US Electric Utilities and the Grid of the Future

An inherent flaw in any electrical grid lies in the inevitable truth that the entire grid system—from the generators to the transmission lines to the substations to the power lines and transformers outside of homes and businesses—must be sized to serve peak use.

For many grids in the US, peak energy use happens over just a few hours on hot summer days. In Massachusetts, for example, it has been estimated that the top 10% of high load hours during the year account for about 40% of the cost of operating the grid 1. Shaving electric use during these key hours of high usage can therefore have a significant benefit in reducing long-term electric rates.

The goal of utility demand response programs is to strategically reduce energy use at those peak times which, in turn, keeps overall costs (and rates) down by reducing the need for expensive and dirty peaker plants while also reducing the required size of grid infrastructure.

Demand response and traditional energy efficiency are viable tools through which utilities across the US plan to reduce peak usage and realize those savings for our customers.

The Road to Tomorrow: Possibilities and Challenges

There is still some debate over what the best path to the future may be and how quickly we can get there, but the end goal for many US electric utilities is clear. To address climate change and other environmental and equity issues, we need an environmentally sustainable power system.

For the Northeast, as for much of the country, this will mean integrating into our grids a lot more solar and wind power to complement existing hydro resources and hopefully (for those of us in the US Northeast) access to even more hydro resources from our Canadian friends.

Solar and wind are valuable and popular resources that should be encouraged during the grid’s transition from the way it was structured and operated for most of the 20th century to a tomorrow lush with sustainable possibilities.

The sun is not always shining, and the wind is not always blowing. For the grid to overcome the inherent intermittency of these clean renewable energy sources and evolve to a cleaner more efficient future, demand response will play a crucial role in balancing the use of electricity with its supply.

The Increasingly Important Role of Demand Response

Today, many demand response programs at the utility level are simple in design, yet effective in achieving results. Most utilities execute their DR programs on peak days in order to reduce peak usage. To attain the future we all desire, however, utilities will need to add new demand response programs to help balance the grid every day of the year.

Battery storage will also play a critical role in this transition to the future. At National Grid in the Northeast US, for example, battery storage is already an important part of the suite of demand response programs we use to manage peak usage on our electric grid.

Relying on storage alone to solve every peak issue, however, would be more expensive than if we were to also include other types of tried-and-true demand response strategies such as turning down HVAC, lighting, or process equipment during times of demand response participation.

This challenge will be best solved with each utility offering a diverse portfolio of DERs in diverse demand response programs to serve the needs of its evolving grid.

Creating a More Cost-Effective Grid at the Utility Level

Much has been made about the benefits to all customers for addressing climate change and other environmental problems. What hasn’t been shouted from the rooftops is the very real possibility that the grid of the future will also be cheaper and more equitable than what we’ve known in recent decades.

The cost of solar, wind, and batteries has dropped considerably in the last five years. These once cost-prohibitive resources are now among the cheapest resources available and have been seized upon by suppliers on the supply side of electricity’s exchange and consumers on the demand side.

Now more than ever, electric utilities across the US need demand response programs to better integrate these key resources into the grid so everyone can benefit from the reduced costs and lowered emissions they enable.

National Grid, like many utilities across the US in deregulated energy markets, is not allowed to own or operate power plants. The regulations that govern us and other utilities involve revenue decoupling mechanisms that ensure our utility’s profits are not tied to increasing electricity sales. Instead, our regulators have put other performance-based incentives in place for us to make sure that our interests always align with our customer’s interests.

Demand response and the rest of our energy efficiency portfolio are great examples of these incentives. As the saying goes, the cleanest kilowatt of electricity is the one you do NOT use. For decades, we and other utilities across the country have offered energy efficiency programs to our customers, because it is a lot cheaper to save energy than it is to build new power plants and grid infrastructure.

Financial Incentives as a Driver of Change

How do we get that to a lofty goal of having 100% of our electricity generated from renewables? It’s a complex answer which requires efforts on both the supply and demand sides.

The opportunities for both commercial and residential consumers to serve their clean and renewable loads back to the grid will likely thrive if the right incentives are in place.

For starters, utilities will need to introduce incentives to encourage more households and businesses to install behind-the-meter solar and storage while simultaneously incentivizing the acceleration of front-of-the-meter solar and wind farms.

That being said, there is a lot more electric utilities need to do to get the word out to our customers about existing incentives to adopt renewables. Many customers would likely move on this today if they knew how lucrative renewables can be and how much they help the environment.

Of course, the grid needs to be ready to accept all that new renewable generation. The challenge then for utilities is to develop customer-friendly programs that incentivize customers if they allow their utility to discharge and charge their batteries at the right times and tweak their inverter settings to improve power quality.

Utilities will also need to further develop the system used to manage distributed energy resources so that the right signals are sent at the right time to the right places on the grid in order to unlock the maximum benefit and reduce emissions and overall costs.

It’s an exciting time for electric utilities. The grid is evolving and we, along with our customers, are evolving with it, poised to do our part to help keep the power flowing, rates affordable, and the Earth plentiful during this important transition to energy’s sustainable future.

Regulatory Round-Up 2021

We are bringing in the Market and Regulatory A-Team for the first-ever Regulatory Round-Up panel. Are you curious about New England, New York, California, ERCOT, PJM Energy Markets? Looking for more insight on FERC Order 2222, or NY’s Rule 222? Wondering what ERCOT is doing to prevent another catastrophic grid outage? Just to name a few. CPower’s entire Market and Regulatory team will be on hand to answer some of the most pressing questions to help you better understand your energy market and make more informed decisions about your energy strategy.

Our experts will provide deep insights into many of the questions we received during the State of the Demand Side Energy Management Webinar series. AND … we will have a live Q&A session during the webinar.

State of the PJM Energy Market in 2021

The square-off between individual states and the ISO continues to ruffle feathers on both sides. In this webinar, Ken Schisler and CPower’s PJM team will examine the core issues of the rift as well as how key regulations such as FERC Order 2222 are impacting the largest wholesale energy market in the world.

State of the Texas Energy Market in 2021

In recent years, Texas’s energy market has been put to the test with shrinking reserve margins, increased electrical demand, and grid-threatening heat waves. The ERCOT grid has held and the market has helped organizations in the Lone Star State earn significant revenue by monetizing distributed energy resources.

State of the California Energy Market in 2021

With the blackouts in August of 2020 lingering in its rearview mirror, California looks to shore up its energy market and grid to thwart future catastrophe before it can take shape. But what has the state’s energy players learned from the missteps of 2020? Register for the webinar and find out from CPower’s Golden State expert, Jennifer Chamberlin to find out.

State of the New York Energy Market in 2021

NYISO President and CEO Richard Dewey believes that market design is the path forward for New York as the state looks to keep its grid reliable as the state pursues its climate goals. In this webinar CPower’s New York team analyzes just what those market designs entail and how local, state, and federal regulations might impact New York’s energy market.

State of the New England Energy Market in 2021

What will New England do to appease states that are angered at the policies they feel affect their desired fuel mixes? In this webinar, CPower’s Nancy Chafetz examines this key topic and will explore other critical regulatory issues and market proposals that are sure to shape the New England Energy Market in 2021 and beyond.

This webinar is part of CPower’s annual State of Demand-Side Energy Management in North America series. To learn more about the series or to register for other webinars for different US energy markets click here.

What has California Learned from the 2020 Blackouts?

The sweltering heat that raged across thirteen western states from August 14-17, 2020, had a significant impact on the tens of millions of people who experienced record high temperatures well above 100°F. The triple-digit temperatures had an historic effect on California’s electric grid, too. Consider August 17 as a case-in-point in the energy deficiency the state’s grid operator faces.

According to CAISO’s market policy and performance vice president, Mark Rothleder, CAISO had expected the load on its grid to peak near 49,800 MW on August 17 during the 5-6 pm PT hour with available capacity near 46,000 MW, leaving a 3,600 MW shortfall.

By 8 pm PT on the 17th, that gap would grow to more than 4,400 MW as peak load approached 47,428 MW, but capacity had fallen to around 43,000 MW due to solar generation declining with the setting sun.

Faced with more inevitable forced outages on August 17, CAISO’s own CEO, Steve Berberich spoke before the ISO’s Board of Governors and said, “The situation could have been avoided,” and further asserted that the state’s resource adequacy program is “broken and needs to be fixed.”

A proposed decision on the future of resource adequacy in California is due in mid-June 2021.

Lack of Imports During the Heatwave

The scorching temperatures drove a massive demand for energy throughout the western US, resulting in California’s inability to import electricity from neighboring states as it typically does in the evenings when its robust solar resources go offline with the setting sun.

In its official analysis, CAISO detailed a series of events explaining how “realtime imports increased by 3,000 MW and 2,000 MW on August 14 and 15, respectively, when the CAISO declared a Stage 3 Emergency.” but ultimately “the total import level was less than the CAISO typically receives.”

Unable to import needed electricity and hamstrung by rising demand amidst record-high temperatures, the California grid suffered its first blackouts in nineteen years.

The Push to Address Climate Change

Californians, by and large, see the recent wildfires and heat waves that have ravaged the Golden State and wreaked havoc on its grid as events driven by climate change.

The state’s drive toward its energy future subsequently involves not only taking steps toward making its grid resilient but doing so in a way that minimizes its climate impacts.

The state’s three main energy organizations–The California Independent System Operator (CAISO), the California Public Utilities Commission (CPUC), and the state’s energy commission (CEC)–have been closely examining the recent grid failures and have submitted two reports (Preliminary and Final Root Cause Analysis) seeking to establish a root cause for the blackouts .

While they may not agree on any single culprit for California’s grid woes and for the August blackouts, the big three organizations rightfully believe that establishing grid resilience and serving the state’s ratepayers are the priorities.

Balancing Energy, Capacity, and Renewables for Grid Resiliency

California’s renewable energy resources performed as expected in 2020, despite some slanted media coverage that may have tried to pin them with the lion’s share of the blame for the August blackouts in 2020.

California has no intention of veering from the state’s long-traveled path of developing and integrating more renewable energy into its generation mix.

In the wake of the 2020 blackouts, the resource adequacy proceeding in California is looking at how to ensure that the state procures energy sufficiency-–

i.e. electricity needed to serve the state on a day-by-day, moment-to-moment basis–in addition to capacity sufficiency–i.e. reserves that can be called on in the event of an emergency.

The proceeding is trying to establish the optimal balance between energy and capacity that can be procured within state boundaries so it can then be determined just how much reliance should be placed on imports now and in the future.

As is the case with other states in different energy markets around the US, California is at somewhat of a tipping point with so much of its generation mix dependent on renewables with inherent intermittency that renders them unavailable at unpredictable times in the day when the sun isn’t shining or the wind isn’t blowing.

Like many grids facing a similar predicament, California’s grid of today and the future needs to ensure that its load begins to follow its supply, meaning that demand-side resources adopt agile flexibility that can react to sudden disruptions in electricity supply due to intermittency.

Those disruptions and foreboding heatwaves show no signs of diminishing in 2021 and beyond. It’s time for California to shore up its grid’s reliability with an energy marketplace that rewards flexible resources on the demand side.

The grid and the people it serves depend on it.

Achieving Carbon Emission Goals with Demand-Side Energy Management

A convergence of pressures in recent years has caused organizations across North America to examine how their energy use can be managed to help achieve their carbon reduction goals.

These converging pressures originate from customers, who desire to do business with sustainability-minded companies; investors, who realize the inherent value associated with an organization being carbon neutral; and regulators, who are introducing laws that reflect and address society’s move toward a cleaner energy future.

Since these pressures show no signs of waning, the question of how exactly demand-side energy management can be optimized to achieve carbon goals is becoming a popular discussion in the industry today.

Some of the best practices for carbon-reducing with demand-side energy management are more obvious than others. Adopting energy efficiency measures or installing on-site renewable energy sources like solar are examples of strategies that have been around for decades.

Let’s examine, then, some of the newer concepts on the topic of achieving carbon goals with demand-side tactics.

Consider the drive toward a carbon-neutral future from the grid operator’s perspective. Across the US, grids face the same converging pressures as organizations and have worked to increasingly shift their generation mixes away from fossil fuels and toward renewable sources like wind and solar.

Of course, wind and solar energy sources are inherently intermittent and can subsequently cease generating if the wind stops blowing or the sun stops shining.

But the immutable truth that some days are overcast and others windless doesn’t ease the pressure on the grid and those who run it to drive toward carbon- neutrality! Nor does inescapable intermittency suffice as an acceptable reason for grid operators to sacrifice reliability in the name of sustainability.

So what’s a grid operator to do?

Here is where commercial and industrial organizations can fill the gap from the demand side and help the US electrical grid find its way to the clean and efficient energy future that everyone desires.

That the grid needs flexible resources which can be dispatched quickly to serve load when it’s needed due to wind and solar generation being unavailable is a central point readers of this book should be quite familiar with, given it’s been examined in detail within these pages over the last three years.

The same is true of the role demand response plays in providing that flexibility to the grid.

What’s becoming more apparent is how increased participation in demand response programs at the ISO and utility levels across the US is providing new tools for grid operators to harmonize their grids’ reliability with their drive toward a future of cleaner generation fuel mixes.

In effect, this demand-side participation enables the firming of renewable energy sources, allowing grids to transition toward cleaner fuel mixes. While demand response participation doesn’t directly help individual organizations achieve their own carbon reduction goals, the cumulative effect of all the organizations’ participation does help our society achieve its desired emission goals.

The pressures organizations face from outside entities that we discussed earlier play a role in driving a given company’s carbon-reduction goals.

Unfortunately, in a reward-based world dominated by measurable metrics, there isn’t a practical way to note just how effective a given organization’s demand response participation is in helping contribute to carbon and greenhouse gas reduction.

That’s starting to change.

Organizations like the non-profit WattTime are searching for and establishing ways to help companies receive measurable recognition for doing their part with demand response to help the grid maintain reliability during its transition to the future.

Naturally, how an organization uses energy can have a large impact on carbon emissions, but when energy is consumed can move the carbon reduction needle, too. By shifting energy usage to a time when the grid mix is cleaner—during the middle of the day when solar is more prevalent compared with coal, for example—overall emissions are lowered.

An increasing number of organizations and cities have sought to eliminate their emissions in the time period when they consume electricity, often in hour-by-hour increments. This is a practice called 24/7 Clean Energy.

The more generation mixes shift toward renewable sources and as more DERs integrate into the grid with help of regulations like FERC Order 2222, the more the 24/7 clean energy effect should increase. That is, an increase in peak renewable generation will likely result in a larger potential emission reduction due to the load having been shifted.

Companies, regulators, and markets are in the early stages of ascribing value to 24/7 clean energy practices.

Consider the New York market, where Local Law 97 (LL97) seeks to reduce carbon emissions in the city’s building stock by 80% by 2050. An estimated 50,000 buildings in New York City stand to be affected by the law, with many in the commercial sector currently above the law’s emission requirements. Retrofits are one means of achieving compliance with LL97. Load shifting may be another, albeit one that will require a tangible means of assigning value to the practice.

Here we have an example of a regulation (LL97) creating a need for a possible market incentive (the value assigned to load shifting) as a means to achieve the societal goal of lowering carbon emissions in a densely populated city.

Absent a concrete policy on climate change at the national level, the market is responding. Throughout each of the deregulated energy markets in the US, demand response programs are growing at the ISO and utility level. The markets are becoming more sophisticated with how they incorporate DERs, and they’re doing all of this at the behest of state legislatures as well as the citizens who the market and grid ultimately serves.

Demand-side resources deliver carbon benefits. They always have, but today more opportunities are emerging to earn revenue with these resources.

For years we’ve touted how flexible resources will help drive the US electric grid to a cleaner future. While the ways organizations that provide those resources will be publicly credited are still undecided, the ways they’ll be financially rewarded are apparent.

This post was excerpted from The State of Demand-Side Energy Management in North America Volume III, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly evolving landscape.

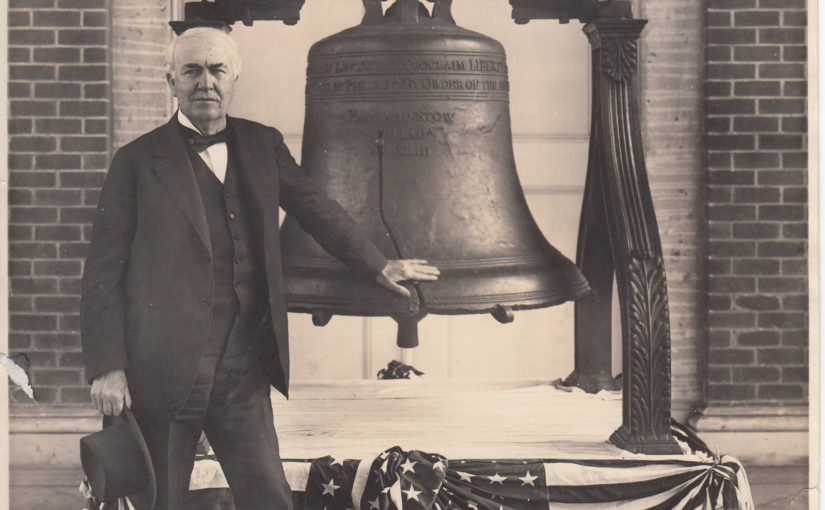

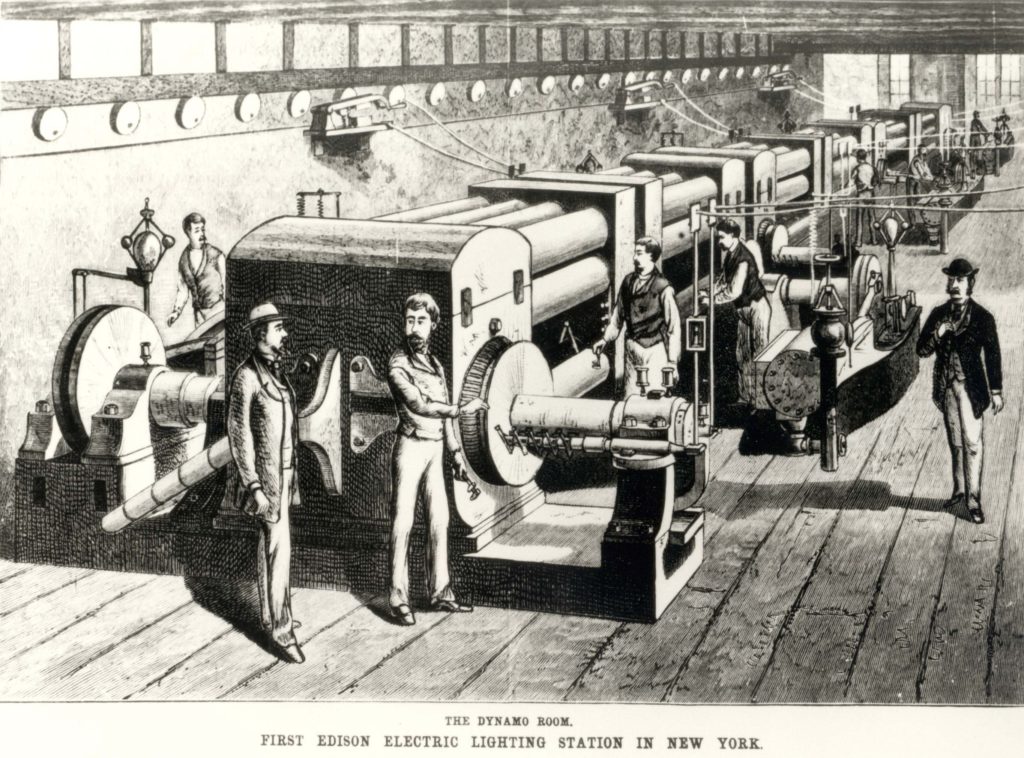

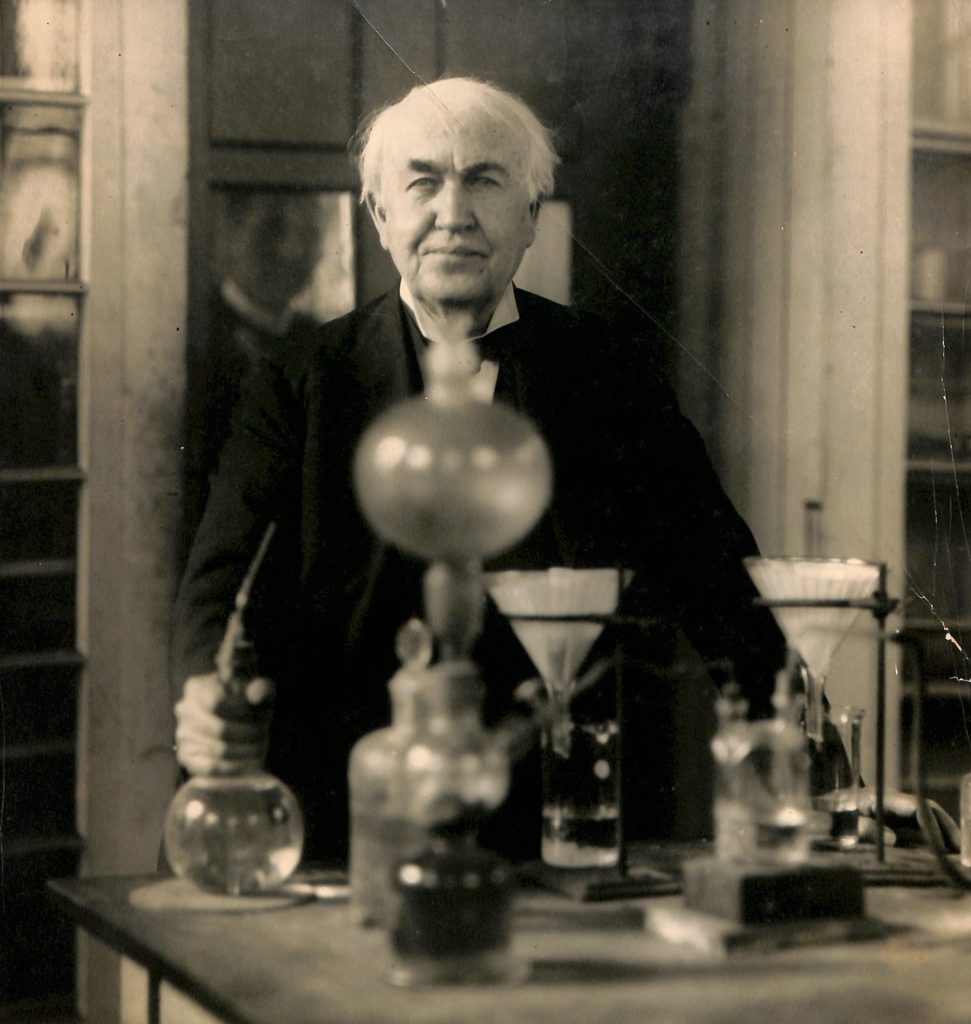

If Thomas Edison could see the world today…

He’d likely marvel at the evolution of several modernities he helped invent.

The light bulb’s journey from Edison’s own incandescent systems that wowed in 1881 at such high-profile public events like the Paris Lighting Exhibition to the energy-efficient LED bulbs of today would certainly be worth a day of the great inventor’s study and fascination.

Having designed a battery that would be introduced in Henry Ford’s iconic Model T in 1912, Edison would no doubt also be impressed with the present-day ubiquity of electric vehicles. He might be even more astonished with those vehicles’ ability to not only plugin and charge their cells at charging stations throughout the country but also their ability to provide capacity back to the electric grid.

Indeed, the very nature of how electricity flows on today’s electric grid would certainly be of interest to Edison. A champion of direct current, Edison thought of electricity for much of his life the way scientists had viewed it for centuries—a continuous flow of current in one direction.

But what would Thomas Edison think of the bi-directional electric grid of today, in which electricity flows not from a central point of generation as it had during Edison’s time until his death in 1931 and would continue to do throughout much of the 20th century, but from many points of origin to its point of consumption?

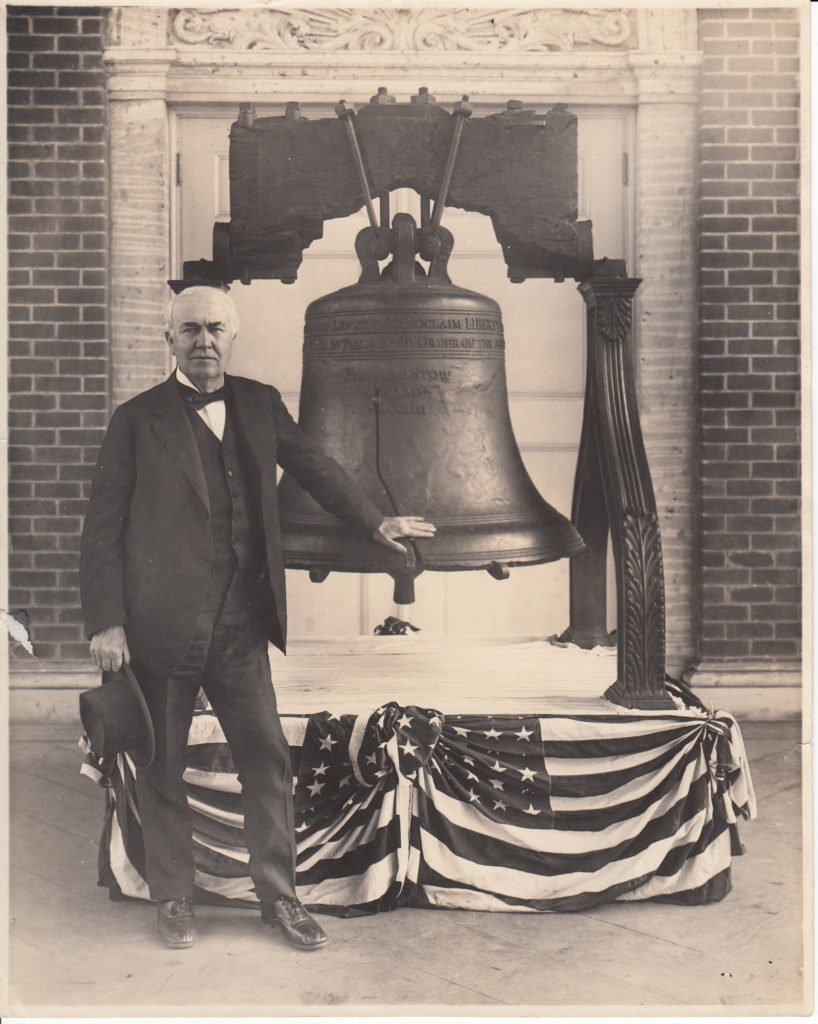

To get his head around this modern marvel, Edison would likely conjure fond memories of September 4, 1882, when at 3 PM he turned on the generators at Pearl Street Station in Lower Manhattan, giving birth to America’s first electric grid—a distributed grid at that, with generation located at the site of demand.

By the time of his death in 1931, Edison’s vision of a nationwide electrical grid distributed by direct current had long become a hallucination, replaced by the realities of an ever-expanding grid powered by alternating current, championed by inventor and one-time Edison employee Nikola Tesla and muscled into practice by investor and entrepreneur George Westinghouse.

But it would be another of Edison’s former employees, Samuel Insull, who would have perhaps the greatest impact on the grid and the electric industry during the first half of the twentieth century.

A former personal secretary of Edison, Insull would develop and profit from his own creation of the regulated monopoly, which he made central to his hotly contested but ultimately successful argument for America’s electricity infrastructure in the 1920s. Widely credited as the inventor of such business model staples as time-of-use electricity rates, Samuel Insull would go down in history as the father of the modern electric utility.

Imagine Edison in 2021, emerging ninety years after his death to view the grid of today and examine its evolution and that of the industry built around it.

He’d certainly study electricity’s flow not just from a central plant to its point of consumption as he’d always imagined, but also from points throughout the distribution system from “prosumers,” commercial and industrial organizations that both consume and produce electricity to serve the needs of the grid.

Eventually, the great inventor and lifelong entrepreneur might ask many of the questions the team at CPower answers in this, the third volume of our annual State of the Demand-Side Energy Management in North America.

Each year we take an in-depth look at the issues and trends affecting the deregulated energy markets in the US and present a breakdown of the key items we think organizations like yours need to understand to make the most of your energy use and spend in the coming year.

If Thomas Edison could see the grid of today, he’d likely be amazed that the opportunity to earn money by supplying electricity to the grid no longer exists solely among the few centralized plants and utilities and operators that control them.

He’d be awestruck at the opportunities available for commercial and industrial organizations to use their existing energy assets to earn revenue by helping the grid stay in balance. He’d surely also be inspired by the ways organizations across the country are using demand-side energy management to reduce carbon emissions and achieve their sustainability goals.

So are we.

It’s a big electric grid, a bigger country, and it’s an exciting time to be traveling across the bridge to energy’s future.

Let’s go.

This post was excerpted from The State of Demand-Side Energy Management in North America Volume III, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly evolving landscape.