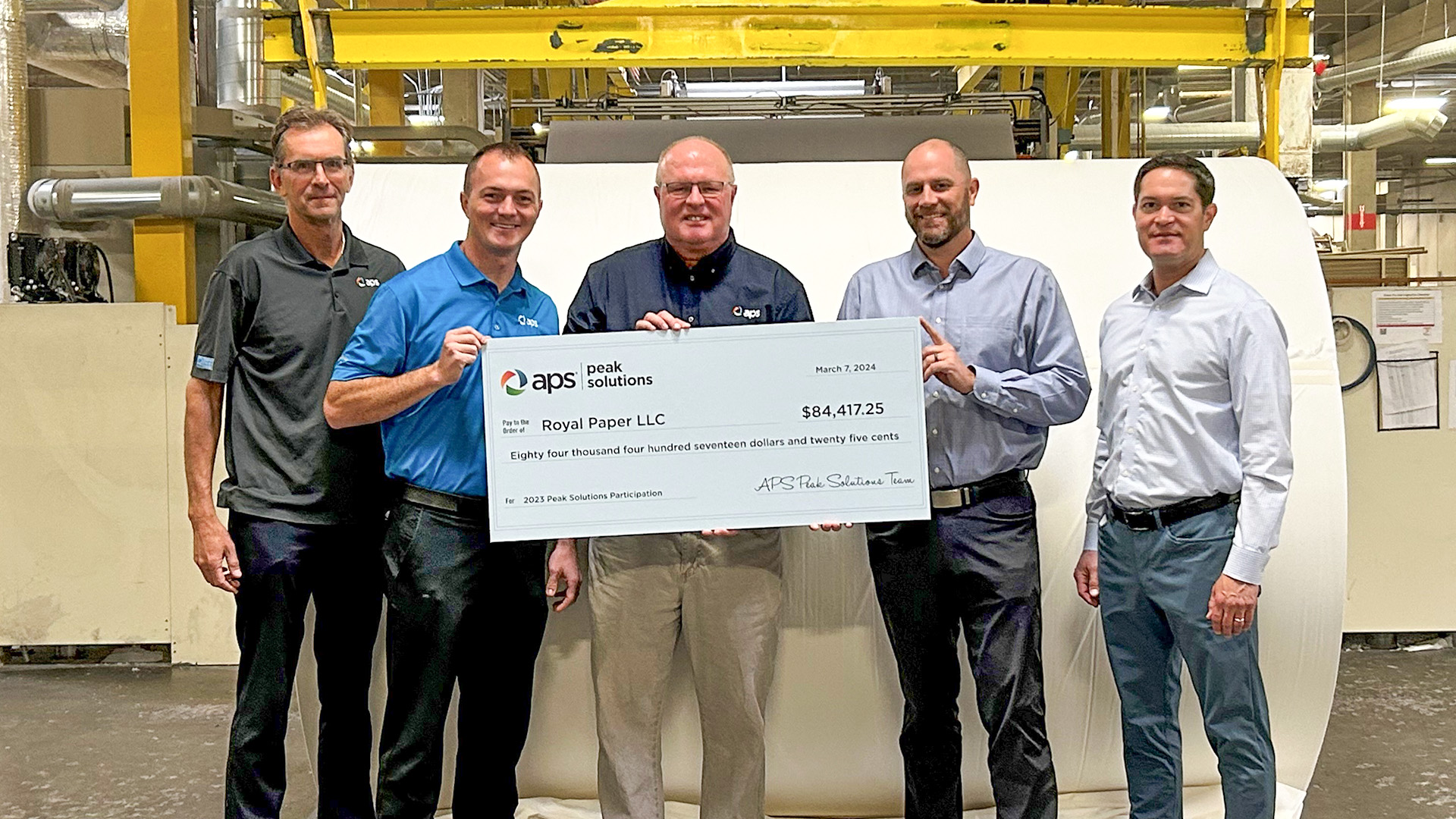

The APS Peak Solutions program available through CPower rewards customers for conserving electricity when the power grid is stressed. Customers earned more than $870,000 during the 2023 program season.

“This is a no-out-of- pocket cost program in which we incentivize APS business customers to reduce electrical usage to relieve strain on the grid periodically. You never get a bill from CPower for participating in the program,” said Matthew Pool, Account Executive for CPower.

Nationwide, CPower has distributed more than $1 billion to customers nationwide since 2015.

For APS, CPower recently presented Royal Paper with a check for nearly $85,000 for its participation in the APS Peak Solutions program last summer. In total, Royal Paper has earned over $230,451 since 2021 by voluntarily implementing energy conservation measures when demand peaks on the power grid.

The APS Peak Solutions program pays business customers to reduce electrical usage when asked between June and September. The electrical load reduction strategies are always at the customer’s discretion.

For example, Royal Paper reduces its production load when called, participating in the Day Ahead option, meaning it is notified by noon the day before an electrical demand response ‘event.’

Commercial and industrial customers that participate in the APS Peak Solutions program are good neighbors as well. Not only do they help maintain affordable, reliable power for all customers, but by reducing their loads businesses reduce the need to use carbon-emitting, fossil-fuel-powered peaker plants to meet demand peaks.

They further their own sustainability goals by participating in demand response as well, thereby further helping the environment and their communities. They also advance APS’s commitment to 100% clean, carbon-free electricity by 2050.

A leader in delivering affordable, clean, and reliable energy in the Southwest, APS serves approximately 1.4 million homes and businesses across 11 of Arizona’s 15 counties. APS launched the Peak Solutions program in 2010, and it is open to customers who can reduce at least 10kW of flexible load. All industries are eligible.

Customers need to partake in a test event. Enrollments can be adjusted monthly during the summer season and may vary for weekdays, weekends and holidays.

If you would like to learn more about how to earn revenue, reduce costs and help your community by participating in the APS Peak Solutions program offered through CPower, visit APS Peak Solutions Program – CPower Energy. You can also contact CPower online or at 844-276-9371 for a no-cost facility assessment and earnings estimate today.

We’re excited to have our technology partner 75F contribute this guest column for The Current.

Buildings are the fourth leading cause of greenhouse gas emissions worldwide, with HVAC systems accounting for about half of a building’s energy use. While technology to make HVAC more energy efficient exists, most buildings aren’t using it.

The reason? Traditional building management systems are offline, complicated and expensive, putting them out of reach for many commercial building owners.

According to the U.S. Energy Information Administration’s Commercial Buildings Energy Consumption Survey (CBECS), over 99% of commercial buildings in the U.S. are smaller than 200,000 square feet and 85% do not use automation.

This absence of smart technology isn’t due to a lack of interest in energy efficiency. Rather, it’s because sophisticated building controls have traditionally been the domain of large facilities with substantial budgets and dedicated technical staff.

The Game-Changer: Cloud-Native Building Automation

Enter cloud-native building automation — a technology that’s commonplace in our homes but has yet to see widespread adoption in commercial spaces. This innovative approach is poised to revolutionize how we manage and optimize building energy use, helping businesses, communities and the environment.

Unlike traditional building management systems that rely on complex, wired infrastructures, cloud-native solutions leverage wireless technology and the power of cloud computing, making them well-suited for smaller and mid-sized commercial buildings. Key features include:

At the core of these systems lies digital twin data adhering to industry standards. This standardization unlocks the potential for accurate and actionable real-time information, seamless integration with other systems and AI implementation.

Combining clean data and AI makes sophisticated building management accessible to a much wider audience, breaking down the barriers of expertise and technical knowledge that have long frustrated users and limited widespread adoption.

Decarbonization will become democratized as automated building management systems that make HVAC more energy efficient become more common, particularly among the 85% of smaller and mid-size commercial buildings that now lack automation.

For example, more businesses will have the power to reduce emissions through automated demand response via participation in virtual power plants (VPPs), where they automatically curtail their load to ensure there is enough electricity supply to meet demand without firing up fossil-fuel-powered peaker plants.

The advanced controls available in cloud-native building automation make participation in VPPs and demand response easier because the facility’s systems automatically respond to requests to conserve electricity, by imperceptibly dimming lights or adjusting temperatures by a few degrees without occupants noticing.

Tangible Benefits to Building Owners and Operators

The features of cloud-native building automation also translate directly into tangible benefits for building owners, including earning and saving money with automated demand response. By participating in VPPs including demand response, building owners can capitalize on incentives that grid operators and utilities offer customers to use less electricity when the grid is stressed.

The tangible benefits begin with the simplified installation process, which thanks to wireless mesh networks and pre-programmed control sequences significantly reduces upfront costs and installation time. This means less disruption to daily operations and a quicker path to reaping the benefits of smart building management.

Also, the cloud-based nature of the technology allows for real-time monitoring and adjustments, leading to rapid optimization of energy use. Building owners often see a quick return on investment, with energy savings accruing from day one.

Additionally, the predictive capabilities of these systems can preemptively address comfort issues, eliminating hot and cold spots before occupants even notice them. This proactive approach to comfort management not only improves the occupant experience but can also lead to increased productivity in office spaces and higher customer satisfaction in retail or hospitality environments.

The AI capabilities of cloud-native systems are a significant leap forward in building management as well. Imagine managing your building’s energy use through simple voice commands — adjusting temperatures, analyzing data, and optimizing performance with unprecedented ease.

With user-friendly interfaces and AI assistants capable of responding to voice commands, building owners no longer need to rely on specialized technicians for every adjustment or analysis. This empowerment leads to more responsive and efficient building operations.

Perhaps most importantly, cloud-native systems future-proof buildings against evolving energy regulations and market demands, creating grid-interactive efficient buildings that the U.S. Department of Energy envisions operating dynamically with the grid to make electricity more affordable while meeting the needs of building occupants.

As sustainability becomes increasingly important to tenants and regulators alike, buildings equipped with flexible, updatable cloud-native building management systems are well-positioned to adapt and comply with new requirements without the need for costly hardware overhauls.

So, not only is cloud-native building automation democratizing our approach to decarbonization by making sophisticated tools accessible to properties of all sizes, but it is also ushering in a new era of energy management in commercial buildings.

In this future, benefits like energy savings, demand response revenue, operational flexibility, improved occupant comfort and future-readiness in an evolving energy landscape will be accessible to the many not the few.

This article first appeared on Utility Dive on Aug. 14, 2024. Click here to view.

Even though PJM’s capacity prices hit record highs for 2025-26, they could go even higher or remain elevated unless the grid operator’s generation capacity can catch up with its surging demand.

PJM Interconnection’s record-high capacity prices for next year may send a build signal to generators, but the nation’s largest grid operator needs more supply to meet accelerating demand growth now — and virtual power plants can help.

A cheaper and faster-to-market alternative than building generation, VPPs use existing distributed energy resources, including batteries, EVs, smart thermostats and other controllable devices and loads, to keep the lights on when the grid is stressed. In aggregating customer DERs and dispatching them together as VPPs, we can quickly and affordably balance the grid today, without the lengthy waits and large investments needed to build physical power plants.

PJM attributed its sharp increase in capacity prices — from $28.92/MW-day for 2024/2025 to $269.92/MW-day for 2025/26 — to generator retirements, increased electricity demand and market reforms, while some market observers put the onus on the grid operator. Advanced Energy United, for one, blamed poor planning and insufficient electric transmission build-out by PJM.

Whatever the cause, the challenge is real. Not only are generation resources retiring faster than their capacity is being replaced, but the projected peak load is rising, due largely to AI, data centers and EVs. In addition, the market is adapting to Federal Energy Regulatory Commission-approved regulations for improved reliability risk modeling for extreme weather and accreditation that more accurately values each resource’s contribution to reliability.

With multiple factors in play and no way to bring enough new generation online in the short term to ensure grid reliability in PJM’s next delivery year, we have little choice but to consider alternatives such as VPPs, which we can quickly stand up without building physical infrastructure, or which are located on the distribution system and can be connected sooner than through the PJM process.

While PJM has not avoided VPPs, it could do more with them, beginning by using demand response more than it does now. A key component in VPPs, demand response accounted for only 5% of the capacity that PJM has secured for next year, despite its dependability and history of improving grid reliability.

After all, it has not yet been two years since VPPs including demand response helped keep the lights on in PJM amidst widespread failures in its generation fleet. During Winter Storm Elliott in December 2022, reducing usage and keeping load down was key to avoiding blackouts. Almost a quarter of the grid operator’s generation capacity — 47,000 MW — was on forced outages at one point when temperatures plunged during the Christmas weekend.

Long a linchpin of grid operators’ handling of peak summer loads, demand response has become a year-round solution as extreme weather events like Winter Storm Elliott have become more common and severe. With a history of handling summer heatwaves as well as winter storms, demand response is critical to ensuring a reliable grid, according to a report about grid reliability challenges co-published by Wood Mackenzie and CPower. Thus, demand response should play a greater role in PJM’s capacity markets.

PJM should similarly embrace energy efficiency, contrary to recent efforts to end its participation in the grid operator’s capacity market. Like demand response, energy efficiency is an essential part of VPPs.

The grid operator’s independent market monitor, or IMM, filed a FERC complaint in July regarding energy efficiency in PJM. The IMM wrongly argued that “PJM has been paying the capacity market clearing price to EE resources that do not meet the definition of an EE Resource,” and therefore that PJM should stop payments to resources that allegedly do not meet its criteria for energy efficiency. Further, IMM urges that EE providers (and by implication, customers) should be forced to return past payments that PJM previously approved.

Not only is the IMM’s argument contrary to PJM’s approved tariff, but it is also wrong economically. PJM’s sharply higher capacity prices for 2025/26 clearly demonstrate the need for more diversification of resources in the market, not less.

Even though PJM’s capacity prices hit record highs for 2025/26, they could go even higher or remain elevated unless the grid operator’s generation capacity can catch up with its surging demand.

The 8.9% decline in total capacity offered by non-energy efficiency resources in PJM’s latest capacity auction, from 148,945.7 MW in 2024/2025 to 135,692.3 MW in 2025/2026, marked the fourth consecutive year-over-year drop. Meanwhile, the peak load forecast increased by 2.2% to 153,883 MW, and the grid operator’s overall reserve margin shrunk by almost two full percentage points, from 20.4% to 18.5%.

With a total cost to load of $14.7 billion for the next delivery year due to tighter supply relative to demand, customers in PJM can ill afford to be stuck with another big bill for capacity. Yet, they may well face a double whammy with the 2026/27 capacity auction set for December. Exelon has already warned of double-digit rate increases for some of its utility subsidiaries due to the results for 2025/26.

PJM has stated that much of the struggle to bring new generation online is beyond its control, noting that 38,000 MW of resources have cleared its interconnection queue but have not been built due to external challenges, including financing, supply chain and siting/permitting issues. Thus, even if PJM has more generation capacity in 2026 than in 2025, it will not be enough to bring prices down dramatically.

So, with great time and expense needed, even if generators react to the build signal sent by the recently released capacity prices for 2025/26, not enough will be built anytime soon. Therefore, the best solution, and perhaps the only one, is to quickly scale up VPPs that include demand response and energy efficiency resources.

We may need more power generation resources, but nothing says those resources must be large, central station grid-scale power plants. Sometimes smaller and more distributed is better.

The sharp increase in PJM capacity prices for the grid operator’s next delivery year demonstrates the value of balancing supply and demand with existing resources.

Rising more than 800%, PJM capacity prices have reached record highs as North America’s largest wholesale electricity market grapples with tightening supply and escalating demand. Generator capacity is being retired faster than it is replaced, and demand growth is accelerating as electricity usage surges for artificial intelligence, data centers and electric vehicles.

Fortunately, we can quickly and affordably balance the grid today without the lengthy waits and large investments needed to build physical power plants. Virtual power plants (VPPs) that include grid services like demand response can supply capacity now by aggregating distributed energy resources (DERs) and dispatching them together.

VPPs offer a cheaper and faster-to-market alternative because they use existing, low-cost DERs, including batteries, EVs, smart thermostats and other controllable devices and loads, to keep the lights on when the grid is stressed. If we were to triple the current scale of VPPs in the U.S. to 80-160 GW by 2030, as the U.S. Department of Energy hopes, we could reliably support load growth such as that in PJM while avoiding $10 billion in annual grid costs.

PJM’s total cost to load for 2025/26 is $14.7 billion, given that capacity prices rose to $269.92/MW-day from $28.92/MW-day for 2024/2025. The grid operator attributed the sharp increase to generator retirements, increased electricity demand and market reforms, including Federal Energy Regulatory Commission (FERC)-approved regulations for improved reliability risk modeling for extreme weather and accreditation that more accurately values each resource’s contribution to reliability.

Such factors are not limited to PJM. Grid operators across the country struggle to balance supply and demand, particularly during critical conditions like extreme weather.

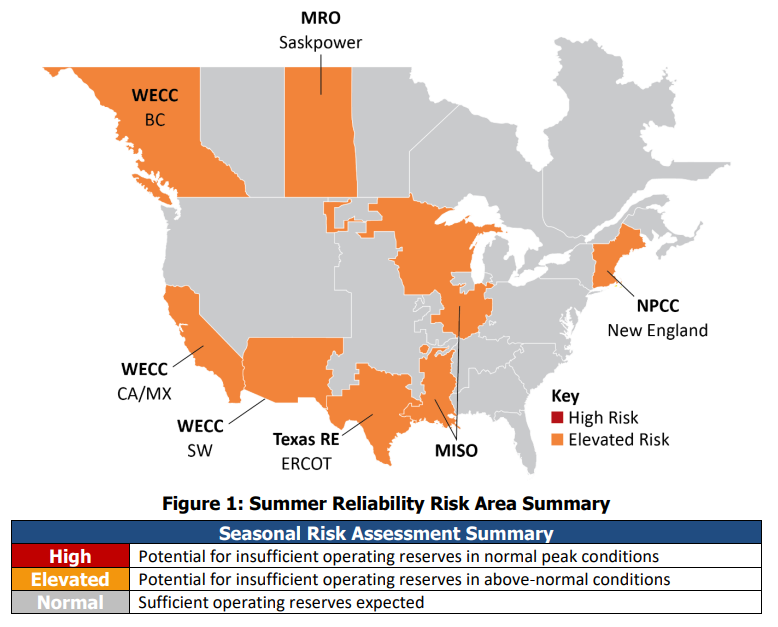

For example, in its 2024 Summer Reliability Assessment, the North American Electric Reliability Corporation warned that markets served by the Midcontinent Independent System Operator (MISO), ISO New England and Electric Reliability Council of Texas (ERCOT) could face summer electricity shortages in extreme summer conditions. When pressed in such instances, grid operators and utilities can use flexible customer DERs for handling grid disruptions.

With extreme weather such as heatwaves increasingly severe and frequent, VPPs can multiply the benefits of DERs by aggregating and dispatching them across types, customers and locations. VPPs including demand response have proved to be a reliable resource during grid emergencies year-round.

VPPs also provide value for energy users who help the grid with their DERs. Customers can earn revenue, reduce energy costs and help the environment.

There are increasingly more opportunities for customers to benefit, and the potential rewards are growing as well. While grid operators have long relied on large energy users like commercial and industrial customers to reduce their loads during emergency conditions by paying them to participate in capacity markets, today’s grid must adapt to shifts in supply or demand more frequently and quickly to remain balanced and avoid blackouts.

This increasing need for flexibility shows up in all services that grid operators now use—including energy, capacity, ancillary services and bespoke programs. Although ancillary services alone rarely make economic sense for customers, once they’re participating in capacity, it often makes sense to add on ancillary services to increase rewards.

Flexible participation programs require customers to react more frequently than in the emergency capacity markets, but they can earn additional revenue streams by participating. Industries with larger, more flexible loads are particularly well suited to earning more money from flexible participation.

For example, big-box retailers with multiple sites in multiple states can widely help the grid with their flexible loads, like by adjusting their lighting or HVAC systems without interrupting operations or inconveniencing customers or employees.

Flexible interruptible computing loads are also valuable, including those for data centers, crypto miners and AI loads. Whatever the industry, the most flexible of demand response programs reward customers with more revenue for curtailing their resources in reaction to grid needs in seconds, not hours.

So, while capacity prices in PJM surge and other grip operators similarly struggle to balance rapidly changing supply and demand, existing customer DERs can efficiently improve grid reliability. Embracing VPPs saves money for grid operators, provides revenue for customers and delivers clean, affordable and more reliable energy for all.

To learn more about VPPs and how CPower can help you monetize your energy assets while supporting sustainability, improving grid reliability and increasing energy resiliency, call us at 844-276-9371 or visit CPowerEnergy.com/contact.

CEO Michael D. Smith knew CPower was a leading enabler of the energy transition when he took the helm a year ago, but he has since learned the extent of that role.

As the nation’s largest virtual power plant (VPP) provider, CPower boosts grid reliability while helping customers unlock the full value of their distributed energy resources (DERs). In aggregating DERs and dispatching them as VPPs, CPower helps customers earn revenue and reduce energy spending by providing services that grid operators need to avoid blackouts. Grid operators pay energy users to help keep the grid balanced, like by using less electricity or supplying power from distributed generation.

Smith has been a leading proponent of VPPs since he became CPower’s CEO in July 2023, broadening awareness of how energy users, particularly commercial and industrial customers and DER Project Owners and Developers, can help the grid transition to clean energy—and be rewarded for doing so.

A year after his first interview with The Current, Smith reflected on how far CPower and VPPs have come and discussed where they are going.

Smith: One is the complexity of the industry. Not being a veteran of demand response and virtual power plants, it was eye-opening to learn how complex of a proposition it is to simplify grid services for our customers and make it easy for them to interact with the power grid.

Secondly, every customer is unique, and we must customize our approach accordingly. They each have their own operating parameters and concerns about how participating in a VPP might impact those operating parameters.

For example, if a customer has a large industrial load that powers their operations, you don’t want to impact the industrial process that is their lifeblood. You must work with them to figure out ways to be responsive to grid dispatch without disrupting their core processes.

We’re good at working with each customer to put them in programs consistent with their unique operating characteristics. We know the particulars of the different industries we serve and the needs of the individual customers within those industries.

One big-box retailer may differ from another, for example, in terms of what their motivations are and what they can and cannot do. Industrials will differ from a college campus. So, having those one-on-one relationships with customers is hugely important. That’s our secret sauce.

Smith: GridFuture was a great milestone for us. Not just because we were looking inward and bringing all our employees together for the first time in four years, but also the outward-facing nature of the event with the inclusion of the U.S. Department of Energy, LS Power and its portfolio companies, our customers and our partners. It made for a fantastic event whose benefits were two-fold.

Internally, there was the engagement of the 200 employees that participated. They were excited to be with their peers and talk about their business and where the industry is headed.

Externally, it validated our ability to attract outside thought leaders who are important to our business and have an interest in our industry. That says a lot about the CPower brand and the interest in the growing importance of VPPs in helping the grid.

And although GridFuture was one of the most memorable moments, it has been one of many enjoyable experiences getting to know the CPower team. Our monthly ‘Get CPowered Days’ in Baltimore have been a great way to bring everyone together on a regular basis.

Many of our employees work remotely or out of offices other than our headquarters in Baltimore. Frequently bringing distributed team members together has fostered face-to-face interactions and relationship building that have further boosted employee engagement, which is vital. We can’t expect to provide world-class service to our customers and our grid partners if we don’t have a highly engaged workforce.

Smith: The single biggest trend in the energy markets right now is load growth. We’re coming out of approximately 10 years without significant growth in demand. In fact, in some regions of the country, demand shrunk, particularly during COVID.

Now, we’re seeing demand grow rapidly, and it’s in large part because of the participation of some key commercial organizations including data centers, crypto miners and companies that are tapping into artificial intelligence. Computing, mining and all the data that is being used for AI are creating macro growth in overall load, especially in burgeoning data center hubs like Ohio, Illinois and Virginia.

These energy users can also come online much quicker than new power plants can be built. That creates a supply-demand imbalance and that’s what we solve.

We give the grid operators much more efficient and effective tools to manage supply-demand imbalance than building new power plants and associated transmission lines.

Also, in addition to supporting grid stability in an era of demand growth, we support further electrification of buildings and vehicle fleets, and the deployment of on-site renewable generation and energy storage.

All these macro trends point to the need for VPPs, and we support them by being good at connecting our customers’ capabilities with the grid’s needs. It’s why we’ve successfully managed a 40% increase in dispatches YoY to help rescue the grid when it has been needed the most.

Smith: Our bread-and-butter is a capacity product where the grid pays us, and therefore our customers, to be available in times of grid stress. Grid operators rely on our customers to reduce their loads during emergency conditions.

However, grid needs have changed and continue to do so. Grid operators need much more help than just asking commercial and industrial customers to conserve electricity during emergencies like peaks in summer electricity demands.

Compounding factors drive a greater need for grid flexibility to smooth the energy transition, including issues such as retiring fossil-fuel generators, more wind and solar generation, accelerating vehicle electrification and more extreme weather events.

With all these factors in play, the grid must adapt to shifts in supply or demand more quickly and frequently to keep them balanced and avoid blackouts. This increasing need for flexibility shows up in all the products and programs grid operators use to ensure the system remains in balance—including energy, capacity, ancillary services and bespoke programs.

We offer flexible programs where customers can get paid to provide energy to the grid in times of need. That could be in response to an energy price signal or to support shorter disturbances to help stabilize the grid, like a car’s shock absorber.

Flexible participation is taking part in those energy and ancillary services programs. Customers generally need to be able to react more quickly than in emergency capacity programs.

Flexible participation programs also need customers to be able to react more frequently than in the emergency capacity markets, but they can earn additional revenue streams by participating.

Although any business or organization that has a box with lights, air conditioning and electricity going to it can be part of our virtual power plants, some industries have larger, more flexible loads that can be more useful to grid operators and more rewarding for customers.

For example, we talked about interruptible computing, which includes data centers, crypto and AI customers that have flexible loads. Big-box retailers with multiple sites in multiple states also have a lot of flexibility in their loads, particularly for adjusting their lighting or HVAC systems without interrupting operations or inconveniencing customers or employees. They have a huge opportunity to help the grid.

Smith: The industry itself will continue to grow and we will continue to grow along with it as the need for grid flexibility increases and the benefits of VPPs multiply.

According to the U.S. Department of Energy, deploying 80-160 GW of VPPs—tripling current scale—by 2030 could expand the U.S. grid’s capacity to reliably support a ~60 GW rise in coincident peak demand while avoiding $10 billion in annual grid costs. Other research shows that relying on customer-sited DERs that make up VPPs is up to 60% more cost-effective than using gas power plants.

VPPs can also be created quickly by tapping existing resources. They will only become more common and expansive as grid operators realize that they typically take less than a year to stand up and customers see that they can start receiving the benefits of participating shortly thereafter.

As the demand for VPPs rises, CPower and its customers will be there to meet it.

To learn more about VPPs and how CPower can help you monetize your energy assets while supporting sustainability, improving grid reliability and increasing energy resiliency, call us at 844-276-9371 or visit CPowerEnergy.com/contact.

We’re excited to have our technology partner, Auradine contribute this guest column for The Current.

We’re excited to have our technology partner, Auradine contribute this guest column for The Current.

In an era of continuously rising energy consumption, the need for efficient and sustainable energy management solutions has never been more critical. Demand response programs, particularly those that require extreme flexibility and near instantaneous reactions from energy users, are emerging as pivotal components in modern energy systems because they offer a dynamic method to balance supply and demand, enhance grid stability, and promote energy efficiency.

Interestingly, Bitcoin mining, traditionally seen as an energy-intensive process, is an integral part of this initiative. The Bitcoin miners at the center of the almost-immediate-response evolution are earning revenue, reducing costs, and helping the power grid by taking advantage of energy providers’ most flexible demand response programs through a combination of cutting-edge, innovative technologies and collaborations with virtual power plant (VPP) providers.

Rapid demand response relies on energy systems’ capability to adjust real-time consumption patterns based on supply conditions. Unlike traditional demand response involving scheduled adjustments, more flexible demand response leverages advanced technologies to provide instantaneous feedback and actions. This capability is essential for integrating renewable energy sources, managing peak demand and ensuring grid reliability.

According to the International Energy Agency (IEA), demand response is vital in modern energy systems because it reduces the need for additional generation capacity, avoids greenhouse gas emissions, and provides economic benefits by optimizing energy usage. The IEA emphasizes the importance of integrating demand response into energy efficiency strategies to achieve a sustainable energy future.

Although Bitcoin mining, the process of validating transactions and securing the Bitcoin blockchain through complex mathematical computations, has been scrutinized for its significant energy consumption, its flexibility and high responsiveness to energy availability make it ideal for the most flexible of demand response programs, which reward customers with more revenue for curtailing their resources in reaction to grid needs in seconds, not hours.

Unlike in many other industries, Bitcoin mining operations can be swiftly adjusted or paused in response to grid signals, thus providing a unique form of demand response. During periods of excess energy supply, Bitcoin miners can ramp up operations to consume surplus electricity that would otherwise go to waste. Conversely, mining activities can be scaled back or halted during peak demand periods, freeing up energy for other uses.

Auradine’s EnergyTune™ technology is at the forefront of integrating Bitcoin mining into the fastest-acting demand response framework. This advanced system utilizes machine learning algorithms and real-time data analytics to optimize energy consumption for Bitcoin mining. EnergyTune™ can seamlessly adjust power usage in response to grid signals within seconds.

Bitcoin miners can dynamically adjust their computational power based on real-time grid conditions. This ensures that mining activities are conducted during periods of low energy demand or high renewable energy availability, thereby minimizing the environmental impact and improving overall energy efficiency.

VPP providers such as CPower Energy are essential partners in the flexible demand response ecosystem for Bitcoin mining. In aggregating distributed energy resources (DERs), such as solar panels, batteries, and flexible loads, that can be dispatched as needed, VPPs provide reliable and scalable demand response services.

CPower, for instance, leverages its extensive network of DERs to offer near-real-time demand response solutions. By integrating with technologies like EnergyTune™, CPower can optimize the performance of its VPPs, thereby ensuring that energy resources are utilized efficiently and effectively. This collaboration enables a more resilient and adaptive energy system capable of rapidly responding to fluctuations in supply and demand.

Benefits of Rapid Demand Response

During periods of high energy demand, miners can reduce or halt their operations, selling their allocated energy back to the grid at premium rates. During low demand or excess renewable energy supply periods, miners can capitalize on cheaper electricity costs to maximize their mining activities. This dual capability not only enhances the profitability of Bitcoin mining but also contributes to grid stability and efficiency, creating a symbiotic relationship between energy providers and miners. |

Flexible demand response programs requiring rapid customer reactions are poised to be pivotal in transforming energy management. By integrating Bitcoin mining into the framework for rapid demand response and leveraging technologies such as Auradine’s EnergyTune™, the energy sector can achieve greater efficiency, stability, and sustainability. Collaboration with VPP providers such as CPower further underscores the potential to revolutionize the energy landscape.

A coordinated approach involving all stakeholders is essential for realizing demand response’s full potential. The most flexible demand response programs, in particular, can lead the way to a more resilient and adaptive energy future through continued innovation and collaboration—and Bitcoin mining is doing its part.

Calendars may show that summer didn’t start until June 20, but thermometers across the country in the past few weeks have suggested otherwise. From heat domes in the Southwest to record-high temperatures in the Northeast, summer electricity needs kicked in early—and grid operators are bracing for another few hot months.

Although grid operators and federal regulators expect to have enough resource capacity to weather a typically hot summer, some parts of the U.S. are at risk of power shortages if the mercury shoots higher and stays there longer.

Markets served by the Midcontinent Independent System Operator (MISO), ISO New England and Electric Reliability Council of Texas (ERCOT) could face summer electricity shortages in extreme summer conditions, according to the North American Electric Reliability Corp. (NERC) 2024 Summer Reliability Assessment.

NERC has recommended that at-risk areas take precautions such as reviewing seasonal operating plans and protocols for communicating and resolving potential supply shortfalls. It has also noted that many assessment areas have expanded demand-side management programs to give grid operators more resources to reduce electricity demand if it exceeds supply.

When temperatures spike, grid operators could turn to energy users to help keep the lights on in communities. If they do, customers that make their distributed energy resources (DERs) available to grid operators as virtual power plants (VPPs) could benefit as a result.

In aggregating customer DERs and dispatching them together, VPPs are an effective and cost-efficient way to quickly balance the grid. So, they could be a go-to resource for grid operators with resource adequacy concerns this summer.

Here’s what grid operators and regulators project the summer’s electricity needs to look like so far.

Source: North American Electric Reliability Corp. (NERC) 2024 Summer Reliability Assessment.

Click on one of the markets below to go directly to that section.

The California Independent System Operator (CAISO) has a positive Summer Outlook for 2024 due to several factors.

After considering all factors, CAISO expects to have sufficient resources to meet forecasted demand plus an 18.5% reserve margin for all summer months in 2024. It also anticipates a surplus of at least 3,438 MW over forecasted demand plus the 18.5% reserve margin during peak net load hours of 6 p.m. to 10 p.m. in September.

However, CAISO has also warned that “extreme drought, wildfires and continued potential for widespread heat events and other disruptions continue to pose a risk for emergency conditions to the ISO grid.” Therefore, the ISO is preparing strategic reserves and emergency programs for this summer.

California demand response programs that could be called upon include the Emergency Load Reduction Program (ELRP) and Demand Side Grid Support (DSGS) Program. ELRP pays energy users for reducing consumption during grid emergencies and DSGS incentivizes electric customers to provide load reduction and backup generation when extreme events occur, like heatwaves.

DSGS is a new program meant to prevent summer power outages, specifically between May and October. It is part of California’s Strategic Reliability Reserve, a suite of programs to alleviate tight energy supplies on the grid caused by heatwaves, wildfires and other ongoing impacts of climate change.

through eligible providers like demand response aggregators. Participating customers can receive payments for help such as reducing load, putting combustion resources on standby or providing remotely controllable generation like backup generators powered by biomethane, natural gas or diesel.

NERC has warned that the Electric Reliability Council of Texas (ERCOT) market could be at risk of power outages due to a decrease in available generation. Conventional generation resources like fossil-fueled power plants are being retired and the state is increasingly dependent on variable energy resources.

Risk is highest during off-peak or net-peak hours in areas dependent on renewables, like solar or wind generation, NERC has noted. With solar and wind accounting for growing shares of the state’s generation mix, ERCOT must replace renewable energy that is not available when the sun does not shine, or the wind does not blow.

“Continued robust growth in both loads and intermittent renewable resources has elevated the risk of emergency conditions in the evening hours when solar generation begins to ramp down,” according to NERC’s summer reliability assessment. “ERCOT’s probabilistic risk assessment indicates an elevated risk of having to declare [energy emergencies] during hours ending 8:00–9:00 p.m. Central on the August peak load day.”

The risk could rise further if ERCOT needs to limit power transfers from South Texas into the San Antonio region when demand peaks. Demand could overload the lines that make up the South Texas export and import interfaces, necessitating South Texas generation curtailments and potential firm load shedding to avoid cascading outages. “The risk is greatest when ERCOT has extremely high net loads in the early evening hours,” NERC noted.

So, even though ERCOT expects to have sufficient resources to meet operating reserve requirements for the peak demand hour scenario, NERC noted that there is risk of supply shortages as solar generation ramps down during the early evening hours when system load is high and transmission constraints limit transfers.

According to NERC, ERCOT expects to have nearly 3,500 MW of demand response resources available this summer, the equivalent of 4% of normal peak demand. ERCOT and utilities offer demand response programs for Texas energy users.

The ERCOT Contingency Reserve Service (ECRS) is the grid operator’s newest demand response program. Available in 2024, the new ERCS program is like the LR program in that resources must respond within 10 minutes of being dispatched. They must also sustain their performance for “as long as they have the responsibility to provide this service.”

New England’s grid operator, ISO-NE, anticipates meeting peak demand for electricity this summer. Assuming typical weather conditions. ISO-NE predicts electricity demand will reach 24,553 megawatts (MW).

However, above-average summer weather, such as an extended heat wave coupled with high humidity, could push demand up to 26,383 MW. This could tighten supply margins because the ISO anticipates having about 30,000 MW of capacity available to meet demand and required reserves.

ISO-NE will have less capacity this summer than last because two natural gas-fired generators (with a total summer capacity of 1,400 MW) were retired in May. “This makes it more likely that ISO New England will need to resort to operating procedures for obtaining resources or non-firm supplies from neighboring areas during periods of above-normal peak demand or low-resource conditions. Summer heat waves that extend over the entire area can limit the availability of excess supplies and increase the risk of energy emergencies in New England,” NERC noted in its summer reliability assessment.

ISO-NE has stated that system operators have numerous tools to balance load, including increasing production of online generation or dispatching stand-by units and energy conservation such as voluntary reductions of energy use.

The grid operator anticipates having 3,891 MW of demand resources for its 2024/2025 Capacity Commitment Period, according to the 2024 Summer Energy Market and Electric Reliability Assessment from the Federal Energy Regulatory Commission (FERC).

In worst-case circumstances, ISO-NE could be forced to call for controlled power outages to maintain system reliability and safeguard the infrastructure of the grid. “With the possibility of more extreme and less predictable weather conditions, there is an increased potential for system operators to activate emergency procedures,” ISO-NE stated in a press release.

ISO-NE and utilities in the region offer demand response programs in New England.

MISO projects sufficient capacity under probable demand, but would rely on load-modifying resources (LMRs) made available through demand response programs and operating reserves to meet a high-demand scenario. Should a high-demand scenario materialize, MISO would be at an elevated risk of operating reserve shortfalls, NERC noted.

According to MISO, its surplus of 4,624 MW remains adequate for normal conditions, even though surplus capacity has decreased 30% since last summer, due largely to generator retirement, increased planning reserve margin requirement (PRMR) and fewer external offers. Regarding transmission, the grid operator says it is well-positioned to handle unplanned events on the MISO system this summer.

Furthermore, MISO has stated that it would mitigate summer risks by leveraging lessons learned from previous heatwaves, such as how appropriately timed use of LMRs and an increased requirement for its 30-minute reserve product worked well. MISO also expects solar generation to play a more active role as its in-service capacity tops 6 GW over the summer.

Should MISO need LMRs, it could turn to demand response programs available to commercial and industrial customers in parts of Illinois and Michigan. Michigan customers served by Consumers Energy, DTE Energy or select municipal and cooperative members in MISO Zone 7, which covers the Lower Peninsula of Michigan, can participate. In Illinois, demand response participation is open to customers served by Ameren Illinois or select municipal and cooperative members.

Illinois is also trying to create more value from distributed energy resources (DERs) by exploring how utilities can maximize their benefits through effective system planning and efficient operational control. Regulators are considering a two-pronged approach to compensation for components of DER value such as benefits to energy and capacity markets and ancillary services.

The New York Independent System Operator (NYISO) does not anticipate any operational issues in the state this summer. It projects having adequate capacity margins and has procedures in place to handle any issues that may occur. For example, the grid operator could use demand response to meet above-normal summer peak load, NERC noted.

Although NYISO expects to have 40,733 MW of power resources available to meet forecasted peak demand conditions of 33,301 MW, the grid operator has warned that reliability concerns remain. Demand peaked at 30,206 MW last summer.

“Reliability margins have declined by more than 1,000 megawatts in just the last two years. That’s a significant issue especially when we’re impacted by heatwaves,” Executive Vice President and Chief Operating Officer Emilie Nelson stated in a press release announcing NYISO’s outlook for summer electricity reliability. “As demand is forecasted to rise in the coming years, this trend will continue to pose a challenge to system reliability.”

The reliability margin for this summer is 752 MW under baseline conditions but would be deficient during extreme weather. For example, if the state experiences a heatwave with an average daily temperature of 95 degrees lasting 3 or more days, the capacity margin is forecasted to be -1,419 MW, NYISO noted.

The margin would worsen to -3,093 MW under an extreme heatwave with an average daily temperature of 98 degrees. Under those conditions, NYISO operators would dispatch up to 3,275 MW through emergency operating procedures to maintain reliability, the grid operator has stated.

Demand response has been at the forefront of NYISO’s efforts to smooth the state’s transition to clean energy. For example, NYISO has paved the way for virtual power plants (VPPs) by implementing its DER & AggregationParticipation Model, which was the country’s first program to integrate aggregations of distributed energy resources (DERs) into wholesale markets.

The DER Participation Model enables DERs to provide energy, ancillary services and capacity in the NYISO markets. DERs of at least 10 kW aggregated into VPPs of at least 100 kW can simultaneously provide wholesale services to the grid operator and retail services to utilities and load servers.

DER aggregations can include resources such as demand response, solar arrays, batteries and electric vehicles. Curtailable load, or demand response, is the only type of DER that can be aggregated as a single resource and technology. Currently, many C&I customers earn substantial revenue and reduce energy costs by participating in demand response in New York,

With a forecasted installed reserve margin of 29%, including expected committed demand response, versus a target of 17.7%, PJM does not any anticipate any problems meeting demand this summer, NERC noted. However, the grid operator does expect reserve margins to be lower than last summer due to rising demand, generator retirements and slower-than-anticipated resource additions.

The loss of generation resources is outpacing the addition of replacement resources amid accelerating growth in consumers’ demand for electricity, PJM stated in its summer outlook announcement. Thus, the grid operator has fewer generation resources (182,500 MW) of installed capacity) to draw on this summer compared with 2023 (186,500 MW of installed capacity).

PJM also projects a higher peak demand for electricity this summer at approximately 151,000 MW compared with the 2023 summer peak load of 147,000 MW. The increased peak load forecast combined with reduced generating capacity reduces reserve margins for extreme weather scenarios.

Scenarios that include this higher level of demand, combined with low solar and wind output and/or high generator outages, would further reduce reserve margins, the grid operator has noted. In these “unlikely but possible set of circumstances,” it might have to implement additional procedures to manage emergencies, including dispatching demand response, calling for conservation, limiting electricity exports or even temporarily interrupting service, according to PJM.

PJM has several demand response programs that it could call upon for help.

With the summer’s heat already here, and more to come in the months ahead, grid operators are preparing to meet surging demand. And as summer electricity usage surges, grid operators will likely seek help from customers that make their DERs available as VPPs. Customers who help will be rewarded.

CPower makes DER monetization easier and more rewarding by using customer resources to strengthen the grid when and where reliable, dispatchable resources are needed most. Customers interested in earning grid services revenue and reducing energy costs by helping grid operators meet their summer electricity needs can contact CPower to learn more: cpowerenergy.com/contact/.