Summer Electricity Demand: A Region-by-Region Outlook

Calendars may show that summer didn’t start until June 20, but thermometers across the country in the past few weeks have suggested otherwise. From heat domes in the Southwest to record-high temperatures in the Northeast, summer electricity needs kicked in early—and grid operators are bracing for another few hot months.

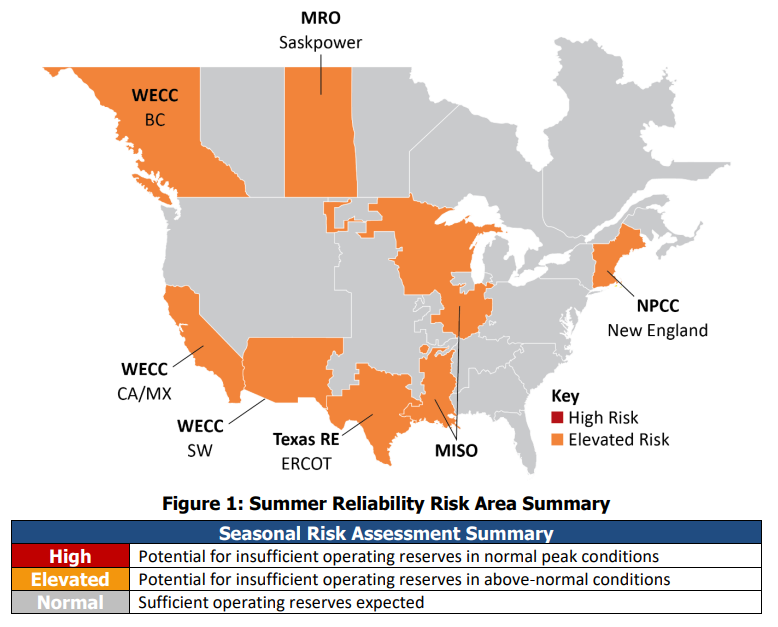

Although grid operators and federal regulators expect to have enough resource capacity to weather a typically hot summer, some parts of the U.S. are at risk of power shortages if the mercury shoots higher and stays there longer.

Markets served by the Midcontinent Independent System Operator (MISO), ISO New England and Electric Reliability Council of Texas (ERCOT) could face summer electricity shortages in extreme summer conditions, according to the North American Electric Reliability Corp. (NERC) 2024 Summer Reliability Assessment.

NERC has recommended that at-risk areas take precautions such as reviewing seasonal operating plans and protocols for communicating and resolving potential supply shortfalls. It has also noted that many assessment areas have expanded demand-side management programs to give grid operators more resources to reduce electricity demand if it exceeds supply.

When temperatures spike, grid operators could turn to energy users to help keep the lights on in communities. If they do, customers that make their distributed energy resources (DERs) available to grid operators as virtual power plants (VPPs) could benefit as a result.

In aggregating customer DERs and dispatching them together, VPPs are an effective and cost-efficient way to quickly balance the grid. So, they could be a go-to resource for grid operators with resource adequacy concerns this summer.

Here’s what grid operators and regulators project the summer’s electricity needs to look like so far.

Source: North American Electric Reliability Corp. (NERC) 2024 Summer Reliability Assessment.

Summer Electricity Outlook by Market

Click on one of the markets below to go directly to that section.

California Independent System Operator (CAISO)

The California Independent System Operator (CAISO) has a positive Summer Outlook for 2024 due to several factors.

-

- A total of 9,071 MW of capacity is expected to have been added to the state’s grid since Sept. 1 or to go online by June 30.

- Average conditions for producing hydropower and a softening of the summer 2024 load forecast peak demand should more than offset generator retirements.

- Although weather forecasts show an increased chance of above-normal temperatures across interior California, there is less likelihood of higher-than-usual temperatures in coastal areas, especially Southern California.

After considering all factors, CAISO expects to have sufficient resources to meet forecasted demand plus an 18.5% reserve margin for all summer months in 2024. It also anticipates a surplus of at least 3,438 MW over forecasted demand plus the 18.5% reserve margin during peak net load hours of 6 p.m. to 10 p.m. in September.

Emergency Programs in Place

However, CAISO has also warned that “extreme drought, wildfires and continued potential for widespread heat events and other disruptions continue to pose a risk for emergency conditions to the ISO grid.” Therefore, the ISO is preparing strategic reserves and emergency programs for this summer.

California demand response programs that could be called upon include the Emergency Load Reduction Program (ELRP) and Demand Side Grid Support (DSGS) Program. ELRP pays energy users for reducing consumption during grid emergencies and DSGS incentivizes electric customers to provide load reduction and backup generation when extreme events occur, like heatwaves.

DSGS is a new program meant to prevent summer power outages, specifically between May and October. It is part of California’s Strategic Reliability Reserve, a suite of programs to alleviate tight energy supplies on the grid caused by heatwaves, wildfires and other ongoing impacts of climate change.

through eligible providers like demand response aggregators. Participating customers can receive payments for help such as reducing load, putting combustion resources on standby or providing remotely controllable generation like backup generators powered by biomethane, natural gas or diesel.

Electric Reliability Council of Texas (ERCOT)

NERC has warned that the Electric Reliability Council of Texas (ERCOT) market could be at risk of power outages due to a decrease in available generation. Conventional generation resources like fossil-fueled power plants are being retired and the state is increasingly dependent on variable energy resources.

Risk is highest during off-peak or net-peak hours in areas dependent on renewables, like solar or wind generation, NERC has noted. With solar and wind accounting for growing shares of the state’s generation mix, ERCOT must replace renewable energy that is not available when the sun does not shine, or the wind does not blow.

“Continued robust growth in both loads and intermittent renewable resources has elevated the risk of emergency conditions in the evening hours when solar generation begins to ramp down,” according to NERC’s summer reliability assessment. “ERCOT’s probabilistic risk assessment indicates an elevated risk of having to declare [energy emergencies] during hours ending 8:00–9:00 p.m. Central on the August peak load day.”

The risk could rise further if ERCOT needs to limit power transfers from South Texas into the San Antonio region when demand peaks. Demand could overload the lines that make up the South Texas export and import interfaces, necessitating South Texas generation curtailments and potential firm load shedding to avoid cascading outages. “The risk is greatest when ERCOT has extremely high net loads in the early evening hours,” NERC noted.

So, even though ERCOT expects to have sufficient resources to meet operating reserve requirements for the peak demand hour scenario, NERC noted that there is risk of supply shortages as solar generation ramps down during the early evening hours when system load is high and transmission constraints limit transfers.

According to NERC, ERCOT expects to have nearly 3,500 MW of demand response resources available this summer, the equivalent of 4% of normal peak demand. ERCOT and utilities offer demand response programs for Texas energy users.

The ERCOT Contingency Reserve Service (ECRS) is the grid operator’s newest demand response program. Available in 2024, the new ERCS program is like the LR program in that resources must respond within 10 minutes of being dispatched. They must also sustain their performance for “as long as they have the responsibility to provide this service.”

ISO New England (ISO-NE)

New England’s grid operator, ISO-NE, anticipates meeting peak demand for electricity this summer. Assuming typical weather conditions. ISO-NE predicts electricity demand will reach 24,553 megawatts (MW).

However, above-average summer weather, such as an extended heat wave coupled with high humidity, could push demand up to 26,383 MW. This could tighten supply margins because the ISO anticipates having about 30,000 MW of capacity available to meet demand and required reserves.

ISO-NE will have less capacity this summer than last because two natural gas-fired generators (with a total summer capacity of 1,400 MW) were retired in May. “This makes it more likely that ISO New England will need to resort to operating procedures for obtaining resources or non-firm supplies from neighboring areas during periods of above-normal peak demand or low-resource conditions. Summer heat waves that extend over the entire area can limit the availability of excess supplies and increase the risk of energy emergencies in New England,” NERC noted in its summer reliability assessment.

ISO-NE has stated that system operators have numerous tools to balance load, including increasing production of online generation or dispatching stand-by units and energy conservation such as voluntary reductions of energy use.

The grid operator anticipates having 3,891 MW of demand resources for its 2024/2025 Capacity Commitment Period, according to the 2024 Summer Energy Market and Electric Reliability Assessment from the Federal Energy Regulatory Commission (FERC).

In worst-case circumstances, ISO-NE could be forced to call for controlled power outages to maintain system reliability and safeguard the infrastructure of the grid. “With the possibility of more extreme and less predictable weather conditions, there is an increased potential for system operators to activate emergency procedures,” ISO-NE stated in a press release.

ISO-NE and utilities in the region offer demand response programs in New England.

Midcontinent Independent System Operator (MISO)

MISO projects sufficient capacity under probable demand, but would rely on load-modifying resources (LMRs) made available through demand response programs and operating reserves to meet a high-demand scenario. Should a high-demand scenario materialize, MISO would be at an elevated risk of operating reserve shortfalls, NERC noted.

According to MISO, its surplus of 4,624 MW remains adequate for normal conditions, even though surplus capacity has decreased 30% since last summer, due largely to generator retirement, increased planning reserve margin requirement (PRMR) and fewer external offers. Regarding transmission, the grid operator says it is well-positioned to handle unplanned events on the MISO system this summer.

Furthermore, MISO has stated that it would mitigate summer risks by leveraging lessons learned from previous heatwaves, such as how appropriately timed use of LMRs and an increased requirement for its 30-minute reserve product worked well. MISO also expects solar generation to play a more active role as its in-service capacity tops 6 GW over the summer.

Demand Response Programs Available

Should MISO need LMRs, it could turn to demand response programs available to commercial and industrial customers in parts of Illinois and Michigan. Michigan customers served by Consumers Energy, DTE Energy or select municipal and cooperative members in MISO Zone 7, which covers the Lower Peninsula of Michigan, can participate. In Illinois, demand response participation is open to customers served by Ameren Illinois or select municipal and cooperative members.

Illinois is also trying to create more value from distributed energy resources (DERs) by exploring how utilities can maximize their benefits through effective system planning and efficient operational control. Regulators are considering a two-pronged approach to compensation for components of DER value such as benefits to energy and capacity markets and ancillary services.

New York Independent System Operator (NYISO)

The New York Independent System Operator (NYISO) does not anticipate any operational issues in the state this summer. It projects having adequate capacity margins and has procedures in place to handle any issues that may occur. For example, the grid operator could use demand response to meet above-normal summer peak load, NERC noted.

Although NYISO expects to have 40,733 MW of power resources available to meet forecasted peak demand conditions of 33,301 MW, the grid operator has warned that reliability concerns remain. Demand peaked at 30,206 MW last summer.

“Reliability margins have declined by more than 1,000 megawatts in just the last two years. That’s a significant issue especially when we’re impacted by heatwaves,” Executive Vice President and Chief Operating Officer Emilie Nelson stated in a press release announcing NYISO’s outlook for summer electricity reliability. “As demand is forecasted to rise in the coming years, this trend will continue to pose a challenge to system reliability.”

The reliability margin for this summer is 752 MW under baseline conditions but would be deficient during extreme weather. For example, if the state experiences a heatwave with an average daily temperature of 95 degrees lasting 3 or more days, the capacity margin is forecasted to be -1,419 MW, NYISO noted.

The margin would worsen to -3,093 MW under an extreme heatwave with an average daily temperature of 98 degrees. Under those conditions, NYISO operators would dispatch up to 3,275 MW through emergency operating procedures to maintain reliability, the grid operator has stated.

Demand Response Programs for Large Energy Users

Demand response has been at the forefront of NYISO’s efforts to smooth the state’s transition to clean energy. For example, NYISO has paved the way for virtual power plants (VPPs) by implementing its DER & AggregationParticipation Model, which was the country’s first program to integrate aggregations of distributed energy resources (DERs) into wholesale markets.

The DER Participation Model enables DERs to provide energy, ancillary services and capacity in the NYISO markets. DERs of at least 10 kW aggregated into VPPs of at least 100 kW can simultaneously provide wholesale services to the grid operator and retail services to utilities and load servers.

DER aggregations can include resources such as demand response, solar arrays, batteries and electric vehicles. Curtailable load, or demand response, is the only type of DER that can be aggregated as a single resource and technology. Currently, many C&I customers earn substantial revenue and reduce energy costs by participating in demand response in New York,

PJM

With a forecasted installed reserve margin of 29%, including expected committed demand response, versus a target of 17.7%, PJM does not any anticipate any problems meeting demand this summer, NERC noted. However, the grid operator does expect reserve margins to be lower than last summer due to rising demand, generator retirements and slower-than-anticipated resource additions.

The loss of generation resources is outpacing the addition of replacement resources amid accelerating growth in consumers’ demand for electricity, PJM stated in its summer outlook announcement. Thus, the grid operator has fewer generation resources (182,500 MW) of installed capacity) to draw on this summer compared with 2023 (186,500 MW of installed capacity).

PJM also projects a higher peak demand for electricity this summer at approximately 151,000 MW compared with the 2023 summer peak load of 147,000 MW. The increased peak load forecast combined with reduced generating capacity reduces reserve margins for extreme weather scenarios.

Scenarios that include this higher level of demand, combined with low solar and wind output and/or high generator outages, would further reduce reserve margins, the grid operator has noted. In these “unlikely but possible set of circumstances,” it might have to implement additional procedures to manage emergencies, including dispatching demand response, calling for conservation, limiting electricity exports or even temporarily interrupting service, according to PJM.

PJM has several demand response programs that it could call upon for help.

With the summer’s heat already here, and more to come in the months ahead, grid operators are preparing to meet surging demand. And as summer electricity usage surges, grid operators will likely seek help from customers that make their DERs available as VPPs. Customers who help will be rewarded.

CPower makes DER monetization easier and more rewarding by using customer resources to strengthen the grid when and where reliable, dispatchable resources are needed most. Customers interested in earning grid services revenue and reducing energy costs by helping grid operators meet their summer electricity needs can contact CPower to learn more: cpowerenergy.com/contact/.