Contracting and Funding Projects with DER-Asset Optimization

Securing funding and structuring a contract may be the hardest parts of developing new distributed energy resource (DER) projects.

Even with the Inflation Reduction Act set to catalyze billions of dollars of investment in renewable energy projects, financial viability – or the perceived lack thereof – has become a bigger barrier to deployment than technology. In a recent survey, microgrid developers ranked funding approval as the most challenging project stage, followed by project sizing and capturing upside monetization opportunities.

Getting DER projects greenlighted can be challenging because proformas often do not reflect the full value of the investment, or financiers discount project return projections because the tools utilized to estimate returns are not employed to realize value in live operations. Many times, DER owners and developers overlook opportunities to earn grid services revenue or reduce costs or do not realize projects can recognize both. Full visibility into a project’s value stack is essential to both funding and contracting DER projects.

Making DER Projects Pencil Financially

DERs are any assets that use, store, discharge, or generate electricity, like on-site generation, energy storage, electric vehicle chargers, solar panels, or load curtailment. Energy users are installing more DERs but only when they can make the projects pencil financially by connecting them to sufficient value.

Optimizing DERs involves choosing between all available value streams in each day or hour based on which would be most lucrative, and stream values can differ substantially depending on the details of the site and project. Successful DER projects justify investments by creating proformas that account for all possible revenue and savings based on the site and asset constraints and the available value opportunities.

If you are a DER owner/operator trying to fund a project, optimization starts at the proposal stage to enable an accurate view of all the on-bill and grid services value and ensure the asset is sized to optimize that value. Beginning at the proposal stage helps in sizing projects correctly and making even marginal projects pencil by considering all available value streams. Calculating the returns that a project would yield and demonstrating where they will come from and how they will be realized improves your chances of securing financing.

Getting Creative with Contracting Structures

In structuring your proposal and contracting structure for behind-the-meter projects, identifying the type of value and timing of realization of that value can be key to identifying creative contracting structures with the utility-account-holder. For example, monthly or annual lease payments from the utility-account-holder may be possible where on-bill value is the driving value source, or a split of grid service revenue may be a more reasonable approach where grid services are key to the project’s financial health. Identifying and executing on the ideal contract structures stems from a high degree of confidence in what sources of value will be realized post-contract.

Impacting Project Success

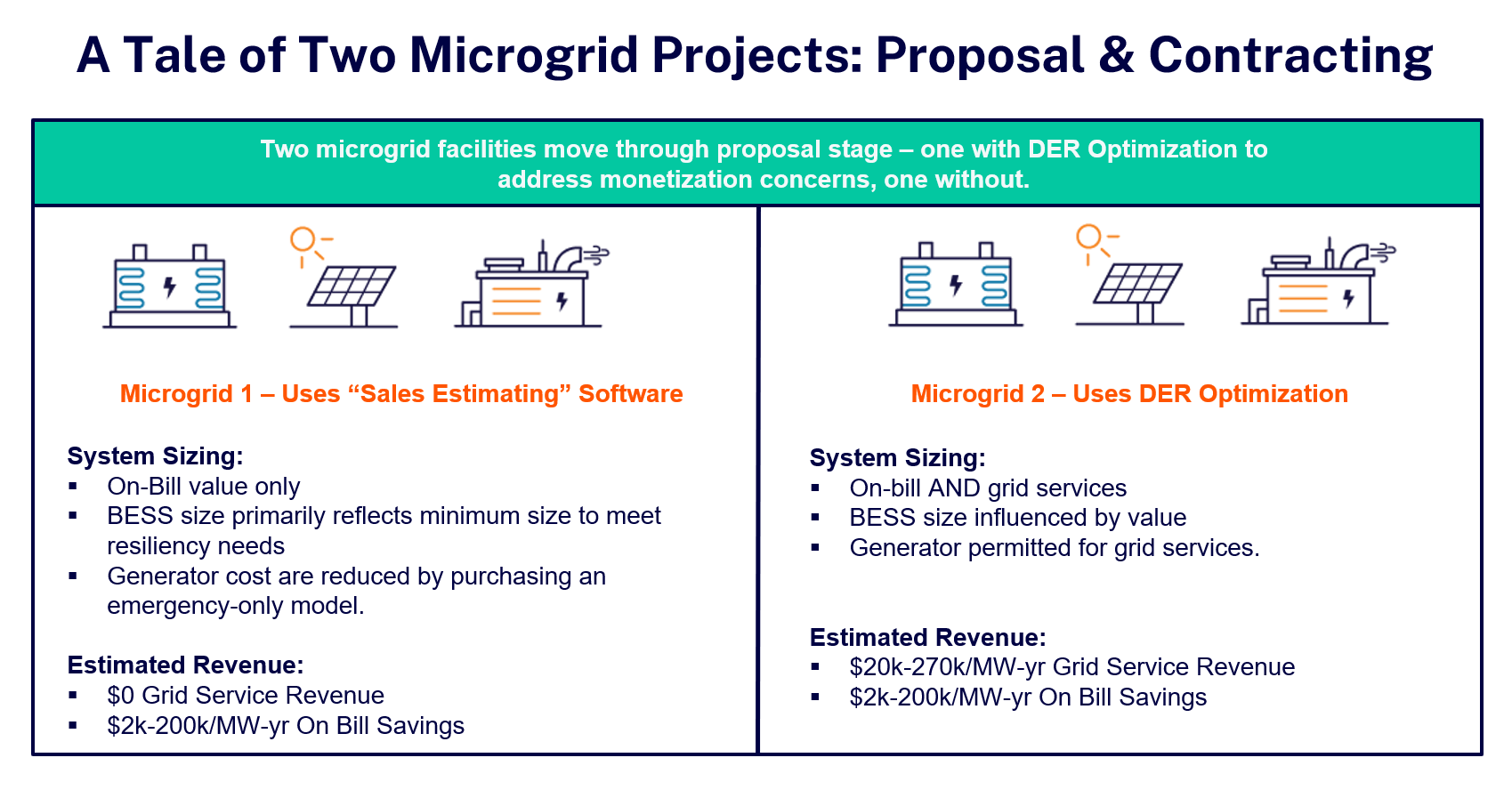

Overlooking opportunities at the outset can prevent a customer from accepting your proposal or limit the project’s eventual returns. Consider the returns from two DER projects in ISO New England (ISONE) as examples. One project used DER optimization but the other did not.

Project #1 (Not Optimized)

This customer developed a microgrid based on the energy user’s resiliency requirements and demand charge management expectations only. Although the project was approved and eventually met the customer’s requirements and expectations, it could have been more rewarding with a larger battery that would have provided incremental resiliency. The customer ultimately left money on the table because it did not consider the full stack of available value streams, and participation in other available programs such as ISONE capacity programs and Connected Solutions was suboptimal.

The participation of the generator was also limited by the lack of DER optimization. The customer invested in a generator that was permitted for emergency-use only and was specifically to address their resiliency requirements. With a DER optimization view and a full picture of all sources of potential value, the customer may have found that they could have contracted instead for a non-emergency-only generator and used that generator for both the resiliency requirements and to earn revenue by providing grid services. The revenue earned from grid services would have more than offset the added cost of a properly permitted non-emergency generator.

Project #2 (Optimized)

Conversely, another customer and benefited more from their project by considering all value streams and the full potential of DER optimization when designing, funding, and contracting their project. Beginning at the conceptual stage, they iterated on key aspects of the battery for a retrofit to a solar array in the PJM area.

Duration was one of the elements evaluated when modelling potential grid services values in PJM. After considering several duration iterations, the project developer decided that a one-hour battery would provide better returns than a multi-hour battery based on anticipated value streams, cost considerations, and warranty constraints. As a result of determining the right size for the battery upfront, the customer increased its projected return and is now set up to take advantage of all revenue streams.

Such potential to benefit from multiple revenue streams is always helpful given that the financiers of DER projects want as many revenue sources as possible. Diversification of project revenue sources and greater returns increase the chances of securing funding.

Securing funding for DER projects may be hard, but DER optimization makes it easier. Considering and pursuing all value streams from the beginning helps projects pencil and increases returns.

If you would like to learn more about why energy users and DER portfolio owners are turning to optimization solutions that evaluate site-specific performance data and energy market options to create project proformas that get projects greenlighted, watch our presentation from the 2023 Microgrid Knowledge conference: The Greatest Bang for Your Buck: Getting Projects Contracted and Funded with DER-Asset Optimization.

You can also call us at 844-276-9371 or visit CPowerEnergy.com/contact to find out how our EnerWise™ Site Optimization solution makes estimating and delivering the value of DER projects easier.

Rob Windle

As CPower’s Vice President, Strategy Planning & Business Development, Rob keeps a curious eye locked on the future. He leads the development and management of innovative solutions that support the proliferation and monetization of distributed energy resources (DERs) such as decentralized generation and energy storage. He has more than 20 years of experience in product development, direct and channel sales development, and management across the Energy, Enterprise Software, and Automation Controls industries. A Certified Energy Manager®, he holds a Bachelor of Science degree in industrial engineering from the University of Cincinnati and lives in Atlanta, Georgia.