Higher Education

White Paper: Distributed Energy Resources and the Role of Aggregated Demand Management

The recent and rapid adoption of distributed energy resources (DER) such as solar PV, energy efficiency, energy storage, and generator sets offers a new set of challenges to aggregation and demand-side energy management. This white paper provides background on the new technologies, highlights major integration issues, and offers recommendations to DR customers looking to monetize their DER assets.

Case Study: City of Virginia Beach

Virginia Beach, Virginia – Energy Manager’s determined pursuit of energy efficiency savings earned the city tens of thousands of dollars in rebates in just a few short years. (Download this case study as a PDF)

THE CUSTOMER: THE CITY OF VIRGINIA BEACH

Located where the Chesapeake Bay meets the Atlantic Ocean, the City of Virginia Beach is anything but a sleepy resort town. It is the most populous city in the Commonwealth of Virginia, and boasts an economy comprising tourism, national and international corporate headquarters, advanced manufacturing, military bases, and agribusiness.

Besides the beach (the longest pleasure beach in the world, according to the Guinness Book of Records), visitors are drawn year-round to Virginia Beach’s many renowned attractions, including:

- The Virginia Beach Convention Center the nation’s first convention center to earn LEED® Gold certification as an existing building from the U.S. Green Building Council;

- The Virginia Aquarium & Marine Science Center, which attracts 650,000 visitors a year and hosts more than 10,000 fish, mammals, birds, and reptiles representing more than 300 species from around the world; and

- The Virginia Beach Boardwalk, three miles of oceanfront access, bike paths, live entertainment, restaurants, shops, and a 12-ton bronze statue of King Neptune.

Keeping the Convention Center, the Aquarium, and 350+ city buildings running in top shape uses a great deal of energy. That means, Virginia Beach is a city that understands the value of world-class demand-side energy management in municipal operations.

THE CHALLENGE: PERMANENT ENERGY (AND COST) REDUCTION

Virginia Beach’s city government serves its citizens and visitors from more than 350 facilities citywide. By 2010, constant increases in energy costs incurred at these facilities had risen to $20 million a year, a total plagued with “lost” buildings and meter reading errors in the hundreds of thousands of dollars.

To address this and other issues, including utility billing, Virginia Beach created the position of Energy Manager and hired Lori Herrick, MBA, LEED Accredited Professional, to lead its energy initiatives and manage municipal energy expenditures. With $5 million from the city, an unexpected $4 million windfall from the U.S. Dept. of Energy, and a mandate to conquer the city’s energy challenges—Ms. Herrick went to work.

THE CPOWERED STRATEGY: FINDING READY KILOWATTS

Energy efficiency (EE) projects result in permanent energy reductions, which the city recognizes as arguably the cheapest, most abundant, and most underutilized resource available to local government. With this in mind, Ms. Herrick sought to find out more about an energy program being offered through DMME, the state’s Division of Mines, Minerals and Energy. The program in question promoted energy performance contracts (EPC) to significantly reduce energy costs through energy efficiency measures that meet a guaranteed level of energy savings.

Ms. Herrick began the process of enrolling city facilities in DMME’s EPC programs, but was soon faced with the complex challenges of identifying what facilities, and how many kilowatts, to enroll. Fortunately, she received another windfall. She was introduced to CPower’s champion of Virginia demand-side energy management, Leigh Anne Ratliff.

Ms. Ratliff has worked with DMME since 2007 to offer integrated demand response services on a performance basis with no set up costs to the state. Demand response programs pay organizations such as government agencies for curtailing, or reducing, their electricity usage during times of high demand. Government entities who participate in demand response both save costs on reduced electricity use and earn revenue for their trouble.

As Ms. Herrick soon found out, CPower has an additional strength: the ability to provide complete measurement & verification (M&V) services for energy efficiency projects, necessary to receive utility rebates and credits. More importantly, CPower has unmatched experience in finding additional kilowatts (kWs) all too easily overlooked in already completed energy efficiency projects—and successfully submitting those kWs for even greater returns on the city’s investments.

CPOWERED SOLUTION: FOLLOW THE DATA (AND FIND THE MONEY)

Because the permanent energy reductions resulting from energy efficiency projects can pay dividends for up to four years after completion, Ms. Herrick and Ms. Ratliff set about the task of unearthing four years’ worth of city files to find buried EE gold – kilowatts that others missed. Looking back, Ms. Herrick says, “We were determined… it was kind of a no-brainer, to go through the files of projects we’ve done and submit the information. We were analyzing these projects to make sure the payback was there… They gave us a lot of data that Leigh Anne could use to calculate our benefit to the grid and then give us a check for it.”

From the outset, Ms. Herrick considered no project too big to tackle, working to help the Virginia Beach Convention Center earn its LEED® Gold certification (see below). She also considered no project too small to enroll, at one point submitting a 7kW project. As Ms. Ratliff explains, “If she had it, she sent it. One building got a credit for $52 in 2017. We’re learning on the cost-benefit element of this, but Lori is always looking further, to get every bit out of it that she can. In that way, she’s revolutionized what people put into energy efficiency.”

SPOTLIGHT: VIRGINIA BEACH CONVENTION CENTER

The Virginia Beach Convention Center (VBCC) is the crown jewel among the city’s facilities. It was the first convention center in the state to receive certification from Virginia Green, the Commonwealth’s voluntary campaign to promote environmentally friendly practices in Virginia’s tourism and hospitality industries. As noted above, it is also the nation’s first convention center to earn LEED® Gold certification as an existing building from the U.S. Green Building Council. These certifications are increasingly important in the competitive convention planning industry, where the VBCC competes nationally. Customer awareness of, and insistence on, “sustainable destinations” plays a greater and greater role in siting conventions.

The VBCC is also a shining example of how state-ofthe-art EE projects can enhance a city’s energy budget as well as its national reputation. Nearly all lighting in the convention center is LED lighting, and the HVAC is controlled through a state-of-the-art Direct Digital Control (DDC) system that incorporates an automated demand response program to control spikes in peak electricity demand. The automation limits any impact to convention-goers and still saves energy dollars.

“Together, we developed a process to systematically go through the building to reduce demand with the least impact on customer events.” – Leigh Anne Ratliff

It’s also a shining example of how the city and CPower Engineering worked together to successfully address one of the biggest challenges facing active convention centers: controlling peak demand electricity and total kilowatt usage. Event load-ins and load-outs at VBCC can be particularly problematic because the bay doors open directly from the loading dock into conditioned exhibit space.

“The Convention Center was a very cool energy project, because people in that space change every day,” Ms. Ratliff explains. “Bay doors are open for hours at a time, a lot of bodies and boxes moving in and out. The open bay doors are a significant source of heating and cooling loss. So how do we control that without disrupting loadins and other convention-goers already onsite?”

The first step was to analyze the status of the bay doors during times of peak demand. The Center’s zoned DDC system, which controls the Center’s HVAC, was programmed to prevent the air conditioning from running in the exhibit halls if the bay doors were open. In addition, the DDC system receives power pulses from the electricity switch gears throughout the day. In the next phase, an automated demand response program was integrated into the DDC system. When the system reads that the Center’s demand is getting ready to peak, it automatically implements one of three phases. Phase 1 changes back-of-house temperatures by one degree. If demand continues to peak, it implements Phase 2, which changes back-of-house temperatures by two degrees, all the way to three degrees at Phase 3. This automated program reduces the demand on VBCC’s chillers, which in turn reduces peak electricity demand.

“Our CPower engineers worked with VBCC’s staff to understand how the bay doors and events taking place in the building impact peak demand and usage,” Ms. Ratliff says. “Together, we developed a process to systematically go through the building to reduce demand with the least impact on customer events.”

With its DDC system program finalized and firmly in place, the Convention Center was able to ease demand on the grid, with near-zero disruption to its customers’ activities. In fact, the Center saved an astonishing 15 percent off their peak during its first year. And since the price of electricity peaks along with demand, this translated into significant cost savings that they otherwise would not have been able to attain.

THE RESULTS: $87,000 AND COUNTING

CPower is instrumental in helping the City of Virginia Beach navigate the complexities of PJM energy efficiency credits and paybacks. CPower submitted the uncovered EE data to PJM and earned the city both savings and revenue. For the delivery years 2017 through 2022, earnings from PJM for the city will reach just over $87,000 (see chart), with the VBCC earning $40,000 alone. And the city’s just getting started. “We just got another big round of funding,” Ms. Herrick says, “so Leigh Anne’s going to be hearing a lot from us.”

LOOKING AHEAD: DEMAND RESPONSE

In November, 2017, the Commonwealth of Virginia retained CPower through 2020 to continue to offer integrated demand response (DR) services to state agencies and departments through DMME. Ms. Herrick worked with Ms. Ratliff to identify five city sites they believe could be the most eligible for DR: Judicial and correctional facilities, the Convention Center, the Aquarium, and the central plant. The Convention Center currently participates in CPower’s DR program and earns revenue. The remaining facilities are undergoing audits to better understand their suitability. “DR involves curtailment, and we have to be careful when and how we curtail,” Ms. Herrick says. “That’s especially true of the aquarium. I want to earn revenue for the city, but we also don’t want to be responsible for a fish fry.” There’s no doubt, though, that Ms. Herrick will find a way to make it work. Above all else, she and the city are determined.

CPower will support their energy goals at every turn, with an energy strategy custom-made to meet their unique requirements.

SAVINGS AND EARNINGS: CITY OF VIRGINIA BEACH/VIRGINIA BEACH CONVENTION CENTER

Projects include lighting and green building. Sites include Aquarium, Boardwalk, Convention Center, library, maintenance garages, recreation centers, fire stations, police stations, EMS administrative and training center, and arts center.

City of Virginia Beach |

|||

|---|---|---|---|

| PROJECTS | ESTIMATED DR (kW) | FORECASTED GROSS $ | |

| 2017/2018 | 14 | 185.67 | $14,820.89 |

| 2018/2019 | 13 | 173.24 | $17,869.86 |

| 2019/2020 | 11 | 170.24 | $9,283.28 |

| 2020/2021 | 7 | 87.17 | $2,434.65 |

| 2021/2022 | 2 | 38.36 | $1,865.51 |

| Total | 654.68 | $46,274.19 | |

Virginia Beach Convention Center |

|||

|---|---|---|---|

| PROJECTS | ESTIMATED DR (kW) | FORECASTED GROSS $ | |

| 2017/2018 | 2 | 172.52 | $13,781.49 |

| 2018/2019 | 2 | 172.52 | $16,374.31 |

| 2019/2020 | 2 | 172.52 | $9,497.01 |

| 2020/2021 | 1 | 40.95 | $1,143.73 |

| Total | 7 | 558.51 | $40,796.54 |

Combined Totals |

|||

|---|---|---|---|

| PROJECTS | ESTIMATED DR (kW) | FORECASTED GROSS $ | |

| Total | 54 | 1,213.19 | $87,069.73 |

Download this case study as a PDF

Will Prices Rise With The Temperature In Texas This Summer?

As we discussed in our recent blog post about this summer’s potential “perfect Texas storm,” two significant factors projected for the ERCOT (Electric Reliability Council of Texas) energy market could have a noticeable impact on demand response participants: Reduced supply and record peak demand. The resulting clash of supply and demand projections points to the possibility of unexpectedly high prices for those organizations participating in ERCOT’s Load Resources (LR) demand response program.

As we noted last November, ERCOT approved the retiring of three coal-fired generation plants, reducing available generation capacity by about 4,200 MW. In its Final Summer 2018 Seasonal Assessment of Resource Adequacy(SARA), ERCOT projects the Summer 2018 total generation capacity available to be 78,184 MWs, resulting in a capacity reserve margin of roughly 11%. That’s well below its capacity reserve margin target of 13.75% of peak electricity demand.

In a slow economy, reduced supply might not be a problem. But that’s not the case in Texas. The economy is booming in the Lone Star State—in fact, it’s currently the fastest growing economy in the nation. That’s good news for Texans, but not-so-good news for Texans looking forward to a summer of uninterrupted electric supply and the state’s historically low energy prices.

Here’s why. ERCOT predicts “record-breaking peak demand usage” for this summer—72,756 MW. According to the SARA report, that’s more than 1,600 MWs higher than the all-time peak demand record of 71,110 MW set in August 2016.

ERCOT recognizes that this tight margin—a mere 5,428 MWs—might be cutting it too close for comfort. With an eye to grid reliability, it says it could find it necessary to deploy Ancillary Services—Load Response, or LR—and Emergency Response Service (ERS) demand response capacity “to maintain sufficient operating reserves.”

The law of supply and demand usually looks something like this:

Low supply + High demand = High prices

With that in mind, will we see record high prices this summer? The forward ERCOT energy market certainly seems to think so. Projected wholesale energy prices in ERCOT for August 2018 have more than doubled since the 4,200 MWs of generation announced it planned to retire in early 2018.

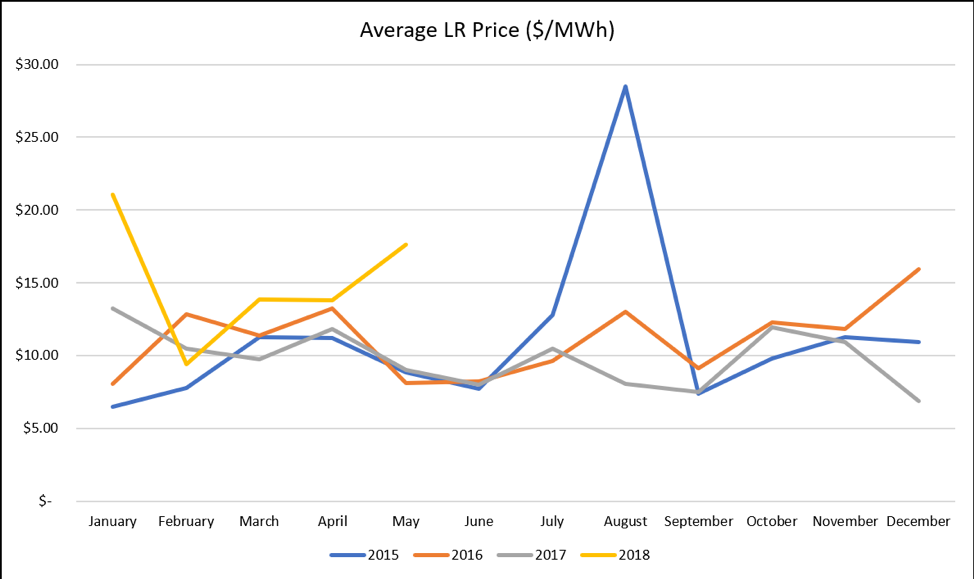

While the price customers receive for participating in LR is different than the energy price they pay when using energy, there is generally a correlation in that when energy prices rise in ERCOT, LR prices also rise. This is due to the structure of the ERCOT market where lower reserves available typically results in higher energy and LR prices.

As we’ve laid out above, we can expect lower reserves available in ERCOT this summer and therefore higher energy prices than we have historically seen.

While it remains to be seen if this summer will ultimately result in record high LR prices, we can already see in the above chart that there has been an increase in LR prices since the 4,200 MWs of generation retired in early 2018. Will this trend continue? That largely depends on the weather and generation availability this summer, but a great way to offset the increase in energy prices is through participation in LR which allows you to proactively gain revenue from your energy usage.

Join CPower on Tuesday, June 26, for the third in our ERCOT Webinar Series, “The Perfect Texas Storm: Low Reserves, High Prices, and Record Peak Demand for Summer 2018.” Join CPower’s Texas experts Mike Hourihan and Joe Hayden as they tackle the topics that will impact demand response customers this summer.

The webinar is free and now open for registration.

“The Perfect Texas Storm: Low Reserves, High Prices, and Record Peak Demand for Summer 2018”

Date: June 26, 2018

Time: 10:00-11:00 a.m. Central Time

Are You Ready For This Summer’s Perfect Texas Storm?

In October 1991, Hurricane Grace formed near Bermuda and began moving north. At the same time, a massive low-pressure system moved south from Canada. They converged in the North Atlantic, creating a deadly, cataclysmic weather event that was dubbed “the perfect storm,” later immortalized in the film of that name starring George Clooney.

No such weather event (or related George Clooney appearance) is currently predicted for Texas this summer. However, two significant man-made forces are currently converging in the ERCOT (Electric Reliability Council of Texas) energy market: Reduced supply and projected record peak demand. The resulting “perfect storm, Lone Star-style” of clashing supply and peak demand projections has led ERCOT to ask those involved in demand response (as well as generators and transmission owners) to focus on maximizing performance.

Let’s take a look at these two big factors impacting ERCOT this summer. First, supply. In Texas, the name of the game is reliability. To ensure a reliable grid, ERCOT prefers to maintain a capacity reserve margin target of 13.75% of peak electricity demand. These reserves enable them to serve electricity needs in case of unexpectedly high demand or levels of unanticipated outages from generation plants.

As we noted last November, ERCOT approved the retiring of three coal-fired generation plants, reducing available capacity reserves by about 4,200 MW. In its Final Summer 2018 Seasonal Assessment of Resource Adequacy (SARA), ERCOT projects total summer capacity to be 78,184 MWs, and the Summer 2018 planning reserve capacity to be 5,428 MWs, or roughly 11% reserve margin. That’s well below its capacity reserve margin target of 13.75% for peak electricity demand.

Second, demand. Texas currently boasts the nation’s fastest growing economy. Its growth is driven, as Forbes reported in May, by a resurgence in oil and gas drilling in the panhandle as well as growth in manufacturing that outpaced national growth rates in that sector. ERCOT’s SARA report acknowledges that this growing economy will continue to drive demand for electrical power, going as high as 84,814 MWs by 2023.

In fact, ERCOT predicts “record-breaking peak demand usage” for this summer—72,756 MWs. According to the SARA report, that’s more than 1,600 MWs higher than the all-time peak demand record of 71,110 MW set in August 2016.

So—72,756 MWs of demand. 78,184 MWs of capacity, 5,428 MWs of reserve planning capacity… frankly, that’s cutting it pretty close. Maybe tooclose. In fact, ERCOT thinks these tight reserves could trigger the need to deploy Emergency Response Service (ERS) demand response capacity, “to maintain sufficient operating reserves.”

If this happens, it increases the potentialforreal-time emergency events in order to maintain the grid’s reliability. How does this affect ERS participants?

ERS pays organizations like yours for using less energy when the grid is stressed and electricity prices are high. There are two types of ERS programs: ERS 10 and ERS 30, which pay businesses for being available to curtail their electricity load within 10 and 30 minutes respectively. The request to curtail is a referred to as a “called event”.

In the aftermath of the SARA report’s release, our ERCOT office heard from a number of customers who were concerned about the potential for real-time extended events. They feared disruptions to operations and the potential negative impact these disruptions could have on their customers and their bottom line. But how likely are we to see calls to curtail in ERS?

Looking at historical data, not very likely. Called events in ERS are rare. Between 2008 and 2017, a total of three events have been called. In the last eight years, we have seen no events at all. Over the past ten years, capacity shortage events above and beyond annual tests have averaged 0.3 per year in ERS 10, and 0.2 per year in ERS 30. As far as frequency goes, over the last 10 years the most that the ERS program has seen in one year is… two.

Based on the numbers, then, the odds are good that you won’t have to endure many, if any, curtailment requests. We’re confident that you should still be able to participate as in years past, and continue to earn revenue for your availability.

That said, CPower recommends the following steps to maximize your performance in ERS this summer.

Check your plan. Businesses and organizations change, expand, contract, evolve, and are seldom the same year over year. The curtailment plan you first developed with CPower’s engineers may no longer be the best fit for your current electricity usage and operations. Contact CPower and set up a review of your plan. An up-to-date curtailment plan is the best path to success in demand response. (You may even find some additional kWs to enroll that weren’t there before.)

Automate your DR. Automation is required for ERS 10 participation, but it’s still optional in ERS 30. Having even one or two steps on your curtailment process automated can make the difference between performing and underperforming. Make sure you discuss automation opportunities, including incorporating CPower’s Link API, when you review your curtailment plan.

Test your generators—at full load. If you’re counting on your back-up generators to provide you with needed energy during your curtailment events, make sure they can handle the load. Too many generators undergo their monthly and weekly test running off load, for fear of wearing their generators out. The problem is, generators are designed to run at their stated rating, every time. In fact, testing at less than full load can ruin an engine in as little as 50 hours of accumulated running time. Ask CPower’s engineers to review your current onsite generation process as part of your curtailment plan review.

While you’re at it, set up some time to assess your generators for enrollment in demand response. Properly permitted, onsite generation is source of additional revenue. Talk with CPower about your options.

CPower is here to help you through what could be a long, hot summer in the Lone Star State. ERCOT expects everyone, including demand response participants, to give the grid maximized performance for the benefit of all. CPower is here to help you do just that.

Join CPower on Tuesday, June 26, for the third in our ERCOT Webinar Series, “The Perfect Texas Storm: Low Reserves, High Prices, and Record Peak Demand for Summer 2018.” Join CPower’s Texas experts Mike Hourihan and Joe Hayden as they tackle the topics that will impact demand response customers this summer.

The webinar is free and now open for registration.

“The Perfect Texas Storm: Low Reserves, High Prices, and Record Peak Demand for Summer 2018”

Date: June 26, 2018

Time: 10:00-11:00 a.m. Central Time

Ontario Peak Demand Management 5CP

Demand Response Auction in Ontario

Generators

Myths… Busted! PJM’s Capacity Performance Soars to New Heights– and Confirms Its Revenue Potential for You

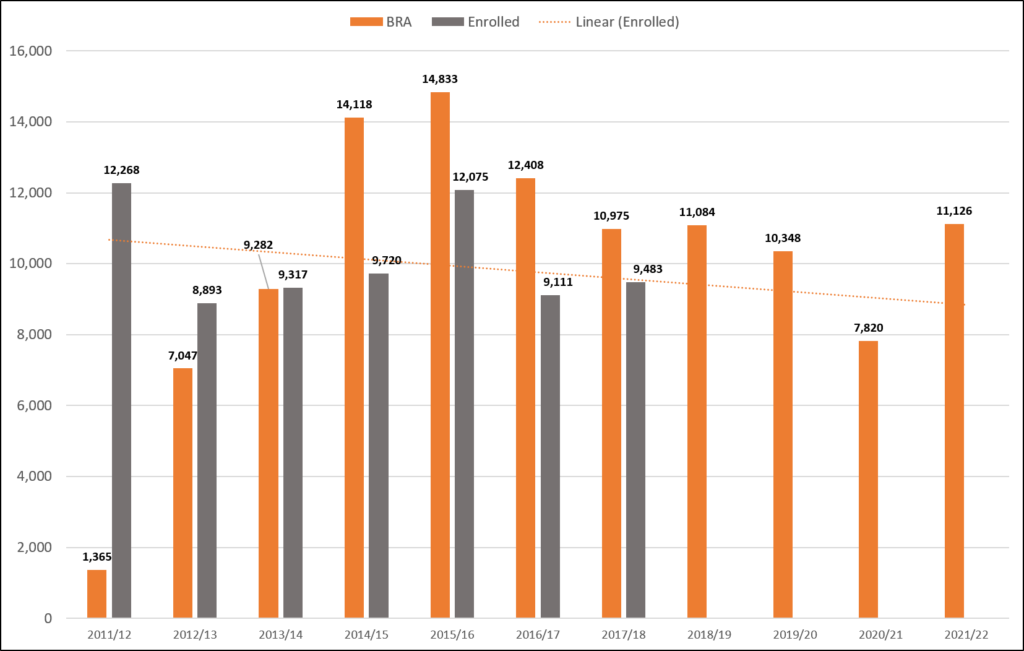

Big news came out of the PJM Interconnection’s Base Residual Auction (BRA), for the 2021/22 delivery year, two weeks ago. Contrary to what most industry experts and trade journalists had predicted, PJM’s Capacity Performance (CP) emergency demand response program did not fail. In fact, we saw offered and cleared Demand Response megawatts (MWs) increase drastically, the highest volume of Energy Efficiency to ever clear a BRA, and prices came soaring back up, shocking prognosticators everywhere.

Although this may all be contrary to the opinions of the majority in the energy industry, it is right in line with what I highlighted in my white paper from October, 2017, “PJM Capacity Performance is Here. Don’t Believe the Myths.” In it, I outlined three “myths” that were clinging to PJM’s CP-only demand response program and shot each one down. Seven months later, the market has proven us right.

It would be impolite to say, “I told you so.” So instead I’ll show you. Here are the three myths that I discussed, and how the results Wednesday’s auction proved each of them wrong.

Myth #1: Demand Response has declined over the last six years.

I called this a “pernicious myth that can prevent organizations from opening a rewarding and potentially substantial revenue source.” The idea was cleared capacity was declining, which meant demand response is declining. Not so, I said. There’s a big difference between cleared capacity and enrolled capacity, and while cleared may have seen recent declines, enrolled was remaining steady and strong, which means DR overall remains strong and will continue to be.

Flash forward to Wednesday. The amount of Demand Response that cleared the BRA was 11,125.8 MW. Not only is that about 3,300 MW more than last year’s BRA (the first for CP-only). It is the highest amount of cleared DR in a BRA since the 2016/17 BRA five years ago. Now it remains to be seen if 11,125.8 MW of DR is enrolled in the 21/22 DY, but it’s well within reason to expect ~9,500 MW to be enrolled, which would maintain the amount of participating DR flat YoY.

Myth #2: New CP requirements make it difficult to participate in DR.

In my white paper I stated that although grid reliability is PJM’s number one focus (and rightfully so), and the new CP requirements imposed on Demand Response customers appear daunting (with higher noncompliance penalties and much longer requirements to perform), the impact on DR should be negligible. The implementation of CP to help prevent PJM from entering into emergency situations should mean less of a need for emergency resources such as Demand Response.

It appears that Demand Response customers are adjusting their mindsets from thinking that they can—or only want to—participate in summer-only emergency programs, to understanding that they do have the ability to be year-round resources. And Curtailment Services Providers now believe that they can support a Capacity Performance DR offering and feel there are sufficient customers that can comply and meet their RPM Commitments. This is evident in that over 2,000 MW more DR was offered into the 21/22 BRA than the 20/21 BRA. The DR industry is becoming more comfortable with the Capacity Performance program.

Myth #3: 100% CP means PJM is moving away from DR.

The RPM is an auction-based model that PJM uses to meet forward demand, and it does so by clearing sufficient capacity needed for reliability at the cheapest cost to load. PJM recognizes and understands the value that Demand Response resources bring to the market. The 21/22 BRA cleared at much higher prices across the RTO than nearly everyone projected. And although the prevailing thought is that many capacity resources adjusted and increased their offer prices, which caused prices to spike and PJM to clear Demand Response and Energy Efficiency resources in their place, nonetheless the need for these resources has been proven.

Despite what you may have been told, Demand Response is not back, folks. It never really went away. At CPower we expect the market and the programs to continue to change. It’s what we’ve always seen and are always prepared to see. And we will continue to adapt every step of the way while finding new ways to help customers reduce their costs and generate revenues to strengthen their energy management strategies.