The Need for Virtual Power Plants Heats Up When the Weather Cools Down

*This article first appeared on Environment+Energy Leader on Feb. 25, 2025. Click here to view.

As a blast of Arctic air swept through the U.S. on Jan. 22, PJM’s winter electricity demand reached an all-time high of 145,000 MW, breaking its 2015 record. The new record may not last 10 years though, as extreme cold and disruptive winter storms, from Uri (2021) to Elliott (2022), to Enzo (2025), have become the new norm in the U.S., increasing demand for electric heating and straining the grid when supply falters.

As our national demand for electricity surges and extreme weather intensifies, we can expect to see more winter consumption records, like that of PJM’s, broken in the coming years. We could also experience dangerous blackouts if we don’t improve the grid’s ability to handle ever-greater peaks in demand.

Grid Strains Worsen as Extreme Weather Intensifies

Intense winter weather further strains an aging grid that is already struggling to keep up with demand as utilities and grid operators retire near-end-of-life generation resources faster than they bring replacement generation online. When winter storms topple power lines and disrupt generation resources, the grid’s capacity is stretched even thinner, and this can result in higher energy costs and potentially dangerous outages when temperatures plummet.

Just a few months before experiencing its record-setting winter demand in January, PJM had expressed concern about maintaining adequate supply if extreme weather conditions were to persist this winter.

Winter grid strategies must evolve beyond the playbook of centralized generation if we are to guard against interruptions in supply as demand surges. This evolution has begun with the rise of distributed energy resources such as onsite generation and variable load (DERs), but we can—and should—do more to strengthen the grid with the DERs available to us now.

The Role of Virtual Power Plants in Grid Resilience

Virtual Power Plants (VPPs) offer a perfect solution due to their immediate availability and unique flexibility. A cost-efficient way to balance the grid with existing DERs, VPPs have emerged as an increasingly valuable resource for making the grid more resilient, regardless of the season.

Traditionally focused on meeting peaks only on the hottest summer days, utilities and grid operators now grapple with surging demand year-round. As weather patterns shift, the grid faces vulnerabilities from extreme cold and winter storms as well as heat waves and triple-digit temperatures.

VPP operators can cheaply and efficiently reduce consumption during any period of peak demand by aggregating DERs and collectively dispatching hundreds and thousands of megawatts of distributed energy from customer variable loads and onsite generation resources and batteries.

This decreases the reliance on gas peaker plants, which have been shown to cost 40% more than a VPP and are at risk of failing during extreme cold due to mechanical problems, fuel supply issues, downed trees, or heavy snow bringing down power lines and transformers. By eliminating the reliance on peakers, utilities can pass cost savings to customers, driving down energy bills.

Furthermore, customer-powered VPPs are an immediate way to maintain a consistent and reliable energy supply when the traditional grid is struggling to accommodate demand growth in winter weather conditions. Because of their inherent flexibility, VPPs can adjust to meet fluctuations in supply or demand. They can also be deployed locally where they’re most needed during emergencies.

Proven Impact: How VPPs Have Helped in Past Winters

VPPs have rescued the grid in previous winters. On Christmas Eve 2022, customer-powered VPPs helped prevent blackouts in the Northeast and Mid-Atlantic regions during Winter Storm Elliott. The Texas grid operator, ERCOT, has similarly turned to them for help, using the integration of VPPs and an increase in renewable energy to improve its preparations for major winter weather, after Winter Storm Uri devasted the state in 2021, leaving 4.5 million residents and businesses without power.

As pressure on grids mounts nationwide, these examples serve as blueprints for other regions to follow in leveraging VPPs to strengthen the grid’s ability to handle extreme weather.

Expanding the Role of VPPs in Future Grid Planning

As winter storms grow in frequency and strength, our power infrastructure weakens with age and wear. Meanwhile, the full extent of demand growth has yet to be realized. Therefore, we need innovative, flexible strategies to take us reliably into tomorrow.

One of the most flexible strategies, VPPs are an affordable and adaptable solution for managing demand response during summer and winter months and integrating DERs into the grid at any time.

Most importantly, while infrastructure upgrades and large-scale power plants will take years to deploy, VPPs can bridge the gap between our aging grid and the modern, resilient energy grid of the future.

With winters growing more severe, VPPs are ready to improve resilience.

Michael Smith is an innovative leader with more than 25 years leadership experience in the energy industry. Michael joined CPower from ForeFront Power, where he was the CEO of the company’s North American solar and energy storage business, responsible for strategy and all business areas across the U.S. and Mexico.

How One Midwest State Aims to Create More Value from Distributed Energy

If states are to fully unlock the value of distributed energy resources (DERs), utilities will have to pay customers for all the grid services they can provide with their DERs.

If states are to fully unlock the value of distributed energy resources (DERs), utilities will have to pay customers for all the grid services they can provide with their DERs.

Regulators in states such as Illinois are exploring how to calculate the value of DERs so that utilities can maximize their benefits through effective system planning and efficient operational control. Such effectiveness and efficiency are often lacking in current state policies, but the opportunity to unlock value for both the grid and customers can and should be taken.

“Although utility-scale assets benefit from economies of scale and lower levelized costs, by virtue of their proximity to demand, distributed energy resources (DERs) can provide unique system benefits (e.g., reduced losses, congestion, and curtailment, and deferred infrastructure investment) and thus higher value per kilowatt-hour (kWh) generated. However, many of these benefits are not fully incorporated into electricity markets or compensation structures,” wrote the authors of a research paper about DER value that was published in Energy Policy.

Investigating DER Value and Compensation in Illinois

In Illinois, regulators are considering a two-pronged approach to compensation for components of DER value such as benefits to energy and capacity markets and ancillary services.

Enacted in 2021, the state’s Climate and Equitable Jobs Act (CEJA) required the Illinois Commerce Commission (ICC) to initiate an investigation into the value of, and compensation for, DERs by no later than June 30, 2023, which the ICC did last year. The ICC has held several related workshops since August 2023.

The Commission has been identifying the various components of DER value and which are compensated. It has also been considering whether DERs can provide additive services and determining the terms and conditions for such services.

In a March 2024 workshop, the ICC began developing a framework for calculating and compensating DER value and working towards a strawman model for DER valuation. The Commission’s goals in designing the framework include fairly compensating DERs for their value, making it simple for customers to understand their compensation, allowing utilities to administer the framework without burdensome cost and complexity, and enabling the framework to be updated annually with consistent results.

Although the ICC is mandated to formulate a base rebate specific to distributed generation, the development of a compensation mechanism for additive services is encouraged but not technically mandated by the statute.

As a result, since the additive services portion of the law is not a required output of the Commission’s implementation of CEJA, there is a risk that it may not receive the attention it deserves. That outcome would not only be a mistake, but it would also be a gigantic, missed opportunity that would hurt Illinois customers.

If regulators do not develop compensation for additive services, the state’s utilities will not get the full value of DERs because customers will not be incentivized to help the grid by providing much-needed flexibility services.

Vast latent resource potential exists today amongst customers who have inherent flexibility in the way they use electricity. That vitally important and valuable potential is growing every day and should be leveraged to assist in distribution system planning and operation. Therefore, it is critically important that regulators develop the state’s base rebate in tandem with additive services compensation.

The base rebate would incentivize the development of distributed generation like solar photovoltaic systems, batteries, wind turbines and electric vehicles, while additive services payments would compensate customers for helping the grid with their DERs. Examples of additive services could include using DERs to respond to distribution system emergencies, managing distribution congestion or deferring investments in distribution infrastructure.

CPower presented suggestions for valuing additive DER services to the ICC at a November 2023 workshop.

Capturing the Value of DERs

The additive services available through DERs correlate with their multiple value streams at multiple levels.

For example, DERs improve reliability by helping grid operators avoid outages when the grid is stressed, and energy prices are high. They also mitigate increases in energy prices by eliminating the need to buy extra electricity.

Furthermore, DERs provide flexibility that helps grid operators balance the grid with operating reserves or regulation programs at the wholesale level or relieve congestion in distribution flows at the distribution level. Grid operators can also defer investments in transmission or distribution infrastructure and avoid burning fossil fuels to bring on peaker plants when the grid is stressed, which helps the environment by avoiding carbon emissions.

While some of these benefits, like those in reliability and flexibility, might be more obvious than others, they all provide value to the grid and should be compensated accordingly. Customers can be compensated at different levels, like by either a wholesale market operator or a utility, to avoid double counting.

Multiplying Grid Services

Distribution programs sometimes conflict with wholesale markets. If the programs are incompatible, customers would have to decide which to enroll their DERs in to avoid simultaneous participation, and therefore double compensation.

Regulators should account for compatibility when designing programs so that customers can participate at multiple levels, and thereby generate multiple value streams. States would then reap the full stream of benefits at both the distribution and wholesale levels.

New York is at the forefront of such layered dynamic load management programs, which increase benefits for customers and grid operators while guarding against double payments for the same MW of grid service.

Customers in New York can extract the full value of their electricity load because they provide distinct grid services across different levels. Perhaps most notably, New York customers can participate in both the Distribution of Load Relief Program (DLRP) and Commercial System Relief Program (CSRP).

Both the DLRP and CSRP programs provide seasonal payments for load curtailment, but they meet different distribution needs. The DLRP program is more emergency-based, while the CSRP is more about delaying infrastructure investments.

Both programs allow for participation in PJM programs because the PJM programs compensate for capacity, while the DLRP and CSRP programs do not. So, there is no issue of double compensation.

With 15 years of harmonious participation by New York customers, the DLRP and CSRP programs offer an example of what Illinois and other states could do in adopting and compensating additive services.

Paying for Grid Services

Lastly, when it comes to incentivizing grid services, paying customers directly for lending their DERs is the most effective motivation for getting energy users to help. Although some states use rebates or bill credits, direct payments work best for compensation because they create more flexibility for customers and encourage broader participation in grid services programs.

For example, if Illinois were to use direct payments to participants for both the base rebate and additive DER services, customers would be more willing to deploy DERs because they could get third-party help in financing projects. DER developers would be more likely to finance projects for energy users in exchange for a steady stream of income from direct payments.

Similarly, customers could use aggregators like CPower to monetize DER assets. This would also encourage broader participation because aggregators make it easier for customers to benefit from helping the grid.

Rules for grid services programs are complex and customers are often not as attuned to the specifics as an aggregator. An aggregator can simplify participation and increase returns by navigating program complexities on a customer’s behalf.

Additionally, by participating through aggregators, customers’ risk of penalties for non-performance is largely taken on by the aggregator, since the aggregator absorbs the penalties and manages its portfolio of customers to minimize or eliminate the expenses.

On the utility side, aggregators eliminate the need to build out the capability of working directly with customers, thereby saving money. This would be particularly true in Illinois, where there is a competitive market for aggregators. There would be no shortage of aggregators willing to step in and connect customers to utilities for grid services.

Illinois and other states can further increase the benefits that DERs provide, particularly in reliability, by leveraging additional DER services through aggregators that collectively dispatch energy resources owned by different customers to help balance the grid. In properly compensating customers for the value of their DERs, regulators will smooth the transition to a clean, flexible, and dependable energy future.

Call us at 844-276-9371 or visit CPowerEnergy.com/contact to explore how you can monetize your DERs and earn revenue for helping the grid.

Everything You Need to Know About New York’s New DER & Aggregation Participation Model

The New York Independent System Operator (NYISO)’s new DER & Aggregation Participation Model reflects how far distributed energy resources (DERs) have come as well as the potential they can unlock as the Empire State drives toward its Reforming the Energy Vision (REV) initiative for creating a more diversified grid by better integrating customers.

Not only has the state’s grid operator acknowledged the collective power of DERs aggregated into virtual power plants (VPPs), but it has also launched the country’s first program to integrate aggregations of DERs into wholesale markets in sync with an effort to create New York’s grid of the future.

As the first registered aggregator for the DER Model and a contributor to the state’s efforts to shape its future grid, CPower sees four key takeaways in how NYISO’s new program improves grid reliability.

NYISO’s DER Model:

1. Benefits commercial and industrial customers.

Commercial and industrial (C&I) customers that can quickly provide grid services can earn additional revenue and save more money by helping NYISO keep the grid balanced. Energy users with automated technology are particularly well positioned because NYISO incentivizes customers to respond to a request for help within minutes.

The DER Model provides market opportunities for C&I energy users by letting them access existing markets as if they were a power plant. For example, customers can access capacity, energy and ancillary service markets under the relevant rules for each. Most of these markets were previously available through other mechanisms, but not all. Until now, these users have had no opportunity to access NYISO’s attractive real-time energy markets. Under the DER Model, they will.

Customers participating in fast-acting demand response for the first time will do so under the new model while NYISO phases out its existing Demand Side Ancillary Service Program (DSASP) for demand response customers. NYISO offers a DER Onboarding Suite for customers interested in participating in the grid operator’s markets.

2. Differs from the DSASP program.

Customers now enrolled in DSASP can remain in the program until it sunsets on April 16, 2025. They will then have to provide grid services through the DER Model if they would like to participate in NYISO markets similarly to how they have done.

Unlike the DSASP program that it replaces for new customers, the DER Model does not confine customers to a single, economic-based demand response program. While DSASP gives energy users the opportunity to offer load reduction into New York’s electricity markets to meet reliability needs, the DER Model allows customers to provide an array of wholesale programs simultaneously.

3. Taps the power of VPPs.

This landmark program unlocks the full benefits of VPPs for the resiliency and reliability of the grid, while also creating new revenue opportunities for commercial and industrial energy users and DER owners and developers. DERs of at least 10 kW aggregated into VPPs of at least 100 kW can simultaneously provide wholesale services to the grid operator and retail services to utilities and load servers.

DER aggregations can include resources such as small-scale solar arrays, batteries and electric vehicles, per market rules approved by the Federal Energy Regulatory Commission (FERC). Curtailable load, or demand response, is the only type of DER that can be aggregated as a single resource and technology.

Leveraging the flexibility of such DERs is essential to achieving New York’s clean energy goals. In its DER Model announcement, NYISO forecasts distributed generation in the state to roughly double over the next three decades as the state strives to have 70% of its electricity generated by renewable resources by 2030 and achieve a 100% clean power grid by 2040. Also, per its REV goals, the state wants to reduce greenhouse gas emissions to 60% of their 1990 levels by 2030 and to just 20% by 2050.

4. Shapes the state’s future grid.

In what was likely a coincidence, New York’s Public Service Commission formally instituted a major, multi-year Grid of the Future proceeding within days of FERC’s approval of the market rules for NYISO’S DER Model.

The Grid of the Future proceeding will dovetail with, and help build upon, the NYISO program by developing a grid flexibility study and plan outlining the current and future potential capabilities of flexible DERs across New York’s electric grid. The study will also identify near-term actions likely to increase the deployment and use of flexible resources and improve integration of flexible resources into grid planning and grid operations.

Just as we helped to drive the process that led to NYISO’S DER Model, CPower will actively participate in the Grid of the Future effort to unlock more opportunities for our customers while helping New York meet its flexibility goals.

Customers interested in earning grid services revenue and reducing energy costs by helping NYISO improve grid flexibility can contact CPower to learn more: cpowerenergy.com/contact/.

Aaron Breidenbaugh | Senior Director, Regulatory and Government Affairs, CPower

How to Make Projects Pencil and Increase Returns with DER Optimization

Securing funding and host site/off-taker contracting often are the most challenging parts of developing new distributed energy resource (DER) projects, but DER optimization solutions can make it easier. Learn how energy users, project developers and owners can evaluate site-specific performance data and energy market options to create cost projections and insights that get projects greenlighted.

Report: Demand response is critical to enabling the energy transition and ensuring a reliable grid

Recently released research shows that mounting reliability risks make demand response (DR) increasingly important as the grid transforms. An aging grid dominated by solar and wind power, battered by storms and fires and struggling to supply new needs like EVs and electric heat pumps, needs the flexibility that DR provides.

“Paradigms for the generation and delivery of electricity are evolving away from a centralized network with predictable power flows toward a distributed and dynamic grid, creating many challenges and opportunities for utilities and other entities involved in the electricity value chain,” according to a new report about grid reliability challenges published by Wood Mackenzie and CPower. “At the heart of these changes is how reliability is assured when the grid is most stressed, like when customer demand peaks during heat waves, natural disasters or extreme weather events.”

Based on insights from analysts at Wood Mackenzie, the report shows that DR programs have proven to be an important resource for ensuring reliability amidst grid challenges in the past, but that such support may not always be available. Analysts explain how low capacity pricing and cumbersome rules on DR participation threaten the future of DR programs and the ability to use distributed energy resources (DERs) to help the grid.

If energy users were to stop participating in DR, analysts note, utilities and grid operators would lose their most reliable resource during emergencies as well as a resource that can provide much-needed flexibility year-round.

Such year-round flexibility is imperative because the proliferation of intermittent renewable resources, the retirement of fossil-fuel generators, and the electrification of vehicles, heating and other key energy needs are straining the grid, making it difficult to balance supply and demand.

“As the grid’s needs continue to evolve, particularly with the growth of other types of distributed energy resources (DERs) besides DR, such as solar generation, battery storage, and electric vehicles, DR is an increasingly important part of the resource stack in energy markets,” according to the report from Wood Mackenzie and CPower.

The North American Reliability Corp. recently issued a similar warning about the importance of flexibility in mitigating risks to grid reliability.

“System operators and planners should ensure that sufficiently flexible ramping/balancing capacity is available to meet the needs of changing patterns of variability and new characteristics of system performance. In future decades, growing storage and demand-side flexibility may help mitigate the concerns for flexibility and attention will turn to multi-day energy concerns, but intraday flexibility remains important during this transition,” according to NERC’s 2023 Electric Reliability Organization (ERO) Reliability Risks Priorities Report.

Today’s tech-enabled DR can play a key role in energy, ancillary services and other flexibility markets. But policymakers must eliminate barriers like unsustainably low pricing and unworkable administrative complexities to unlock the full flexibility of DERs, according to Wood Mackenzie and CPower’s report. To do so, the paper’s authors suggest market reforms such as revising compensation methods for DR resources, fixing capacity accreditation and introducing a price floor for DR.

If you would like to learn more about the research and recommendations from Wood Mackenzie and CPower, you can download a copy of the report here: Ensuring Grid Reliability with DERs.

Kenneth Schisler

Ken leads CPower’s regulatory and government affairs team, having previously served in similar roles at both Vicinity Energy and EnerNOC/Enel. He brings nearly three decades of policy leadership on innovation in clean and advanced energy technologies and collaborates with public officials, regulators, power exchange and system operators, academia and industry peers to unleash the potential of demand-side resources.

Contracting and Funding Projects with DER-Asset Optimization

Securing funding and structuring a contract may be the hardest parts of developing new distributed energy resource (DER) projects.

Even with the Inflation Reduction Act set to catalyze billions of dollars of investment in renewable energy projects, financial viability – or the perceived lack thereof – has become a bigger barrier to deployment than technology. In a recent survey, microgrid developers ranked funding approval as the most challenging project stage, followed by project sizing and capturing upside monetization opportunities.

Getting DER projects greenlighted can be challenging because proformas often do not reflect the full value of the investment, or financiers discount project return projections because the tools utilized to estimate returns are not employed to realize value in live operations. Many times, DER owners and developers overlook opportunities to earn grid services revenue or reduce costs or do not realize projects can recognize both. Full visibility into a project’s value stack is essential to both funding and contracting DER projects.

Making DER Projects Pencil Financially

DERs are any assets that use, store, discharge, or generate electricity, like on-site generation, energy storage, electric vehicle chargers, solar panels, or load curtailment. Energy users are installing more DERs but only when they can make the projects pencil financially by connecting them to sufficient value.

Optimizing DERs involves choosing between all available value streams in each day or hour based on which would be most lucrative, and stream values can differ substantially depending on the details of the site and project. Successful DER projects justify investments by creating proformas that account for all possible revenue and savings based on the site and asset constraints and the available value opportunities.

If you are a DER owner/operator trying to fund a project, optimization starts at the proposal stage to enable an accurate view of all the on-bill and grid services value and ensure the asset is sized to optimize that value. Beginning at the proposal stage helps in sizing projects correctly and making even marginal projects pencil by considering all available value streams. Calculating the returns that a project would yield and demonstrating where they will come from and how they will be realized improves your chances of securing financing.

Getting Creative with Contracting Structures

In structuring your proposal and contracting structure for behind-the-meter projects, identifying the type of value and timing of realization of that value can be key to identifying creative contracting structures with the utility-account-holder. For example, monthly or annual lease payments from the utility-account-holder may be possible where on-bill value is the driving value source, or a split of grid service revenue may be a more reasonable approach where grid services are key to the project’s financial health. Identifying and executing on the ideal contract structures stems from a high degree of confidence in what sources of value will be realized post-contract.

Impacting Project Success

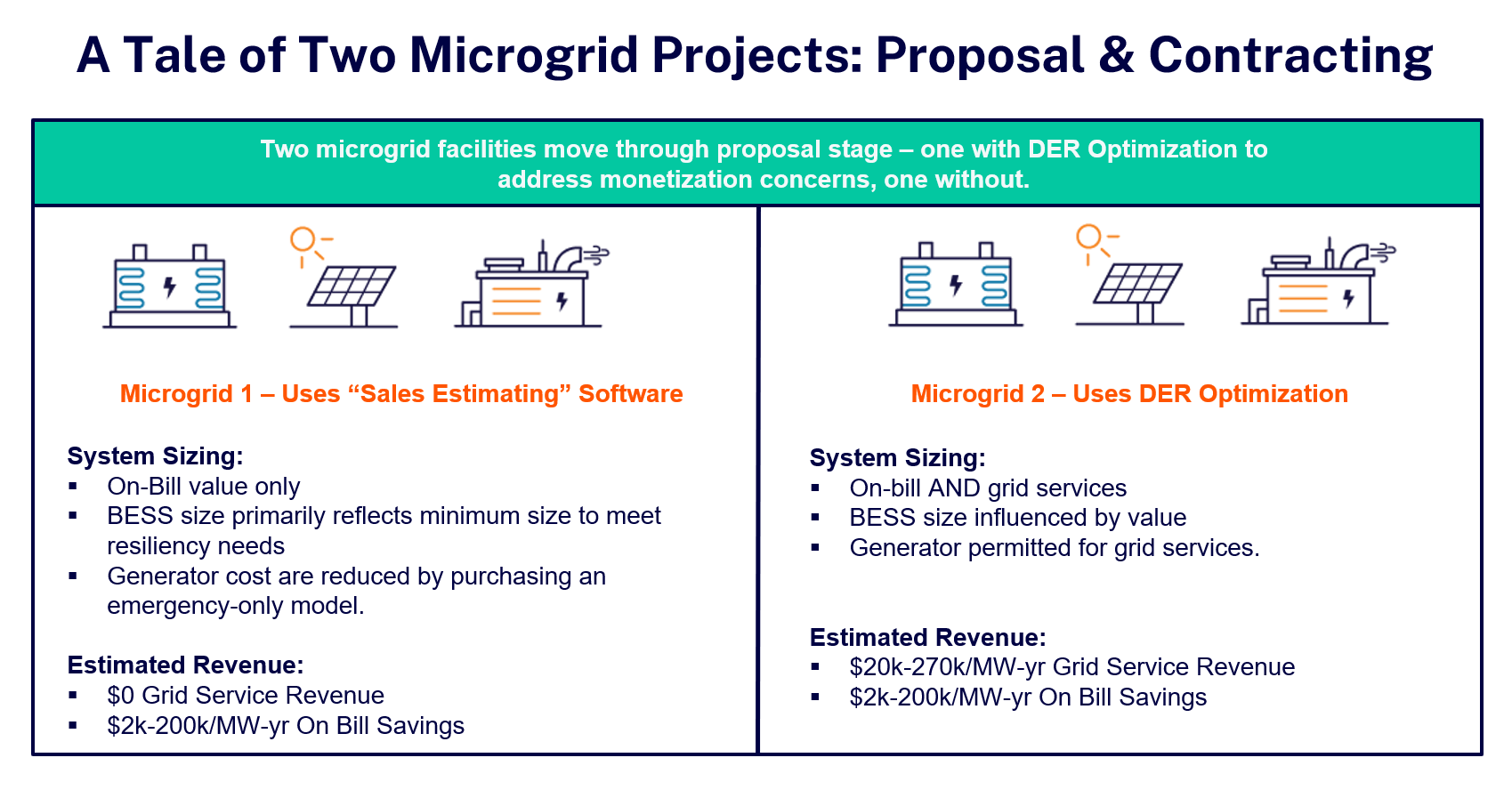

Overlooking opportunities at the outset can prevent a customer from accepting your proposal or limit the project’s eventual returns. Consider the returns from two DER projects in ISO New England (ISONE) as examples. One project used DER optimization but the other did not.

Project #1 (Not Optimized)

This customer developed a microgrid based on the energy user’s resiliency requirements and demand charge management expectations only. Although the project was approved and eventually met the customer’s requirements and expectations, it could have been more rewarding with a larger battery that would have provided incremental resiliency. The customer ultimately left money on the table because it did not consider the full stack of available value streams, and participation in other available programs such as ISONE capacity programs and Connected Solutions was suboptimal.

The participation of the generator was also limited by the lack of DER optimization. The customer invested in a generator that was permitted for emergency-use only and was specifically to address their resiliency requirements. With a DER optimization view and a full picture of all sources of potential value, the customer may have found that they could have contracted instead for a non-emergency-only generator and used that generator for both the resiliency requirements and to earn revenue by providing grid services. The revenue earned from grid services would have more than offset the added cost of a properly permitted non-emergency generator.

Project #2 (Optimized)

Conversely, another customer and benefited more from their project by considering all value streams and the full potential of DER optimization when designing, funding, and contracting their project. Beginning at the conceptual stage, they iterated on key aspects of the battery for a retrofit to a solar array in the PJM area.

Duration was one of the elements evaluated when modelling potential grid services values in PJM. After considering several duration iterations, the project developer decided that a one-hour battery would provide better returns than a multi-hour battery based on anticipated value streams, cost considerations, and warranty constraints. As a result of determining the right size for the battery upfront, the customer increased its projected return and is now set up to take advantage of all revenue streams.

Such potential to benefit from multiple revenue streams is always helpful given that the financiers of DER projects want as many revenue sources as possible. Diversification of project revenue sources and greater returns increase the chances of securing funding.

Securing funding for DER projects may be hard, but DER optimization makes it easier. Considering and pursuing all value streams from the beginning helps projects pencil and increases returns.

If you would like to learn more about why energy users and DER portfolio owners are turning to optimization solutions that evaluate site-specific performance data and energy market options to create project proformas that get projects greenlighted, watch our presentation from the 2023 Microgrid Knowledge conference: The Greatest Bang for Your Buck: Getting Projects Contracted and Funded with DER-Asset Optimization.

You can also call us at 844-276-9371 or visit CPowerEnergy.com/contact to find out how our EnerWise™ Site Optimization solution makes estimating and delivering the value of DER projects easier.

Rob Windle

As CPower’s Vice President, Strategy Planning & Business Development, Rob keeps a curious eye locked on the future. He leads the development and management of innovative solutions that support the proliferation and monetization of distributed energy resources (DERs) such as decentralized generation and energy storage. He has more than 20 years of experience in product development, direct and channel sales development, and management across the Energy, Enterprise Software, and Automation Controls industries. A Certified Energy Manager®, he holds a Bachelor of Science degree in industrial engineering from the University of Cincinnati and lives in Atlanta, Georgia.

DER Monetization the Key to Enabling the Energy Transition

When the grid is stressed, would you rather turn on a fossil-fuel-powered peaker plant or tap into existing resources to reduce our electricity consumption? For us, it’s a simple choice for the community and our planet.

The Customer-Powered Grid™ is the answer. In aggregating customers’ distributed energy resources (DERs) and collectively using them to help the grid when and where it’s needed the most, we can create a flexible, clean and dependable future.

Peaker plants are major emitters of greenhouse gases and have a negative impact on air quality and public health. By leveraging DERs that are already available, like demand response, we can help reduce carbon emissions and other pollutants to help mitigate the impacts of climate change.

DERs Counter Climate Change Impact

Customers recognize the potential of DERs, which are assets or devices that consume, store or generate power and can respond to a signal, as well. Sustainability is the second-most-common reason for implementing DERs, with one in three customers citing it as a motivation, according to CPower’s 2023 Customer-Powered Grid Survey.

The grid needs more clean energy, which DERs can supply reliably and affordably, and that need for flexibility is growing:

-

- Annual additions of renewable power capacity globally must grow three times the current level by 2030 to limit global warming to 1.5°C or less per the Paris Agreement, according to the International Renewable Energy Agency (IRENA). This would require investing $35 trillion in energy transition technologies worldwide by 2030, IRENA estimates.

- The clean energy transition must accelerate for the U.S. to avoid the worst climate impacts, according to the Business Council for Sustainable Energy (BCSE), which noted that 2022 was the third most costly climate disaster year on record with 18 climate-related disasters causing at least $1 billion in damage each. The country needs modernized and expanded infrastructure to accelerate the deployment of clean energy and energy efficiency solutions, BCSE says.

- The U.S. is only halfway to its emissions reduction goal for 2025 and slightly more than a quarter to its target for 2030. It must double the share of electricity generated by non-carbon-emitting sources by 2030 to achieve net-zero carbon emissions by 2050.

We won’t be able to ensure grid stability through this rapid transition and beyond without DERs. DERs such as demand response and energy efficiency support greater deployments of clean, renewable energy resources by filling gaps in variable generation. Given their flexibility, DERs can quickly respond to changing grid needs at any time, like if renewable generation unexpectedly drops due to a decrease in the availability of sun, wind or gas.

DERs also reduce the need to build new generation capacity, which is crucial because we must quickly replace coal-fired power plants like the peaker plants that have historically provided flexibility to the grid. The U.S. is on track to close half of its coal generation capacity by 2026 and cut coal consumption by the power sector in half by 2030, all of which could affect the stability of the grid.

CPower envisions a flexible, clean and dependable energy future enabled by The Customer-Powered Grid™.

DER Monetization Supports Sustainability.

Energy users benefit from investing in DERs and by monetizing them through grid services. More than 88% of CPower customers say that DER Monetization has helped their business. In addition to saving money by curtailing their loads when the grid is stressed, these energy users can take the revenue generated from their participation in wholesale market or utility grid programs to improve or invest in operational or sustainability initiatives for their organization.

Energy users are also under significant pressure to reduce emissions, make ESG investments and counter the impacts of climate change. DER Monetization helps an organization achieve its clean energy goals by allowing it to use less electricity and reduce associated emissions.

We are proud to have helped our customers avoid more than 280,000 metric tons of CO2, equivalent to not burning more than 317 million pounds of coal, in a single year alone. We know that the work we do is essential in making our vision of a flexible, clean and dependable energy future enabled by The Customer-Powered Grid a reality.

This year, we are also supporting sustainability as an organization through our internal initiatives as well as by donating to EarthDay.org, whose mission is to diversify, educate and activate the environmental movement worldwide.

Clean energy commitments by companies — and the pressure others face to keep up — are becoming watershed moments for the energy transition. From technology and manufacturing companies to real estate and big-box retailers, companies are committing to decarbonization.

By investing in clean energy, using less electricity and participating in utility and energy market grid services, energy users can help fill the role now played by gas generators from central systems. That is, why burn fuel to power a peaker plant when you can use DERs to balance the grid when it’s stressed?

The answer is obvious to us. How about you?

Join us on the journey to the Customer-Powered Grid — and the flexible, clean and dependable energy future that it will enable. Call us at 844-276-9371 or visit CPowerEnergy.com/contact to learn how we can help you most effectively invest in DERs to support sustainability, improve grid reliability and increase energy resiliency.

Shelley Schopp

As Senior Vice President, Customer Fulfillment & Human Resources, Shelley leads CPower’s Operations team. With over 25 years of experience in the energy industry, she helps the company share its collective wisdom through every touchpoint CPower offers.

Three Reasons Why Your DER Strategy Isn’t Working

The next phase of a reliable and clean energy mix will center on deploying more distributed energy resources (DERs) and using them efficiently.

DERs have become increasingly prevalent, largely due to available market revenue streams, opportunities for demand charge mitigation, falling hardware prices for storage and renewable generation and deployment incentives like those in the Inflation Reduction Act. However, up until now, DERs have been mostly used through strategies centered solely on either tariff-based cost avoidance or confined to limited grid services program participation.

DER project owners and operators that only focus on cost avoidance or just participate in capacity programs, which require load reduction commitments ahead of time, often leave value on the table. To unlock the full value of DERs, owners and operators must balance priorities and make decisions based on changes in conditions like asset availability and market prices for energy resources. Only then will DERs fully contribute to a Customer-Powered Grid™ that enables a flexible, clean and dependable energy future.

Common Hurdles to Maximizing DER Value

Maximizing DER value requires a comprehensive strategy. If you do not earn as much grid services revenue as possible and achieve the on-bill savings that you could, your DER strategy may not be working for one or more of the following reasons.

1. The strategy doesn’t consider all DERs.

DERs are any asset that consumes, generates or stores electricity. Or, to put it more simply: If it can reduce demand “behind the meter,” it can be considered and included in your DER strategy. These can be generation assets like generators, solar, co-gens and storage, but can also include energy curtailment and even energy efficiency.

The supply of flexible DERs, including load curtailment, onsite storage, electric vehicle (EV) fleets and other resources, is set for massive growth because the grid needs more flexibility to avoid failures caused by an aging infrastructure and the rising penetration of intermittent, renewable generation.

DERs that can be enrolled in demand response (DR) programs with short lead times, called on frequently, and be highly automated are particularly valuable. DR is the largest DER available in the market, and you don’t need anything other than the flexibility to curtail load to benefit from it.

As the need for flexibility increases even further, and existing and new DERs are incentivized to participate, including all your DERs in your strategy will become ever more important. Accounting for all your DERs is crucial because the more flexibility they collectively provide, the more valuable they are to the grid.

2. Underlying goals and the programs that will help achieve them haven’t been identified.

Unlocking latent DER value often begins with determining your goals. For example:

-

- Are you pursuing all available financial benefits? Such as on-bill savings, grid service revenues and incentives? Optimizing returns requires considering all simultaneously.

- How important is resiliency? Do you want to avoid business interruptions and associated revenue losses? Do you need back-up power? And, if so, what’s your non-emergency strategy for these assets? You may be able to earn revenue by supplying flexible capacity to the grid or to save money by using on-site generation and/or storage assets to reduce demand.

- How can your DERs support your organizational objectives for sustainability? Customers and partners increasingly want to do business with organizations that share their concerns about helping the environment. You may also have to comply with regulations like limits on carbon emissions.

The best strategy for your facility will accomplish all your goals within a comprehensive framework of programs.

3. There is not an efficient plan for implementing DERs.

Unlocking the maximum earning potential of a suite of energy assets in complex markets requires creativity, focus and sophistication. Multiple DER projects, implementers and consultants can result in conflicting strategies.

Unfortunately, however, when it comes to problems that owners and operators face in optimizing their DERs, most solutions fall short in one or more areas. They:

-

- Solve for grid services or on-bill savings – but not both.

- Support only one type of DER asset – not multiple.

- Depend on manual workflows and processes – instead of automation.

If a solution doesn’t solve for both grid services and on-bill savings, support multiple types of DERs and also automate workflows and processes, then your DER strategy doesn’t work. Therefore, you do not maximize the return on investment (ROI) in your DERs.

A Single Solution for DER Optimization

However, optimizing your DERs does not have to be complex. CPower’s EnerWise® Site Optimization solution can help you fully unlock the combined value of grid-services revenue and on-bill savings – in a single solution.

In automatically identifying and executing the most lucrative energy management strategies across on-bill savings and grid services programs and the different types of DERs, EnerWise addresses all the challenges around the optimization of DERs. A virtual energy manager, it maximizes the financial return, resiliency and sustainability benefits of energy storage, onsite and renewable generation and other DERs.

For example, in terms of financial benefits, EnerWise can help you:

-

- Easily estimate and deliver the value from DER projects.

- Justify DER investments and generate forecasted revenue and projected savings.

- Shorten your DER project’s ROI horizon and maximize the financial return.

It also offers resiliency benefits such as:

-

- Avoiding business interruptions by ensuring that back-up power is available.

- Optimizing DERs’ usage according to resource and regulatory constraints.

- Leveraging automated scheduling technology to manage your resources 24 hours a day.

And, when it comes to sustainability, EnerWise can:

-

- Support organizational sustainability goals.

- Redirect carbon-free power to help grid operators reduce reliance on fossil fuel resources.

- Enable the transition to a cleaner and more reliable grid.

EnerWise has been named a finalist in the prestigious 2023 Edison Awards due to the energy optimization technology’s ability to help DER owners and operators get the most out of their assets. It is being honored in the Innovative Solutions and Services category for simplifying the approach to participation in multiple energy-market and utility programs.

Through its dynamic hourly scheduling customized for each site, EnerWise ensures each DER is allocated to the most lucrative available programs on an hourly basis, with one site averaging a 54% increase in grid revenues. It has expanded to 40 new sites across PJM and recently launched in ISO-New England.

EnerWise has drawn strong interest from DER owners and operators across crypto mining, government, education, manufacturing, retail and other commercial sectors who want to gain access to new value streams from their DERs.

If you would like to learn more about EnerWise or other ways to optimize your energy assets, call us at 844-276-9371 or visit CPowerEnergy.com/contact to find out how we can help you create and implement a DER strategy that works.

Customer DERs Relieved Grid Strain and Reduced Electricity Demand During Winter Storm Elliott

CPower customers helped grid operators avoid blackouts by providing over 50 GWh of electricity reduction during Winter Storm Elliott. Customers responded to 197 unique dispatches across three demand response programs in PJM and ISO-NE alone, which together cover all or part of 19 states and Washington, D.C.

In quickly curtailing their loads, CPower customers helped the PJM and ISO-NE regions avoid grid failures as freezing weather caused widespread power outages elsewhere in the country over the two days before Christmas.

“This storm underscores the increasing frequency of significant extreme weather events (the fifth major winter event in the last 11 years) and underscores the need for the electric sector to change its planning scenarios and preparations for extreme events,” NERC President and CEO Jim Robb said, in announcing that FERC, NERC and NERC Regional Entities have launched a joint inquiry into the operations of the bulk power system during Winter Storm Elliott.

With extreme weather events occurring more often, in both winter and summer, regulators and grid operators increasingly look to customer DERs to keep the power on during times of high energy demand. CPower customers, for example, were dispatched a record 1,030 times in 2022.

Electricity Reduction was Key in Winter Storm Elliott Response

During Winter Storm Elliott, CPower customers responded to dispatched events in PJM’s Emergency Capacity and Synch Reserves DR programs as well as ISO-NE’s Active-Demand Capacity Reserves (ADCR) program. The PJM Emergency Capacity dispatches were the program’s first winter events since the 2014 Polar Vortex.

PJM dispatched roughly 4,000 MW of DR on Dec. 23 and another 7,000 MW on Dec. 24 as capacity dropped and demand rose. Power demand rose to a peak of 135,000 MW on the evening of Dec. 23 while forced outages reached as high as 34,500 MW. Demand then remained high overnight, thereby preventing some power plants from replenishing their fuel supplies. By the time the morning peak came on Dec. 24, which was the coldest day of the Christmas weekend, PJM was missing approximately 57,000 MW of its generation flee due to winter storm challenges.

Similarly, unexpected generator outages and reductions and lower-than-expected imports led to a shortfall in operating reserves in ISO-NE, prompting the grid operator to dispatch DR twice as part of its efforts to balance supply and demand and maintain reliability on the regional power system during the evening peak hours of Dec. 24. ISO-NE declared a capacity deficiency and implemented measures under Operating Procedure No. 4 (OP-4) after 2,150 MWs of resources scheduled to contribute power during the evening peak became unavailable. Measures included using reserve resources to balance supply and demand and requesting conservation at market participants’ facilities.

DER Participation Alleviates Grid Strain During Extreme Weather

Historically, grid operators have called upon customers for load relief in summer months when demand has typically been highest due to extreme heat. However, winter electricity demand has increased in recent years due to extreme cold and heating electrification. For example, industry leaders cited big growth in electric heat as a chief cause of blackouts during Winter Storm Elliott, noting that over the past decade the number of households heated with electricity had surged by about 20% in the hardest hit states of Tennessee, North Carolina and South Carolina.

With heat electrification expanding and severe cold becoming more common and spreading further across the country, customer DERs are important in providing load relief and preventing blackouts during extreme weather events year-round.

CPower is the national leader in unlocking the power of customer DERs, with 6.3 GW of capacity across more than 17,000 sites in the U.S, and its customers are vital in strengthening the grid where and when it’s needed the most, as evidenced by how they provided load relief and energy reduction during Winter Storm Elliott.

Furthermore, CPower has hosted a webinar to help businesses in PJM understand the increasing importance of DERs in providing grid resiliency during winter months and learn how they can get paid for providing load relief to the grid. To watch, please click here.

Dann Price

Dann has specialized in PJM Demand Response for more than 10 years. As CPower’s Executive Director of Market Development for the PJM market, he is responsible for keeping hundreds of customers with thousands of sites up-to-speed on market conditions, energy prices, program particulars, and regulatory issues in the ever-changing PJM demand response market.

Mike Hourihan

Mike is Market Development Director at CPower. He has extensive experience in analyzing and developing market rules in multiple energy markets across North America. His career has focused on advocating for demand side resources participation in the energy markets as a reliable low-cost option compared to traditional generation assets.

Data Centers Have the Grid’s Answer for the Fourth “D”

Much has been made in the energy industry during recent years of the “3 Ds,” the macro trends of digitization, decentralization, and decarbonization that have driven the electric grid’s transformation toward a cleaner, more dependable, and efficient future.

The 3 Ds are generally considered to be positive trends rooted in good intentions for the grid and society.

There is, however, a fourth “D” that has been nothing short of a costly troublemaker for the grid since its inception and threatens to undermine every good deed the original 3Ds seek to accomplish.

“Disruption” has been the grid’s ever nemesis since Thomas Edison fired up electricity’s first electric grid in 1882 at Pearl Street Station in lower Manhattan. Like any arch-villain, disruption has a knack of showing up at the most inconvenient of times, particularly when the grid is already vulnerable.

Consider the most disruptive grid events of the last decade. Most were weather-related and resulted in blackouts.

Actually, we don’t have to flip too far in the history book for evidence of weather-related disruption pushing the grid to the brink of total failure. The tragedy this past February in Texas when record winter temperatures forced the ERCOT grid to suffer its first blackouts in a decade is a prime example of disruption’s wicked handiwork.

The California blackouts in August of 2020 that took place during an extreme heatwave in the western US are another example and prove that disruption doesn’t partake in an offseason.

Unfortunately for the grid, disruption is a devil that takes many forms. The COVID pandemic is a prime example.

The lockdowns during 2020 led to electric loads shifting from commercial buildings to residential, which caused grids across the US to work overtime to ensure electric supply and demand remained in balance.

Like death and taxes, disruption may very well be an inevitable fate for the grid. Yet throughout history, fate has had a way of swinging favor back toward the good guys.

Demand response, the practice by which organizations are financially rewarded for shifting load from the grid during times of stress, is a case in point.

We’ve previously written how demand response has been in the US electric grid’s defense arsenal for decades. Today, with the proliferation of distributed energy resources (DERs) adding to that arsenal, demand response has proven to be an even greater thwart to grid disruption than ever before.

Data Centers, with their penchant for owning on-site DERs such as backup generators and energy storage, are in a prime position to participate in demand response and help the grid fend off disruption when the last (or any) of the 4 Ds rears its ugly head.

Across the country, an increasing number of data center organizations are realizing how helping the grid pays immeasurable dividends for their local communities.

During February’s grid collapse in Texas–which tragically resulted in hundreds of citizens losing their lives–data centers proved to be the local heroes.

Data centers participating in demand response programs provided flexible energy resources at the critical times when the ERCOT grid needed them. These resources played an integral role in keeping the grid from a total collapse, which ERCOT has stated was minutes away and would have kept much of the Lone Star State in the dark and freezing for weeks.

For their helping the ERCOT grid, these Texas data centers earned a substantial demand response revenue payment. But it’s their stewardship of community sustainability that should be noted and applauded. Fortunately for data centers, sustainability recognition for demand response participation is starting to garner measurable notice.

Demand response and all forms of demand-side energy management allow the grid to continue its transition from a fossil-fuel-dominated past to a renewable energy future.

Disruption, be it of the foul weather variety or some other adversarial pill will be waiting in lie around every bend of our journey to energy’s future. Within their sophisticated suite of behind-the-meter energy assets, data centers have the antidote to disruption’s poison.

The modern world relies on data centers’ megabytes. The grid and local communities nationwide are counting on data centers megawatts.

To learn more about how data centers can help the grid, reduce their carbon footprint, and improve their local communities’ sustainability, download CPower’s latest ebook: “A New Age of Demand-Side Energy Management.”