How to Monetize Electricity from Waste Stream Recovery

According to the U.S. Department of Energy, an estimated 20-50% of industrial energy input is lost as waste heat.

Many industrial organizations in the U.S. have learned how to recover waste heat, yet few understand how to monetize it.

Industrial waste heat is the energy generated in an industrial process that is not put to practical use. Waste heat sources include hot combustion gases discharged to the atmosphere, heated products exiting industrial processes, and heat transfer from hot equipment surfaces.

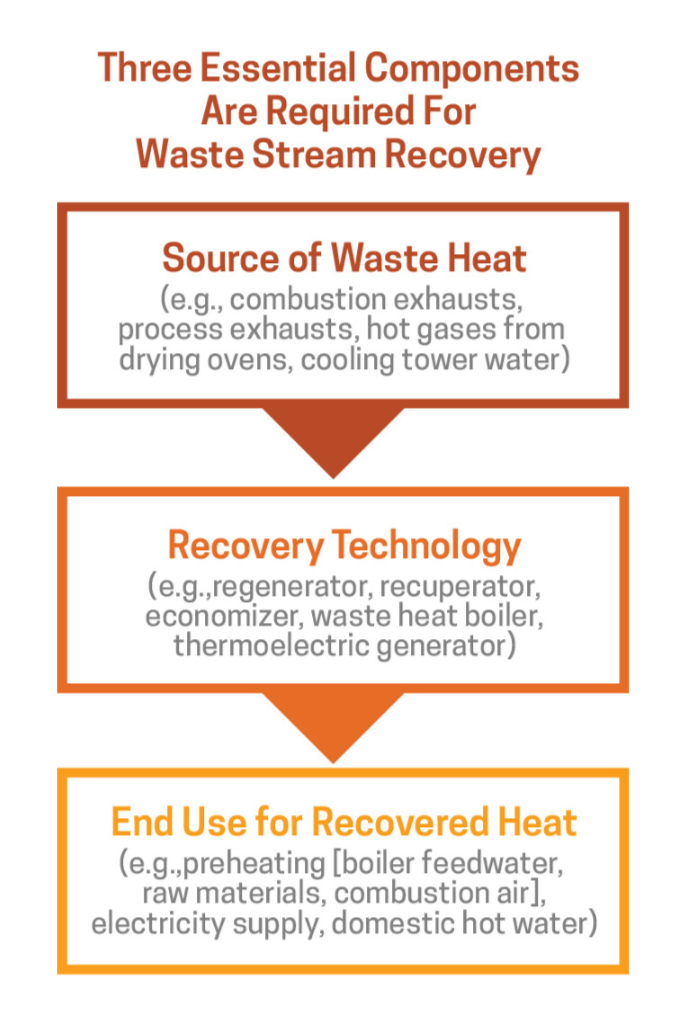

Waste stream recovery involves capturing and reusing waste heat for the purpose of heating or for generating mechanical or electrical work.

Example uses for recovered waste heat include:

- Generating electricity

- Preheating combustion air

- Preheating furnace loads

- Absorption cooling

- Space heating

Types of industrial manufacturers that are good candidates for waste heat recovery include:

Glass Manufacturing–Regenerators and recuperators are the most frequently used systems for waste heat recovery in the glass industry, which collectively consumes approximately 300 TBtu/year.

Cement Manufacturing–The cement industry consumes about 550 TBtu/year with its most energy-intense processes including those which mine and prepare raw materials for the kiln, clinker, production, and cement milling. Options for heat recovery include preheating meal and power generation (cogeneration).

Iron and Steel Manufacturing–Consuming approximately 1,900 TBtu of energy per year, the U.S. iron and steel industries are prime candidates yet face a challenge for executing economically sound heat recovery. While recovery from clean gaseous streams in these industries is common, heat recovery techniques from dirty gaseous streams (from coke ovens, blast furnaces, basic oxygen furnaces, and electric arc furnaces) often incur high capital investment costs.

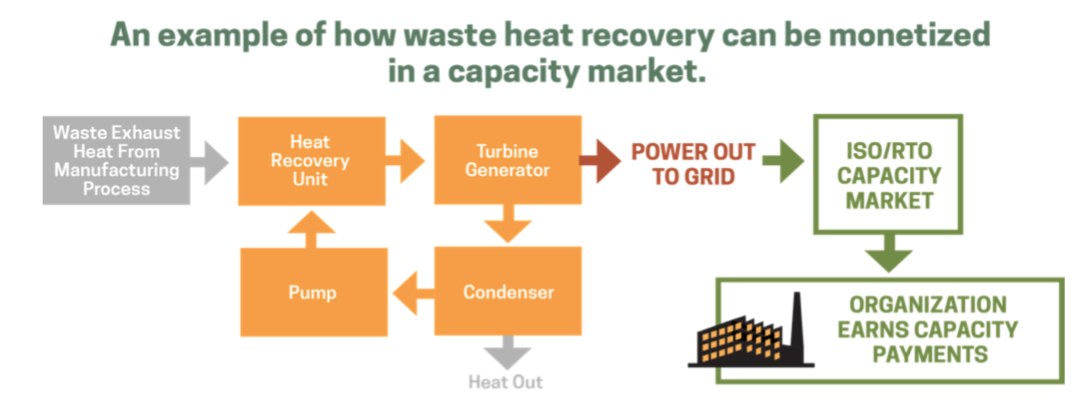

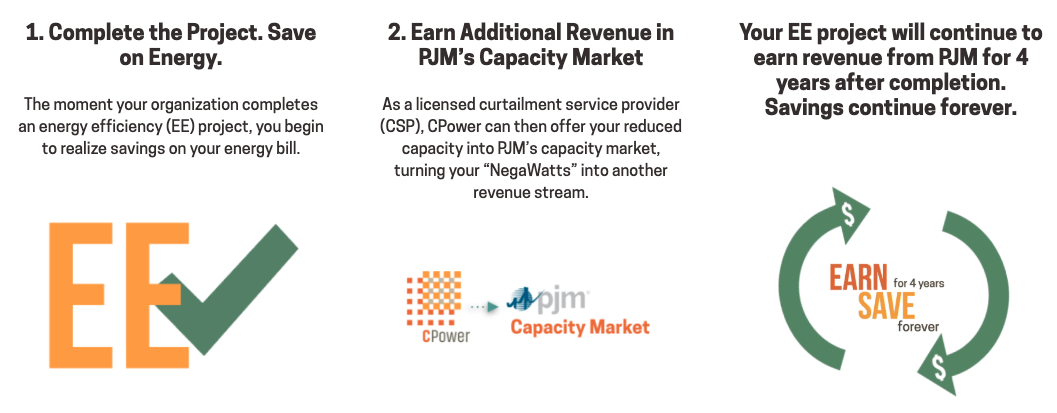

In several deregulated markets in the U.S.–PJM, for example–recovered waste heat can be monetized by offering the recovered resource into the region’s forward capacity market.

Forward capacity markets like PJM’s Reliable Pricing Model (RPM) allow the grid operator to procure the grid’s required capacity in advance of its delivery day.

Implemented in 2007, PJM’s Reliability Pricing Model uses a market approach to obtain the capacity needed to ensure its grid’s reliability.

The RPM’s market approach includes incentives that stimulate investment in existing generation from traditional sources like power plants while encouraging the development of other resources such as demand response and energy efficiency.

In many cases, organizations that are already participating in waste stream recovery can realize easy earnings akin to found money that requires little work to obtain other than offering the recovered resource into the market.

To learn more about monetizing waste stream recovery and how to offset the rising U.S. energy expenditure share, read CPower’s “Demand-Side Energy Management in the U.S. Manufacturing Industrial Sector: an analysis of revenue-generating strategies.”