Monetizing Energy Assets

In the Commercial Real Estate Industry

A complete guide for earning revenue with demand-side energy management

Contents:

I. Energy Use in the Commercial Real Estate Industry

Facts, figures, and trends that affect a CRE organization’s bottom line.

II. Analysis of a CRE organization and its Potential Energy Assets

What challenges do CRE organizations face? What existing energy assets might help solve those challenges?

III. Monetizing Energy Assets with Demand-Side Energy Management

Demand-side energy management, in all of its revenue-generating forms, explained.

IV. Energy Markets in North America

A look at regulated and deregulated energy markets.

V. Demand-Side Energy Management in Action

An inside look at a CRE organization’s demand-side strategy and curtailment plan

VI. Getting Started with Demand-Side Management

What to look for in a company that will guide and facilitate your demand-side energy management.

I. Energy Use in the Commercial Real Estate Industry

There are nearly 16 billion square feet of commercial real estate properties in the United States. Combined, these properties consume more than 17% of all commercial building energy in the country and spend more than $32 billion annually on energy.1

According to the U.S. Department of Energy, commercial buildings account for 18.7 percent of energy usage, 40 percent of carbon dioxide (CO2) emissions, and 88 percent of potable water consumption in the United States.2

For the past several years, the economic and policy climate of North America has created an impetus for green and energy-efficient buildings. The commercial real estate (CRE) industry has contributed this momentum.

Keeping the supreme goal of providing a great tenant experience at the forefront of their operations, commercial real estate facility managers and executives are increasing their focus on energy management plans rooted in a sustainable building philosophy based on cost-effectiveness and energy-optimization.

The CRE industry’s current push toward a more efficient and sustainable future comes at a serendipitous time when energy markets around the country are working to integrate distributed energy resources (DERs) onto their energy grids in an attempt to diversify their fuel mixes.

Right now and for the foreseeable future, grid operators and electric utilities in each of the nation’s six deregulated energy markets have created a wealth of incentive programs to encourage commercial and industrial organizations to help integrate their grids with distributed energy.

CRE organizations with distributed resources at their facilities like backup generators, solar photovoltaic cells, fuel cells, energy storage are therefore in a position to reap significant financial benefits by working with a properly licensed company that can help them monetize their existing energy assets.

What’s in this article:

This article explains in full what these resources are on how a commercial real estate organization can monetize their existing energy assets with demand-side energy management.

In the sections that follow we’re going to examine the challenges the CRE industry faces concerning energy management and identify and analyze potential assets many organizations in the industry already have that can be monetized.

We’re also going define what demand-side energy management is and the many types of programs and practices that comprise it. In this explanation, we’ll take a close look at the evolving energy industry in the US and Canada with an emphasis on the growth of DERs and the role they play and will continue to play in the nation’s fuel mix of today and tomorrow.

We’re then going to outline a complete demand-side energy management plan for a fictitious commercial real estate organization with more the 50 million square feet of floor space spread throughout the US. Included in this plan will be a sample curtailment plan the organization uses at one of their facilities to participate in a grid-sponsored demand response program, which pays organizations for using less energy when the grid is stressed or electricity prices are high.

Lastly, we’re going to recommend how your commercial real estate organization can get started with demand-side energy management, including how to go about selecting the right company to facilitate your participation and monetize your organization’s existing energy assets.

1US Department of Energy

2 Deloitte Financial Services “Breakthrough for sustainability in commercial real estate”

II. Analysis of a CRE organization and its Potential Energy Assets

The Importance of Tenant Experience

No two commercial buildings are alike and every commercial real estate organization is unique. One trait CRE organization’s share, however, is the unwavering desire to provide a great experience for their tenants.

More and more commercial real estate companies are realizing that sound demand-side energy management–the practice of modifying consumer demand for energy–can play an integral part in providing a great tenant experience.

Without satisfied tenants, of course, the CRE industry wouldn’t exist. That’s why every measure a CRE organization explores concerning energy management should be examined through the tenant-experience lens.

Demand for Green Buildings

Utility costs related to energy, water, and waste have a significant impact on a CRE organization’s profits. For decades, CRE organizations have sought to reduce these impacts by making their buildings more efficient and (if at all possible) environmentally friendly.

Green buildings–those which are environmentally responsible and resource-efficient–are estimated to consume 30-50% less energy than non-green buildings. Green buildings also use an average of 40% less water, emit 30-40% less carbon-dioxide, and produce 70% less solid waste.3

Green Buildings, Happy Tenants

In the last several years, CRE organizations across North America have recognized the direct correlation between green buildings and tenant attraction. The increasing popularity of green leases, which include an up-front establishment of sustainability goals and allocation of implementation responsibilities between the owner and the tenant, is proof that the notion of sustainability is a value shared between CRE organizations and the tenants they serve.

Since the Great Recession, many tenants’ business performance has been and continues to be evaluated by customers and investors looking at aspects beyond the strictly-financial. Tenants want to tell the story of their operating in a green building that actively pursues sustainability efforts with a positive effect on the community and the environment.

CRE organizations who oblige will not only provide a superior tenant experience, they’ll also be in a position to monetize their efforts through demand-side energy management.

Energy Assets in the CRE Industry

CRE Organizations that have made their buildings more energy efficient–whether by lighting upgrades, HVAC improvement, or any other measure, may be eligible to earn money for the permanent reduction of their electric demand.

They may already possess energy assets like backup generators, energy storage, solar generation, and more that can also earn revenue through demand-side energy management.

In the next section, we’ll explain how.

3“Metrics for Responsible Property Investing: Developing and Maintaining a High-Performance Portfolio”

III. Monetizing Energy Assets with Demand-Side Energy Management

CRE organizations have ample opportunity to monetize existing energy assets through demand-side energy management. The revenue earned through these efforts can be used as the organization sees fit, including upgrading properties to further enhance tenant experience.

What is Demand-Side Energy Management?

Demand-side energy management is the modification of consumer demand for energy.

Most of the time, demand-side energy management involves strategies designed to cut back, or curtail, the amount of energy a given facility uses for any number of reasons like saving money, reducing air pollution, cutting carbon footprints, and earning revenue.

How Does Demand-Side Energy Management Work?

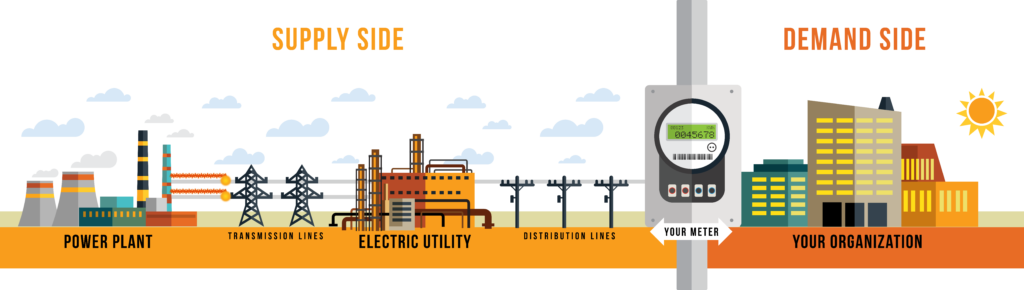

To better understand how demand-side energy management works, let us trace the journey of power from its point of generation to consumption.

The energy an organization uses is generated at a power plant and travels along transmission lines until it reaches the electric utility, then it travels along distribution lines to the facility where it’s ultimately consumed.

A given building has a meter that monitors how much energy the building consumes. The meter is the imaginary dividing line between the demand side and the supply-side of energy. The supply side of energy refers to everything involved with how an organization goes about receiving its energy, including how it purchases energy from its supplier. The demand-side of energy is often referred to as behind-the-meter. Behind-the-meter energy management includes all the ways an organization controls and uses energy.

Distributed Energy Resources

Distributed energy resources (DERs) consist of smaller power sources—like battery or thermal storage, solar photovoltaic, and on-site generation—that can be aggregated to provide the power necessary to help meet an organization’s regular demand for electricity otherwise required from the grid.

Distributed energy resources have developed at their own individual pace and with little interaction with each other since the 1970s energy crisis when the US and the world faced elevated gas prices due to real and perceived petroleum shortages.

In recent years technological, economic, and regulatory changes in the energy industry have made it feasible for grid operators to integrate DERs onto their electric grids in an effort to move away from fossil fuel generation.

This trend presents an opportunity for CRE organizations to monetize DER assets they may already have at their properties.

Integrated DERs, DER Aggregators, and the Link to Monetization

Integrated DERs include distributed generation resources such as diesel gensets, solar photovoltaic, demand response, energy storage, and energy efficiency. The link between these assets, many of which are widely used within the CRE industry, and the grid is formed by DER aggregators, which are licensed companies with the proper expertise and technology platforms to connect the energy resources with the grid.

By partnering with an experienced demand-side energy management company that specializes in DER aggregation, commercial real estate organizations can leverage their existing energy assets, turning these resources into sources of revenue.

Types of Revenue-Earning Demand-Side Energy Management

Demand Response (DR)

Demand response programs pay organizations to reduce energy load during times of grid stress or high energy prices. Sometimes the demand for energy outpaces the grid’s ability to supply it, which can lead to brownouts or blackouts. Instead of producing more energy at great expense to consumers and the environment, the grid can offset the imbalance by reducing the amount of electricity being consumed during times when demand exceeds supply.

Since the early 2000s, demand response has grown in wholesale energy markets across the US. As DR’s popularity has flourished, regulators have called for tighter requirements to ensure demand response remains a reliable resource when called upon to help balance the grid. These increasingly stringent regulations have caused many smaller curtailment service providers (licensed companies that ensure DR participants execute safe and compliant curtailment) to leave the market due to their inability to compete amidst less forgiving regulations and larger more established competitors.

While demand response programs vary in detail from utility to utility and from market to market, they essentially fall into types: capacity, ancillary services, or economic

Energy Efficiency

Energy Efficiency (EE) is the permanent reduction of electrical demand through the installation of efficient systems, including improvements or upgrades in equipment or devices.

In some energy markets in the US (PJM and New England, for example) organizations can earn money for these permanent reductions in demand by partnering with a licensed demand-side management company who can offer these “negawatts” (power created through conservation rather than consumption) into the Independent System Operator’s (ISO) forward capacity market.

Many electric utilities offer rebate incentives to organizations that have permanently reduced demand through energy efficiency projects. These opportunities create another revenue stream to either decrease project paybacks or allow for reinvestment for future projects.

IV. Energy Markets in North America

A brief history of energy markets in the US

When the electric grid in America was initially constructed in the early 20th century, the safe and reliable distribution of electricity to homes and businesses was deemed a responsibility too important to our society to be subjected to the ups and downs of pure free-market capitalism.

The founding planners of the US grid saw the inherent problems that would arise should a financially struggling electric company providing power to consumers go out of business and leave portions of the public in the dark.

To ensure safe and reliable electric service and to also make sure that didn’t include unsightly and dangerous messes of competing proprietary equipment littering the streets of an expanding America, the same type of vertically integrated electric generation and delivery system as we have in many states today was established

Electric utilities have been granted franchise rights by the states in which they operate to be the sole provider of electricity in a geographic area. This serves to ensure consistent and reliable service to customers. It also guarantees a level of financial success for the utility, which is subject to a wealth of laws–which cap the utilities’ profits and losses– that aim to secure their continued success in delivering safe and reliable electric service while limiting their otherwise apparent ability to act like monopolies.

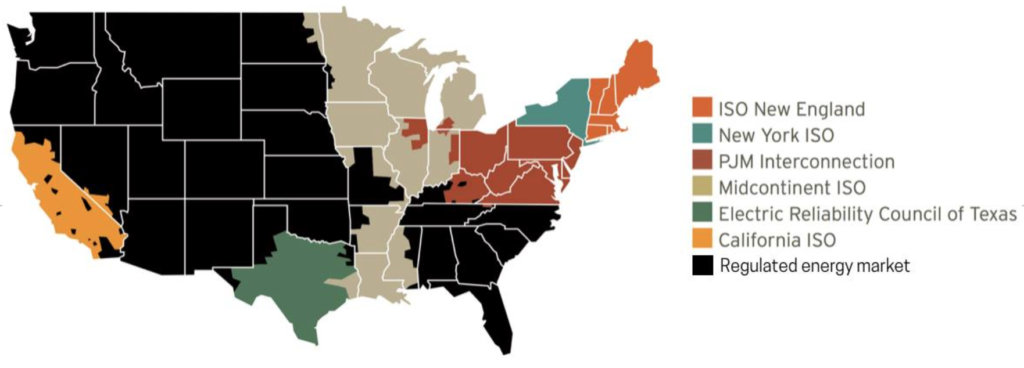

Today, there are two types of energy markets in the US: regulated and deregulated.

Regulated Energy Markets

Many states in the US operate a regulated energy market in which the power consumed by citizens is controlled from the power plant to the end-user’s building by a vertically-integrated utility, who sends the consumer an electric bill each month that reflects levels of consumption.

Deregulated Energy Markets

In the 1990’s, six deregulated energy markets emerged in the US with an aim to provide a more competitive arena for electricity. Those markets remain today.

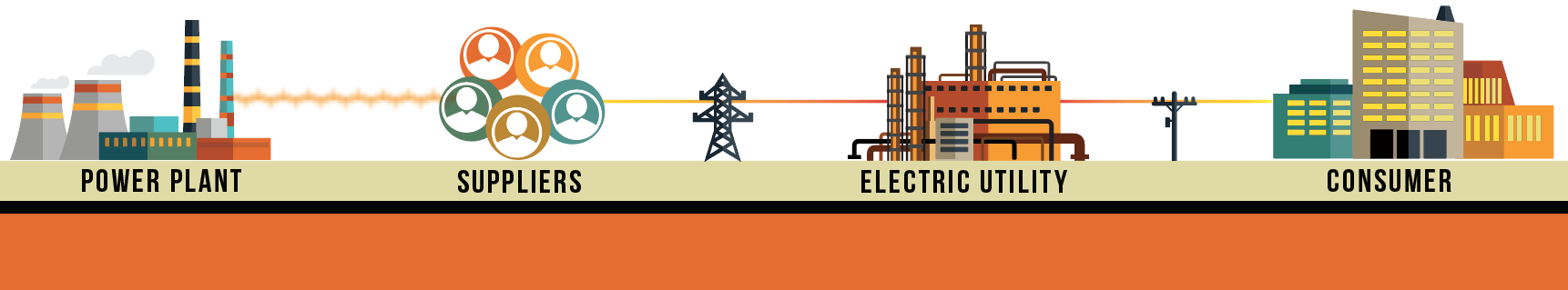

How a deregulated market works

Deregulated markets feature grid operators that administer wholesale electricity markets to ensure reliability on the grid and prevent blackouts.

In a deregulated market, the electric utility is also granted franchise rights to provide electricity to customers and bill them monthly. However, in a deregulated market the utility has no control over the supply of electricity. Instead, utilities divest all ownership in generation and transmission of electricity and are only responsible for the distribution of electricity to consumers and for billing those same consumers.

Deregulated energy markets are often called open or competitive because they promote choice and free market enterprise to provide consumers with electricity prices that are fair and just.

In a deregulated market, the consumers are allowed to choose their commodity supplier. The structure of the market motivates retailers to differentiate their products from the utility’s and those of competitors by developing innovative features, pricing plans, and options that are not available in regulated markets.

Consumers can choose their supplier in a deregulated market. Choice and competition strive to keep electricity prices fair and just, but there is no guarantee that customers in deregulated markets will pay less than those in regulated markets.

Monetizing Energy Assets in a Deregulated Energy Market

Each deregulated market differs in its rules and regulations involving demand-side energy management. Each offers its own set of demand response programs and policies for monetizing energy assets including reduced demand from energy efficiency projects. Each has its own way of calculating electricity rates, including demand charges, which are inextricably tied to being connected to the grid. Each has its own unique plan for integrating distributed energy resources with its grids. Each has its own very unique rules and parameters for how aggregators can help integrate DERs onto the grid and how organizations are compensated for providing those assets.

The opportunity to monetize energy assets for commercial consumers lies, first and foremost, in deregulated energy markets. CRE organizations aiming to monetize energy assets should consider consulting a demand-side energy management company that operates in the deregulated markets where their facilities reside.

V. Demand-Side Energy Management in Action

Now let’s take a look at how a fictitious commercial real estate organization might go about monetizing its energy assets working with CPower, a real-life demand-side energy management company.

In this exercise, we’ll assume the perspective of two principal organizations. The first is the customer, a CRE organization with 79 total properties totaling more than 80 million square feet of floor space across five deregulated energy markets: California, Texas, New York, New England, and PJM.

The second organization is CPower, a licensed curtailment service provider (CSP) that helps more than 1,700 commercial and industrial organizations across the US and Canada monetize their existing energy assets.

National Experience. Local Expertise.

That the customer has properties in five different US energy markets presents a series of challenges when it comes to enacting a cohesive demand-side energy management strategy.

Each market has its own set of complex regulations governing energy use and monetization of energy assets for commercial and industrial customers. Each building in the organization’s portfolio is unique in the way it consumes energy and the types of assets it possesses on its grounds.

With teams of energy experts working in each of the nation’s deregulated energy markets, CPower is in a unique position to help this CRE customer devise a demand-side energy management strategy that includes contributions from as many properties the customer chooses to include.

Facility Assessment

Working with one of CPower’s national coordinators, the customer’s Director of Facilities will arrange to provide CPower with the ability to assess the participating facilities to determine an optimized strategy for asset monetization.

Part of this access includes the customer sharing their facilities’ energy usage data. With authorization, CPower can access load data from the customer’s electric utilities dating back the previous two years, allowing for CPower’s team of engineers to analyze each facility’s historical consumption patterns prior to visiting individual sites.

In assessing the customer’s facilities, CPower engineers work with facility staff to identify opportunities to curtail electric load at each of the customer’s facilities. Keeping tenant comfort in mind, CPower looks for potential loads that can be curtailed and offered into demand response programs.

Typically, the discussion starts by considering the facility’s highest potential load source and working to its lowest. For example:

On-site generation (highest load):

Many demand response programs across the US allow backup generators to participate as part of a curtailment plan as long as the generator is in compliance with the current NESHAP/RICE regulations of the EPA’s Clean Air Act.

CPower’s engineers will assess each of the customer’s generators and perform any necessary upgrades to comply with all applicable statutes at both the national and state level.

From here, understanding a facility’s energy asset structure involves asking a lot of questions.

Central Plants

Does the facility possess any large central plants like a chiller? If so, how old is it? What is the tonnage rating? Is it air or water cooled? If it’s water cooled, then what are the cooling tower details? What about primary, secondary, and tertiary pumping systems. Does the facility use condenser pumps? If so, how much horsepower do they use? What about variable fan drives? Does the facility have a thermal storage system?

Building Automation System (BAS)

Does the facility have a BAS or Energy Management System (EMS)? If so, what make and model are they? What kind of controls does it/do they have? Local? Manual?

HVAC systems

Central units? Packaged rooftops? Fan coils? Water or air-source heat pumps? Does the facility have any controls in place? Is a variable fan drive (VFD) installed?

Exhaust Systems

What type of exhaust systems does the facility use?

Lighting Systems

Does the facility’s lighting system have any controls in place? What about architectural lighting?

Architectural features: (lowest load)

Are there any elevator systems in use? If so, what type? Any freight elevators? How about escalators, fountains or waterfalls?

No one knows more about their buildings than the customer’s facility staff. That’s why a good demand-side energy management team will spend a great deal listening to the customer’s facility team explain the intricacies of their buildings.

Assessing a CRE Organization’s DERs for Monetization

In many regions, an organization’s distributed energy resources can be combined with demand response participation.

Consider California’s Local Capacity Resource (LCR) Program, which allows for energy storage resources to pair with demand response to add local capacity in the constrained West LA Basin and to enable a clean, renewable energy supply.

In the wake of LCR’s successful launch, utilities and grid operators around the US are looking to add similar programs in their regions. New York and New England are following California’s progressive lead as they and other regions look to integrate DERs onto their energy grids.

Additionally, several energy markets in the US–New England, for example–are working toward regulation changes that would allow DERs (wind, solar PV, energy storage, and others) to participate in their wholesale markets just as they allow for other traditional resources like nuclear or coal-fired electricity.

CPower’s team of engineers will evaluate each of the customer’s DERs to determine their earning potential by pairing with demand response or participating directly in wholesale energy markets.

A list of potential DERs a CRE organization might possess at their properties includes:

- Energy storage (e.g. battery, thermal, flywheel)

- Solar photovoltaic generation

- Wind generation

- Fuel Cells

- Smart Gensets

Toward Demand Response and Monetization

When it comes to devising curtailment scenarios, the customer’s facility staff knows better than anyone which loads and how much of each are absolutely necessary to ensure tenant comfort. Curtailing load for demand response participation needn’t be an all-or-nothing endeavor. The goal should be the create a curtailment plan that allows a facility to reduce load when called upon by the grid operator and still meet the needs of day-to-day business.

With their extensive experience working with other CRE organizations, CPower’s engineers will share success strategies employed by other similar organizations and work with the facility’s staff to determine if any of them are appropriate to explore.

Choosing the right set of demand response programs begins with assessing the customer’s properties (described above), then selecting the optimal set of DR programs in which the customer will participate.

In this case, the customer’s demand response participation breakdown for each of its properties might look like this:

Curtailment in Action

Now that the customer’s facilities have been assessed and programs have been selected, it’s time to issue a curtailment plan.

Curtailment plans are easy-to-follow lists of action items to be executed at a specific utility in preparation for demand response event. They outline a detailed procedure for reducing load at a given facility.

What follows is an abbreviated curtailment plan for one of the customer’s fictitious facilities in Manhattan, New York.

Property: ACME Facility

Location: New York

Program: Special Case Resources (SCR)

The following actions should be taken at least 30 minutes prior to the start time of an event.

Improving the Tenant Experience with Demand-Side Energy Management

Communication and education are the cornerstones of transparency in the commercial real estate industry. It’s the building block to trust and also the key to making demand-side energy enhance tenant experience.

Many CRE professionals agree that informing and educating tenants about the types of demand-side energy management their buildings participate in and the benefit their participation has on the grid, environment, and community helps tenants not only cope with the shifts in energy use but embrace them.

While the preferred method of tenant communication is face-to-face and one-on-one, successful practitioners of demand-side energy management often employ a host of mixed media approaches to explain why buildings participate in demand-side programs.

Examples include:

- Free walking tours of buildings to help tenants and their guests learn about how the building is helping keep the environment clean and the grid reliable.

- Info-graphic signs inform of when scheduled events will occur and remind why the building and tenants participate in demand-side energy management.

- Elevator screen messages reinforce the value of demand-side management participation by highlighting its benefits in a feel-good way.

- Smartphone applications for tenants provide a technological connection between them, the building they lease and the demand-side activities in which their buildings participate.

A CRE organization’s tenants spend a lot of time at work. The more an organization can inform and educate them about demand-side energy management practices, the more connected tenants will feel to the building they lease, and the more positive their overall experience will be.

VI. Getting Started with Demand-Side Management

Organizations in the commercial real estate industry have a host of opportunities to monetize their existing energy assets through demand-side energy management.

Getting started involves selecting the right demand-side energy management company to guide you through and facilitate your participation.

When selecting a company to guide your demand-side energy management, it’s important to consider the company’s scope of demand-side expertise. Do they serve the markets where your properties reside? Does the company specialize in one type of demand-side energy management, or is it equally skilled in a wide range of energy asset monetization practices?

Most importantly, a demand-side energy management partner should earn your trust in every aspect of the relationship your organizations share.

Demand-side energy management is not a one-size-fits-all exercise. No two buildings are alike and every CRE organization is unique in its complexities.

Like your business, your demand-side energy management strategy should evolve and refine over time, forever in pursuit of unattainable perfection.

About CPower:

CPower is a demand-side energy management company. We create optimized energy solutions that help organizations reduce energy costs, generate revenue, increase grid reliability, and help achieve sustainability goals.

Learn more about CPower’s extensive experience in the commercial real estate industry, including how Tishman Speyer Commercial Real Estate earned more than $1.4 million through demand-side management with CPower as their guide.

References

Optimizing Corporate Energy Management: CHoosing an Integrated DER Vendor for C&I Customers—Brett Feldman, Roberto Labastida, Alex Eller; Navigant Research, Q2 2018

Commercial Real Estate: An Overview of Energy Use and Energy Efficiency Opportunities –Energy Star

Better Buildings: CRE–US Department of Energy, commercial real estate section

Believe in Green: Investor Oriented Sustainability Insights for CRE–US Department of Energy presentation PDF; May 15, 2017

Commercial Real Estate Outlook in 2018 –Deloitte; 2018

The Economics of Energy Management in Commercial Real Estate Facilities–Facilities Management (FM Link)

Effective Integration of Demand Response and Energy Efficiency in Commercial Buildings–Jon Starr, Jesus Preciado, and Wes Morgan; EnerNOC, INC. ACEEE Summer Study on Energy Efficiency in Buildings

How to Unlock Asset value and Maximize Returns–Waypoint

Top 5 Trends in Commercial Real Estate Energy Management Solved by Blue Pillar’s Energy IoT Platform: Part 2–Robert Garrett, Blue Pillar; Oct 5, 2017

Breakthrough for sustainability in commercial real estate–Jon Lovell, Deloitte Financial Services 2014

Environmental Sustainability Principles for the Real Estate Industry–World Economic Forum

Energy usage in the CRE industry–US Energy Information Administration

Commercial Real Estate Industry Consumption Survey–US Energy Information Administration, 2012

Commercial Real Estate Research Study–US Department of Energy, Energy Efficiency & Renewable Energy division