Our Blog On-Demand

Content

Knowledge Hub

Knowledge Hub

We’re excited to have our technology partner Energy IQ contribute this guest column for The Current.

As 2026 capital plans take shape, one issue keeps showing up in industrial and large commercial facilities: aging control infrastructure. This keeps companies from earning more demand response (DR) revenue because they cannot seize opportunities.

For when capacity markets tighten and DR programs pay more, facilities that respond fast are rewarded while those that don’t can be effectively sidelined. Such is the case in PJM, for example, where capacity prices have jumped sharply and FERC has approved a broadening of the window for DR participation to enhance grid reliability and resource adequacy.

Missed opportunities often come down to a customer’s controls. Slower respondents tend to rely on building management systems (BMS) and supervisory control and data acquisition (SCADA) systems designed for monitoring, trending and alarms; not for fast, coordinated curtailment across multiple loads.

This dependence creates four common barriers to DR participation:

The result: facilities with perfectly good mechanical and electrical systems still miss out on what could be six-figure (and in some industrial cases seven-figure) annual DR opportunities, simply because the controls can’t prove or execute the event.

The good news is that most sites don’t need a full rip-and-replace to participate. Rather, a common approach in DR programs is to insert an integration/translation layer that does four jobs:

This middle layer is what brings an older plant “up to program speed” without a capital-heavy BMS replacement.

In one industrial project, CPower worked with Energy IQ to implement an integration layer at a 100 MW steel plant. This solution allows the site to predefine a load-shed sequence and reliably drop a large portion of load (30 MW) in under 10 minutes, making participation in DR programs requiring faster responses viable and creating a meaningful new revenue stream. The key enabler was the modernization between the facility and the DR platform.

For organizations participating in, or considering, programs like Synchronized Reserves, Capacity Performance, or other fast-responding DR products, the most useful next step is a controls-readiness assessment:

From there, the team can right-size an integration project and prioritize “fastest revenue” loads first.

Grid operators reward speed, automation, and reliability. Facilities that demonstrate those three things will continue to have access to higher-value DR opportunities. Conversely, facilities limited to manual response or slow controls will find themselves watching from the sidelines even if their actual load is large.

The U.S. Environmental Protection Agency’s recent interpretation on using emergency backup generators in demand response programs does not change the existing prohibition in United States wholesale markets, such as PJM. Emergency generators must still meet federal non-emergency standards to participate in demand response in wholesale energy markets, despite some misinformation that has circulated on the topic.

There is some indication that the federal government may consider a change in the future, but it has not yet done so or indicated what such changes may entail. Until that occurs, federal, state and local air quality agencies are bound to enforce current regulations, which carry serious penalties for violations.

The confusion started in May of this year, when the EPA issued an interpretation approving a Duke Energy emergency backup generator program in North Carolina and South Carolina. Some have mistakenly interpreted the EPA’s announcement as changing the current prohibition that has been in place for over a decade. It did not. The EPA approval was expressly limited to an existing regulation applicable only to local entities such as a utility addressing strictly local reliability problems.

Duke Energy in the Carolinas is not part of a wholesale energy market, also known as an Independent System Operator or Regional Transmission Organization (ISO/RTO). Wholesale markets cover many utility service territories across a broad region. Neither the EPA interpretation nor the existing regulation applies to programs operated by wholesale markets such as PJM. Moreover, a 2014 federal appeals court decision that removed emergency generator participation in wholesale market demand response programs has not been reversed.

The EPA interpretation was explicitly limited to Duke Energy in its capacity as a local balancing authority (LBA) and its dispatching of participating generators for local transmission and distribution system support. An LBA includes a utility that does its own balancing across a localized area such as a single utility.

In contrast, PJM is a regional balancing authority that dispatches across the regional transmission network and many utilities and does not provide balancing within local distribution systems. Because the EPA’s 50-hour rule for enrolling generators requires a demand response program to be managed by a local balancing authority (which Duke Energy is, but RTOs and ISOs are not), emergency generators in these wholesale markets must still meet federal non-emergency standards to participate in demand response.

The following answers to frequently asked questions are based on CPower’s review of the EPA’s guidance on the Duke Energy program and similar reviews by environmental consulting firms.

On May 1, the EPA released clarifying information in the form of FAQs with specific guidance “to help ensure data centers and power companies have reliable power” for artificial intelligence (AI). In doing so, the agency stated that it had determined that Duke Energy’s demand response program met the criteria for enrolling stationary emergency engines in response to the utility’s request for interpretation.

According to the fact sheet released by the EPA, the agency understands that backup generators powered by stationary reciprocating internal combustion engines (RICE) are important for maintaining the reliability of the electric grid. It expects these generators to become even more important as the demand for electricity increases.

The EPA also noted that regulatory provisions allow emergency engines to operate for up to 50 hours per year in non-emergency situations if all of the following conditions are met:

Nothing has changed yet to allow emergency generators to participate in PJM or other wholesale market demand response programs. As previously stated, the EPA clarification did not apply to demand response programs run by RTOs or ISOs because it emphasized Duke Energy’s role as a local balancing authority and its dispatching of participating generators for local transmission and distribution system support, per the EPA’s 50-hour regulation. ISOs and RTOs such as PJM are not local balancing authorities.

However, the clarification does signal heightened, and perhaps unprecedented, interest in harnessing distributed energy resources such as backup generators to increase grid flexibility and reliability. Given shifting rules and programs, plus heightened price signals and improved economics, CPower’s expert team continues to track regulations and policies closely. We will inform customers if the EPA issues further guidance or makes changes.

If you would like to learn more in the meantime, read this CPower whitepaper: Generating Revenue with Your Emergency Generation: How to Reclassify Assets as Non-Emergency Generation.

Today, PJM, North America’s largest grid operator covering DC and 13 states across the Mid-Atlantic and Midwest, updated the design of Frequency Regulation. Frequency Regulation is part of PJM’s ancillary services to maintain a precise balance between electricity generation and consumption on the grid’s transmission system.

Specifically, PJM’s Frequency Regulation program is available 24/7/365, and customers are rewarded for their ability to perform quickly and keep the grid steady at 60 hertz. When demand suddenly spikes or generation drops, PJM calls on CPower’s customers with flexible resources like batteries or quick-responding generators to respond quickly and restore balance. You can think of Frequency Regulation like a car’s shock absorber, smoothing out bumps on the electric grid. Because it requires fast response and precision, Frequency Regulation is one of the highest-value grid services available to energy users who can provide it.

What’s Changing with Frequency Regulation

As of Oct. 1, 2025, PJM is rolling out Phase One of its Frequency Regulation changes to streamline dispatch and reduce complexity for participants, shifting from two signals (RegA and RegD) to one merged bidirectional signal. Frequency Regulation will also shift from hourly to 30-minute offer intervals.

Looking ahead to Oct. 1, 2026, PJM will make further changes to the Frequency Regulation program with the implementation of one signal and two products: RegUp and RegDown. CPower will keep our customers informed as we get closer.

Turning Flexibility into Profit

PJM’s Frequency Regulation changes mean that the energy assets you already own, like batteries and quick-responding generators, can generate revenue with less operational complexity. The new rules streamline how resources are dispatched and put a premium on fast, accurate response, which plays directly to the strengths of a battery and other flexible technologies. It’s also a chance to turn grid support into more reliable revenue without significant changes to your operations.

Complexity Simplified with CPower’s EnerWise

CPower has updated its EnerWise platform to align with the latest changes from PJM, helping you maintain compliance and supporting your continued participation and success in PJM’s Frequency Regulation program. EnerWise helps you increase returns without any major changes to your operations or constraints. Our role is to make market participation easier, so you can focus on your core business while your assets generate value.

PJM’s Frequency Regulation updates are part of a broader trend: flexibility is becoming central to the future of the grid. As demand patterns shift, resources that can respond quickly will be increasingly valuable.

If you’re a DER project developer or a large energy user wanting to learn more about Frequency Regulation or other programs in PJM, please contact us.

The “AI Race” is seen as this decade’s Space Race: a signal of American leadership and competitiveness globally, and a key priority of the Trump administration. There are significant economic ramifications as well, with the U.S. AI market having the potential to measurably impact GDP beginning in 2027.

However, the future of mega-energy-intensive industries like AI depends on our power grid. Therefore, the country risks missing out on an AI economic wave — over $100 billion in market growth over the next five years — due to a lack of energy.

This potential lack of energy is somewhat of an elasticity issue. If you were to think of the grid as a rubber band, in its current form, it can stretch to accommodate more demand, but only if pulled in the right way, at the right times. That is, in meeting the need for electricity during the approximately 40 hours a year that the grid is stretched thin to its full capacity, we could unlock new capacity to expand critical industries like AI.

However, instead of strategically stretching the grid periodically as needed, regulatory conversations and political action to address our supply and demand imbalance tend to emphasize putting steel in the ground: building more of the supply-side and grid infrastructure solutions that the power industry has relied on for decades.

Even with President Trump’s efforts to accelerate new energy generation, building nuclear and natural gas power plants are still long-lead, capital-intensive projects that are a 15-year solution to a five-year problem. U.S. electricity demand is projected to grow 25% by 2030 compared to 2023 levels, outpacing supply and pushing power prices up as much as 40%.

We need immediate solutions to compete in the global AI race, and there are untapped gigawatts of power already available in our current electricity system. Instead of only adding supply, we can also reduce peak demand by aggregating large, flexible loads and other customer-sited energy assets into virtual power plants (VPPs).

Estimates gauge that this approach would unlock nearly 100 gigawatts of growth potential on our grid. Adding that same amount of capacity by building new natural gas plants would cost close to $100 billion and take years — if not over a decade — to achieve. Able to be deployed in months without costly infrastructure investments, VPPs provide flexibility to our existing grid by using customer energy assets such as flexible load reduction, battery storage systems, solar panels and smart thermostats to level supply and demand. They currently provide 30 GW to 60 GW of capacity in the U.S. — about 6-12% of the country’s total natural gas capacity — but VPPs have not reached their full potential. The Department of Energy has reported that accelerating VPP deployment to reach 80 GW to 160 GW can support the rapid rise in energy demand and help reduce price spikes.

Turning our AI ambitions into reality requires regulators and policy makers to prioritize VPPs as a competitive edge in the AI race and enable our existing grid to support more economic growth.

First, we need to incentivize energy flexibility among large energy customers. If new demand drivers, like AI data centers or crypto-mining facilities, join VPPs and participate in demand-side flexibility programs, they can access the energy they need faster, support the grid, and drive economic growth in the U.S. Those same VPPs also serve as opportunities for all types of large energy users to enroll and offset their rising energy costs. Regulators should embrace this VPP participation, which meets demand by stretching the grid. For example, in Texas, Senate Bill 6 was approved by legislators and will require new large loads like data centers to participate in load management — a model we may see other parts of the country adopt.

Second, we need to lift key restrictions on VPP participation. Despite FERC Order 2222, which was designed to promote VPP participation, implementation in some power markets has fallen well short of FERC’s vision. Regulators can encourage increased VPP enrollment by ensuring customer energy assets can participate in multiple grid programs simultaneously and by allowing local utilities to dispatch VPPs.

And finally, we need to push for improved access to meter data. In the U.S., many electricity customers have a smart meter that produces real-time data about their power consumption, but most utilities restrict access to this data. If state and energy regulators helped give VPP operators and their customers better access to non-sensitive meter data, it could spur faster payments for participation, more customer sign-ups and an acceleration of available distributed resources across the country.

In short, it’s high time we cut the bias and treat distributed energy as equivalent to supply-side solutions. A dispatched demand reduction through a VPP is functionally identical to a dispatch of increased generation from a peaker power plant.

By rapidly accelerating VPPs, which are already proving their worth across the country, we can help capture the near-term value of an American AI renaissance. If AI companies embrace energy flexibility, driven by regulatory and policy support, this power-hungry industry will go from a grid problem to an economic solution that helps the U.S. compete on the global stage.

Michael D. Smith is CEO of CPower Energy, which operates a virtual power plant platform across more than 23,000 commercial and industrial customer sites in the U.S.

While demand response has long played a vital role in energy management, its importance was on full display at CPower’s GridFuture 2025, hosted in Washington, DC, in early August, as stakeholders across the industry noted its importance in tackling unprecedented grid challenges. Paying customers to use less electricity when demand peaks or electricity prices are high is increasingly seen as an efficient means of supplying the power needed to support innovation and spur economic growth.

“This is a pivotal moment in our country’s energy history for demand response. But this isn’t just CPower’s story – it’s a growing chorus across the energy sector,” CPower CEO Michael D. Smith said at GridFuture 2025, the company’s annual thought leadership conference focused on advancements in demand response, distributed energy and virtual power plants.

“It’s because of everyone in this room, and many more out across our ecosystem, that we can drive meaningful outcomes for our customers, for the grid, for our communities and our economy. And that collaboration is essential as we continue to face new challenges as an industry.”

With demand growing faster than new capacity can be built, faster-to-deploy solutions such as demand response bridge the expanding gap between supply and demand. For example, from June 1 to August 1, CPower and its customers across the US provided ~34,000 MWh of load relief during the hottest days of summer, stabilizing the grid and keeping our communities going.

“Demand response acts as the grid’s great economic shock absorber. In times of volatility or disruption, it helps smooth out price spikes while freeing up capital that customers can reinvest elsewhere, including job creation,” Smith said.

Properly utilized, demand response could deliver $15 billion in annual savings nationwide, providing a strategic lever for businesses and the economy. “Great value comes from taking existing assets and leveraging them more effectively and efficiently,” Smith said.

The factor driving the call for more capacity and the biggest economic gains also offers the most immediate and efficient solution: artificial intelligence. More specifically, data centers for AI compute companies, hyperscalers, crypto miners and other large energy users can become grid assets through demand response.

“Data centers are not new, but what is new is the way that AI is pushing the load associated with data centers. AI is changing what load growth looks like and has raised questions about what the next five to 10 years will look like,” said GridFuture 2025 keynote speaker Morgan Scott, vice president, Global Partnerships and Outreach at EPRI.

From transportation to manufacturing to healthcare, AI impacts every industry, requiring exponentially more electricity. “This is creating the knowledge economy, with data centers as knowledge factories. It’s imperative to ensure they have the power they need so that they continue to drive economic growth,” Scott said.

Touching on EPRI’s DCFlex initiative, Scott noted that data centers can leverage flexible energy from energy assets like on-site generation, thermal energy storage, cooling systems or compute workload.

At GridFuture 2025, innovators from Mercury Computing, Emerald AI, Bentaus and Miratech elaborated on unlocking flexibility from data centers. They explored how new technologies enable data centers to adjust power use dynamically, increasing their value to the grid.

“The narrative is starting to change to realizing we can bring stability and resiliency to the grid by working with CPower and others to flex load,” said Bob Davidoff, CEO and Founder, Bentaus.

AI compute load is particularly flexible because power consumption can be adjusted around workloads such as training, fine-tuning and inference. “We need to stop thinking of AI as inherently inflexible and start seeing it for what it is: the Holy Grail of demand-side management,” said Varun Sivaram, CEO, Emerald AI.

“Most end users are focused on results, not where the processing happens. That gives us the power to shift compute in ways that maximize the infrastructure we’ve already built,” he continued.

Some markets connect data centers to the grid sooner for participating in demand response. “Time-to-power is critical to data centers. That is what has allowed the idea of flexible data centers to take root,” said Monty Prekeris, Co-Founder, Mercury Computing.

In some cases, demand response may be required as utilities and grid operators struggle to accommodate large data centers and other large loads.

For example, Texas Senate Bill 6 gives the Electric Reliability Council of Texas (ERCOT) the authority to curtail energy users with electric loads over 75 MW during grid emergencies, such as summer heatwaves when demand peaks or winter storms when power supply can wane.

Traditionally used to keep the lights on during sweltering summer days, demand response has become a year-round resource with extreme weather creating demand peaks across all seasons. Utilities and grid operators also turn to demand response resources more frequently and on shorter notice to balance the grid amidst rapid shifts in supply or demand due to intermittent generation or other factors.

As demand response has become more accepted and encouraged, it has also become increasingly automated and optimized. And it has expanded beyond curtailed load, encompassing distributed generation, storage, microgrids, smart thermostats, EV chargers and other energy assets. The resulting multitude of complex demand response programs spanning capacity, energy and ancillary services makes simplification paramount.

“We literally have a Saudi Arabia of latent flexibility capability that we have yet to unleash, and we need to do that given the anticipated demand growth in our country. But to leverage it, we need to engage with customers without interrupting their business,” said Ken Schisler, Chief Legal and Regulatory Officer, CPower, in introducing a customer flexibility panel discussion at GridFuture 2025.

Panelists from commercial real estate, transportation and manufacturing shared how they have tailored their load management strategies to their specific industries, as well as best practices for navigating market participation and steps for optimizing their energy assets in grid service programs.

Reflecting on lessons learned from the panel and other GridFuture 2025 presenters, Smith noted the collective impact. “We’ve gained clarity on where our industry is, the vision for what it could become and what actions the industry needs to bridge that gap.”

Glenn Bogarde

As CPower’s Chief Sales and Marketing Officer, Glenn has led the company’s sales team on a nationwide mission to help customers unlock the most value from their flexible energy assets. Glenn has more than 20 years of sales experience in the enterprise software and energy industries.

*This article first appeared on Environment+Energy Leader on Feb. 25, 2025. Click here to view.

As a blast of Arctic air swept through the U.S. on Jan. 22, PJM’s winter electricity demand reached an all-time high of 145,000 MW, breaking its 2015 record. The new record may not last 10 years though, as extreme cold and disruptive winter storms, from Uri (2021) to Elliott (2022), to Enzo (2025), have become the new norm in the U.S., increasing demand for electric heating and straining the grid when supply falters.

As our national demand for electricity surges and extreme weather intensifies, we can expect to see more winter consumption records, like that of PJM’s, broken in the coming years. We could also experience dangerous blackouts if we don’t improve the grid’s ability to handle ever-greater peaks in demand.

Intense winter weather further strains an aging grid that is already struggling to keep up with demand as utilities and grid operators retire near-end-of-life generation resources faster than they bring replacement generation online. When winter storms topple power lines and disrupt generation resources, the grid’s capacity is stretched even thinner, and this can result in higher energy costs and potentially dangerous outages when temperatures plummet.

Just a few months before experiencing its record-setting winter demand in January, PJM had expressed concern about maintaining adequate supply if extreme weather conditions were to persist this winter.

Winter grid strategies must evolve beyond the playbook of centralized generation if we are to guard against interruptions in supply as demand surges. This evolution has begun with the rise of distributed energy resources such as onsite generation and variable load (DERs), but we can—and should—do more to strengthen the grid with the DERs available to us now.

Virtual Power Plants (VPPs) offer a perfect solution due to their immediate availability and unique flexibility. A cost-efficient way to balance the grid with existing DERs, VPPs have emerged as an increasingly valuable resource for making the grid more resilient, regardless of the season.

Traditionally focused on meeting peaks only on the hottest summer days, utilities and grid operators now grapple with surging demand year-round. As weather patterns shift, the grid faces vulnerabilities from extreme cold and winter storms as well as heat waves and triple-digit temperatures.

VPP operators can cheaply and efficiently reduce consumption during any period of peak demand by aggregating DERs and collectively dispatching hundreds and thousands of megawatts of distributed energy from customer variable loads and onsite generation resources and batteries.

This decreases the reliance on gas peaker plants, which have been shown to cost 40% more than a VPP and are at risk of failing during extreme cold due to mechanical problems, fuel supply issues, downed trees, or heavy snow bringing down power lines and transformers. By eliminating the reliance on peakers, utilities can pass cost savings to customers, driving down energy bills.

Furthermore, customer-powered VPPs are an immediate way to maintain a consistent and reliable energy supply when the traditional grid is struggling to accommodate demand growth in winter weather conditions. Because of their inherent flexibility, VPPs can adjust to meet fluctuations in supply or demand. They can also be deployed locally where they’re most needed during emergencies.

VPPs have rescued the grid in previous winters. On Christmas Eve 2022, customer-powered VPPs helped prevent blackouts in the Northeast and Mid-Atlantic regions during Winter Storm Elliott. The Texas grid operator, ERCOT, has similarly turned to them for help, using the integration of VPPs and an increase in renewable energy to improve its preparations for major winter weather, after Winter Storm Uri devasted the state in 2021, leaving 4.5 million residents and businesses without power.

As pressure on grids mounts nationwide, these examples serve as blueprints for other regions to follow in leveraging VPPs to strengthen the grid’s ability to handle extreme weather.

As winter storms grow in frequency and strength, our power infrastructure weakens with age and wear. Meanwhile, the full extent of demand growth has yet to be realized. Therefore, we need innovative, flexible strategies to take us reliably into tomorrow.

One of the most flexible strategies, VPPs are an affordable and adaptable solution for managing demand response during summer and winter months and integrating DERs into the grid at any time.

Most importantly, while infrastructure upgrades and large-scale power plants will take years to deploy, VPPs can bridge the gap between our aging grid and the modern, resilient energy grid of the future.

With winters growing more severe, VPPs are ready to improve resilience.

Michael Smith is an innovative leader with more than 25 years leadership experience in the energy industry. Michael joined CPower from ForeFront Power, where he was the CEO of the company’s North American solar and energy storage business, responsible for strategy and all business areas across the U.S. and Mexico.

The energy industry faces uncertainty as 2025 draws near but key trends and issues provide some predictability.

For instance, as in 2024, demand for electricity will accelerate while generation capacity constricts. As a result, virtual power plants and other immediately available sources of clean, affordable and reliable energy will continue to expand as new generation is built.

Recognizing the importance of planning ahead to stay ahead, The Current asked CPower executives Mathew Sachs and Ken Schisler for their thoughts on the energy trends to watch in 2025. Their responses have been edited here for clarity and conciseness.

Mathew Sachs (Senior Vice President, Strategy & Product):

If it takes too long to improve the rules for VPPs or interconnections or fill in the blank with anything else that has a chance to solve our problems, the grid could move towards less-than-ideal states.

Customers in other countries are already going off the grid entirely because they don’t feel they can trust their grid and we’re starting to see that here in the U.S. too, like with data centers. Or maybe people will lose trust in the free markets and deregulated states could go back to regulated with vertically integrated utilities. So, we should focus on reducing the friction that could lead to suboptimal outcomes by making it too hard for things to work, whatever that reason may be.

Ken Schisler (Senior Vice President, Law & Policy):

Roadblocks that were erected by the regional transmission organizations (RTOs) and independent system operators (ISOs) in their efforts to facilitate participation by distributed energy resources (DERs) under FERC Order 2222 will become evident and participation will be slow.

Although you may hear that DER participation models have been approved and implemented and that participation will be starting in the next year or two, the fact is that those models are far from being perfect and fulfilling FERC’s vision. And because the RTOs’ and ISOs’ implementation of Order 2222 have fallen well short of that vision for promoting participation in VPPs, the impacts will start to be seen.

Sachs: The #1 driver for VPPs is going to be load growth driven by computing load for AI and data centers. AI is like a modern-day Manhattan Project. It’s the U.S. versus the rest of the world, particularly China. Maybe the federal government will even get involved in ensuring there is enough power for AI.

Wherever the supply comes from, we will have to deal with transmission and distribution constraints within the existing grid infrastructure. However, we can’t rapidly build out infrastructure, so we’re going to have to rely on resources we already have in the near-term. That means turning to VPPs, which can meet increases in demand now.

Schisler: Improving access to data is a key enabler of growth that is often overlooked in VPP deployment. However, data access issues have become a federal and state concern. The more that states and the Federal Energy Regulatory Commission (FERC) do to make data accessible, the more scalable VPPs will be across the country.

States such as California, Illinois and Texas have become smarter about how to give customers access to their electricity data, but it needs to be architected into systems if we are to scale. We need the ability to query 500 accounts at once instead of using unique logins for every individual customer, for example.

It’s not just a matter of making it seamless for the customer. It’s about making it seamless for energy agents too.

Sachs: Everywhere I go, the number one talking point is how data centers are driving demand growth. There will be a particular focus on making sure we stay competitive with the Chinese on AI and don’t get hampered by a scarcity of power.

Schisler: Heavy industrial makes up a significant part of U.S. load and will be an important part of national energy strategy under the new president. For, an energy strategy geared toward increasing the global competitiveness of America’s manufacturing industry may include allowing manufacturers to make their flexible loads available in electricity markets. Leveraging their flexible loads would make them more efficient and be vital to re-energizing our country’s manufacturing base.

Sachs: As much as the consumer doesn’t want electricity prices to go up, they really don’t want their grid going down—and one of those two things happening is inevitable. Higher prices signal a need for more generation and there could be a major grid failure in 2025 if we don’t take significant steps to maintain reliability amidst increasing demand.

Schisler: I expect to see electricity prices rising in the next year and then over the next several years as increasing demand from new sources of load like data centers and AI outstrips the ability to build the generation resources and transmission needed to keep up.

Schisler: If grid operators don’t fix their problems, politicians will and they’re paying attention. We saw it in the past in Texas when the leaders of its grid operator, its board members and the commissioners of the state’s regulatory board all resigned after widespread power outages during Winter Storm Uri a few years ago.

Now, governors of several states in PJM have called upon the grid operator to help cut costs because they worry about soaring electricity prices impacting consumers. Meanwhile, across the country, the governor of California has signed an executive order to curb rising costs for consumers there, like by trimming state programs that could be inflating electricity bills.

When prices get out of control, politicians will do something to change it up.

To learn more about VPPs and how CPower can help you monetize your energy assets while supporting sustainability, improving grid reliability and increasing energy resiliency, call us at 844-276-9371 or visit CPowerEnergy.com/contact.

We’re excited to have our technology partner Lithion Battery contribute this guest column for The Current.

Large energy users like commercial and industrial customers have long benefited from backup batteries that have kept their operations running when the grid goes down or electricity prices go up. Way up.

However, C&I customers, governments, hospitals and other large energy users can do more with energy storage. When energy users tie behind-the-meter batteries into virtual power plants (VPPs), they earn revenue while helping keep the lights on in their communities.

VPPs prevent power outages by balancing supply and demand with dispatchable distributed energy resources (DERs) such as batteries, which can quickly increase or decrease the power supplied or consumed when the other shifts. For example, customers can use battery energy storage systems from Lithion to make and save money by providing grid services through CPower, which is the nation’s largest VPP operator.

Batteries and other DERs are increasingly important—and valuable—as grid operators struggle to supply enough electricity to keep up with accelerating demand.

Demand for electricity has never been higher and continues to reach new heights. The drivers of the increase, like new data centers and adoption of electric vehicles, are expected to persist for decades to come. So much so that the DOE’s recent VPP Liftoff Report forecasts peak demand to grow by over 60,000 MW by 2030 alone.

Peak demand occurs during the periods when energy consumption is at its highest and is at least partially served by power plants built to supply power during just peak periods. Power from these “peaking plants,” which run less than 15% of the year, comes at a much higher cost than electricity generated by baseload power plants that usually run over 90% of the time.

In addition to driving up electricity costs, peaker plants require significant time and money to build, meaning they alone cannot alleviate the strain that surging demand growth is exerting on existing grid assets. We need significant deployment of energy storage and other demand side solutions.

Rapid growth in peak demand is especially difficult to manage for utilities and system operators and drives higher power prices during peak periods. Energy is priced in real time within wholesale markets and when demand outpaces supply, prices increase.

These fluctuations are often significant, especially during periods when heating or cooling demands are highest. This volatility creates a large difference in power pricing between peak and off-peak periods and is especially impactful to customers in deregulated energy markets (i.e., summers in Texas or winters in the Northeast).

However, the ability to shift demand around peak and off-peak pricing periods can create massive value for both utilities and energy consumers—and batteries in particular unlock this value. Unlike intermittent on-site generation like solar energy, batteries give utilities and consumers complete control of the flow of energy.

They also allow maximum flexibility around charge and discharge periods versus other storage resources like electric vehicles. And they impact consumers less by maintaining energy levels to the site versus demand curtailing options like smart thermostats.

Energy storage has always been used to create resiliency and increase reliability of the grid. At the outset of the electricity industry, energy storage was reliant on geographical factors, like hydro power or mechanical features of power plants, like flywheels. Rechargeable chemical batteries like lead acid have existed for over 150 years. However, their low energy density and power could not meet the demands of large-scale energy storage. Only with the advent of lithium batteries did large scale energy storage make practical sense. The higher energy density of lithium decreased the space requirements and lowered long-term costs which made battery storage a viable solution.

Lithium Iron Phosphate (LFP) batteries, like those incorporated into Lithion Battery’s HomeGrid residential storage and GridBox commercial and industrial storage products are generally considered the best battery chemistry for energy storage systems (ESS). This is due to multiple factors including their high-cycle life and safety features, cost effectiveness, and other environmental benefits based on readily available materials. The modularity of Lithion’s batteries also allows consumers to scale systems up or down to maximize their benefit.

Batteries have multiple grid benefits when installed in various applications. Installations can generally be categorized as either in-front-of-the-meter by utilities or power producers or behind-the-meter, which lie on site with customers.

Front-of-the-meter batteries are installed by utilities or independent power producers and tied to power plants or transmission lines. These batteries are meant to optimize the grid assets they are tied into.

Renewable power resources like solar and wind are intermittent generators. Batteries allow the smoothing of that supply by shifting demand to pull from the stored energy when wind and solar aren’t producing. Batteries installed at transmission and distribution nodes can allow quicker balancing, minimize transmission losses and provide voltage control. Even fossil fuel plants can benefit from battery storage by providing supply coverage during the time it takes to ramp up facilities and allow plants to operate at capacities where efficiency is maximized.

Being that front of meter storage is tied directly into the grid, there are potential security concerns around foreign-made batteries in the US. In response to these concerns and the growth of the energy storage market, Lithion Battery has built a facility with 2GWh of battery manufacturing capacity in Henderson, NV to provide US made batteries to customers when system or grid security is a concern.

Behind-the-meter batteries are installed at customer sites as either standalone backup power, or when accessible by a utility or aggregator as part of a Virtual Power Plant (VPP). Behind-the-meter batteries are installed on a customer electrical supply panel and not tied directly into the grid. When not tied into a VPP, batteries allow customers to peak shave (decrease consumption during expensive “peak” times) and provide backup power during outages.

Again, while these alone are beneficial, the greatest value of the stored energy is unlocked when aggregated into a VPP. Aggregation of many distributed resources allows electricity consumers to participate in several incentive programs being offered by utilities and system operators across the country. Batteries can maximize returns by making energy available for both demand response and other ancillary services sold into wholesale energy markets.

Although backup power is a good beginning, more value is to be had in VPPs.

Commercial and industrial energy users in Arizona can earn revenue and reduce costs while helping the people in their communities keep cool amidst sweltering summers.

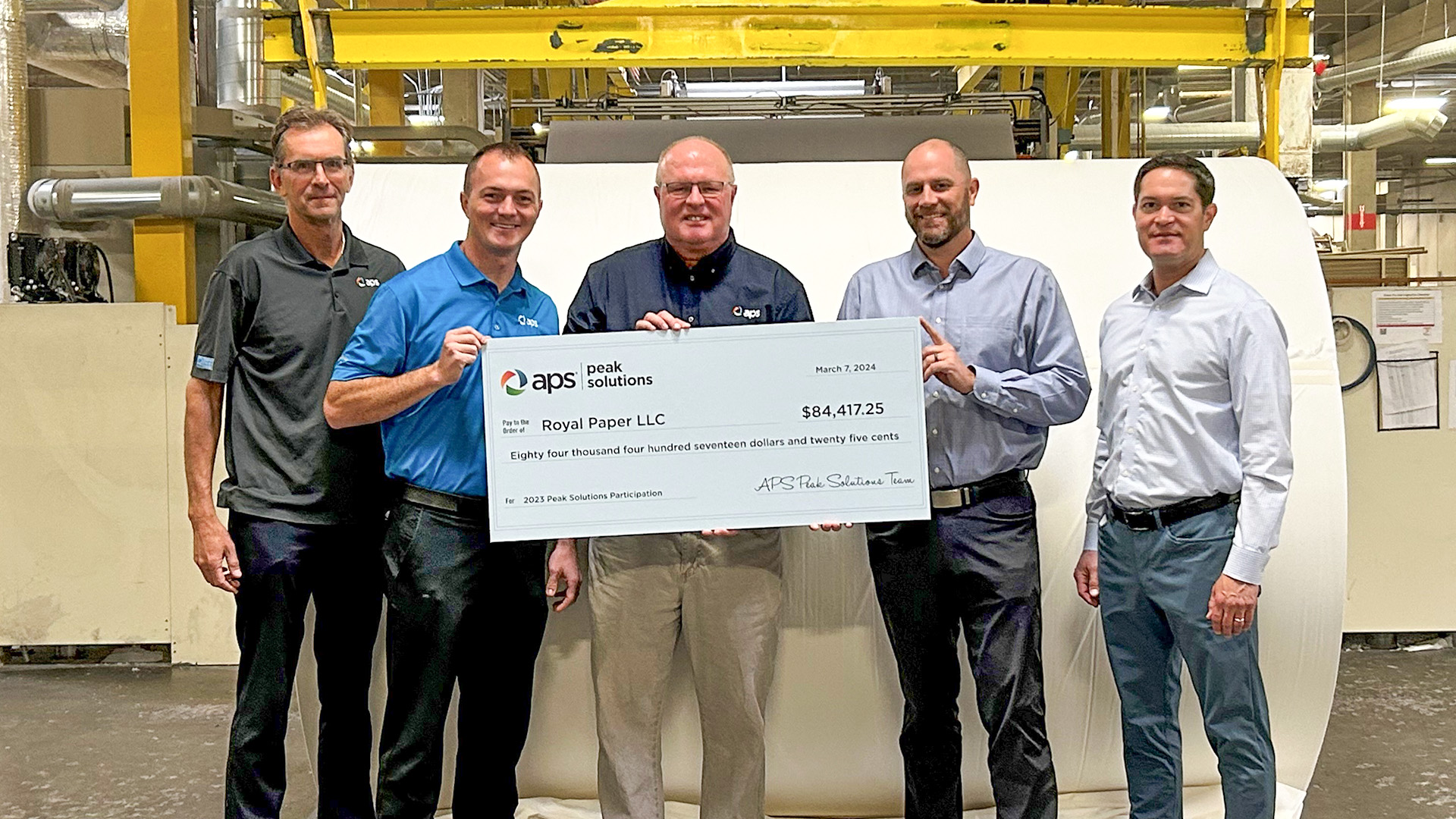

The APS Peak Solutions program available through CPower rewards customers for conserving electricity when the power grid is stressed. Customers earned more than $870,000 during the 2023 program season.

“This is a no-out-of- pocket cost program in which we incentivize APS business customers to reduce electrical usage to relieve strain on the grid periodically. You never get a bill from CPower for participating in the program,” said Matthew Pool, Account Executive for CPower.

Nationwide, CPower has distributed more than $1 billion to customers nationwide since 2015.

For APS, CPower recently presented Royal Paper with a check for nearly $85,000 for its participation in the APS Peak Solutions program last summer. In total, Royal Paper has earned over $230,451 since 2021 by voluntarily implementing energy conservation measures when demand peaks on the power grid.

The APS Peak Solutions program pays business customers to reduce electrical usage when asked between June and September. The electrical load reduction strategies are always at the customer’s discretion.

For example, Royal Paper reduces its production load when called, participating in the Day Ahead option, meaning it is notified by noon the day before an electrical demand response ‘event.’

Commercial and industrial customers that participate in the APS Peak Solutions program are good neighbors as well. Not only do they help maintain affordable, reliable power for all customers, but by reducing their loads businesses reduce the need to use carbon-emitting, fossil-fuel-powered peaker plants to meet demand peaks.

They further their own sustainability goals by participating in demand response as well, thereby further helping the environment and their communities. They also advance APS’s commitment to 100% clean, carbon-free electricity by 2050.

A leader in delivering affordable, clean, and reliable energy in the Southwest, APS serves approximately 1.4 million homes and businesses across 11 of Arizona’s 15 counties. APS launched the Peak Solutions program in 2010, and it is open to customers who can reduce at least 10kW of flexible load. All industries are eligible.

Customers need to partake in a test event. Enrollments can be adjusted monthly during the summer season and may vary for weekdays, weekends and holidays.

If you would like to learn more about how to earn revenue, reduce costs and help your community by participating in the APS Peak Solutions program offered through CPower, visit APS Peak Solutions Program – CPower Energy. You can also contact CPower online or at 844-276-9371 for a no-cost facility assessment and earnings estimate today.

We’re excited to have our technology partner 75F contribute this guest column for The Current.

Buildings are the fourth leading cause of greenhouse gas emissions worldwide, with HVAC systems accounting for about half of a building’s energy use. While technology to make HVAC more energy efficient exists, most buildings aren’t using it.

The reason? Traditional building management systems are offline, complicated and expensive, putting them out of reach for many commercial building owners.

According to the U.S. Energy Information Administration’s Commercial Buildings Energy Consumption Survey (CBECS), over 99% of commercial buildings in the U.S. are smaller than 200,000 square feet and 85% do not use automation.

This absence of smart technology isn’t due to a lack of interest in energy efficiency. Rather, it’s because sophisticated building controls have traditionally been the domain of large facilities with substantial budgets and dedicated technical staff.

The Game-Changer: Cloud-Native Building Automation

Enter cloud-native building automation — a technology that’s commonplace in our homes but has yet to see widespread adoption in commercial spaces. This innovative approach is poised to revolutionize how we manage and optimize building energy use, helping businesses, communities and the environment.

Unlike traditional building management systems that rely on complex, wired infrastructures, cloud-native solutions leverage wireless technology and the power of cloud computing, making them well-suited for smaller and mid-sized commercial buildings. Key features include:

At the core of these systems lies digital twin data adhering to industry standards. This standardization unlocks the potential for accurate and actionable real-time information, seamless integration with other systems and AI implementation.

Combining clean data and AI makes sophisticated building management accessible to a much wider audience, breaking down the barriers of expertise and technical knowledge that have long frustrated users and limited widespread adoption.

Decarbonization will become democratized as automated building management systems that make HVAC more energy efficient become more common, particularly among the 85% of smaller and mid-size commercial buildings that now lack automation.

For example, more businesses will have the power to reduce emissions through automated demand response via participation in virtual power plants (VPPs), where they automatically curtail their load to ensure there is enough electricity supply to meet demand without firing up fossil-fuel-powered peaker plants.

The advanced controls available in cloud-native building automation make participation in VPPs and demand response easier because the facility’s systems automatically respond to requests to conserve electricity, by imperceptibly dimming lights or adjusting temperatures by a few degrees without occupants noticing.

Tangible Benefits to Building Owners and Operators

The features of cloud-native building automation also translate directly into tangible benefits for building owners, including earning and saving money with automated demand response. By participating in VPPs including demand response, building owners can capitalize on incentives that grid operators and utilities offer customers to use less electricity when the grid is stressed.

The tangible benefits begin with the simplified installation process, which thanks to wireless mesh networks and pre-programmed control sequences significantly reduces upfront costs and installation time. This means less disruption to daily operations and a quicker path to reaping the benefits of smart building management.

Also, the cloud-based nature of the technology allows for real-time monitoring and adjustments, leading to rapid optimization of energy use. Building owners often see a quick return on investment, with energy savings accruing from day one.

Additionally, the predictive capabilities of these systems can preemptively address comfort issues, eliminating hot and cold spots before occupants even notice them. This proactive approach to comfort management not only improves the occupant experience but can also lead to increased productivity in office spaces and higher customer satisfaction in retail or hospitality environments.

The AI capabilities of cloud-native systems are a significant leap forward in building management as well. Imagine managing your building’s energy use through simple voice commands — adjusting temperatures, analyzing data, and optimizing performance with unprecedented ease.

With user-friendly interfaces and AI assistants capable of responding to voice commands, building owners no longer need to rely on specialized technicians for every adjustment or analysis. This empowerment leads to more responsive and efficient building operations.

Perhaps most importantly, cloud-native systems future-proof buildings against evolving energy regulations and market demands, creating grid-interactive efficient buildings that the U.S. Department of Energy envisions operating dynamically with the grid to make electricity more affordable while meeting the needs of building occupants.

As sustainability becomes increasingly important to tenants and regulators alike, buildings equipped with flexible, updatable cloud-native building management systems are well-positioned to adapt and comply with new requirements without the need for costly hardware overhauls.

So, not only is cloud-native building automation democratizing our approach to decarbonization by making sophisticated tools accessible to properties of all sizes, but it is also ushering in a new era of energy management in commercial buildings.

In this future, benefits like energy savings, demand response revenue, operational flexibility, improved occupant comfort and future-readiness in an evolving energy landscape will be accessible to the many not the few.