Myths… Busted! PJM’s Capacity Performance Soars to New Heights– and Confirms Its Revenue Potential for You

Big news came out of the PJM Interconnection’s Base Residual Auction (BRA), for the 2021/22 delivery year, two weeks ago. Contrary to what most industry experts and trade journalists had predicted, PJM’s Capacity Performance (CP) emergency demand response program did not fail. In fact, we saw offered and cleared Demand Response megawatts (MWs) increase drastically, the highest volume of Energy Efficiency to ever clear a BRA, and prices came soaring back up, shocking prognosticators everywhere.

Although this may all be contrary to the opinions of the majority in the energy industry, it is right in line with what I highlighted in my white paper from October, 2017, “PJM Capacity Performance is Here. Don’t Believe the Myths.” In it, I outlined three “myths” that were clinging to PJM’s CP-only demand response program and shot each one down. Seven months later, the market has proven us right.

It would be impolite to say, “I told you so.” So instead I’ll show you. Here are the three myths that I discussed, and how the results Wednesday’s auction proved each of them wrong.

Myth #1: Demand Response has declined over the last six years.

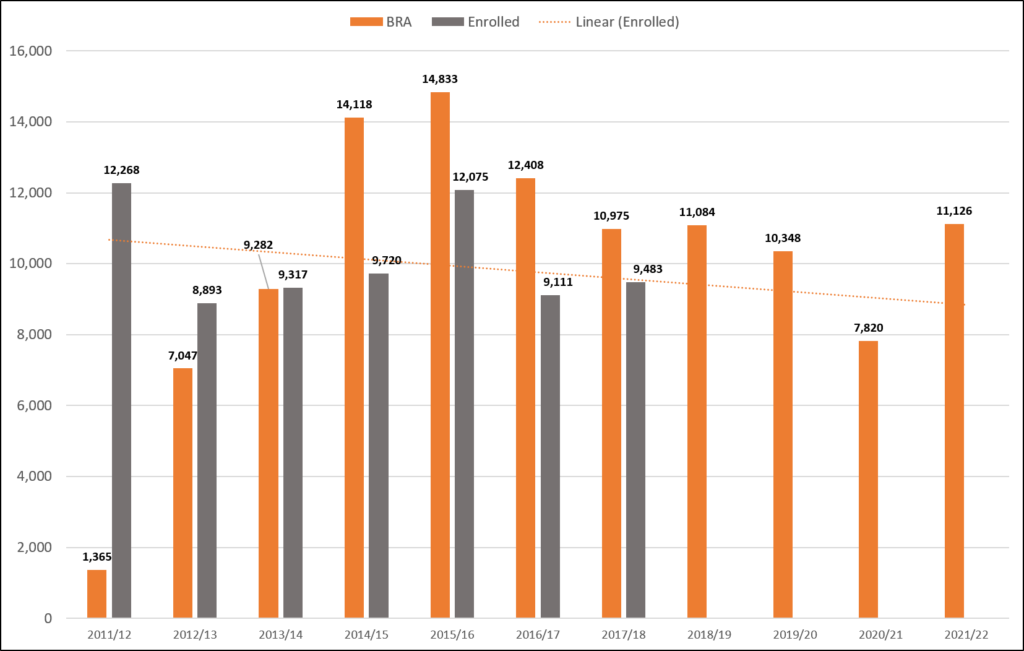

I called this a “pernicious myth that can prevent organizations from opening a rewarding and potentially substantial revenue source.” The idea was cleared capacity was declining, which meant demand response is declining. Not so, I said. There’s a big difference between cleared capacity and enrolled capacity, and while cleared may have seen recent declines, enrolled was remaining steady and strong, which means DR overall remains strong and will continue to be.

Flash forward to Wednesday. The amount of Demand Response that cleared the BRA was 11,125.8 MW. Not only is that about 3,300 MW more than last year’s BRA (the first for CP-only). It is the highest amount of cleared DR in a BRA since the 2016/17 BRA five years ago. Now it remains to be seen if 11,125.8 MW of DR is enrolled in the 21/22 DY, but it’s well within reason to expect ~9,500 MW to be enrolled, which would maintain the amount of participating DR flat YoY.

Myth #2: New CP requirements make it difficult to participate in DR.

In my white paper I stated that although grid reliability is PJM’s number one focus (and rightfully so), and the new CP requirements imposed on Demand Response customers appear daunting (with higher noncompliance penalties and much longer requirements to perform), the impact on DR should be negligible. The implementation of CP to help prevent PJM from entering into emergency situations should mean less of a need for emergency resources such as Demand Response.

It appears that Demand Response customers are adjusting their mindsets from thinking that they can—or only want to—participate in summer-only emergency programs, to understanding that they do have the ability to be year-round resources. And Curtailment Services Providers now believe that they can support a Capacity Performance DR offering and feel there are sufficient customers that can comply and meet their RPM Commitments. This is evident in that over 2,000 MW more DR was offered into the 21/22 BRA than the 20/21 BRA. The DR industry is becoming more comfortable with the Capacity Performance program.

Myth #3: 100% CP means PJM is moving away from DR.

The RPM is an auction-based model that PJM uses to meet forward demand, and it does so by clearing sufficient capacity needed for reliability at the cheapest cost to load. PJM recognizes and understands the value that Demand Response resources bring to the market. The 21/22 BRA cleared at much higher prices across the RTO than nearly everyone projected. And although the prevailing thought is that many capacity resources adjusted and increased their offer prices, which caused prices to spike and PJM to clear Demand Response and Energy Efficiency resources in their place, nonetheless the need for these resources has been proven.

Despite what you may have been told, Demand Response is not back, folks. It never really went away. At CPower we expect the market and the programs to continue to change. It’s what we’ve always seen and are always prepared to see. And we will continue to adapt every step of the way while finding new ways to help customers reduce their costs and generate revenues to strengthen their energy management strategies.