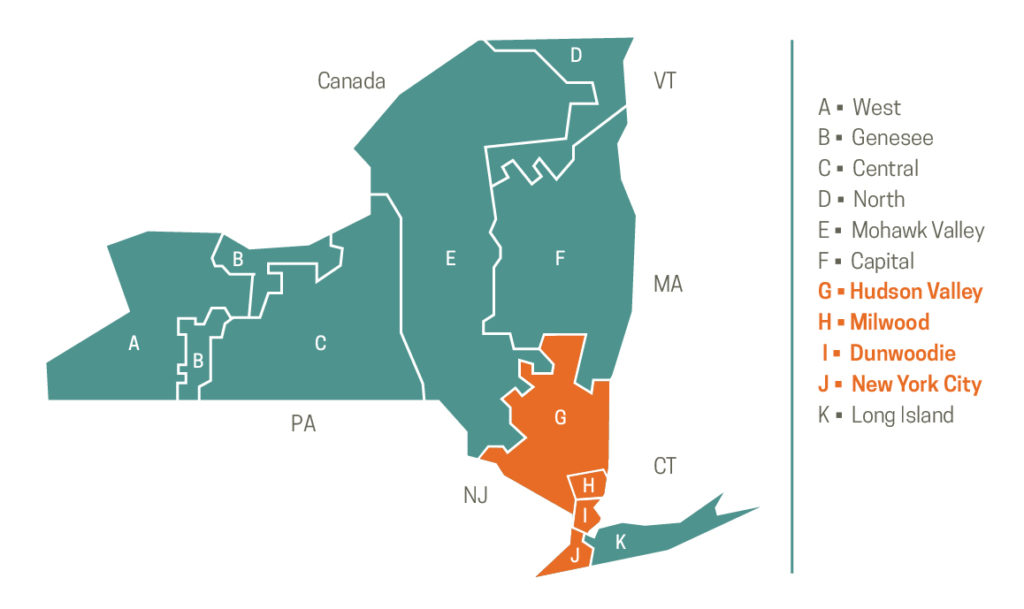

FERC Order Removes Restrictions for Utility Demand Response Resources in New York Zones G-J

Good news on the regulatory front for new demand response resources from New York’s zones G-J entering NYISO’s Installed Capacity Market.

On February 18, 2021, the Federal Energy Regulatory Commission (FERC) issued an Order that overturned a portion of its previously issued Oct. 7, 2020 Order in the paper hearing on whether utility demand response programs Commercial System Relief Program (CSRP) and Distribution Load Relief Program (DLRP) are intended to provide benefits solely to the distribution system (i.e. not for providing similar services to wholesale capacity) and whether the revenues from such programs should be included in new Special Case Resources (SCR) entering the market in New York’s ‘Mitigated Capacity Zones’ G-J Offer Floor calculations as part of Buyer-Side Mitigation (BSM).

FERC’s Feb. 18 Order excludes CSRP revenues (in addition to DLRP revenues as the Oct. 7 Order did), making it much more feasible for most new SCRs to pass the Offer Floor test and not have to sell into New York’s installed capacity (ICAP) market at a price point that is unlikely to clear.

Customers located in Mitigated Capacity Zones who are new to the NYISO SCR program are now significantly less likely to 1) be subject to Buyer-Side Mitigation (BSM) and 2) be required to offer to sell capacity at or above an offer floor price that may not clear in the market.

Rather than run the risk of being found subject to buyer-side mitigation and have an offer floor applied (that carries with the Resource until it clears in at least 12, not necessarily consecutive, monthly Spot Auctions), DR participants will no longer need to choose between retail and wholesale markets to provide DR.

Resources capable of providing different types of DR services will be able to realize the full value, benefiting both the bulk power and distribution system operations.

The order helps to unlock the full value stack of wholesale and retail demand response values to participating customers. Subsequently, new demand response customers no longer need to choose between retail and wholesale markets in which to provide demand response resources.

What is Buyer-Side Mitigation?

Buyer-Side Mitigation (BSM) helps maintain the New York energy market’s integrity by preventing power providers from exerting market power by offering into the capacity market at an artificially low price.

BSM helps ensure both energy providers and generators are not able to exercise unfair buyer-side market power—a form of monopoly control over a market.

For example, energy providers that receive “out-of-market” payments such as state subsidies could have an unfair advantage over other power providers who do not receive out-of-market payments when it comes to offering in New York’s capacity market since the subsidized resources could offer into the market at a price that is lower than that of unsubsidized resources.

Allowing subsidized resources to offer into the capacity market at an artificially low price would distort the actual cost and the resulting market price of capacity when power providers compete fairly in the free market.

What is the Offer Floor Test?

Without getting overly complicated with details, the Offer Floor test is used to determine if a given resource is either subject to or exempt from Buyer-Side Mitigation.

NYISO defines the Offer Floor Test’s calculation for new SCRs as follows:

The Offer Floor for a Special Case Resource shall be equal to the minimum monthly payment for providing Installed Capacity payable by its Responsible Interface Party, plus the monthly value of any payments or other benefits the Special Case Resource receives from a third party for providing Installed Capacity, or that is received by the Responsible Interface Party (RIP) for the provision of Installed Capacity by the Special Case Resource, except that it shall exclude the monthly value of any payments or other benefits the Special Case Resource receives from a retail-level demand response program designed to address distribution-level reliability needs that the Commission has, on a program-specific basis, determined should be excluded.

A Brief History of Buyer-Side Mitigation and Special Case Resource in New York

The preceding article’s timeline begins in February 2021 with FERC overturning its October 2020 order. Let’s review how the issue has evolved over the previous thirteen years.

Much of the following has been paraphrased from Section II of Docket No. EL16-92-001-NY Public Service Commission v. NY Independent System Operator

Special Case Resources have been subject to NYISO’s Buyer-Side Mitigation since September 2008. In May 2010, FERC approved an Order that excluded certain payments that an SCR may receive from state-regulated, distribution-level demand response programs.

In March 2015, FERC clarified that it did NOT intend to grant an “exemption for all state programs that subsidize demand response” and further explained that a state “may seek an exemption from the Commission [FERC] pursuant to section 206 of the Federal Power Act if it believes that the inclusion in the SCR Offer Floor of rebates and other benefits under a state program interferes with a legitimate state objective.”

On June 24, 2016, the NYSPSC, the New York Power Authority, the Long Island Power Authority, NYSERDA, the City of New York, AEMA, and NRDC filed the Complaint against NYISO, challenging NYISO’s imposition of BSM on SCRs on the grounds that they interfere with legitimate state objectives. The parties requested a blanket exemption from BSM for all SCRs receiving payments pursuant to a “utility-administered distribution-level Demand Response program.”

The parties requested that the Commission approve an exemption for each of the individual utility-administered, distribution-level programs discussed in the Complaint.

On February 3, 2017, FERC ordered a blanket exemption for all new SCRs, explaining that SCRs had no incentive or ability to affect wholesale market rates. FERC also stated that existing SCRs currently subject to mitigation would not be eligible for the exemption, due to the FERC’s “long-standing practice” of not adjusting mitigation measures after a resource enters the market.

On March 6, 2017, Independent Power Producers of New York, Inc. (IPPNY) filed a request for rehearing, arguing that the SCRs, considered in aggregate, could affect wholesale market rates.

In February 2020, FERC issued an Order revoking the blanket exemption granted in the February 2017 Order.17 FERC also ordered the initiation of a “paper hearing” to determine if any specific New York programs to support SCRs should be exempted.

Peter Dotson-Westphalen coordinated AEMA support on the issue of Buyer-Side Mitigation and Special Case Resources following FERC’s February 2020 ruling and coordinated multiple comment filings with staff from NYPSC, NYSERDA, City of New York, NRDC, and Energy Spectrum. He contributed heavily to the drafting work to the joint comments, as well as the testimony of Katherine Hamilton (on behalf of AEMA) in the paper hearing.