ERCOT Summer 2019: Supply, Demand, and Red-Hot Energy Prices

UPDATE March 5: ERCOT announced today that, due to expected record high demand and “historically low” 7.4% expected reserve margin, they have “identified a potential need to call an energy [emergency] alert at various times this summer.” (Emphasis ours.) Alerts allow ERCOT to take advantage of resources available only during scarcity conditions—particularly demand response. ERCOT will release its final summer report in May.

Two significant factors projected for ERCOT — the Electric Reliability Council of Texas—stand to have a noticeable impact on its energy market: Reduced supply and record peak demand. The resulting clash between these two market drivers point to the very real possibility of unexpectedly high prices for organizations participating in ERCOT’s Load Resources (LR) demand response program. Let’s take a look at what’s driving these two important factors, and how this could translate into an opportunity to generate revenue through demand response.

Reserves have dropped dramatically. Since mid-2017, ERCOT has approved the retiring of four coal-fired generation plants responsible for generating more than 4,500 MW in capacity. It’s not just coal generation, though. Since the May 2018 Capacity, Demand, and Reserves (CDR) report, three planned gas-fired projects totaling 1,763 MW and five wind projects totaling 1,069 MW have been canceled. Another 2,485 MW of gas, wind and solar projects have been delayed.

In its December 2018 CDR report, ERCOT projected total available generation capacity for Summer 2019 at 78,555 MWs—an estimate, as it turns out, that’s too low. ERCOT recently learned that it is losing another 470 MWs from the Gibbons Creek coal plant going offline this summer. That drops reserve capacity to 78,085 MWs—a low, low 7.4% reserve margin, just over half of the long-standing target margin of 13.75% of peak electricity demand.

And demand will peak. Last year, ERCOT set an all-time peak demand record of 73,473 MWs on July 19 between 4 and 5 p.m. This year, ERCOT predicts more “record-breaking peak demand usage” for the summer: 74,853 MWs, 1300 MWs higher than last year’s all-time peak.

That leaves a gap of—hold on—just 3,232 MWs. Low supply. High demand. Tight, tight margins. All that adds up to the potential for record high prices in ERCOT’s Load Resources (LR) ancillary services demand response program that ERCOT deploys to maintain sufficient operating reserves.

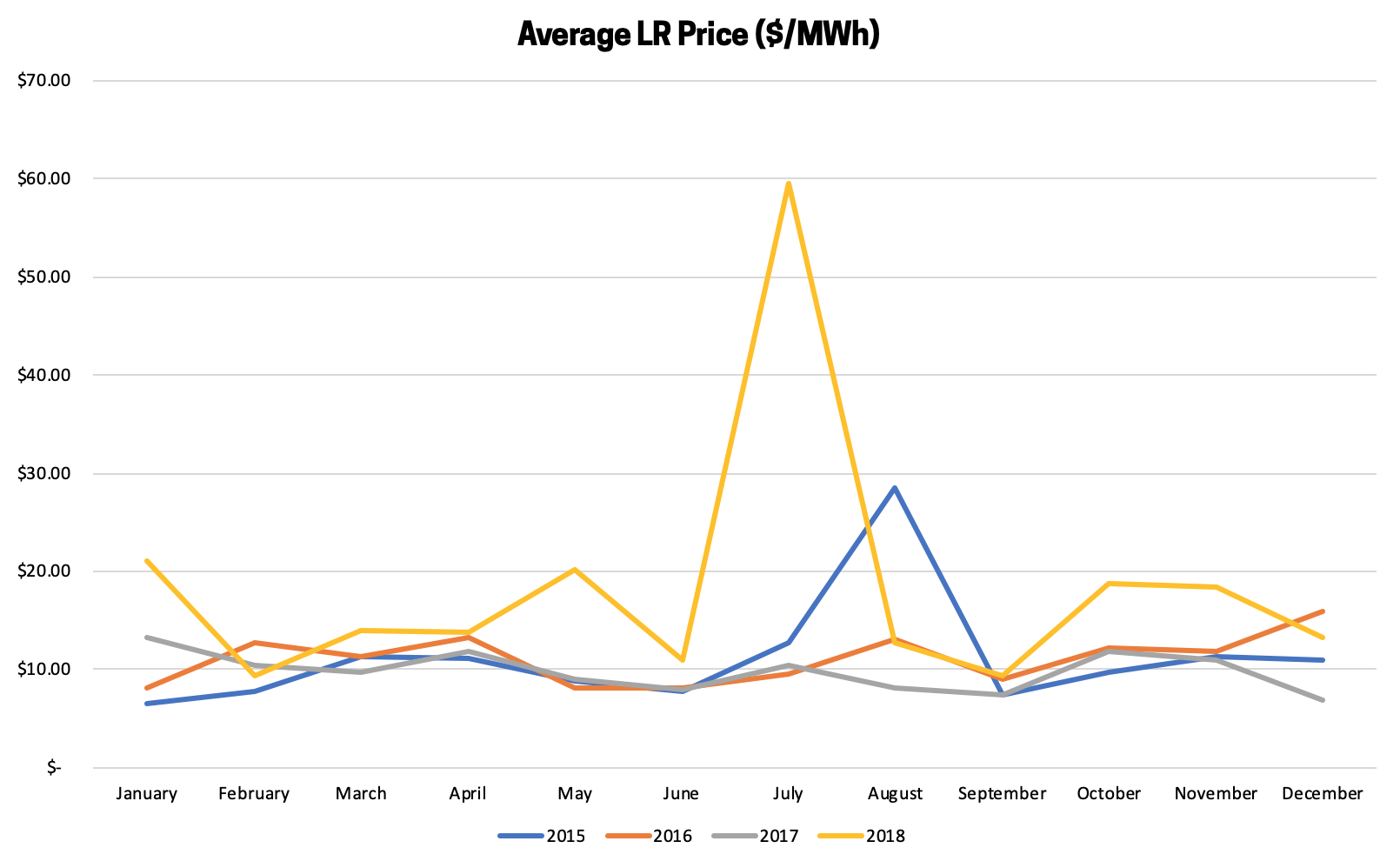

Already, LR prices have increased since the retiring of 4,200 MWs of generation in 2018. (see chart.) Additionally, projected wholesale energy prices in ERCOT for Summer 2019 are some of the highest we have seen. It’s not a stretch to anticipate high, if not record high, LR prices this summer.

High prices in Load Resources mean generous revenue paid to you for your participation in the program which pays businesses for being available to curtail energy on short notice when the grid is stressed. LR has the potential to pay organizations two to three times more than other ERCOT demand response programs.

CPower can help you get the most out of the Load Resources program by working closely with your organization to develop a customized curtailment strategy, including automation, that suits your business objectives and operational considerations. Start the conversation today. Learn how to maximize your curtailment revenue with CPower and ERCOT’s LR program.