ERCOT’s Capacity Reserve is Dropping. Here’s What Your Business Should Know.

The Electric Reliability Council of Texas (ERCOT) and independent market analysts agree on at least one thing: there will be about 4,200 MW less fossil fuel capacity in the Lone Star State in 2018, a decrease that can be attributed to the approved retiring of three coal-fired generation plants–Monticello, Sandow, and Big Brown.

Exactly how the decreased capacity reserves will affect the Texas market is less agreeable, at least for now.

ERCOT maintains a capacity reserve margin target of 13.75% of peak electricity demand so the grid operator may serve electric needs in the case of unexpectedly high demand or levels of generation plant outages.

Analysts like Potomac Economics, an independent market monitor for ERCOT, predict the retiring generation plants in Texas will lead to the grid’s capacity reserves dipping below ERCOT’s margin target.

Potomac’s prediction is at odds with ERCOT’s official forecast for capacity reserves in 2018, at least now.

Last May, ERCOT released its bi-yearly Capacity, Demand, and Reserves (CDR) Report, which projected the grid’s reserve margins to be above 18% until 2022 when the margin falls to 16.8%. The report, however, was published several months before the recently announced coal retirements.

After doing the math and subtracting the capacity associated with the retiring units from the 2017 CDR report’s forecast, a breach of ERCOT’s target reserve margin seems possible.

So ERCOT’s capacity reserve may drop below the 13.75% target. What does that mean?

We’ll likely learn the official answer in mid-December 2017 when ERCOT releases an updated CDR report to address what the loss of capacity from retired generation plants will mean to the grid.

Until then, we can make a few educated guesses on how the Texas market will react to decreased capacity based on the market’s recent history.

In the last 10 years, ERCOT’s reserve margin projections have dropped to single digits 10 times, reaching a recent low of 5.8% in 2012. The market has repeatedly bounced back from low projections. It’s worth noting, however, what happens when ERCOT’s capacity reserves actually fall below the grid operator’s target reserve margin.

That last happened in 2011, which was also the last time ERCOT’s scarcity pricing mechanism was triggered.

Scarcity pricing introduces a price floor and price cap to the market when an electricity supply emergency causes concerns of forced power cuts (called emergency load shedding) throughout Texas. When ERCOT’s reserves hit 2,000 MW as they last did in 2011, scarcity pricing sets an automatic cap at $9,000 per MWh.

Now let’s analyze who benefits from scarcity pricing. The short answer is generators. In an energy-only market like Texas, generators make money when the price of electricity spikes. Over the last several years, demand for electricity in Texas has set numerous peak load records, including new monthly highs in July and August 2017.

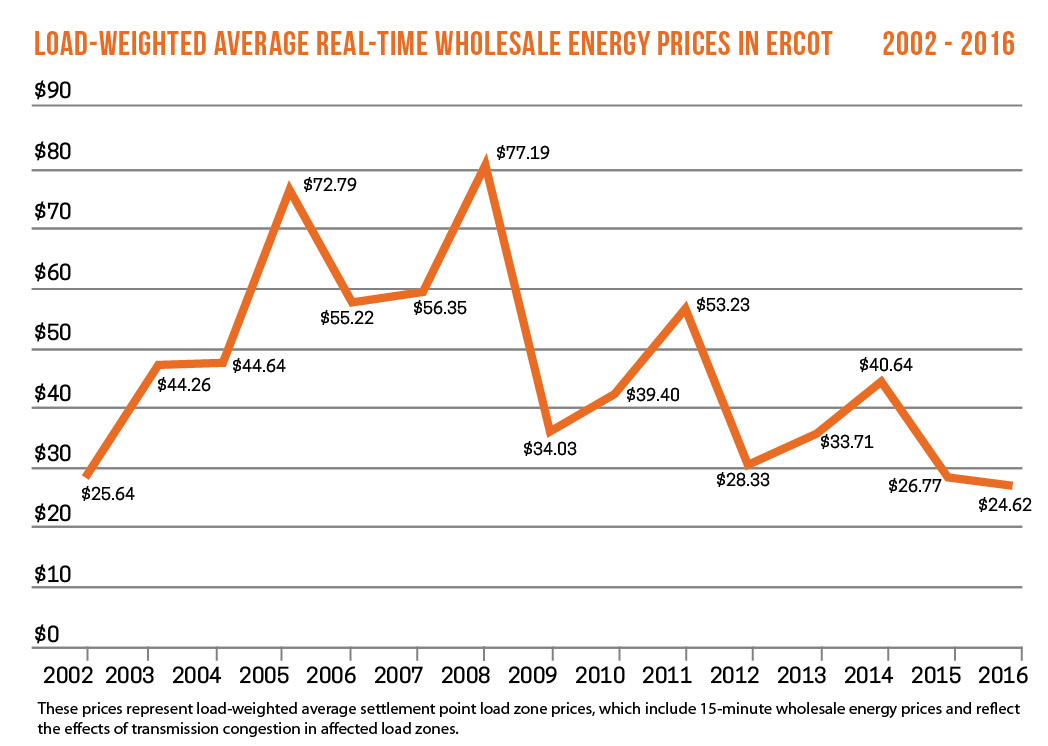

Power prices in Texas, however, have remained relatively stable. In fact, ERCOT reported that 2016 saw average wholesale prices in its real-time market hit an all-time low (see chart below). Increased wind production, which accounted for less than 1% of ERCOT’s power in 2003 rose to 15% in 2016, continues to put downward pressure on prices, as does cheap natural gas supply.

The drop in capacity reserve in 2018 may lead to the kind of price spikes that generators have been waiting for, but generators will not be the only beneficiaries if wholesale prices see a significant rise.

If triggered, scarcity prices will be translated into ERCOT’s day-ahead ancillary services capacity procurements. That could mean financial opportunity for businesses who participate in ERCOT’s Load Resource demand response program, which pays businesses to be on call to curtail their energy use on short notice when the grid is stressed or electricity prices are exceptionally high.

Load Resource, ERCOT’s go-to ancillary service demand response program, already has the potential to pay businesses 2-3 times more than reliability-based demand response programs in Texas like the Emergency Response Service (ERS) program.

If scarcity pricing triggers in 2018, that potential payoff may be a lot bigger in Texas.

Part 1, “ERCOT Fundamentals: DR 101,” introduces you to DR in ERCOT and covers topics ranging from market structure to participating with automation and emergency generators.

Part 2, “Strategies for Maximized Results,” takes your DR knowledge to the next level and shares some important out-of-the-box methods for maximizing your value.

Both webinars are FREE and now open for registration.