CPower Expands Distributed Energy Resource Integration with AMPLY Power

Demand Response Has Been Part of America’s Energy Plan for 40 Years. Why Should the next 40 be any Different?

The idea that reducing a watt of energy on the demand side can be just as valuable as generating one on the supply side in a time of grid stress is hardly new. Nor is the idea that such a solution helps thwart both energy-related and environmental crises.

The origin of demand response can be traced to roughly forty years ago when both the US and the world grappled with many of the same energy and environmental issues we are still trying to solve today.

Let’s take a trip back to the mid-late 1970s and see if a few things don’t look and sound familiar.

The oil crisis of 1973 sent shockwaves throughout the world, raising concerns on the security of electricity supply in the US while pointing to a need to diversify the nation’s power generation mix away from a fossil fuel dependency and toward a mix with a greater share of renewable and clean energy sources.

Global environmental awareness had grown to a movement large enough to be seized upon by newly-elected American president Jimmy Carter who, within a month of taking office, donned a cardigan sweater, sat before a roaring White House fire, and urged Americans to join him in conserving energy in a nationally-televised fireside chat.

During that broadcast on February 2, 1977, the president related how a particularly harsh winter had depleted the domestic supply of natural gas and fuel oil. He warned of dark consequences that awaited the most powerful country on earth if we as a nation failed to devise a sound energy plan for the future.

Sound familiar?

The 39th POTUS didn’t outright cite demand response as a means to a profitable and sustainable end that night in 1977, but he did allude to the Public Utility Regulatory Policies Act (PURPA), a piece of legislation that would be enacted in 1978 to promote more competitive energy markets in the US by allowing “non-utility generators” to participate in them.

The act would prove to be a landmark piece of legislation, setting the country on the road to conservation and the development of clean and renewable energy sources. It would also open the door to demand response as a viable solution to keeping both the electric grid and the environment in balance.

That open door paved the way for the deregulated, competitive energy markets we have today to replace the vertically-dominated regulatory ones that had existed for most of the 20th century. It also would prove to be the seed that would soon mature and bear the lucrative fruit of modern demand response.

Fast forward back to the present. Federal legislation is still working to ensure energy markets remain competitive with clean and renewable energy sources securing a just and reasonable position place in them.

Order 2222 from the Federal Energy Regulatory Commission (FERC) is a case-in-point. The Order is the latest in a series of directives aimed to create a fair balance between traditional generators on the supply-side and distributed energy resources seeking to enter markets on the demand side.

Issued in September 2020, Order 2222 calls for the removal of “barriers preventing distributed energy resources (DERs) from competing on a level playing field in the organized capacity, energy, and ancillary services markets run by regional grid operators.”

Order 2222, widely hailed as a landmark achievement in the history of the energy industry is about more than just creating more competitive markets. By allowing DERs, including demand response, their just seat in the marketplace, Order 2222 enables the US electric grid to take a giant leap toward a cleaner future.

Consider this recent data on demand response performance in the US:

In 2019, the most recent year for which the data is available, the combined wholesale demand response capacity of all regional system operators in the US grew to 27,000 MW.

How much environmental pollution did all that demand response save the country in 2019 by providing a resource that would have otherwise been supplied by a traditional “peaker” plant?

According to the EPA, the 27,000 MW of capacity from all commercial DR participation in the US in 2019 prevented the greenhouse gas emission equivalent of what an average passenger vehicle would produce were it to drive a little more than 142 million miles.

That same total of reduced load roughly converts to the carbon dioxide emission equivalent of 63 million pounds of coal being burned.

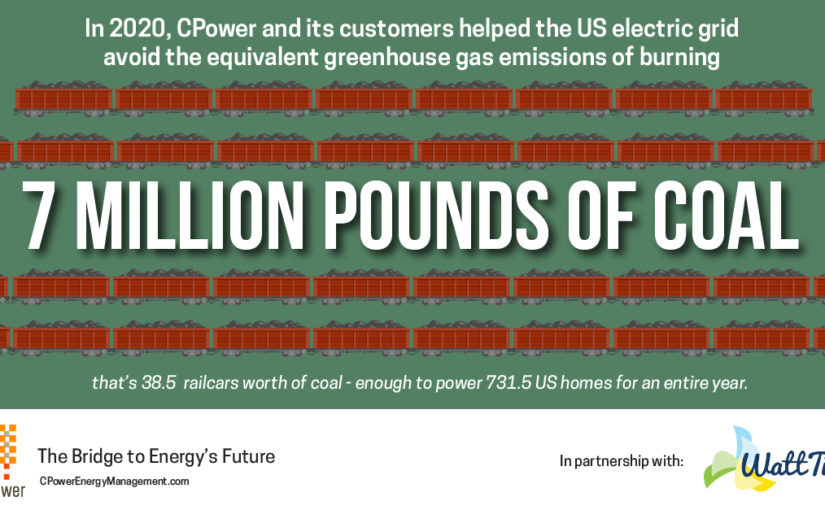

In 2020, CPower’s more than 1,700 customers contributed more than 4,000 MWs of capacity to demand response, effectively reducing the energy equivalent of 7 million pounds of coal that would otherwise have been burned and released into the environment.

Helping the grid stay balanced and keeping the air clean aren’t the only benefits to demand response.

The global demand response market is projected to value at USD $24.71 billion by 2022, an increase from the $5.7 billion valuation of the same market in 2014, according to a recent report published by Million Insights market research firm.

Much has been made in this publication and others in the energy industry about the evolving electric grid and demand response’s role in helping to bridge past, present, and future.

As you read these words, energy markets and electric utilities across America are refining their demand response programs and introducing new ones, providing organizations with a lucrative and socially responsible way to use their energy assets to support grid reliability in this critical time of transition.

America opened the door for demand response nearly forty years ago. Closing it now (even just a little bit) would be a step toward the past in a time when the country should be crossing the bridge to energy’s future.

CPower and WattTime’s Historic Partnership Allows Carbon-Reduction Benefits of Demand-Side Energy Management to Finally be Qualified

CPower’s President and CEO, John Horton, has long held a vision for how his company can help bridge the present and future as the electrical grid makes its low-carbon energy transition.

A leading energy solutions provider in North America, CPower has more than 1,700 customers across five deregulated energy markets in the country. Combined, those customers provide nearly 12,000 MW of electric load each year when the grid needs it most.

Formed in 2007, CPower has always known the demand-side efforts they facilitate for customers have an impact on carbon reduction.

That crucial megawatts are delivered to the grid via the demand side in times of need negates that load from having to be delivered from the supply side by way of dirty peaker plants.

The question that’s burned in the mind of CPower and other decarbonization-minded energy managers has always been exactly how much are carbon emissions reduced by demand-side energy management?

A recent partnership between CPower and nonprofit WattTime has finally delivered a quantifiable answer to this question.

Since its founding in 2014, WattTime’s mission has been to help customers achieve emissions reductions without compromising cost, comfort, and function.

Like CPower and its customers, WattTime has continued to ask itself a burning question of its own: how clean is the energy I’m using right now?

To answer the question, dozens of software coders set to work in a hackathon. Since then a team of more than 200 volunteers across many disciplines contributed their skills, backed by efforts from a host of PhDs and researchers from the University of California, Berkeley, and Carnegie Mellon University.

The result was WattTime’s prized invention, a unique intelligent software platform called Automated Emissions Reduction (AER) which has since become one of the premier climate-tracing technologies in the world.

AER proved to be CPower’s missing link, finally allowing for the effect their customer’s demand-side contributions have on carbon reduction to be quantified.

The results were impressive beyond their significance as a historical first and industry breakthrough.

In 2020, CPower customers curtailed their grid demand in nearly 20,000 events spread across six independent system operator (ISO) regions, totaling 11.5 GWh of load reduction. Based on WattTime’s analysis, this corresponded to an emissions reduction of nearly 7,000 metric tons of carbon dioxide on average for demand response events alone. This is equivalent to eliminating the greenhouse gas (GHG) emissions associated with over 7 million pounds of coal burned.

CPower’s energy efficiency (EE) monetization had on carbon reduction proved to be even more grandiose. In 2020, CPower helped its customers in PJM, the largest wholesale energy market in the world, monetize more than 520 MW of permanently reduced demand in the region’s capacity market.

According to WattTime’s analysis, that permanent load reduction resulted in 1.8 million metric tons of carbon dioxide reduction, the equivalent of 2 billion pounds of coal burned.

CPower’s John Horton believes the partnership with WattTime is one that will play a pivotal role in building a bridge to America’s energy future.

“As a company, our demand-side management solutions span demand response, energy efficiency, distributed generation, energy storage, and peak load reduction. They all have roles to play decarbonizing power grids as part of the low-carbon energy transition,” Mr. Horton said.

“In partnership with WattTime, we’ll be exploring how we can deliver even stronger emissions-reduction benefits to our customers throughout North America.”

CPower Partners with WattTime to Supercharge Emissions-reduction Benefits of Demand Response

Con Edison and National Grid Select CPower for Dynamic Load Management Program in New York

CPower Extends Distributed Energy Resource Strategy with New Executive Hires

FERC Order Removes Restrictions for Utility Demand Response Resources in New York Zones G-J

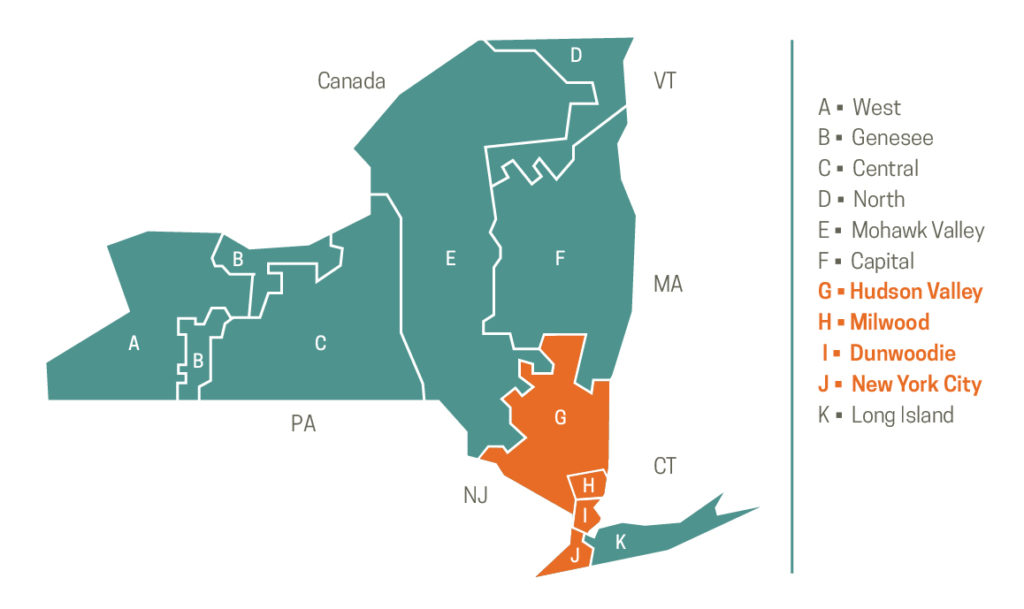

Good news on the regulatory front for new demand response resources from New York’s zones G-J entering NYISO’s Installed Capacity Market.

On February 18, 2021, the Federal Energy Regulatory Commission (FERC) issued an Order that overturned a portion of its previously issued Oct. 7, 2020 Order in the paper hearing on whether utility demand response programs Commercial System Relief Program (CSRP) and Distribution Load Relief Program (DLRP) are intended to provide benefits solely to the distribution system (i.e. not for providing similar services to wholesale capacity) and whether the revenues from such programs should be included in new Special Case Resources (SCR) entering the market in New York’s ‘Mitigated Capacity Zones’ G-J Offer Floor calculations as part of Buyer-Side Mitigation (BSM).

FERC’s Feb. 18 Order excludes CSRP revenues (in addition to DLRP revenues as the Oct. 7 Order did), making it much more feasible for most new SCRs to pass the Offer Floor test and not have to sell into New York’s installed capacity (ICAP) market at a price point that is unlikely to clear.

Customers located in Mitigated Capacity Zones who are new to the NYISO SCR program are now significantly less likely to 1) be subject to Buyer-Side Mitigation (BSM) and 2) be required to offer to sell capacity at or above an offer floor price that may not clear in the market.

Rather than run the risk of being found subject to buyer-side mitigation and have an offer floor applied (that carries with the Resource until it clears in at least 12, not necessarily consecutive, monthly Spot Auctions), DR participants will no longer need to choose between retail and wholesale markets to provide DR.

Resources capable of providing different types of DR services will be able to realize the full value, benefiting both the bulk power and distribution system operations.

The order helps to unlock the full value stack of wholesale and retail demand response values to participating customers. Subsequently, new demand response customers no longer need to choose between retail and wholesale markets in which to provide demand response resources.

What is Buyer-Side Mitigation?

Buyer-Side Mitigation (BSM) helps maintain the New York energy market’s integrity by preventing power providers from exerting market power by offering into the capacity market at an artificially low price.

BSM helps ensure both energy providers and generators are not able to exercise unfair buyer-side market power—a form of monopoly control over a market.

For example, energy providers that receive “out-of-market” payments such as state subsidies could have an unfair advantage over other power providers who do not receive out-of-market payments when it comes to offering in New York’s capacity market since the subsidized resources could offer into the market at a price that is lower than that of unsubsidized resources.

Allowing subsidized resources to offer into the capacity market at an artificially low price would distort the actual cost and the resulting market price of capacity when power providers compete fairly in the free market.

What is the Offer Floor Test?

Without getting overly complicated with details, the Offer Floor test is used to determine if a given resource is either subject to or exempt from Buyer-Side Mitigation.

NYISO defines the Offer Floor Test’s calculation for new SCRs as follows:

The Offer Floor for a Special Case Resource shall be equal to the minimum monthly payment for providing Installed Capacity payable by its Responsible Interface Party, plus the monthly value of any payments or other benefits the Special Case Resource receives from a third party for providing Installed Capacity, or that is received by the Responsible Interface Party (RIP) for the provision of Installed Capacity by the Special Case Resource, except that it shall exclude the monthly value of any payments or other benefits the Special Case Resource receives from a retail-level demand response program designed to address distribution-level reliability needs that the Commission has, on a program-specific basis, determined should be excluded.

A Brief History of Buyer-Side Mitigation and Special Case Resource in New York

The preceding article’s timeline begins in February 2021 with FERC overturning its October 2020 order. Let’s review how the issue has evolved over the previous thirteen years.

Much of the following has been paraphrased from Section II of Docket No. EL16-92-001-NY Public Service Commission v. NY Independent System Operator

Special Case Resources have been subject to NYISO’s Buyer-Side Mitigation since September 2008. In May 2010, FERC approved an Order that excluded certain payments that an SCR may receive from state-regulated, distribution-level demand response programs.

In March 2015, FERC clarified that it did NOT intend to grant an “exemption for all state programs that subsidize demand response” and further explained that a state “may seek an exemption from the Commission [FERC] pursuant to section 206 of the Federal Power Act if it believes that the inclusion in the SCR Offer Floor of rebates and other benefits under a state program interferes with a legitimate state objective.”

On June 24, 2016, the NYSPSC, the New York Power Authority, the Long Island Power Authority, NYSERDA, the City of New York, AEMA, and NRDC filed the Complaint against NYISO, challenging NYISO’s imposition of BSM on SCRs on the grounds that they interfere with legitimate state objectives. The parties requested a blanket exemption from BSM for all SCRs receiving payments pursuant to a “utility-administered distribution-level Demand Response program.”

The parties requested that the Commission approve an exemption for each of the individual utility-administered, distribution-level programs discussed in the Complaint.

On February 3, 2017, FERC ordered a blanket exemption for all new SCRs, explaining that SCRs had no incentive or ability to affect wholesale market rates. FERC also stated that existing SCRs currently subject to mitigation would not be eligible for the exemption, due to the FERC’s “long-standing practice” of not adjusting mitigation measures after a resource enters the market.

On March 6, 2017, Independent Power Producers of New York, Inc. (IPPNY) filed a request for rehearing, arguing that the SCRs, considered in aggregate, could affect wholesale market rates.

In February 2020, FERC issued an Order revoking the blanket exemption granted in the February 2017 Order.17 FERC also ordered the initiation of a “paper hearing” to determine if any specific New York programs to support SCRs should be exempted.

Peter Dotson-Westphalen coordinated AEMA support on the issue of Buyer-Side Mitigation and Special Case Resources following FERC’s February 2020 ruling and coordinated multiple comment filings with staff from NYPSC, NYSERDA, City of New York, NRDC, and Energy Spectrum. He contributed heavily to the drafting work to the joint comments, as well as the testimony of Katherine Hamilton (on behalf of AEMA) in the paper hearing.

Demand Response in PJM 2021

Wild Backstory Aside, House Bill 6 Opens a Door for Energy Efficiency Monetization in Ohio

Ohio House Bill 6 had the kind of year that, if it hadn’t taken place during 2020, might have garnered national headlines and caught the attention of Hollywood.

Before we succumb to the temptation of divulging exploitative details–which include outcries of scandal, bribery, corruption, and racketeering–let’s cover the fundamentals of the bill and what they mean to organizations in the Buckeye State looking to monetize their energy efficiency (EE) projects in 2021 and beyond.

HB 6 was enacted into law on Oct. 19, 2019, and requires all energy efficiency (EE) programs offered by electric utilities in Ohio to end by December 31, 2020.

That utility EE programs are no longer offered in 2021 means any rebate rewards offered by utilities are no longer available to organizations who complete or have completed, EE projects.

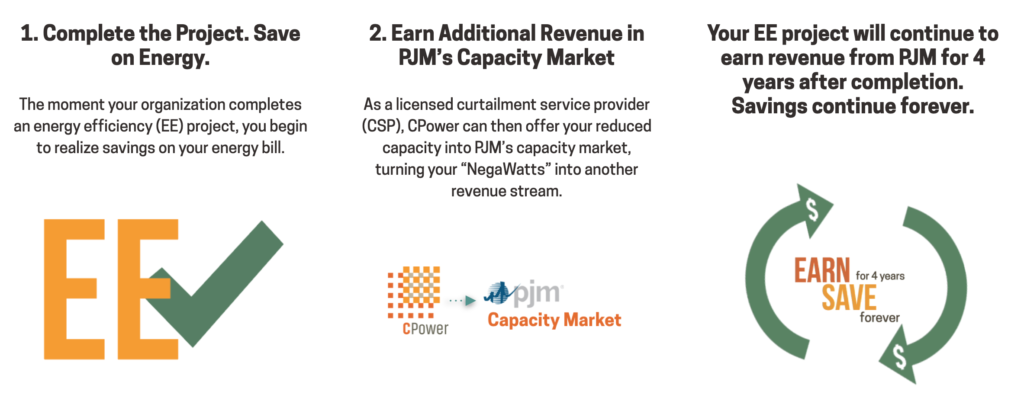

But that DOES NOT mean that organizations and EE project developers in Ohio who help the electric grid by permanently reducing electric demand are shut out from earning revenue for their efforts.

When one door closes…

In Ohio, organizations and EE project developers can, with the help of a licensed curtailment service provider (CSP), offer their permanently reduced demand (“negawatts”) into PJM’s capacity market, the Reliability Pricing Model.

Once the reduced load is accepted into the market, the organization will earn revenue from PJM for four years after the project was completed.

To learn more about monetizing energy efficiency projects in PJM in the wake of Ohio House Bill 6’s enactment, click here.

To learn more about the wild ride House Bill 6 had, Google it and pick from any number of vitriol-laced articles that show up on the first page.

Fun as it may be to shine a light on the mudslinging around HB 6, it’s not our place at The Current to feed the political maelstrom. We’re here to inform, so you can make educated energy management decisions.

That said, you might want to make sure you do your reading on HB 6 indoors and away from the windows. There is a lot of lightning out there right now.

Arizona’s Largest Utility Ramps its Demand Response program to Pursue Carbon-Free Mission

The largest electric utility in Arizona is making strides toward a more sustainable future and it’s clear demand response is part of the plan.

Arizona Public Service (APS) is the owner and operator of the country’s largest producer of carbon-free electricity–the Palo Verde Generating Station.

Currently, the utility generates clean, reliable electricity for 1.3 million homes and businesses in 11 of Arizona’s 15 counties and boasts a current energy fuel mix that is 50 percent clean.

50 percent clean energy in 2021 is impressive enough, but APS CEO Jeff Guldner sees an even cleaner future and has pledged to cease all coal-fired generation in the APS service territory by 2031 and for the utility’s fuel mix to be 100 percent carbon-free by 2050.

To get there, APS plans to call on a generation portfolio that is 45 percent renewable in just nine years.

To help bridge the present and future, APS is counting on its own Peak Solutions demand response program to ensure its grid remains reliable when stressed with heavy electrical demand.

Launched in 2010, the Peak Solutions program engages commercial and industrial customers in voluntary energy conservation measures when demand for energy peaks on APS’s system, particularly during Arizona’s scorching summers.

The program also helps maintain lower-cost power for all customers.

As APS ramps up its drive to a carbon-free future, they’re also ramping up their demand response program and the financial rewards participating commercial and industrial organizations will earn for voluntarily reducing their electricity consumption when the demand on the APS grid is high.

The APS Peak Solutions aims to include participants both small and large evidenced by its minimum load commitment of just 10 kW instead of the more customary 50 kW minimum required by most commercial demand response programs in the US.

By not having any penalties for non-performance, another atypical demand response program parameter, APS is further making Peak Solutions attractive to organizations who have never before participated in demand response.

APS’s CEO Jeff Guldner knows that plans and programs aren’t enough to attain a sustainable future in Arizona. “Achieving and realizing the full benefits of a completely clean energy mix will take partnership,” he said in APS’s published clean energy commitment document, “It’s something for all of us, by all of us.”

To learn more about demand response and the APS Peak Solutions program, click here.