Case Study: Virginia State University

Virginia’s Opportunity University:

successfully seized the opportunity to earn additional revenue for the school through demand response

The Customer: Virginia State University

Virginia State University (VSU), founded in 1882, is one of Virginia’s two land-grant institutions. It boasts a current student population of approximately 4,700. VSU’s 231-acre campus includes 11 residence halls, 18 academic buildings and a 412-acre working farm used for agriculture research. VSU features academic environments within six colleges and is ranked No. 12 institution in the United States for historically black colleges or universities (HBCUs) by College Choice.

Ms. Jane Harris, Assistant Vice President for Facilities and Capital Outlays, was enthusiastic about PJM Interconnection’s demand response (DR) program, which pays organizations for curtailing energy use during times of high demand that strain the region’s electrical grid. She felt VSU had a good probability of a successful outcome, generating revenue to fund needed campus upgrades. In 2014, she was given the go-ahead to enroll in DR.

Team of Professionals

To make sure the university’s DR participation had a successful launch, Ms. Harris built a leadership team which included the facilities management staff and building managers. The team was led by one of her project managers, Mr. George “Bubba” Bowles. Mr. Bowles brought deep knowledge of utility operations and was tasked with managing the project. CPower, represented by Ms. Leigh Anne Ratliff, brought unmatched expertise in PJM’s DR curtailment program.

Planning and Communication

Mr. Bowles developed a demand response action plan that included a survey of all campus buildings, and the energy technology available in each building. The campus infrastructure was not designed to curtail energy quickly and easily. Not every building was equipped with sub-meters and automated controls, and some generators could supply power for only emergency lighting. Nonetheless, Mr. Bowles felt that with proper planning, training, and communication, VSU would succeed.

Communication–specifically communicating the program’s benefits–proved to be the key component of the plan. Months before the first test event, which required the university to reduce their usage at a particular date and time, the leadership team undertook an extensive communication program that targeted the university’s building managers, campus facilities maintenance contractor, information technology staff, facilities inspector, campus safety officer, and Yourdonus James, Conference Services Manager, who schedules outside groups for events on campus. Each step of the plan was explained in detail, emphasizing the real and substantial benefits the university would receive from DR. As the test date approached, specific tasks were assigned to facilities staff and the safety officer that would help VSU meet their targeted curtailment goals, from turning on generators to turning off the breakers to entire buildings. Ms. James explained that she was concerned when first informed of the demand response program, but the actual test proved transparent with no noticeable impact on her clients.

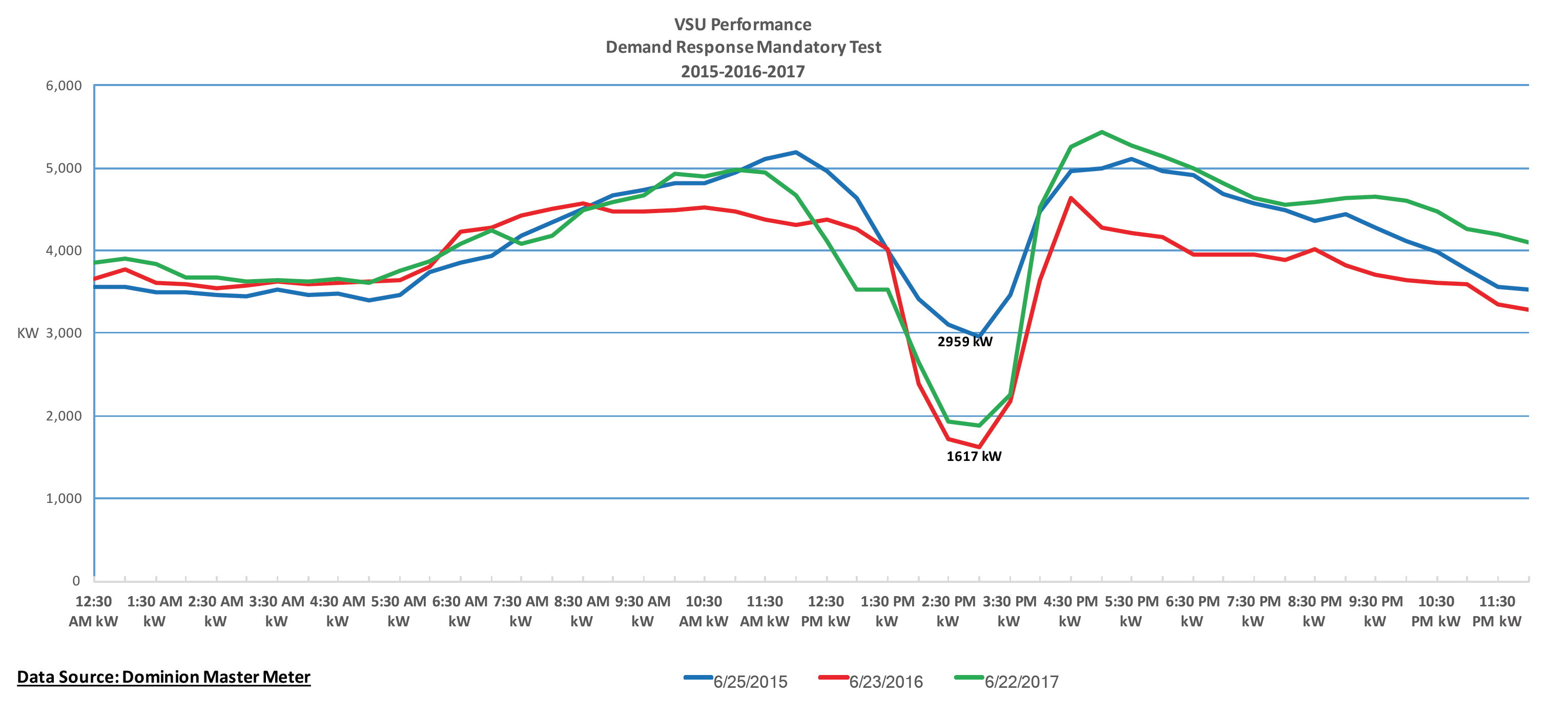

In June 2015, VSU participated in its first test event and exceeded its curtailment goal. In 2016, they set their curtailment goal even higher and exceeded that as well. In 2017, they set their goal higher.

“We make it easy for them to say ‘Yes’ by showing that it benefits them.”

— Robert “Bubba” Bowles, Project Manager

Record-Setting Reduction

The event test for 2017 was scheduled for a June afternoon at exactly 2:00 p.m. Around noon the plan, improved and streamlined over the past two years, was put into action. HVAC was cut off to 19 buildings, which were pre-cooled. In 10 buildings, energy could not be curtailed, so building managers enlisted the tenants to close blinds, turn off lights and computers, and schedule a late lunch to reduce usage during the test. Power to another 19 buildings was shut off completely.

As the plan proceeded, they faced an “11th-hour-and-59th-minute” challenge that threatened their continuing success. The team learned that at that moment, VSU was hosting 900 potential students at all academic buildings, including Daniel Gymnasium, one of the buildings targeted for complete shutdown. Not only that, but the students were to be sent out to explore any building of their choosing–many of them already curtailed–at exactly 2:00 p.m. Shifting gears, the team quickly “un-curtailed” Daniel Gymnasium.

At 2:00 p.m, with the temperature outside registering 87 degrees, VSU began its test curtailment. VSU had committed to curtailing their load by approximately 4 MW. By the time the event ended, of a total campus load of 6 MW, VSU curtailed 4.5 MW–an unprecedented 75% campus-wide load reduction.

Secret of Success

The one factor that all team leaders agree was critical to success is effective communication. By communicating clearly not only what had to be done, but why, the team was able to get buy-in from the entire campus community. Ms. Harris made it clear that the revenue generated by DR would benefit them directly–they would have the funds to do things that they normally wouldn’t be able to afford. Each building manager became an enthusiastic stakeholder, which assured campus-wide success. As Mr. Bowles notes, “We make it easy for them to say ‘Yes’ by showing that it benefits them.”

Rewards of Demand Response

Three years of increasingly profitable participation has funded a number of university facility projects. Chief among them are upgrades to two residence halls in the historical section of campus. The upgrades turned residence halls into destinations for which students now compete for assignment.

VSU has also been able to pursue energy efficiency projects that result in permanent curtailment and energy savings. Residence halls are being upgraded to highly efficient LED lighting, and generators are being upgraded to full building operation. Both upgrades, besides saving energy, have the potential for adding more revenue from DR participation.

Perhaps more importantly, the success of DR at VSU has helped create a culture of energy conservation and sustainability on campus. Faculty, staff, and students increasingly embrace programs such as recycling, energy conservation, and research into environmental programs and economic development. “Virginia’s Opportunity University” is also becoming “Virginia’s

Sustainability University,” true stewards of the earth that anchors their mission.

Download a shareable PDF version of this case study

Case Study: Desert Water Agency

2.5 MW of monthly demand response commitment gives the Desert Water Agency energy savings and additional revenue to offset costs.

The Customer: Desert Water Agency, Palm Springs, California

The Desert Water Agency (DWA) is a not for profit government agency providing water to the desert resort community of Palm Springs, in the Coachella Valley, as well as adjacent areas. Nearly all of the water that is used in the Coachella Valley comes from a groundwater basin, or aquifer estimated to contain about 30 million acre-feet of water. DWA pumps water using 29 wells spread throughout its retail area and delivers it to 23,000 water connections serving approximately 106,000 residents and businesses.

DWA embraces sustainable energy resources, including hydroelectric and solar, to power its pumps and generate energy savings. A solar field comprising 4,500 ground-mounted fixed tilt panels produces just over a megawatt of energy. The solar facility powers their Operations Center and Water Reclamation Plant and is projected to save the Agency and its ratepayers about $6 million in energy costs during its lifetime.

The Challenge: Tap the Demand Response Revenue Stream

The demand response program offered by CPower pays customers for reducing their energy usage upon same-day notification of a possible grid event. DWA understands the benefit of earning additional revenue by curtailing their power load and using that revenue to further offset energy costs. The key to DWA’s successful participation was technically implementing a curtailment program with the least possible disruption to its operations and its customers. Wells throughout the city that could participate in the program would be turned off when CPower issues a curtailment notification.

That left them with one important question: “Can we survive three to four hours of having wells shut down and still be able to refill our reservoirs to meet customer demand?”

The CPowered Strategy: One Well at a Time

Thankfully, with CPower’s help, the answer was “Yes.”

DWA chose CPower as their demand response provider to manage their participation in the demand response program. CPower provides a team of energy experts to review the Agency’s operations and energy goals. Together, DWA and CPower developed an energy management strategy that gives DWA the tools to optimize their participation in the program.

The strategy called for DWA to start with a small number of wells, to familiarize themselves with the curtailment process with minimal impact on day-to-day operations. As DWA’s staff became more comfortable with the process, more wells were added, until all eligible wells—25 of their total of 29—are now actively participating and generating revenue for the Agency.

“The CPower relationship has been outstanding… I fully trust them. The integrity is always there, they are always reliable and very knowledgeable.”

-Steve Johnson, Assistant General Manager

CPowered Solutions: Power Empowerment

Understanding the Agency’s preference for autonomy over automation, CPower empowered it with the tools to control its energy spend and demand response participation. The Agency can turn individual sites on and off at will upon notification through their supervisory control and data acquisition (SCADA) software to implement the custom-designed energy strategy developed with CPower’s experts. Perhaps best of all, the Agency can manage it all from their central Operations Center, without dispatching staff to well sites under a grid-stressing desert sun.

CPower collects utility meter data for each of DWA’s sites and supplies them with quarterly performance data. These data provide DWA with an understanding of each site’s base load value. The Agency can use these data to decide their optimum load curtailment commitment for each month of the program.

The Results: An Oasis of Cost-Saving Revenue

DWA typically nominates a changing rotation of eight wells each month into the program. The total monthly load drop amounts to about 2.5 MW. This is a significant commitment that helps relieve stress on the electric grid.

The program also provides DWA significant financial incentive for their participation. During a recent six-month period, May-October, they received $105,872.68 in payments for their participation. These incentives allowed them to further offset their energy costs, to the benefit of their customers.

Just as importantly, perhaps, DWA enjoys the total commitment of CPower’s dedicated California energy market experts. The Agency knows from experience that CPower will support their energy goals at every turn, with an energy strategy custom-made to meet their unique requirements.

Download a PDF version of this case study

ERCOT’s Capacity Reserve is Dropping. Here’s What Your Business Should Know.

The Electric Reliability Council of Texas (ERCOT) and independent market analysts agree on at least one thing: there will be about 4,200 MW less fossil fuel capacity in the Lone Star State in 2018, a decrease that can be attributed to the approved retiring of three coal-fired generation plants–Monticello, Sandow, and Big Brown.

Exactly how the decreased capacity reserves will affect the Texas market is less agreeable, at least for now.

ERCOT maintains a capacity reserve margin target of 13.75% of peak electricity demand so the grid operator may serve electric needs in the case of unexpectedly high demand or levels of generation plant outages.

Analysts like Potomac Economics, an independent market monitor for ERCOT, predict the retiring generation plants in Texas will lead to the grid’s capacity reserves dipping below ERCOT’s margin target.

Potomac’s prediction is at odds with ERCOT’s official forecast for capacity reserves in 2018, at least now.

Last May, ERCOT released its bi-yearly Capacity, Demand, and Reserves (CDR) Report, which projected the grid’s reserve margins to be above 18% until 2022 when the margin falls to 16.8%. The report, however, was published several months before the recently announced coal retirements.

After doing the math and subtracting the capacity associated with the retiring units from the 2017 CDR report’s forecast, a breach of ERCOT’s target reserve margin seems possible.

So ERCOT’s capacity reserve may drop below the 13.75% target. What does that mean?

We’ll likely learn the official answer in mid-December 2017 when ERCOT releases an updated CDR report to address what the loss of capacity from retired generation plants will mean to the grid.

Until then, we can make a few educated guesses on how the Texas market will react to decreased capacity based on the market’s recent history.

In the last 10 years, ERCOT’s reserve margin projections have dropped to single digits 10 times, reaching a recent low of 5.8% in 2012. The market has repeatedly bounced back from low projections. It’s worth noting, however, what happens when ERCOT’s capacity reserves actually fall below the grid operator’s target reserve margin.

That last happened in 2011, which was also the last time ERCOT’s scarcity pricing mechanism was triggered.

Scarcity pricing introduces a price floor and price cap to the market when an electricity supply emergency causes concerns of forced power cuts (called emergency load shedding) throughout Texas. When ERCOT’s reserves hit 2,000 MW as they last did in 2011, scarcity pricing sets an automatic cap at $9,000 per MWh.

Now let’s analyze who benefits from scarcity pricing. The short answer is generators. In an energy-only market like Texas, generators make money when the price of electricity spikes. Over the last several years, demand for electricity in Texas has set numerous peak load records, including new monthly highs in July and August 2017.

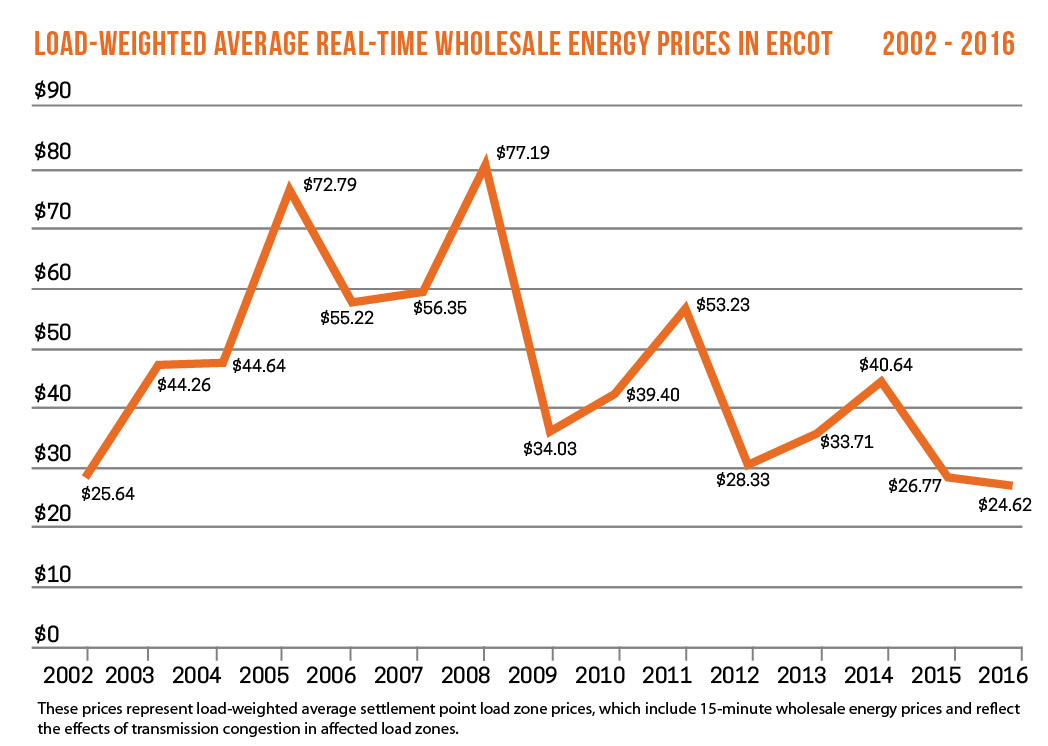

Power prices in Texas, however, have remained relatively stable. In fact, ERCOT reported that 2016 saw average wholesale prices in its real-time market hit an all-time low (see chart below). Increased wind production, which accounted for less than 1% of ERCOT’s power in 2003 rose to 15% in 2016, continues to put downward pressure on prices, as does cheap natural gas supply.

The drop in capacity reserve in 2018 may lead to the kind of price spikes that generators have been waiting for, but generators will not be the only beneficiaries if wholesale prices see a significant rise.

If triggered, scarcity prices will be translated into ERCOT’s day-ahead ancillary services capacity procurements. That could mean financial opportunity for businesses who participate in ERCOT’s Load Resource demand response program, which pays businesses to be on call to curtail their energy use on short notice when the grid is stressed or electricity prices are exceptionally high.

Load Resource, ERCOT’s go-to ancillary service demand response program, already has the potential to pay businesses 2-3 times more than reliability-based demand response programs in Texas like the Emergency Response Service (ERS) program.

If scarcity pricing triggers in 2018, that potential payoff may be a lot bigger in Texas.

Part 1, “ERCOT Fundamentals: DR 101,” introduces you to DR in ERCOT and covers topics ranging from market structure to participating with automation and emergency generators.

Part 2, “Strategies for Maximized Results,” takes your DR knowledge to the next level and shares some important out-of-the-box methods for maximizing your value.

Both webinars are FREE and now open for registration.

How to Maximize Demand Response Earnings with California’s DRAM Program

For most of the last two decades, demand response in California has been largely procured and operated by the state’s electric utilities.

That trend is changing.

Demand response in California is currently experiencing significant changes as regulators implement measures to expand the state’s pool of energy resources and assimilate these resources with the California Independent System Operator’s (CAISO) markets.

This regulatory reform has created new opportunities in California for demand response programs, which pay businesses for using less energy when the grid is stressed or electricity prices are high.

The Demand Response Auction Mechanism

The Demand Response Auction Mechanism (DRAM) was developed in 2014 under the guidance of the California Public Utility Commission (CPUC) in an effort to harmonize utility-based reliability demand response with CAISO, the state’s grid operator.

In December 2014, the Commission issued D. 14-12-024 which requires the state’s IOUs: Southern California Edison Company (SCE), San Diego Gas & Electric Company (SDG&E) and Pacific Gas and Electric Company (PG&E) to design and implement Demand Response Auction Mechanism (DRAM) pilot programs in 2015 for 2016 capacity (DRAM I or 2015 DRAM) and in 2016 for 2017 capacity (DRAM II or 2017 DRAM). The three utilities recently completed a solicitation for 2018/2019 capacity (DRAM III) procuring over 200 MW of DR resources across the state.

Now in its third year, the program seeks to allow CAISO to add reliable demand response resources to areas of California where electric reliability may be at risk.

DRAM is a pay-as-bid program with three goals:

1)Fully integrate DR resources with the CAISO energy market

2) Test whether third parties can bring these resources to the table without structured utility programs

3) Allow residential resources to participate directly in the CAISO markets

The DRAM program also provides market participation testing from a broader base of distributed energy resources, including behind-the-meter storage. Under DRAM, these resources have the opportunity to behave not just as system capacity, but also as local and flexible resources.

California’s recent actions aim to revise the market’s existing demand response program structure and are an indication that DR has an important role to play in the state’s future.

The best way for an organization to take advantage of the DRAM program and the opportunities available in the California Market is to consult a trusted demand-side energy management company.

Such a company can evaluate an organization’s facilities and determine its curtailment capabilities. Next, they can explain in full the many demand response and demand management programs that are available in the California Market and help determine which offer the particular organization the best chance for curtailment success.

To learn more about how CPower can help your organization earn with the Demand Response Auction Mechanism program, please visit CPowerEnergy.com/dram-california.

To continue learning about how the California grid is changing to meet the needs of the future, read: The Evolution of The California Energy Market: How Demand Response and Demand Management will Play Integral Roles in The Golden State’s Energy Future

White Paper: PJM Capacity Performance Is Here. Don’t Believe The Myths

Demand response contributes more than just sustainability to K-12 public school system

The Virginia Beach City Public School System is on a mission. At the heart of that mission lies a commitment to education, which you’d expect from the largest school division in southeastern Virginia. What you might not expect is how money earned from participating in demand response programs is helping fund the VBCPS’ drive toward academic excellence.

Ranked the fifth best large school division in the entire nation by GreatSchools, Virginia Beach City Public Schools (VBCPS) has earned a reputation for fostering a culture of outstanding academics.

That’s not all the school division has earned lately.

Since 2014, VBCPS has also earned over $250,000 through demand response and demand management. The increased revenue has helped pave the way for a sustainable future of energy efficiency and academic achievement.

Compass to 2020

VBCPS’ Charting the Course initiative was launched in 2015 to set the vision of school division over the next five years. The strategic framework includes four goals – high academic expectations, multiple pathways, social-emotional development, and culture of growth and excellence – and multiple strategies to guide this important work. This focus on excellence at VBCPS extends into their drive towards energy efficiency and sustainability initiatives across their entire K-12 campus system and facilities.

VBCPS understands the importance of conserving resources and protecting our environment. Among the nearly 70,000 students and approximately 15,000 employees are the often unique and innovative conservation efforts that can be found in every office and school in the division. As a testimony to this commitment, they have embraced Demand Response participation with support at all levels of the organization, from the office of the president to the facilities personnel, faculty, and students.

The Opportunity

VBCPS has been participating in the PJM Emergency Capacity DR and Energy Efficiency programs with CPower since 2013. They participate through the State Contract E194-1378 administered by the Department of Mines Minerals and Energy (DMME), which has joined forces with CPower to bring enhanced Demand Response services to Virginia.

VBCPS has 85 schools, 13 of which were registered in 2016 to participate in the Emergency DR program. The peak load of the 13 school campuses is 9.6MW of which they curtail 8MW when called upon to reduce load during times of grid emergencies. Since 2014, their efforts have brought in earnings of over $250,000, which they have used to fund additional efficiency projects to support campus-wide sustainability goals.

Consistent Success

VBCPS staff at each participating school takes ownership of their Demand Response participation and have consistently over-performed each season thanks to:

- Excellent cross-functional preparation and pre-season on-boarding with their facilities personnel and the CPower team

- End-to-end communications/notifications exercise and load drop test conducted by CPower allows the VBCPS team to identify potential issues (if any) and take actions to fix them

- Effective curtailment planning strategies to optimize load reductions with minimal impact on campus staff and students

- Complete buy-in, approvals and support from the VBCPS school division management

- VBCPS facilities team has sharp focus on setting up a detailed process for participation based on each school’s timecards and student schedules/events

- Team expectations clearly; communications plan includes command central (radio, email, telephone, text) with notifications as early as possible

Regular meetings and clear internal communications (via newsletters, posters etc.) - Team expectations clearly; communications plan includes command central (radio, email, telephone, text) with notifications as early as possible

- Regular meetings and clear internal communications (via newsletters, posters etc.)

- Every year pre-season, the VBCPS team proactively updates their Demand Response informational guide and set of procedures

- With a total of 8 staff in Central Command and 30 across the other schools; they maintain 2-3 trained staff per school, with 1 person handling a specific event at each school and the rest at back -up in the case of vacations/illness. Moreover, experienced staff members act as mentors/trainers for others that are new to the program.

Challenges and Lessons Learned

Some initial challenges included managing data from multiple utility meters as well as different building automation systems (BAS). However, the methods used above with site-specific planning allowed VBCPS to overcome the hurdles. Some sites have an Easy Button and use an automated approach while some utilize a more detailed hands-on approach.

In the end, clear communications and reliable equipment/metering are key factors for consistent performance. For instance, there was an emergency event called at the end of the season in 2013, where VBCPS delivered per their commitments even though school was fully in session. The schools also got the added benefit of earning energy payments from that event.

Forward-Thinking towards a Sustainable Future

Additionally, in 2014 the team pioneered the State of Virginia Energy Efficiency effort with lighting upgrades across the division footprint. They embraced the energy efficiency program, connecting CPower with their contractors to get the required information of qualified projects, and ultimately will earn close to $100,000 for their efforts.

Looking to the future, VBCPS has consistently added load reductions to their commitment to support grid reliability. They have added 8 more schools with an additional 2.8 MW of curtailable load to participate in the 2017 PJM performance season program, and are also exploring the PJM Economic DR program. Four new lighting upgrades from the spring of 2017 were submitted to the PJM Energy Efficiency program. The team at VBCPS are a powerful asset to demand response. By providing their operating procedures as a starting point to other participants, they have served as mentors for other schools – providing encouragement to their peers so they feel confident to take advantage of the program and optimize energy earnings and savings at other K12s across the Commonwealth.

Contact Leigh Anne Ratliff or anyone on CPower’s PJM team at www.CPowerEnergy.com/markets/pjm-interconnection-contact

Surviving New EPA Rules and the Emergency Generator Regulatory Maze

Is your organization one of the thousands of commercial/industrial energy customers that use back-up generators (BUGs)? Are they used as emergency generators (a.k.a., EGs or gensets) in demand response (DR) programs? If so, 2016 may have felt like an episode of the “Survivor” reality show, except instead of the usual cast of GenX characters and challenges you were unfortunately tasked with surviving a maze of ever-changing genset regulations.

Bad News, Good News: The past year saw important changes regarding the use of stationary reciprocating internal combustion engines (RICE) that continue to evolve at the federal level as administered by the U.S. Environmental Protection Agency (EPA), which itself is in now in the midst of changes with newly-confirmed administrator Scott Pruitt at the helm. EPA rules provide that BUGs that are intended for emergency use when blackouts occur are exempt from reporting requirements and most emissions regulations. The bad news is that EPA changes significantly restricted the circumstances where such generators can be compensated for operations while the grid is still up. The good news is many such generators can achieve “non-emergency” status without equipment upgrades by meeting specific permitting and reporting requirements.

Bit of History – 50-hour Rule No Longer Applies: In early 2016, it was determined that EGs could potentially participate in DR programs under a different rule (referred to as the “50-hour rule”). A coalition of DR providers including CPower took specific steps to clarify the applicability of the 50-hour rule with EPA as well as explore avenues to address concerns with the prior 100-hour rule as related to EG use for DR:

- We funded an extensive legal review on the 50-hour rule which outlined the case for allowing EGs to continue DR participation with this rule as a basis.

- We shared our well-documented analysis with EPA, who responded that they were not in agreement.

- While we believe the EPA’s interpretation is not aligned with the actual language in the regulation nor the structure of the electricity market, federal agencies such as EPA enjoy the latitude to interpret their regulations in any manner they deem appropriate.

- While CPower will continue to try to convince EPA that our well-documented position bears merit, all DR service providers clearly need to comply with EPA’s current interpretation.

Further confounding the situation is that a generator classified as “nonemergency” under federal regulations could be deemed “emergency” under state and/or local regulations. Recent examples include the Rule 222 that applies to permitting in New York; while California is moving from the traditional environmental permitting approach towards utility-based restrictions.

What This Means to You: As a DR participant with EGs, you should always be aware of the nuances defining EG assets that do not meet EPA’s interpretations of local requirements as well as the Federal Non-Emergency standard for DR curtailments. This applies even if your current DR service provider may advise you otherwise (especially regarding the use of EGs via the 50-hour rule). Any reputable vendor certainly should not expose you to any potential EPA violations or penalties. And if you indeed find out that EGs are not permitted for use in DR programs, make sure your service provider has an experienced engineering team who is willing to work with you to achieve the best possible alternative curtailment strategies.

On the Positive Side: Again, the good news is that in many instances, you can still use EGs to participate in DR programs and support grid reliability. A good curtailment service provider or DR aggregator should be able to assist clients with specific steps for permitting and retrofits so their engines can still participate wherever possible. At CPower, we have helped several clients with permitting so their engines can now effectively participate in emergency DR events to support the grid. Some of these services include:

- Helping clients evaluate generation assets for permitting compliance at both the federal and state/local levels

- Upgrading engines with aftermarket controls and/or automated DR (ADR) controls

- Developing recommendations for adding load to optimize use of generators

- Facilitating engine and generator upgrades (either working with a carefully vetted partner or customer-preferred vendor)

Bottom Line: As capacity costs increase, active DR participation becomes even more compelling and relevant. Changes in EPA regulations have impacted the ability of DR customers like you to use stationary emergency generators as part of your load reduction strategies. Luckily, you can look to DR service providers to offer valuable “survival tips” that can bring this episode to a stable ending.

“Thanks to accurate guidance from CPower’s engineering team, our engines were successfully permitted for use in demand response by the state’s Department of Environment. Their in-depth knowledge and tenacity throughout the process clearly contributed to enabling our facilities’ continued participation in the 2017 DR performance season.” – Facilities Director at a large New England based manufacturing firm.

CPower takes a leadership role and shaping market transformation while advocating for our customers to help you navigate the regulatory maze and maximize DR program benefits. The result? Increased energy savings and earnings not just from optimized participation in Emergency DR, but also in non-emergency voluntary programs (like price based Economic DR). In some cases, you can also use your engines for peak-shaving to reduce capacity costs while maintaining compliance with environmental regulations.

Do you have a generator? Does it meet State and EPA guidelines? Are you leveraging it as a demand response revenue resource? Check out our Emergency Generator Decision Tree today to ensure you make the right EG permitting and compliance choices moving forward.

Managing Rising Costs Amidst the Alphabet Soup of NY Energy Initiatives

If you’re a mid- to large-sized energy user in New York, you’ve likely come across a veritable alphabet soup of acronyms: REV, CES, DR, DER…the list goes on. Many of you who run commercial and industrial (C&I) businesses know that you can actively leverage Demand Response (DR) programs and earn revenue by curtailing load when called upon to do so during emergencies to support grid reliability. Granted, some years have been more rewarding than others since capacity prices ebb and flow in New York just like in other energy markets. Of course, capacity prices have risen substantially since 2012, resulting in increased earnings from DR participation in New York. So what can DR participants across New York expect in 2017 and beyond?

First, a bit of context on REV and CES:

In 2012, Hurricane Sandy hit the East Coast, causing devastation and leaving millions without power. Shortly thereafter, working with the New York governor’s office, New York Power Authority and other state agencies, the Public Service Commission (PSC) launched the landmark Reforming the Energy Vision regulatory proceeding. Now commonly referred to as REV, its goal is to make the power system cleaner, resilient and more affordable. Regulators aim to transform traditional utilities into platform providers — entities that facilitate the deployment of distributed energy resources (DERs) and use them instead of traditional infrastructure. And Demand Response is poised to continue to play a vital role as this initiative evolves.

In simplest terms, the Clean Energy Standard (CES) mandates New York to acquire 50% of its energy from clean resources by 2030. As part of this, it seeks to further that goal by providing zero-emission credits (ZEC) to support upstate nuclear plants that were in danger of closing. In late 2016, the PSC fended off numerous challenges to its adoption of the CES and its subsidy for nuclear power generators. Keep an eye on this space, however, as the PSC’s order doesn’t mean this is finalized (as of this writing in Feb 2017, two court challenges remain pending). Generators and some environmental advocates said the ZEC program — which critics say will cost over $7 billion over its 12-year lifespan — goes beyond the authority granted to the PSC by state law.

Impact on your bottom line:

In the near term at least, REV and CES, while noble causes, are going to lead to increased fixed costs (~$4/MWh) on mid- to large-sized energy consumers. This scenario, however, also presents additional opportunities and specific actions you can take today to offset these costs:

- Increased DR participation especially in new distribution utility programs, and

- Capacity tag management.

New DR Programs: Both the NYISO and New York Electric Utilities offer demand response programs that pay businesses like yours for using less energy when the grid is stressed. Many commercial and industrial businesses in New York aren’t aware of the new summer-only local utility programs available to them via an authorized DR services provider. These programs offer another revenue stream in addition to the NYISO DR program that they may have been enrolled in for years. In 2016 for example, the New York Public Service Commission mandated that local utilities provide a Commercial System Relief Program (CSRP) throughout their entire service territory as part of a statewide effort to develop a new regulatory framework which includes incentives to leverage the deployment of distributed energy resources such as demand response.

Capacity Tag Management: Additionally, there are demand management services that can help significantly lower your capacity charge which make up 20-40% of the total supply portion on your monthly utility bill. The capacity charge is based on your individual capacity tag which, in New York, is determined by your facility’s usage when the NYISO sets its single annual peak hourly demand across the whole system. CPower sends an advanced day ahead demand management notification to reduce your usage when it is likely the NYISO will hit its hourly peak demand, thus reducing your capacity tag and capacity charges for the following year.

In the end, it’s all about implementing smarter techniques to manage your overall energy spend. The NYREV was launched 3+ years ago but it’s more relevant now than ever to survive as a large C&I energy user, as it will certainly change how energy is transacted in the future. At CPower, our job is to stay abreast of these developments and keep you informed about their potential impact. To get started, check out the various programs available in NY and informational videos to learn more on how you can offset rising energy costs in 2017 and beyond.

Energy Policy 101: How the Movement of Electrons is Regulated

Energy policy development is complicated. Recall that the electric industry has been regulated for more than 100 years and it remains highly regulated today, even with competitive markets. Moreover, both the Federal government and States have roles to play in regulation. Using examples, this article focuses on federal jurisdiction over “wholesale” electricity that flows across state lines and is not sold for direct consumption to end users. Sales to end users, including authorization of competitive retail suppliers, is the exclusive jurisdiction of the states.

In the U.S., policy at the highest level is established by Acts of Congress and the President. It is implemented by the executive branch including the Federal Energy Regulatory Commission (FERC) and the Department of Energy (DoE). This policy establishes a framework for the tariffs that govern the use of the nation’s electric transmission grid. It is useful to think of this framework as a “top down” process. The owners and operators of the transmission grid, in turn, submit tariffs that comply with the law and policy to FERC for approval. The development of tariffs is a “bottom up” process.

Three examples of the biggest orders to come out of FERC during President Obama’s administration include FERC Order 745, which required ISOs and RTOs to pay customer-side capacity resources such as demand response an equivalent value to what power plants and other supply-side resources earn; FERC Order 755, which required ISOs to create programs to reward “fast-responding” resources such as batteries for frequency regulation; and FERC Order 1000, which has set up a new regime for transmission operators and utilities to plan for, and pay for, regional grid investments.

The FERC has been instrumental in creating Regional Transmission Operators (RTOs) through policy decisions. RTOs and Independent System Operators (ISOs) have largely eliminated the need to set wholesale electricity prices by a fixed tariff and instead allow prices to be established by markets. The detailed implementation of electric policy is done at the RTO level. FERC’s decisions and orders apply to the tariffs of ISOs and RTOs that run much of the U.S. power grid. About 70 percent of the country is served by ISOs and RTOs, which fall under federal jurisdiction because they cross state lines.

The shift to RTOs has not eliminated the need for regulation of electricity. Instead it has shifted the regulatory focus from setting prices to setting market rules. The market rules are embodied in the RTO tariffs. The FERC is responsible for approving the RTO tariffs. The RTO tariffs are developed with varying degrees of stakeholder input, depending on the RTO itself. The basic process follows the steps from stakeholder consideration to RTO and final review and approval by FERC using stakeholder input as shown below:

Each RTO handles stakeholder consideration differently. PJM Interconnection, for example, is the only RTO that is required to accept stakeholder recommendations as determined by a vote – at least on some issues. Other RTOs simply consider the input of stakeholders and file what they think best. There is little doubt that PJM has the most robust process. Most issues are addressed through a series of meetings that follow a set process. The process is not unlike a government legislative body with committees, subcommittees, etc. Often stakeholders reach consensus and many issues are resolved with no or nominal opposition.

Demand Response Policy Considerations

Perhaps one major exception to consensus pertains to issues involving capacity market design, including Demand Response (DR) participation. On these issues, stakeholders are typically split between generation owners – including incumbent utilities – and load interests. This is because any changes that reduce the opportunity for generation participation or revenue leads to reduced income for generators. Such changes include enabling competitive resources such as DR and reductions in overall capacity requirements.

Conversely, stakeholders representing users of electricity oppose changes that increase costs without a credible probability of improving reliability. As a result, most controversial issues have competing proposals. Stakeholder votes are allocated in such a way that a required two-thirds’ supermajority (this applies to PJM) for approval of contested changes is difficult to reach. A deadlocked stakeholder process allows PJM to file changes that may not have broad stakeholder support. RTOs are non-profit entities without a commercial stake in market outcomes. However, as organizations, PJM and other RTOs have an inherent bias toward “reliability” which often results in costly requirements for more resources, especially conventional generation.

Stakeholders that oppose an RTO filing have the opportunity to “protest” the tariff changes at FERC. FERC need only determine that a filing is “just and reasonable”. While ostensibly the “just and reasonable” standard may include cost considerations, FERC, like PJM and other RTOs, also has a bias toward reliability and often will accept the RTO filing regardless of cost implications.

FERC Decisions and the Appeals Process

FERC decisions can be appealed to the federal courts on the basis non-compliance with the governing law, or an “arbitrary and capricious” decision. Appeals Courts avoid ruling on the substance of a FERC ruling because this can place the Court in the position of creating laws and regulations. Appeals Court decisions can be appealed to the Supreme Court as occurred in the high-profile case of FERC Order 745. In particular, owners of conventional generation (the petitioners) opposed the Order because the treatment of demand response threatened their revenues and they took FERC to court. The case hinged primarily on the issue of state versus federal jurisdiction (was the Order consistent with the Federal Power Act’s provisions designating retail rate setting as the exclusive jurisdiction of the states?).

In a major victory for the DR industry, the U.S. Supreme Court upheld FERC Order 745 via a 6-2 decision in January 2016, reversing a lower court opinion that found that it violated states’ jurisdiction over retail energy pricing, and dealing a blow to the utility group that brought the original lawsuit. DR providers and environmental groups supported FERC Order 745, noting that it has opened markets that have brought significant new demand-side capacity to the country’s grid operators for use in controlling the wholesale grid. Order 745 also helped reduce the need for fossil fuel-fired power and lowered overall electricity costs for consumers. But the underlying legal question behind the lawsuit — the bounds between federal and state jurisdiction over energy markets — could be modified by Acts of Congress.

You can see why the process of defining energy policy can be extremely complicated in practice. CPower takes a leadership role in shaping market transformation and regulatory reform, while working hard to maximize program benefits for our customers. It’s imperative that our Market Development team constantly stays abreast about regulatory processes as thought leaders in the DR community. These efforts enable us to provide services that take the complexity out of DR participation within the context of changing program rules, while optimizing your energy savings and earnings. This will become increasingly critical as energy markets continue to transform in the near future.

Hot Summer Ends Without Emergency Demand Response Events in PJM

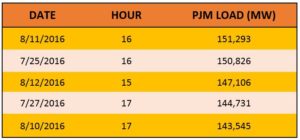

The 2016 PJM summer compliance season which runs from June through September has come to an end without a PJM-initiated emergency demand response (DR) event. The first six months of the year were already one of the warmest on record. So, for many of us sweating it out across the northeast, it was no surprise that this summer produced several heat waves that pushed system peaks to their highest levels in recent years. PJM’s top 5 system peaks (see table), reflect the summer’s weather and should be the Five Coincidental Peaks (5CP) that drive customers’ capacity charges through their Peak Load Contribution (PLC). It is important to note that any load reductions during these hours may reduce your capacity charges for next summer.

When it came to actual demand response events, however, a different picture unfolded compared to prior years. For instance, the 2013 summer saw system peaks at similar levels and was one of the most active summers for demand response customers ever. So you may ask: Why were no Emergency DR events called this summer, despite the heat and high system peaks? A few reasons come to mind:

- Some of it may be attributed to PJM’s new reliability product, Capacity Performance (CP), which debuted this delivery year and imposes greater availability requirements on generation;

- Some of it may be attributed to increased transmission efficiency;

- Also, flat or declining system peaks are starting to reflect the impact of energy efficiency regulations (the last system peak demand record was set in 2007); and finally

- Pure Luck? After all, the timing of several heat waves passing through the PJM territory coincided during weekends.

Whatever the primary reason(s), PJM Emergency DR customers should take pride in their commitment to be on standby to reduce load when called upon. Your ability to curtail electricity consumption when needed by the grid is a tremendous asset to maintaining system reliability and preventing potential blackouts/brownouts.

This doesn’t mean that PJM may not have a reliability issue beyond the summer as the program year does run through May 2017. Also, while the summer period yields the greatest risk of an emergency event, demand response customers that have committed to curtailments all year should continue to be prepared to perform and reduce load if/when needed to support grid reliability.

Moreover, with the transition to the new CP product, demand response is morphing into a year-round program. Customers can start participating in CP now to get themselves prepared for the coming changes and earn additional capacity revenue in the process. Many forward-thinking facility managers are already thinking about how they may be able to participate beyond the summer and are reviewing effective winter curtailment strategies.

CPower would like to take this time to thank all demand response customers for their commitment to PJM reliability this summer. CPower customers can always review their load drop test and event performance in the CPower App and should be expecting summer performance reports and payments starting early November.

Last but not least, we always encourage all participants to stay tuned for earnings opportunities in other DR programs available. Many participants augment their demand response earnings from the capacity program via active participation in PJM’s voluntary programs such as (price based) economic demand response and (faster response) ancillary services such as synchronized reserves.

Please feel free to contact Dann or the CPower team if you have any questions. Our engineering team is happy to help you understand the nuances of participating in these programs and assist in optimizing your overall energy savings and earnings year round.