Three Reasons Your DER Strategy Isn’t Working Like You Planned (and how you can be creating more value)

The electric grid is amidst a transition to a cleaner more dependable and sustainable future. Today, the grid needs flexible resources many organizations currently possesses to complete that transition. These Distributed Energy Resources (DERs) include: energy storage, generation, demand response, energy efficiency and many more. The solution sounds simple, implement DERs, help the grid, improve sustainability and lower energy costs. But for most, this far more complex that it sounds. Join us for this 30-minute webinar to learn the four reasons that your DER strategy may not be working like you planned. It’s never too late to create or adjust a strategy that saves resources, drives better resilience and grid reliability, more cost savings and a predictable revenue stream.

Watch now to learn these four common errors and what you can do to get your strategy on track for success through site-level optimization, automation, and holistic energy management.

Key Takeaways/Learning Objectives:

What is driving the Grid and DER evolution

The four most common reasons DER strategies don’t deliver

How to start improving your DER and Energy Management strategy today

How to maximize the value of your assets

Presenters:

Rob Windle, Executive Director, Distributed Resources

Mr. Windle directs his energies to expanding the monetization of distributed energy resources (DERs) such as decentralized energy generation and battery storage. DERs allow energy consumers to generate financial cost offsets and revenue benefits from increased energy markets participation while leveraging existing and planned systems infrastructure and assets. Previously, He has more than 20 years of experience in direct and channel sales, channel program development, and management within the Energy, Enterprise Software, and Automation Controls industries. Mr. Windle is a Certified Energy Manager and serves as a board member of the Technology Association of Georgia’s Smart Energy Solutions group. He received his Bachelor of Science degree in Industrial

Engineering from the University of Cincinnati. Mr. Windle and his wife live in Atlanta, Georgia.

Millie Knowlton, Sr. Manager, Strategy & Business Development

Millie is the senior manager of strategy and business development at CPower Energy Management, a leading national energy solutions provider. In her role, Knowlton leads new product development and commercialization. Prior to CPower, Knowlton spent four years at Tesla working in commercial energy storage, grid services, and project development. Knowlton has a master’s degree in Environmental Change and Management from the University of Oxford.

ERCOT’S Roadmap to the Future Includes Distributed Energy Resources

On July 13, 2021, ERCOT announced the delivery of its “Roadmap to Improving Grid Reliability,” a 60-item plan that addresses needed improvements to ERCOT’s electric grid with the aim of avoiding future failures like the one experienced this past February when much of the state was left without power and over 200 people died amidst record-setting winter temperatures.

In an official press release announcing the Roadmap’s delivery, ERCOT Board member and Texas Public Utility Chairman claimed the map “puts a clear focus on protecting customers while also ensuring that Texas maintains free-market incentives to bring new generation to the state.”

The notion of the free market is one we at CPower have often discussed in explaining how the ERCOT market differs from others around the country. From its very founding, ERCOT’s energy-only market was designed to let economics, not legislation, drive the action within its marketplace.

In the wake of February’s tragedy–and the harrowing death toll certainly qualifies the event as such–there has been a wealth of debate in Texas and throughout the US on whether ERCOT’s economically driven approach to grid reliability is the best way to avoid future grid failure.

There is one curious item in ERCOT’s 60-item roadmap that is worth pointing out to large consumer and industrial organizations in Texas.

Item 19 concerning the future of distributed generation, energy storage, and demand response speaks to both legislative and financial methods of exacting change on a grid seeking to cross the bridge to energy’s future.

Item 19 of the roadmap reads as follows:

“Eliminate barriers to distributed generation, energy storage, and demand response/ flexibility to allow more resources to participate in the ERCOT market while also maintaining adequate reliability”

With this item, which is “on track” according to the roadmap, we see ERCOT is well on its way to implementing an improvement to its market that is rather similar to the intent of the Federal Energy Regulatory Commission’s Order 2222, which states:

“Order No. 2222 will help usher in the electric grid of the future and promote competition in electric markets by removing the barriers preventing distributed energy resources (DERs) from competing on a level playing field in the organized capacity, energy, and ancillary services markets run by regional grid operators.”

Language like what ERCOT submitted in its roadmap with item 19 wouldn’t raise an eyebrow had it come from any other deregulated US energy market outside of Texas.

That’s because other state and regional energy markets must comply with Order 2222 within FERC’s mandated period of time. ERCOT does not.

Here’s why:

Because its grid is isolated from the surrounding states, ERCOT’s market does not engage in interstate commerce and is therefore not under FERC’s jurisdiction.

Yet ERCOT appears to be on the road to creating a future marketplace that allows its grid to integrate the flexible DERs CPower and other demand-side energy management companies have been touting for years are necessary to maintain a balanced, dependable grid that is evolving to a cleaner future.

Here we have an example of ERCOT agreeing with Federal legislation despite the truth that they are under no legal obligation to do so.

Why?

In the simplest of terms, Order 2222 is a piece of legislation aimed at fostering just and reasonable competition in the wholesale marketplace.

ERCOT’s market is and always has been designed with competition in mind. Look no further than item 19’s language for proof that the future of ERCOT’s grid involves allowing more energy resources to enter the marketplace and compete, not fewer.

ERCOT is expressly stating that it believes more distributed generation, energy storage, and demand response in its marketplace is the best way to ensure a more reliable grid for Texas and more value for its market participants.

As the Supreme Court is fond of saying, it is written. As Texans like to say, let’s get to work and take care of business.

Demand Response Has Been Part of America’s Energy Plan for 40 Years. Why Should the next 40 be any Different?

The idea that reducing a watt of energy on the demand side can be just as valuable as generating one on the supply side in a time of grid stress is hardly new. Nor is the idea that such a solution helps thwart both energy-related and environmental crises.

The origin of demand response can be traced to roughly forty years ago when both the US and the world grappled with many of the same energy and environmental issues we are still trying to solve today.

Let’s take a trip back to the mid-late 1970s and see if a few things don’t look and sound familiar.

The oil crisis of 1973 sent shockwaves throughout the world, raising concerns on the security of electricity supply in the US while pointing to a need to diversify the nation’s power generation mix away from a fossil fuel dependency and toward a mix with a greater share of renewable and clean energy sources.

Global environmental awareness had grown to a movement large enough to be seized upon by newly-elected American president Jimmy Carter who, within a month of taking office, donned a cardigan sweater, sat before a roaring White House fire, and urged Americans to join him in conserving energy in a nationally-televised fireside chat.

During that broadcast on February 2, 1977, the president related how a particularly harsh winter had depleted the domestic supply of natural gas and fuel oil. He warned of dark consequences that awaited the most powerful country on earth if we as a nation failed to devise a sound energy plan for the future.

Sound familiar?

The 39th POTUS didn’t outright cite demand response as a means to a profitable and sustainable end that night in 1977, but he did allude to the Public Utility Regulatory Policies Act (PURPA), a piece of legislation that would be enacted in 1978 to promote more competitive energy markets in the US by allowing “non-utility generators” to participate in them.

The act would prove to be a landmark piece of legislation, setting the country on the road to conservation and the development of clean and renewable energy sources. It would also open the door to demand response as a viable solution to keeping both the electric grid and the environment in balance.

That open door paved the way for the deregulated, competitive energy markets we have today to replace the vertically-dominated regulatory ones that had existed for most of the 20th century. It also would prove to be the seed that would soon mature and bear the lucrative fruit of modern demand response.

Fast forward back to the present. Federal legislation is still working to ensure energy markets remain competitive with clean and renewable energy sources securing a just and reasonable position place in them.

Order 2222 from the Federal Energy Regulatory Commission (FERC) is a case-in-point. The Order is the latest in a series of directives aimed to create a fair balance between traditional generators on the supply-side and distributed energy resources seeking to enter markets on the demand side.

Issued in September 2020, Order 2222 calls for the removal of “barriers preventing distributed energy resources (DERs) from competing on a level playing field in the organized capacity, energy, and ancillary services markets run by regional grid operators.”

Order 2222, widely hailed as a landmark achievement in the history of the energy industry is about more than just creating more competitive markets. By allowing DERs, including demand response, their just seat in the marketplace, Order 2222 enables the US electric grid to take a giant leap toward a cleaner future.

Consider this recent data on demand response performance in the US:

In 2019, the most recent year for which the data is available, the combined wholesale demand response capacity of all regional system operators in the US grew to 27,000 MW.

How much environmental pollution did all that demand response save the country in 2019 by providing a resource that would have otherwise been supplied by a traditional “peaker” plant?

According to the EPA, the 27,000 MW of capacity from all commercial DR participation in the US in 2019 prevented the greenhouse gas emission equivalent of what an average passenger vehicle would produce were it to drive a little more than 142 million miles.

That same total of reduced load roughly converts to the carbon dioxide emission equivalent of 63 million pounds of coal being burned.

In 2020, CPower’s more than 1,700 customers contributed more than 4,000 MWs of capacity to demand response, effectively reducing the energy equivalent of 7 million pounds of coal that would otherwise have been burned and released into the environment.

Helping the grid stay balanced and keeping the air clean aren’t the only benefits to demand response.

The global demand response market is projected to value at USD $24.71 billion by 2022, an increase from the $5.7 billion valuation of the same market in 2014, according to a recent report published by Million Insights market research firm.

Much has been made in this publication and others in the energy industry about the evolving electric grid and demand response’s role in helping to bridge past, present, and future.

As you read these words, energy markets and electric utilities across America are refining their demand response programs and introducing new ones, providing organizations with a lucrative and socially responsible way to use their energy assets to support grid reliability in this critical time of transition.

America opened the door for demand response nearly forty years ago. Closing it now (even just a little bit) would be a step toward the past in a time when the country should be crossing the bridge to energy’s future.

Power Shift: How DERs are Creating a New Balance of Power (Webinar)

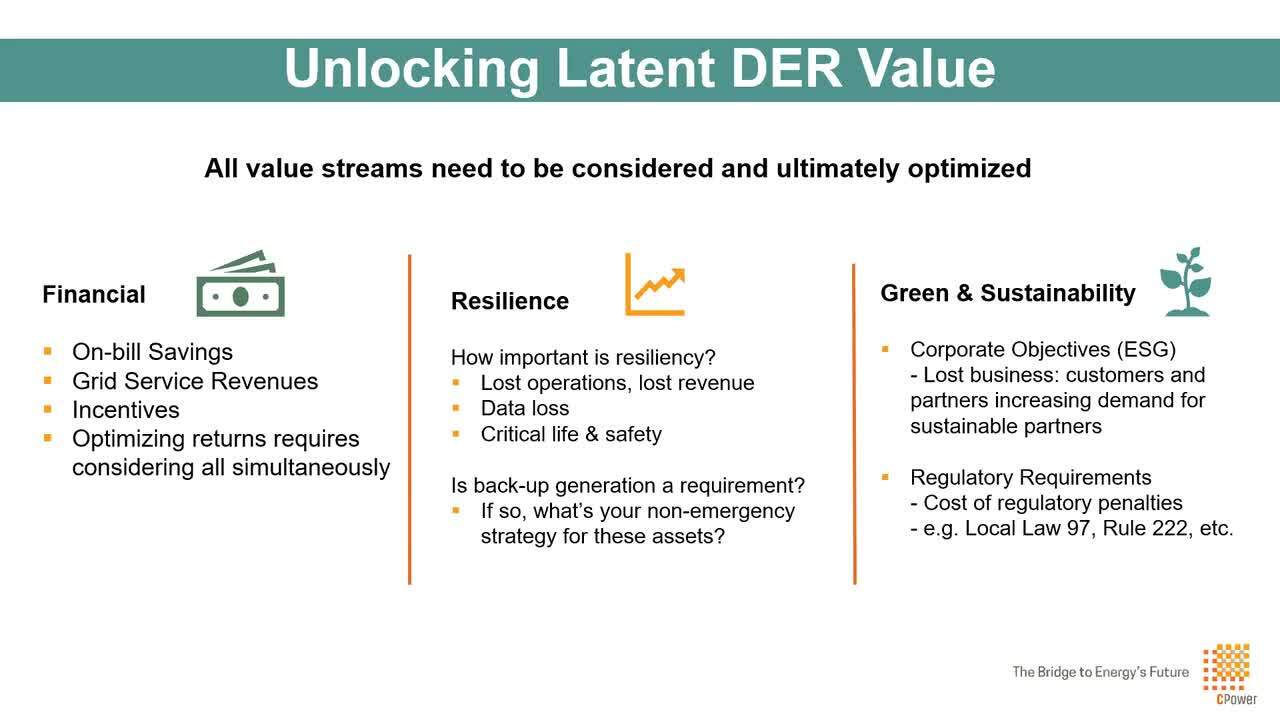

What will electrical power consumption in North America look like in 2050? Will centralized power generation still dominate, or will distributed energy resources–DERs–shift the balance of power generation to the energy end consumer? Our presentation takes “a look back” from the future to show how expanding DER implementation is laying the groundwork for a new balance of power, freeing organizations to independently pursue sustainability and reliability goals, and how monetizing DER energy assets is accelerating that shift. Our case study reveals how one university monetizes solar, battery storage, and demand-side energy management strategies to power its future, today.

Learning Objectives:

- Examine How the “balance of power” will shift from generators and utilities to the end energy consumer over the next decade.

- Explore the ways in which flexible demand and aggregation at the consumer level will change the grid infrastructure.

- Investigate the impact that distributed energy resources (DER) and microgrids will have on the state of grid modernization.

- Identify additional renewable resources, beyond solar and wind, that will see the greatest increase in adoption for both supply and demand of electricity.

Watt’s Up With Backup Generators?

Simplifying back-up generation rules, permitting, and demand response participation.

Renewables are here and continue to displace traditional coal resources on the grid. Battery storage is compelling and becoming more cost-effective — but it is still not a full-proof, scalable solution. Utilities are battling the challenges of grid intermittency amidst infrastructure challenges to support renewable penetration. All of this to say, the tried-and-true back-up generator is still the go-to resource when it comes to energy resilience and still remains a misunderstood energy resource.

Join CPower’s back up generation and demand response experts Arusyak Ghukasyan and Michael Mindell for this 30-minute panel to learn and understand topics including:

- How generators can earn revenue for your organization

- The rules and policies for BUGs at the federal, state, and local level

- Common myths about using BUGs for ‘non-emergency’ situations like demand response and testing under load

- What industries, markets, and programs are more favorable to BUGs for revenue

- How to fund and finance generator upgrades or replacements

Case Study: UMass Amherst – A Revolutionary Approach to Sustainability Yields Revolutionary Results

State-of-the-art battery storage, an innovative solar PV system, and “stacked” demand management programs provide energy savings, steady revenue, reduced greenhouse gases, and grid reliability for

this revolutionary institution.

Webinar: North America’s Changing Demand Side Management Opportunities

Webinar: Why Reliability, Sustainability and Resiliency are Changing the Way We Think About Demand Response

Webinar: Monetizing Energy Resilience in Healthcare Facilities

The Push for Renewables in New York

One of the Reforming Energy Vision’s primary goals includes renewable sources generating 70% of the state’s electricity by 2030. To do that, the New York grid seeks to implement distributed energy resources into its fuel mix.

How might New York’s energy market be redesigned to incorporate DERs like solar, energy storage, and others?

NYISO’s proposed changes meet opposition

In 2018, the NYISO proposed changes to the ICAP Capacity Market for how long a resource must be able to run to be eligible to be paid the full value of capacity.

Using the results of a study on energy-limited resources by GE Consulting (GE), the NYISO initially proposed that resources would need to be able to run for 8-hours in order to obtain full capacity value. The NYSIO then proposed it would allow resources that can perform for shorter durations to be paid a fractional portion of the capacity value as follows:

8-hrs=100%

6-hrs = 75%

4-hrs = 50%,

2-hrs =25%

A group of demand response and energy storage providers, including CPower, challenged the GE study’s findings.

A formal review of the GE study by Astrapé Consulting revealed “several flaws in the assumptions and methodology that influenced the study results to show a decreased capacity value for shorter-duration resources than would likely be expected.”

Skepticism of the GE study’s results quickly spread among key New York energy stakeholders, including DR providers, energy storage developers, C&I customers, environmental groups and various trade associations.

These stakeholders submitted a joint letter to the NYISO executive team and board of directors requesting “all market design changes relating to the GE Study results (including any changes to the SCR program) be removed from the DER Roadmap.”

So where does that leave New York?

Potential changes in the New York Energy Market

While there is an ongoing debate about the future of New York’s capacity market, there are no major regulations or market design changes yet announced to take effect in 2019. That could change pending the outcome of an April vote (more than a month away as of this writing) among New York’s energy stakeholders.

That means, for example, the Special Case Resource (SCR) demand response program will continue to operate under its current parameters, including a four-hour duration requirement.

As far as the DER wholesale market goes, New York is in wait-and-see mode. DERs, especially battery storage, and renewable energy sources are a key component of the REV’s drive toward New York’s energy future.

New York, like several other US energy markets, is faced with the question of how to value distributed energy resources in its marketplace.

The question of DER valuation is being debated by the NYISO and various energy stakeholders in the state. As of this writing, there is no definitive timetable for when the debate will conclude and regulations for DER valuation will be enacted.

Energy Storage

New York has taken its place alongside California, New Jersey, and Massachusetts as a first-mover in establishing energy storage targets.

In June 2018, Governor Cuomo announced an energy storage roadmap that set New York’s storage target for 1,500 MW by 2025. According to the roadmap, that ambitious goal could elevate to 3,000 MW by 2030.

At the state level, New York has recognized the need to fund storage projects instead of subsidizing them. Last June, Governor Cuomo committed $200 million from the New York Green Bank to fund storage investments that will help integrate renewable energy onto New York’s grid.

Funding opportunities for storage abound with plenty of state money being made available for storage development.

But without certainty on the wholesale market side and established rules concerning dual participation between markets, meeting the state’s ambitious storage goals will continue to have its challenges.

The key energy players in New York will need to resolve these issues before any substantial investment from the private sector will take a position on energy storage. The NYISO is targeting April 17, 2019, for a vote on market design to accommodate DER integration into its wholesale markets.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.