Will Prices Rise With The Temperature In Texas This Summer?

As we discussed in our recent blog post about this summer’s potential “perfect Texas storm,” two significant factors projected for the ERCOT (Electric Reliability Council of Texas) energy market could have a noticeable impact on demand response participants: Reduced supply and record peak demand. The resulting clash of supply and demand projections points to the possibility of unexpectedly high prices for those organizations participating in ERCOT’s Load Resources (LR) demand response program.

As we noted last November, ERCOT approved the retiring of three coal-fired generation plants, reducing available generation capacity by about 4,200 MW. In its Final Summer 2018 Seasonal Assessment of Resource Adequacy(SARA), ERCOT projects the Summer 2018 total generation capacity available to be 78,184 MWs, resulting in a capacity reserve margin of roughly 11%. That’s well below its capacity reserve margin target of 13.75% of peak electricity demand.

In a slow economy, reduced supply might not be a problem. But that’s not the case in Texas. The economy is booming in the Lone Star State—in fact, it’s currently the fastest growing economy in the nation. That’s good news for Texans, but not-so-good news for Texans looking forward to a summer of uninterrupted electric supply and the state’s historically low energy prices.

Here’s why. ERCOT predicts “record-breaking peak demand usage” for this summer—72,756 MW. According to the SARA report, that’s more than 1,600 MWs higher than the all-time peak demand record of 71,110 MW set in August 2016.

ERCOT recognizes that this tight margin—a mere 5,428 MWs—might be cutting it too close for comfort. With an eye to grid reliability, it says it could find it necessary to deploy Ancillary Services—Load Response, or LR—and Emergency Response Service (ERS) demand response capacity “to maintain sufficient operating reserves.”

The law of supply and demand usually looks something like this:

Low supply + High demand = High prices

With that in mind, will we see record high prices this summer? The forward ERCOT energy market certainly seems to think so. Projected wholesale energy prices in ERCOT for August 2018 have more than doubled since the 4,200 MWs of generation announced it planned to retire in early 2018.

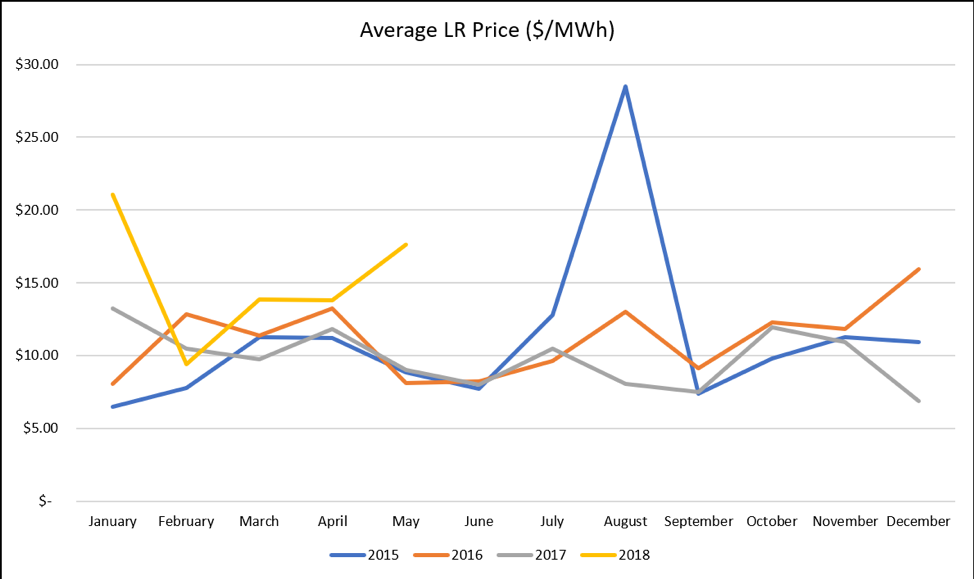

While the price customers receive for participating in LR is different than the energy price they pay when using energy, there is generally a correlation in that when energy prices rise in ERCOT, LR prices also rise. This is due to the structure of the ERCOT market where lower reserves available typically results in higher energy and LR prices.

As we’ve laid out above, we can expect lower reserves available in ERCOT this summer and therefore higher energy prices than we have historically seen.

While it remains to be seen if this summer will ultimately result in record high LR prices, we can already see in the above chart that there has been an increase in LR prices since the 4,200 MWs of generation retired in early 2018. Will this trend continue? That largely depends on the weather and generation availability this summer, but a great way to offset the increase in energy prices is through participation in LR which allows you to proactively gain revenue from your energy usage.

Join CPower on Tuesday, June 26, for the third in our ERCOT Webinar Series, “The Perfect Texas Storm: Low Reserves, High Prices, and Record Peak Demand for Summer 2018.” Join CPower’s Texas experts Mike Hourihan and Joe Hayden as they tackle the topics that will impact demand response customers this summer.

The webinar is free and now open for registration.

“The Perfect Texas Storm: Low Reserves, High Prices, and Record Peak Demand for Summer 2018”

Date: June 26, 2018

Time: 10:00-11:00 a.m. Central Time