Our Blog On-Demand

Content

Knowledge Hub

Knowledge Hub

successfully seized the opportunity to earn additional revenue for the school through demand response

Virginia State University (VSU), founded in 1882, is one of Virginia’s two land-grant institutions. It boasts a current student population of approximately 4,700. VSU’s 231-acre campus includes 11 residence halls, 18 academic buildings and a 412-acre working farm used for agriculture research. VSU features academic environments within six colleges and is ranked No. 12 institution in the United States for historically black colleges or universities (HBCUs) by College Choice.

Ms. Jane Harris, Assistant Vice President for Facilities and Capital Outlays, was enthusiastic about PJM Interconnection’s demand response (DR) program, which pays organizations for curtailing energy use during times of high demand that strain the region’s electrical grid. She felt VSU had a good probability of a successful outcome, generating revenue to fund needed campus upgrades. In 2014, she was given the go-ahead to enroll in DR.

To make sure the university’s DR participation had a successful launch, Ms. Harris built a leadership team which included the facilities management staff and building managers. The team was led by one of her project managers, Mr. George “Bubba” Bowles. Mr. Bowles brought deep knowledge of utility operations and was tasked with managing the project. CPower, represented by Ms. Leigh Anne Ratliff, brought unmatched expertise in PJM’s DR curtailment program.

Mr. Bowles developed a demand response action plan that included a survey of all campus buildings, and the energy technology available in each building. The campus infrastructure was not designed to curtail energy quickly and easily. Not every building was equipped with sub-meters and automated controls, and some generators could supply power for only emergency lighting. Nonetheless, Mr. Bowles felt that with proper planning, training, and communication, VSU would succeed.

Communication–specifically communicating the program’s benefits–proved to be the key component of the plan. Months before the first test event, which required the university to reduce their usage at a particular date and time, the leadership team undertook an extensive communication program that targeted the university’s building managers, campus facilities maintenance contractor, information technology staff, facilities inspector, campus safety officer, and Yourdonus James, Conference Services Manager, who schedules outside groups for events on campus. Each step of the plan was explained in detail, emphasizing the real and substantial benefits the university would receive from DR. As the test date approached, specific tasks were assigned to facilities staff and the safety officer that would help VSU meet their targeted curtailment goals, from turning on generators to turning off the breakers to entire buildings. Ms. James explained that she was concerned when first informed of the demand response program, but the actual test proved transparent with no noticeable impact on her clients.

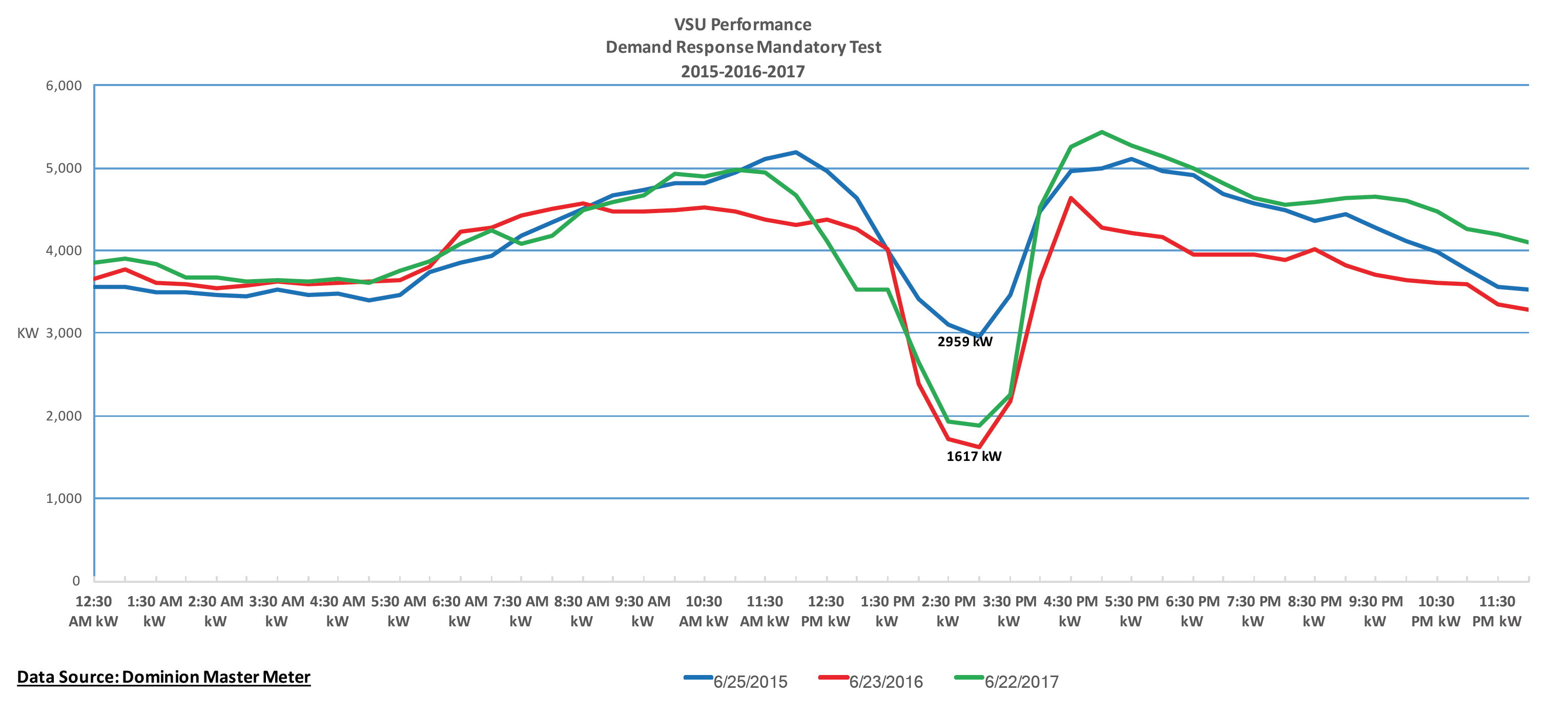

In June 2015, VSU participated in its first test event and exceeded its curtailment goal. In 2016, they set their curtailment goal even higher and exceeded that as well. In 2017, they set their goal higher.

The event test for 2017 was scheduled for a June afternoon at exactly 2:00 p.m. Around noon the plan, improved and streamlined over the past two years, was put into action. HVAC was cut off to 19 buildings, which were pre-cooled. In 10 buildings, energy could not be curtailed, so building managers enlisted the tenants to close blinds, turn off lights and computers, and schedule a late lunch to reduce usage during the test. Power to another 19 buildings was shut off completely.

As the plan proceeded, they faced an “11th-hour-and-59th-minute” challenge that threatened their continuing success. The team learned that at that moment, VSU was hosting 900 potential students at all academic buildings, including Daniel Gymnasium, one of the buildings targeted for complete shutdown. Not only that, but the students were to be sent out to explore any building of their choosing–many of them already curtailed–at exactly 2:00 p.m. Shifting gears, the team quickly “un-curtailed” Daniel Gymnasium.

At 2:00 p.m, with the temperature outside registering 87 degrees, VSU began its test curtailment. VSU had committed to curtailing their load by approximately 4 MW. By the time the event ended, of a total campus load of 6 MW, VSU curtailed 4.5 MW–an unprecedented 75% campus-wide load reduction.

The one factor that all team leaders agree was critical to success is effective communication. By communicating clearly not only what had to be done, but why, the team was able to get buy-in from the entire campus community. Ms. Harris made it clear that the revenue generated by DR would benefit them directly–they would have the funds to do things that they normally wouldn’t be able to afford. Each building manager became an enthusiastic stakeholder, which assured campus-wide success. As Mr. Bowles notes, “We make it easy for them to say ‘Yes’ by showing that it benefits them.”

Three years of increasingly profitable participation has funded a number of university facility projects. Chief among them are upgrades to two residence halls in the historical section of campus. The upgrades turned residence halls into destinations for which students now compete for assignment.

VSU has also been able to pursue energy efficiency projects that result in permanent curtailment and energy savings. Residence halls are being upgraded to highly efficient LED lighting, and generators are being upgraded to full building operation. Both upgrades, besides saving energy, have the potential for adding more revenue from DR participation.

Perhaps more importantly, the success of DR at VSU has helped create a culture of energy conservation and sustainability on campus. Faculty, staff, and students increasingly embrace programs such as recycling, energy conservation, and research into environmental programs and economic development. “Virginia’s Opportunity University” is also becoming “Virginia’s

Sustainability University,” true stewards of the earth that anchors their mission.

The Customer: Desert Water Agency, Palm Springs, California

The Desert Water Agency (DWA) is a not for profit government agency providing water to the desert resort community of Palm Springs, in the Coachella Valley, as well as adjacent areas. Nearly all of the water that is used in the Coachella Valley comes from a groundwater basin, or aquifer estimated to contain about 30 million acre-feet of water. DWA pumps water using 29 wells spread throughout its retail area and delivers it to 23,000 water connections serving approximately 106,000 residents and businesses.

DWA embraces sustainable energy resources, including hydroelectric and solar, to power its pumps and generate energy savings. A solar field comprising 4,500 ground-mounted fixed tilt panels produces just over a megawatt of energy. The solar facility powers their Operations Center and Water Reclamation Plant and is projected to save the Agency and its ratepayers about $6 million in energy costs during its lifetime.

The Challenge: Tap the Demand Response Revenue Stream

The demand response program offered by CPower pays customers for reducing their energy usage upon same-day notification of a possible grid event. DWA understands the benefit of earning additional revenue by curtailing their power load and using that revenue to further offset energy costs. The key to DWA’s successful participation was technically implementing a curtailment program with the least possible disruption to its operations and its customers. Wells throughout the city that could participate in the program would be turned off when CPower issues a curtailment notification.

That left them with one important question: “Can we survive three to four hours of having wells shut down and still be able to refill our reservoirs to meet customer demand?”

The CPowered Strategy: One Well at a Time

Thankfully, with CPower’s help, the answer was “Yes.”

DWA chose CPower as their demand response provider to manage their participation in the demand response program. CPower provides a team of energy experts to review the Agency’s operations and energy goals. Together, DWA and CPower developed an energy management strategy that gives DWA the tools to optimize their participation in the program.

The strategy called for DWA to start with a small number of wells, to familiarize themselves with the curtailment process with minimal impact on day-to-day operations. As DWA’s staff became more comfortable with the process, more wells were added, until all eligible wells—25 of their total of 29—are now actively participating and generating revenue for the Agency.

CPowered Solutions: Power Empowerment

Understanding the Agency’s preference for autonomy over automation, CPower empowered it with the tools to control its energy spend and demand response participation. The Agency can turn individual sites on and off at will upon notification through their supervisory control and data acquisition (SCADA) software to implement the custom-designed energy strategy developed with CPower’s experts. Perhaps best of all, the Agency can manage it all from their central Operations Center, without dispatching staff to well sites under a grid-stressing desert sun.

CPower collects utility meter data for each of DWA’s sites and supplies them with quarterly performance data. These data provide DWA with an understanding of each site’s base load value. The Agency can use these data to decide their optimum load curtailment commitment for each month of the program.

The Results: An Oasis of Cost-Saving Revenue

DWA typically nominates a changing rotation of eight wells each month into the program. The total monthly load drop amounts to about 2.5 MW. This is a significant commitment that helps relieve stress on the electric grid.

The program also provides DWA significant financial incentive for their participation. During a recent six-month period, May-October, they received $105,872.68 in payments for their participation. These incentives allowed them to further offset their energy costs, to the benefit of their customers.

Just as importantly, perhaps, DWA enjoys the total commitment of CPower’s dedicated California energy market experts. The Agency knows from experience that CPower will support their energy goals at every turn, with an energy strategy custom-made to meet their unique requirements.

Download a PDF version of this case study

The Electric Reliability Council of Texas (ERCOT) and independent market analysts agree on at least one thing: there will be about 4,200 MW less fossil fuel capacity in the Lone Star State in 2018, a decrease that can be attributed to the approved retiring of three coal-fired generation plants–Monticello, Sandow, and Big Brown.

Exactly how the decreased capacity reserves will affect the Texas market is less agreeable, at least for now.

ERCOT maintains a capacity reserve margin target of 13.75% of peak electricity demand so the grid operator may serve electric needs in the case of unexpectedly high demand or levels of generation plant outages.

Analysts like Potomac Economics, an independent market monitor for ERCOT, predict the retiring generation plants in Texas will lead to the grid’s capacity reserves dipping below ERCOT’s margin target.

Potomac’s prediction is at odds with ERCOT’s official forecast for capacity reserves in 2018, at least now.

Last May, ERCOT released its bi-yearly Capacity, Demand, and Reserves (CDR) Report, which projected the grid’s reserve margins to be above 18% until 2022 when the margin falls to 16.8%. The report, however, was published several months before the recently announced coal retirements.

After doing the math and subtracting the capacity associated with the retiring units from the 2017 CDR report’s forecast, a breach of ERCOT’s target reserve margin seems possible.

So ERCOT’s capacity reserve may drop below the 13.75% target. What does that mean?

We’ll likely learn the official answer in mid-December 2017 when ERCOT releases an updated CDR report to address what the loss of capacity from retired generation plants will mean to the grid.

Until then, we can make a few educated guesses on how the Texas market will react to decreased capacity based on the market’s recent history.

In the last 10 years, ERCOT’s reserve margin projections have dropped to single digits 10 times, reaching a recent low of 5.8% in 2012. The market has repeatedly bounced back from low projections. It’s worth noting, however, what happens when ERCOT’s capacity reserves actually fall below the grid operator’s target reserve margin.

That last happened in 2011, which was also the last time ERCOT’s scarcity pricing mechanism was triggered.

Scarcity pricing introduces a price floor and price cap to the market when an electricity supply emergency causes concerns of forced power cuts (called emergency load shedding) throughout Texas. When ERCOT’s reserves hit 2,000 MW as they last did in 2011, scarcity pricing sets an automatic cap at $9,000 per MWh.

Now let’s analyze who benefits from scarcity pricing. The short answer is generators. In an energy-only market like Texas, generators make money when the price of electricity spikes. Over the last several years, demand for electricity in Texas has set numerous peak load records, including new monthly highs in July and August 2017.

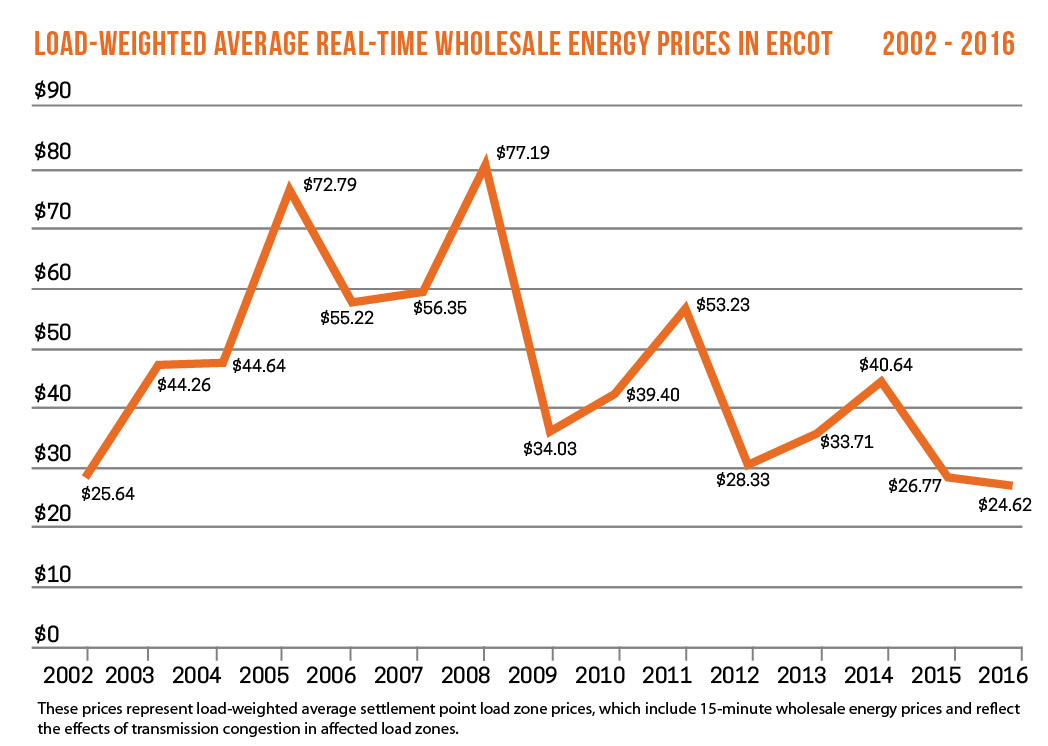

Power prices in Texas, however, have remained relatively stable. In fact, ERCOT reported that 2016 saw average wholesale prices in its real-time market hit an all-time low (see chart below). Increased wind production, which accounted for less than 1% of ERCOT’s power in 2003 rose to 15% in 2016, continues to put downward pressure on prices, as does cheap natural gas supply.

The drop in capacity reserve in 2018 may lead to the kind of price spikes that generators have been waiting for, but generators will not be the only beneficiaries if wholesale prices see a significant rise.

If triggered, scarcity prices will be translated into ERCOT’s day-ahead ancillary services capacity procurements. That could mean financial opportunity for businesses who participate in ERCOT’s Load Resource demand response program, which pays businesses to be on call to curtail their energy use on short notice when the grid is stressed or electricity prices are exceptionally high.

Load Resource, ERCOT’s go-to ancillary service demand response program, already has the potential to pay businesses 2-3 times more than reliability-based demand response programs in Texas like the Emergency Response Service (ERS) program.

If scarcity pricing triggers in 2018, that potential payoff may be a lot bigger in Texas.

Part 1, “ERCOT Fundamentals: DR 101,” introduces you to DR in ERCOT and covers topics ranging from market structure to participating with automation and emergency generators.

Part 2, “Strategies for Maximized Results,” takes your DR knowledge to the next level and shares some important out-of-the-box methods for maximizing your value.

Both webinars are FREE and now open for registration.

For most of the last two decades, demand response in California has been largely procured and operated by the state’s electric utilities.

That trend is changing.

Demand response in California is currently experiencing significant changes as regulators implement measures to expand the state’s pool of energy resources and assimilate these resources with the California Independent System Operator’s (CAISO) markets.

This regulatory reform has created new opportunities in California for demand response programs, which pay businesses for using less energy when the grid is stressed or electricity prices are high.

The Demand Response Auction Mechanism

The Demand Response Auction Mechanism (DRAM) was developed in 2014 under the guidance of the California Public Utility Commission (CPUC) in an effort to harmonize utility-based reliability demand response with CAISO, the state’s grid operator.

In December 2014, the Commission issued D. 14-12-024 which requires the state’s IOUs: Southern California Edison Company (SCE), San Diego Gas & Electric Company (SDG&E) and Pacific Gas and Electric Company (PG&E) to design and implement Demand Response Auction Mechanism (DRAM) pilot programs in 2015 for 2016 capacity (DRAM I or 2015 DRAM) and in 2016 for 2017 capacity (DRAM II or 2017 DRAM). The three utilities recently completed a solicitation for 2018/2019 capacity (DRAM III) procuring over 200 MW of DR resources across the state.

Now in its third year, the program seeks to allow CAISO to add reliable demand response resources to areas of California where electric reliability may be at risk.

DRAM is a pay-as-bid program with three goals:

1)Fully integrate DR resources with the CAISO energy market

2) Test whether third parties can bring these resources to the table without structured utility programs

3) Allow residential resources to participate directly in the CAISO markets

The DRAM program also provides market participation testing from a broader base of distributed energy resources, including behind-the-meter storage. Under DRAM, these resources have the opportunity to behave not just as system capacity, but also as local and flexible resources.

California’s recent actions aim to revise the market’s existing demand response program structure and are an indication that DR has an important role to play in the state’s future.

The best way for an organization to take advantage of the DRAM program and the opportunities available in the California Market is to consult a trusted demand-side energy management company.

Such a company can evaluate an organization’s facilities and determine its curtailment capabilities. Next, they can explain in full the many demand response and demand management programs that are available in the California Market and help determine which offer the particular organization the best chance for curtailment success.

To learn more about how CPower can help your organization earn with the Demand Response Auction Mechanism program, please visit CPowerEnergy.com/dram-california.

To continue learning about how the California grid is changing to meet the needs of the future, read: The Evolution of The California Energy Market: How Demand Response and Demand Management will Play Integral Roles in The Golden State’s Energy Future

The Virginia Beach City Public School System is on a mission. At the heart of that mission lies a commitment to education, which you’d expect from the largest school division in southeastern Virginia. What you might not expect is how money earned from participating in demand response programs is helping fund the VBCPS’ drive toward academic excellence.

Ranked the fifth best large school division in the entire nation by GreatSchools, Virginia Beach City Public Schools (VBCPS) has earned a reputation for fostering a culture of outstanding academics.

That’s not all the school division has earned lately.

Since 2014, VBCPS has also earned over $250,000 through demand response and demand management. The increased revenue has helped pave the way for a sustainable future of energy efficiency and academic achievement.

Compass to 2020

VBCPS’ Charting the Course initiative was launched in 2015 to set the vision of school division over the next five years. The strategic framework includes four goals – high academic expectations, multiple pathways, social-emotional development, and culture of growth and excellence – and multiple strategies to guide this important work. This focus on excellence at VBCPS extends into their drive towards energy efficiency and sustainability initiatives across their entire K-12 campus system and facilities.

VBCPS understands the importance of conserving resources and protecting our environment. Among the nearly 70,000 students and approximately 15,000 employees are the often unique and innovative conservation efforts that can be found in every office and school in the division. As a testimony to this commitment, they have embraced Demand Response participation with support at all levels of the organization, from the office of the president to the facilities personnel, faculty, and students.

The Opportunity

VBCPS has been participating in the PJM Emergency Capacity DR and Energy Efficiency programs with CPower since 2013. They participate through the State Contract E194-1378 administered by the Department of Mines Minerals and Energy (DMME), which has joined forces with CPower to bring enhanced Demand Response services to Virginia.

VBCPS has 85 schools, 13 of which were registered in 2016 to participate in the Emergency DR program. The peak load of the 13 school campuses is 9.6MW of which they curtail 8MW when called upon to reduce load during times of grid emergencies. Since 2014, their efforts have brought in earnings of over $250,000, which they have used to fund additional efficiency projects to support campus-wide sustainability goals.

Consistent Success

VBCPS staff at each participating school takes ownership of their Demand Response participation and have consistently over-performed each season thanks to:

Challenges and Lessons Learned

Some initial challenges included managing data from multiple utility meters as well as different building automation systems (BAS). However, the methods used above with site-specific planning allowed VBCPS to overcome the hurdles. Some sites have an Easy Button and use an automated approach while some utilize a more detailed hands-on approach.

In the end, clear communications and reliable equipment/metering are key factors for consistent performance. For instance, there was an emergency event called at the end of the season in 2013, where VBCPS delivered per their commitments even though school was fully in session. The schools also got the added benefit of earning energy payments from that event.

Forward-Thinking towards a Sustainable Future

Additionally, in 2014 the team pioneered the State of Virginia Energy Efficiency effort with lighting upgrades across the division footprint. They embraced the energy efficiency program, connecting CPower with their contractors to get the required information of qualified projects, and ultimately will earn close to $100,000 for their efforts.

Looking to the future, VBCPS has consistently added load reductions to their commitment to support grid reliability. They have added 8 more schools with an additional 2.8 MW of curtailable load to participate in the 2017 PJM performance season program, and are also exploring the PJM Economic DR program. Four new lighting upgrades from the spring of 2017 were submitted to the PJM Energy Efficiency program. The team at VBCPS are a powerful asset to demand response. By providing their operating procedures as a starting point to other participants, they have served as mentors for other schools – providing encouragement to their peers so they feel confident to take advantage of the program and optimize energy earnings and savings at other K12s across the Commonwealth.

Contact Leigh Anne Ratliff or anyone on CPower’s PJM team at www.CPowerEnergy.com/markets/pjm-interconnection-contact

A changing weather landscape may bring early summer heat.

Although the recent La Nina season is officially over, we are experiencing a Mother Nature hangover as the 2017 Spring season has seen above normal temperatures. As we transition from La Nina to El Nino, we should expect the hotter than normal temperatures to continue through the early part of the summer in the PJM region. This should give way to cooler than normal late summer temperatures, which is opposite of what we saw during the 2016 summer season. Warmer temperatures early in the season could yield some emergency issues, especially localized transmission concerns, so be prepared early in the 2017/18 Demand Response (DR) season.

As usual, CPower tends to schedule the PJM mandatory test event early in the summer to ensure customers will have time to be retested in the event they under-perform. CPower customers should be on the lookout for our test event messaging.

Capacity Performance Non-Summer M&V changes take effect in 2017/18.

As part of PJM’s filing to FERC in November 2016, the Non-Summer Measurement and Verification (M&V) methodology for Capacity Performance (CP) has been changed starting with the 2017/18 season. The new Non-Summer M&V will be a Winter PLC construct. The Winter PLC will be based on the customer’s highest load value between 6am-9pm during PJM’s 5 Winter Peak Days. CP Demand Response customers will have separate Summer and Winter PLCs and FSLs for compliance purposes although the load reduction will be the same value for the entire season.

PJM ushers in a new era of Demand Response with the 2020/21 BRA.

In May of 2017 PJM will conduct its annual Base Residual Auction (BRA) for the 2020/21 season. This year marks the first year that Demand Response can only be Capacity Performance. Although there will be a mechanism for Summer seasonal DR resources to offer and clear as a CP aggregation, the overwhelming majority of DR that clears the BRA will be pure CP.

Prognosticators are reviewing the auction parameters and making predictions on clearing prices. Although capacity resources are expected to exit the market under the new CP construct, PJM has also lowered their load forecast, causing many to believe the CP price could clear flat compared to last year. There is, however, reason to believe that there could be significant premiums in EMAAC and COMED due to limited CP resources and transmission constraints. One can never predict participant behaviors which is a variable that always makes price prediction an interesting but inexact science.

During the 2020/21 season, many traditional “summer only” DR customers will be forced to participate as annual resources in the CP program at potentially a lesser load drop commitment, while others may leave the market entirely. CPower would like to work with all DR customers to maximize their participation and find ways to keep them in the program as either CP enrollments or part of a CP aggregation.

To learn more about PJM’s changing market or about how to be better prepared for potential grid instability this summer, contact Dann or any member of the CPower’s PJM Team.

Many customers as well as my colleagues at CPower often ask me about the benefits of installing reliable metering equipment to access energy data in near real time. I typically respond with a handful of advantages (some listed below), but even before going there I find it useful to explain the full context about why these are important.

No discussion on the topic would be complete without a basic understanding of Demand (measured in kilowatts or kW) versus Consumption (measured in kilowatt hours or kWh). This is key to making the right choices when it comes to reducing energy costs, since electricity use for a commercial/industrial customer is typically billed and metered after taking at least these factors into consideration:

So, what’s the big deal between kW vs kWh?

An analogy using traditional light bulbs can help: Consider a single 100W bulb lit for ten hours versus ten 100W bulbs lit simultaneously for one hour. In both scenarios, the total cumulative “consumption” is 1,000 watt-hours (or 1 kWh). In the first case, however, the single light bulb will “demand” 100W or 0.1 kW from the electric supplier. Thus, the utility must have that 0.1 kW ready whenever that bulb is switched on. But note how the second scenario impacts the utility from a “demand” perspective. The electric supplier in this case must be ready to deliver 10x as much ‘capacity’ in response to the demand of the 10 light bulbs burning simultaneously!

Quite simply, here’s the difference. If these two scenarios reflected the behavior of two different customers, and if they were each billed for only their consumption, then both would get the same bill (for 1 kWh of energy used) even though the burden placed on the utility to meet each customer’s energy requirement is very different. Among other reasons, this is primarily why C&I (as opposed to residential) customers are typically metered and billed based on both their hourly “consumption” patterns and their peak “demand” for energy.

Demand-side energy management in near real time

CPower’s savvy demand response (DR) customers effectively leverage the energy they consume as a facility asset. Our diverse customer base covers mid- to large-sized electricity users in commercial, industrial, government and institutional organizations, including water/wastewater pumping and treatment facilities, colleges and universities, public agencies, office campuses, cold storage, data centers and a wide range of manufacturing facilities, to name just a few.

Many of our most active DR participants nationwide additionally leverage real-time metering for its clear advantages, including more visibility and control over load reductions as well as better overall energy management and sustainability benefits. The image above shows just two of the many views available to users via the CPower App (the graph on top shows 7-day hourly interval consumption while the one below shows demand on an intra-day 1-minute interval chart).

Key reasons to get real-time metering installed at your facility:

The Bottom line

Real-time metering ultimately increases your DR earnings and savings to fund additional efficiency initiatives, while complementing your facility’s energy conservation and sustainability efforts. There are no out-of-pocket costs, since fees to install hardware, support software provisioning and enable data measurement & verification (M&V) are typically covered by DR program earnings.

By giving you near real-time visibility and analytics of your energy consumption, enhanced metering techniques provide more earnings and savings via greater control over your DR participation and greater awareness of electricity usage patterns (remember kW vs kWh!)

Is your organization one of the thousands of commercial/industrial energy customers that use back-up generators (BUGs)? Are they used as emergency generators (a.k.a., EGs or gensets) in demand response (DR) programs? If so, 2016 may have felt like an episode of the “Survivor” reality show, except instead of the usual cast of GenX characters and challenges you were unfortunately tasked with surviving a maze of ever-changing genset regulations.

Bad News, Good News: The past year saw important changes regarding the use of stationary reciprocating internal combustion engines (RICE) that continue to evolve at the federal level as administered by the U.S. Environmental Protection Agency (EPA), which itself is in now in the midst of changes with newly-confirmed administrator Scott Pruitt at the helm. EPA rules provide that BUGs that are intended for emergency use when blackouts occur are exempt from reporting requirements and most emissions regulations. The bad news is that EPA changes significantly restricted the circumstances where such generators can be compensated for operations while the grid is still up. The good news is many such generators can achieve “non-emergency” status without equipment upgrades by meeting specific permitting and reporting requirements.

Bit of History – 50-hour Rule No Longer Applies: In early 2016, it was determined that EGs could potentially participate in DR programs under a different rule (referred to as the “50-hour rule”). A coalition of DR providers including CPower took specific steps to clarify the applicability of the 50-hour rule with EPA as well as explore avenues to address concerns with the prior 100-hour rule as related to EG use for DR:

Further confounding the situation is that a generator classified as “nonemergency” under federal regulations could be deemed “emergency” under state and/or local regulations. Recent examples include the Rule 222 that applies to permitting in New York; while California is moving from the traditional environmental permitting approach towards utility-based restrictions.

What This Means to You: As a DR participant with EGs, you should always be aware of the nuances defining EG assets that do not meet EPA’s interpretations of local requirements as well as the Federal Non-Emergency standard for DR curtailments. This applies even if your current DR service provider may advise you otherwise (especially regarding the use of EGs via the 50-hour rule). Any reputable vendor certainly should not expose you to any potential EPA violations or penalties. And if you indeed find out that EGs are not permitted for use in DR programs, make sure your service provider has an experienced engineering team who is willing to work with you to achieve the best possible alternative curtailment strategies.

On the Positive Side: Again, the good news is that in many instances, you can still use EGs to participate in DR programs and support grid reliability. A good curtailment service provider or DR aggregator should be able to assist clients with specific steps for permitting and retrofits so their engines can still participate wherever possible. At CPower, we have helped several clients with permitting so their engines can now effectively participate in emergency DR events to support the grid. Some of these services include:

Bottom Line: As capacity costs increase, active DR participation becomes even more compelling and relevant. Changes in EPA regulations have impacted the ability of DR customers like you to use stationary emergency generators as part of your load reduction strategies. Luckily, you can look to DR service providers to offer valuable “survival tips” that can bring this episode to a stable ending.

“Thanks to accurate guidance from CPower’s engineering team, our engines were successfully permitted for use in demand response by the state’s Department of Environment. Their in-depth knowledge and tenacity throughout the process clearly contributed to enabling our facilities’ continued participation in the 2017 DR performance season.” – Facilities Director at a large New England based manufacturing firm.

CPower takes a leadership role and shaping market transformation while advocating for our customers to help you navigate the regulatory maze and maximize DR program benefits. The result? Increased energy savings and earnings not just from optimized participation in Emergency DR, but also in non-emergency voluntary programs (like price based Economic DR). In some cases, you can also use your engines for peak-shaving to reduce capacity costs while maintaining compliance with environmental regulations.

Do you have a generator? Does it meet State and EPA guidelines? Are you leveraging it as a demand response revenue resource? Check out our Emergency Generator Decision Tree today to ensure you make the right EG permitting and compliance choices moving forward.