Everything You Need to Know About New York’s New DER & Aggregation Participation Model

The New York Independent System Operator (NYISO)’s new DER & Aggregation Participation Model reflects how far distributed energy resources (DERs) have come as well as the potential they can unlock as the Empire State drives toward its Reforming the Energy Vision (REV) initiative for creating a more diversified grid by better integrating customers.

Not only has the state’s grid operator acknowledged the collective power of DERs aggregated into virtual power plants (VPPs), but it has also launched the country’s first program to integrate aggregations of DERs into wholesale markets in sync with an effort to create New York’s grid of the future.

As the first registered aggregator for the DER Model and a contributor to the state’s efforts to shape its future grid, CPower sees four key takeaways in how NYISO’s new program improves grid reliability.

NYISO’s DER Model:

1. Benefits commercial and industrial customers.

Commercial and industrial (C&I) customers that can quickly provide grid services can earn additional revenue and save more money by helping NYISO keep the grid balanced. Energy users with automated technology are particularly well positioned because NYISO incentivizes customers to respond to a request for help within minutes.

The DER Model provides market opportunities for C&I energy users by letting them access existing markets as if they were a power plant. For example, customers can access capacity, energy and ancillary service markets under the relevant rules for each. Most of these markets were previously available through other mechanisms, but not all. Until now, these users have had no opportunity to access NYISO’s attractive real-time energy markets. Under the DER Model, they will.

Customers participating in fast-acting demand response for the first time will do so under the new model while NYISO phases out its existing Demand Side Ancillary Service Program (DSASP) for demand response customers. NYISO offers a DER Onboarding Suite for customers interested in participating in the grid operator’s markets.

2. Differs from the DSASP program.

Customers now enrolled in DSASP can remain in the program until it sunsets on April 16, 2025. They will then have to provide grid services through the DER Model if they would like to participate in NYISO markets similarly to how they have done.

Unlike the DSASP program that it replaces for new customers, the DER Model does not confine customers to a single, economic-based demand response program. While DSASP gives energy users the opportunity to offer load reduction into New York’s electricity markets to meet reliability needs, the DER Model allows customers to provide an array of wholesale programs simultaneously.

3. Taps the power of VPPs.

This landmark program unlocks the full benefits of VPPs for the resiliency and reliability of the grid, while also creating new revenue opportunities for commercial and industrial energy users and DER owners and developers. DERs of at least 10 kW aggregated into VPPs of at least 100 kW can simultaneously provide wholesale services to the grid operator and retail services to utilities and load servers.

DER aggregations can include resources such as small-scale solar arrays, batteries and electric vehicles, per market rules approved by the Federal Energy Regulatory Commission (FERC). Curtailable load, or demand response, is the only type of DER that can be aggregated as a single resource and technology.

Leveraging the flexibility of such DERs is essential to achieving New York’s clean energy goals. In its DER Model announcement, NYISO forecasts distributed generation in the state to roughly double over the next three decades as the state strives to have 70% of its electricity generated by renewable resources by 2030 and achieve a 100% clean power grid by 2040. Also, per its REV goals, the state wants to reduce greenhouse gas emissions to 60% of their 1990 levels by 2030 and to just 20% by 2050.

4. Shapes the state’s future grid.

In what was likely a coincidence, New York’s Public Service Commission formally instituted a major, multi-year Grid of the Future proceeding within days of FERC’s approval of the market rules for NYISO’S DER Model.

The Grid of the Future proceeding will dovetail with, and help build upon, the NYISO program by developing a grid flexibility study and plan outlining the current and future potential capabilities of flexible DERs across New York’s electric grid. The study will also identify near-term actions likely to increase the deployment and use of flexible resources and improve integration of flexible resources into grid planning and grid operations.

Just as we helped to drive the process that led to NYISO’S DER Model, CPower will actively participate in the Grid of the Future effort to unlock more opportunities for our customers while helping New York meet its flexibility goals.

Customers interested in earning grid services revenue and reducing energy costs by helping NYISO improve grid flexibility can contact CPower to learn more: cpowerenergy.com/contact/.

Aaron Breidenbaugh | Senior Director, Regulatory and Government Affairs, CPower

Seasonal Readiness 2024

The Booming Potential of Virtual Power Plants

A recent Bloomberg opinion piece contrasted the massive growth in distributed energy resources (DERs), such as rooftop solar and electric vehicles, with sluggish deployment of other clean energy solutions, such as wind power and transmission upgrades, as the world races to reach net zero emissions. While the author was spot on in many respects, the piece failed to account for the role that Virtual Power Plants (VPPs) can play in augmenting the ability of DERs to support the entire grid, and how utility mindsets are shifting.

VPPs aggregate and coordinate distributed energy assets like flexible load assets, rooftop solar, stationary batteries and electric vehicle chargers. This turns these DERs into a reliable block of flexible capacity that can support a variety of grid needs. With VPPs we can harness the rapid expansion of DERs for the benefit of all and continue driving greater decarbonization and energy reliability while we work through longer timelines for other necessary pieces of the new energy economy.

Furthermore, VPPs provide grid benefits at a far lower cost than alternatives. A study released earlier this year found that the net cost to a utility of providing resource adequacy from a VPP is roughly 40% to 60% of the cost of alternatives, which translates into a 60 GW VPP deployment meeting future resource adequacy needs while saving $15 billion to $35 billion.

There is growing public and private support for VPPs. Recently, the day before the opinion piece was published, the U.S. Department of Energy released its Pathways for Commercial Liftoff report for VPPs. The report found that tripling the current scale of VPPs to 80-160 GW by 2030 could expand the U.S. grid’s capacity to reliably support rapid electrification while reducing overall grid costs by $10 billion per year. Not only that, but there are up to $100 Billion in loans available to support VPP deployment.

Utilities can’t afford to ignore these cost savings, and are highly motivated to gain better visibility and control of DERs to maintain the stability of the grid. Therefore, we have many reasons to be optimistic about the rapid growth in VPPs over the next decade. Any forward-looking energy system analysis that doesn’t include VPPs is incomplete.

VPPs can increase the impact of DERs and buy precious time for technologies like wind generation and transmission upgrades to progress. VPPs won’t solve the climate crisis alone, but they are a promising tool to accelerate the clean energy transition. With their flexible capacity, they can bridge the gap created by the sluggish deployment of technologies such as wind power by leveraging existing resources until large-scale renewables can fully deliver.

Michael Smith

Michael Smith is a visionary and innovative leader who brings more than 25 years leadership experience in the energy industry to CPower as its CEO. Michael joined CPower from ForeFront Power, where he was the CEO of the company’s North American solar and energy storage business, responsible for strategy and all business areas across the U.S. and Mexico.

Prior, Michael served as Senior Vice President, Distributed Energy, at Constellation, the retail energy subsidiary of Exelon Corp., where he was responsible for Constellation’s distributed solar, energy efficiency, and energy asset operations businesses across the U.S. He also served as Vice President, Innovation and Strategy Development, for Exelon Generation, and led Constellation Technology Ventures, Exelon’s venture investing organization. Earlier, Michael was Vice President and Assistant General Counsel for Enron Energy Services and a trial lawyer at Bricker & Eckler, LLP.

Possible 446 MW Shortfall Threatens Grid Reliability in NYC for Summer 2025

Photo Credit: New York Independent System Operator

A summer like this year’s could be trouble for New York City in 2025.

Earth’s hottest summer on record lingered into early September in the Big Apple, as the city posted its first official heatwave of the year with three consecutive days of high temperatures exceeding 90 degrees Fahrenheit.

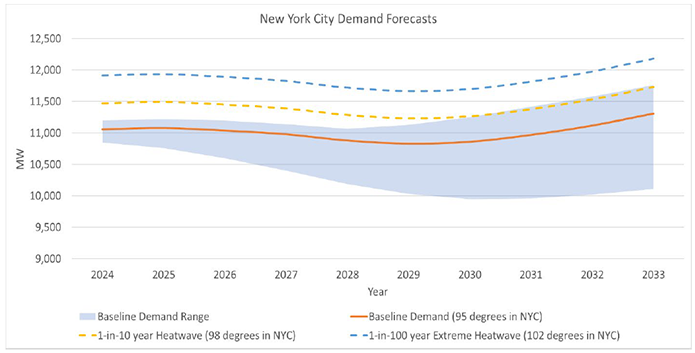

Should the summer two years hence also be especially hot, New York City could grapple with blackouts or brownouts. The New York Independent System Operator (NYISO) has projected a deficit of as much as 446 MW on the peak day during expected weather conditions (95 degrees Fahrenheit).

The baseline summer coincident peak demand forecast for New York City (Zone J) in 2025 increased by 294 MW in the past year, primarily due to the increasing electrification of transportation and buildings, NYISO noted, in identifying a “reliability need” in its Q2 Short-Term Assessment of Reliability (STAR).

Also, NYISO noted, as of May 1, 2023, 1,027 MW of affected peak generation plants have deactivated or limited their operations under the New York State Department of Environmental Conservation’s (DEC’s) “Peaker Rule,” which provides for a phased reduction in emission limits, in 2023 and 2025, during the ozone season (May 1-September 30). An additional 590 MW of peakers are expected to become unavailable for summer 2025, all of which are in New York City, thereby resulting in a total unavailability of 1,617 MW of peaker generation capability.

In terms of possible relief, the DEC regulations include a provision to allow an affected generator to continue to operate for up to two years, with a possible further two-year extension, after the compliance deadline if the generator is designated by the NYISO or by the local transmission owner as needed to resolve a reliability need until a permanent solution is in place. So, at least some of the peaker generation capacity that is currently expected to be unavailable could instead remain available through a two-year extension, and an additional two years thereafter if an additional extension were granted, thus perhaps mitigating the near-term reliability need for New York City.

Also, “The New York City transmission security margin is expected to improve in 2026 if the Champlain Hudson Power Express (CHPE) connection from Hydro Quebec to New York City enters service on schedule in spring 2026, but the margin gradually erodes through time thereafter as expected demand for electricity grows,” according to NYISO’s STAR report.

Looking beyond 2025, NYISO warned that the forecasted reliability margins within New York City may not be sufficient if the opening of the CHPE, which will deliver 1,250 MW of renewable power into the New York metro area, is significantly delayed. Reliability margins also may not be sufficient if additional power plants become unavailable or demand significantly exceeds current forecasts, NYISO noted.

“Without the CHPE project in service or other offsetting changes or solutions, the reliability margins continue to be deficient for the ten-year planning horizon. In addition, while CHPE is expected to contribute to reliability in the summer, the facility is not expected to provide any capacity in the winter,” according to NYISO.

In the meantime, Con Edison, as the Responsible Transmission Owner, is solely responsible for developing a regulated solution to the near-term reliability need that NYISO has identified for summer 2025. NYISO has also solicited market-based solutions.

Per NYISO: “If proposed regulated or market-based solutions are not viable or sufficient to meet the identified reliability need, interim solutions must be in place to keep the grid reliable. One potential outcome could include relying on generators that are subject to the DEC’s Peaker Rule to remain in operation until a permanent solution is in place.”

A reliability need could also drive up capacity prices for New York City in summer 2025, if the possible conditions that NYISO has warned could be created by a combination of escalating demand and the retirement of generators come to fruition.

As this is an emerging and evolving situation, CPower will follow it closely. If you have immediate questions or would like information in the meantime, please contact us online or at 844-276-9371.

Keith Black

As CPower’s Regional Vice President and General Manager for the Northeast, Keith has leveraged his unique combination of sales and operations expertise, energy business relationship development, channel development, sales opportunity identification and solutions management, backed by his intrinsic talent for building winning business strategies, to help the company and its customers achieve strong and sustainable financial gains.

In leading CPower’s business and growth strategy for New England and New York, he has helped in expanding New England’s leading edge of solar, storage, and residential monetization and capturing market share in all aspects of the evolving DER landscape in New York. Succeeding in these exciting and cutting-edge DER opportunities has come with a complex array of technologies, controls and partner integrations, as well as a demanding and high touch for his team.

A versatile, high-energy executive, he has extensive experience in leading high-performing teams, at businesses from Fortune 500 organizations through start-ups, and guiding companies to profitable growth. With more than 30 years of experience in the energy industry, he has become a trusted energy advisor to both prospects and customers, enabling them to reduce risk, lower costs and use renewable resources when possible.

Seasonal Readiness 2023

NY Utility Con Edison Sees DERs and Demand Response Programs that Use Them in its Future (and Present)

Con Edison’s grid of the future aims to deliver 100% clean energy by 2040.

The New York electric utility in charge of delivering safe, reliable energy to 10 million people living in New York City and Westchester County knows full well what’s at stake during their drive to a cleaner, more dependable grid.

Like any utility in the country striving toward a future powered less from fossil resources and more from renewables and other clean sources, Con Edison must deal with the inherent intermittency issues renewable resources such as wind and solar present.

Unlike most utilities in the US, however, Con Edison has more citizens and businesses depending on them.

That’s why a key initiative of their plan to build a “resilient, 22nd-century electric grid” of the future involves significantly expanding distributed energy resources (DERs), which are small, decentralized, electrical systems that are connected to the grid and can consume, produce, or store electricity.

DERs, as regular readers of The Current likely know by now, include curtailed loads from commercial and industrial organizations participating in demand response programs, which pay organizations for using less energy when the grid is stressed due to high electrical usage or when electricity prices are high.

Con Edison has for years counted on demand response programs to help lower peak usage on its grid with popular demand response programs such as the Distribution Load Relief Program (DLRP) and the Commercial System Relief Program (CSRP), both of which were launched in 2016 and continue to be popular among participating organizations today.

In 2020, the New York Public Service Commission established two new demand response programs, Term-Dynamic Load Management (Term DLM) and Auto Dynamic Load Management (Auto DLM), to further help utilities in the Empire State reduce peak loads during times of high electrical use.

Term DLM and Auto DLM specifically aim to help New York reach its clean energy goals, which are among the most ambitious in the US, by allowing capacity from behind-the-meter DERs such as energy storage, on-site generators, CHP units, and more to participate in demand response.

Con Edison hopes the revenue earned by Term DLM participants inspires New York organizations in the utility’s territory to invest in DER technology. Marlon Argueta, Con Edison’s manager of demand response programs announced as much in a recent interview when he said he hopes “the revenue certainty the Term-and Auto-DLM programs provide will encourage participants to invest in battery storage and other clean energy technologies for demand response.”

It’s those clean technologies, Con Edison believes, that will help New York reach its clean energy goals. Those same technologies can help New York City organizations comply with climate-focused regulations such as Local Law 97, which establishes emissions regulations on buildings in the city over 25,000 square feet that must be complied with beginning in 2024.

An estimated 50,000 buildings in New York City stand to be affected by Local Law 97. Many are in the commercial sector and may require comprehensive retrofits, which can be partially or perhaps fully paid for with revenues earned from participating in Con Edison’s demand response programs.

Flexible consumer demand, which DERs certainly provide organizations that possess them, is helping to evolve the electrical grid from, in the words of senior advisor to the Regulatory Assistance Project (RAP) Mike Hogan, “a world where we forecasted demand and scheduled supply to a world where we will forecast supply and schedule demand.”

This grid of tomorrow where demand follows supply instead of the other way around as the case has been since the grid was invented is the grid of the future–not just for Con Edison, but for utilities and grid operators across the country.

Learn more about how CPower’s Building Management System-as-a-Service can turn your New York building into a smart building, lower your energy costs, and earn revenue for helping the grid.

Seasonal Readiness 2022

State of the New York Energy Market in 2021

NYISO President and CEO Richard Dewey believes that market design is the path forward for New York as the state looks to keep its grid reliable as the state pursues its climate goals. In this webinar CPower’s New York team analyzes just what those market designs entail and how local, state, and federal regulations might impact New York’s energy market.