Will Prices Rise With The Temperature In Texas This Summer?

As we discussed in our recent blog post about this summer’s potential “perfect Texas storm,” two significant factors projected for the ERCOT (Electric Reliability Council of Texas) energy market could have a noticeable impact on demand response participants: Reduced supply and record peak demand. The resulting clash of supply and demand projections points to the possibility of unexpectedly high prices for those organizations participating in ERCOT’s Load Resources (LR) demand response program.

As we noted last November, ERCOT approved the retiring of three coal-fired generation plants, reducing available generation capacity by about 4,200 MW. In its Final Summer 2018 Seasonal Assessment of Resource Adequacy(SARA), ERCOT projects the Summer 2018 total generation capacity available to be 78,184 MWs, resulting in a capacity reserve margin of roughly 11%. That’s well below its capacity reserve margin target of 13.75% of peak electricity demand.

In a slow economy, reduced supply might not be a problem. But that’s not the case in Texas. The economy is booming in the Lone Star State—in fact, it’s currently the fastest growing economy in the nation. That’s good news for Texans, but not-so-good news for Texans looking forward to a summer of uninterrupted electric supply and the state’s historically low energy prices.

Here’s why. ERCOT predicts “record-breaking peak demand usage” for this summer—72,756 MW. According to the SARA report, that’s more than 1,600 MWs higher than the all-time peak demand record of 71,110 MW set in August 2016.

ERCOT recognizes that this tight margin—a mere 5,428 MWs—might be cutting it too close for comfort. With an eye to grid reliability, it says it could find it necessary to deploy Ancillary Services—Load Response, or LR—and Emergency Response Service (ERS) demand response capacity “to maintain sufficient operating reserves.”

The law of supply and demand usually looks something like this:

Low supply + High demand = High prices

With that in mind, will we see record high prices this summer? The forward ERCOT energy market certainly seems to think so. Projected wholesale energy prices in ERCOT for August 2018 have more than doubled since the 4,200 MWs of generation announced it planned to retire in early 2018.

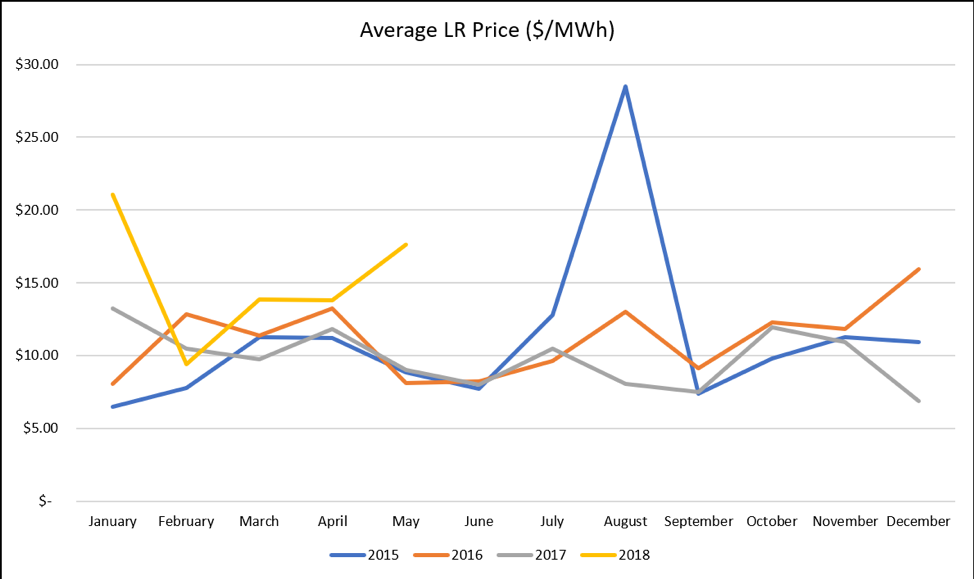

While the price customers receive for participating in LR is different than the energy price they pay when using energy, there is generally a correlation in that when energy prices rise in ERCOT, LR prices also rise. This is due to the structure of the ERCOT market where lower reserves available typically results in higher energy and LR prices.

As we’ve laid out above, we can expect lower reserves available in ERCOT this summer and therefore higher energy prices than we have historically seen.

While it remains to be seen if this summer will ultimately result in record high LR prices, we can already see in the above chart that there has been an increase in LR prices since the 4,200 MWs of generation retired in early 2018. Will this trend continue? That largely depends on the weather and generation availability this summer, but a great way to offset the increase in energy prices is through participation in LR which allows you to proactively gain revenue from your energy usage.

Join CPower on Tuesday, June 26, for the third in our ERCOT Webinar Series, “The Perfect Texas Storm: Low Reserves, High Prices, and Record Peak Demand for Summer 2018.” Join CPower’s Texas experts Mike Hourihan and Joe Hayden as they tackle the topics that will impact demand response customers this summer.

The webinar is free and now open for registration.

“The Perfect Texas Storm: Low Reserves, High Prices, and Record Peak Demand for Summer 2018”

Date: June 26, 2018

Time: 10:00-11:00 a.m. Central Time

Are You Ready For This Summer’s Perfect Texas Storm?

In October 1991, Hurricane Grace formed near Bermuda and began moving north. At the same time, a massive low-pressure system moved south from Canada. They converged in the North Atlantic, creating a deadly, cataclysmic weather event that was dubbed “the perfect storm,” later immortalized in the film of that name starring George Clooney.

No such weather event (or related George Clooney appearance) is currently predicted for Texas this summer. However, two significant man-made forces are currently converging in the ERCOT (Electric Reliability Council of Texas) energy market: Reduced supply and projected record peak demand. The resulting “perfect storm, Lone Star-style” of clashing supply and peak demand projections has led ERCOT to ask those involved in demand response (as well as generators and transmission owners) to focus on maximizing performance.

Let’s take a look at these two big factors impacting ERCOT this summer. First, supply. In Texas, the name of the game is reliability. To ensure a reliable grid, ERCOT prefers to maintain a capacity reserve margin target of 13.75% of peak electricity demand. These reserves enable them to serve electricity needs in case of unexpectedly high demand or levels of unanticipated outages from generation plants.

As we noted last November, ERCOT approved the retiring of three coal-fired generation plants, reducing available capacity reserves by about 4,200 MW. In its Final Summer 2018 Seasonal Assessment of Resource Adequacy (SARA), ERCOT projects total summer capacity to be 78,184 MWs, and the Summer 2018 planning reserve capacity to be 5,428 MWs, or roughly 11% reserve margin. That’s well below its capacity reserve margin target of 13.75% for peak electricity demand.

Second, demand. Texas currently boasts the nation’s fastest growing economy. Its growth is driven, as Forbes reported in May, by a resurgence in oil and gas drilling in the panhandle as well as growth in manufacturing that outpaced national growth rates in that sector. ERCOT’s SARA report acknowledges that this growing economy will continue to drive demand for electrical power, going as high as 84,814 MWs by 2023.

In fact, ERCOT predicts “record-breaking peak demand usage” for this summer—72,756 MWs. According to the SARA report, that’s more than 1,600 MWs higher than the all-time peak demand record of 71,110 MW set in August 2016.

So—72,756 MWs of demand. 78,184 MWs of capacity, 5,428 MWs of reserve planning capacity… frankly, that’s cutting it pretty close. Maybe tooclose. In fact, ERCOT thinks these tight reserves could trigger the need to deploy Emergency Response Service (ERS) demand response capacity, “to maintain sufficient operating reserves.”

If this happens, it increases the potentialforreal-time emergency events in order to maintain the grid’s reliability. How does this affect ERS participants?

ERS pays organizations like yours for using less energy when the grid is stressed and electricity prices are high. There are two types of ERS programs: ERS 10 and ERS 30, which pay businesses for being available to curtail their electricity load within 10 and 30 minutes respectively. The request to curtail is a referred to as a “called event”.

In the aftermath of the SARA report’s release, our ERCOT office heard from a number of customers who were concerned about the potential for real-time extended events. They feared disruptions to operations and the potential negative impact these disruptions could have on their customers and their bottom line. But how likely are we to see calls to curtail in ERS?

Looking at historical data, not very likely. Called events in ERS are rare. Between 2008 and 2017, a total of three events have been called. In the last eight years, we have seen no events at all. Over the past ten years, capacity shortage events above and beyond annual tests have averaged 0.3 per year in ERS 10, and 0.2 per year in ERS 30. As far as frequency goes, over the last 10 years the most that the ERS program has seen in one year is… two.

Based on the numbers, then, the odds are good that you won’t have to endure many, if any, curtailment requests. We’re confident that you should still be able to participate as in years past, and continue to earn revenue for your availability.

That said, CPower recommends the following steps to maximize your performance in ERS this summer.

Check your plan. Businesses and organizations change, expand, contract, evolve, and are seldom the same year over year. The curtailment plan you first developed with CPower’s engineers may no longer be the best fit for your current electricity usage and operations. Contact CPower and set up a review of your plan. An up-to-date curtailment plan is the best path to success in demand response. (You may even find some additional kWs to enroll that weren’t there before.)

Automate your DR. Automation is required for ERS 10 participation, but it’s still optional in ERS 30. Having even one or two steps on your curtailment process automated can make the difference between performing and underperforming. Make sure you discuss automation opportunities, including incorporating CPower’s Link API, when you review your curtailment plan.

Test your generators—at full load. If you’re counting on your back-up generators to provide you with needed energy during your curtailment events, make sure they can handle the load. Too many generators undergo their monthly and weekly test running off load, for fear of wearing their generators out. The problem is, generators are designed to run at their stated rating, every time. In fact, testing at less than full load can ruin an engine in as little as 50 hours of accumulated running time. Ask CPower’s engineers to review your current onsite generation process as part of your curtailment plan review.

While you’re at it, set up some time to assess your generators for enrollment in demand response. Properly permitted, onsite generation is source of additional revenue. Talk with CPower about your options.

CPower is here to help you through what could be a long, hot summer in the Lone Star State. ERCOT expects everyone, including demand response participants, to give the grid maximized performance for the benefit of all. CPower is here to help you do just that.

Join CPower on Tuesday, June 26, for the third in our ERCOT Webinar Series, “The Perfect Texas Storm: Low Reserves, High Prices, and Record Peak Demand for Summer 2018.” Join CPower’s Texas experts Mike Hourihan and Joe Hayden as they tackle the topics that will impact demand response customers this summer.

The webinar is free and now open for registration.

“The Perfect Texas Storm: Low Reserves, High Prices, and Record Peak Demand for Summer 2018”

Date: June 26, 2018

Time: 10:00-11:00 a.m. Central Time

Green Buildings Attract Happy Tenants and Bring Green Earnings to the Commercial Real Estate Industry

The following is an excerpt from “Monetizing Energy Assets in the Commercial Real Estate Industry: A Complete Guide for Earning Revenue with demand-side energy management” by CPower:

For the past several years, the economic and policy climate of North America has created an impetus for green and sustainable energy-efficient buildings. The commercial real estate (CRE) industry has contributed to this momentum.

Keeping the supreme goal of providing a great tenant experience at the forefront of their operations, commercial real estate facility managers and executives are increasing their focus on energy management plans rooted in a sustainable building philosophy based on cost-effectiveness and energy-optimization.

The CRE industry’s current push toward a more efficient and sustainable future comes at a serendipitous time when energy markets around the country are working to integrate distributed energy resources (DERs) onto their energy grids in an attempt to diversify their fuel mixes.

Right now and for the foreseeable future, grid operators and electric utilities in each of the nation’s six deregulated energy markets have created a wealth of incentive programs to encourage commercial and industrial organizations to help integrate their grids with distributed energy.

CRE organizations with distributed resources at their facilities like backup generators, solar photovoltaic cells, fuel cells, energy storage and more are therefore in a position to reap significant financial benefits by working with a properly licensed company that can help them monetize their existing energy assets.

The Importance of Tenant Experience

No two commercial buildings are alike and every commercial real estate organization is unique. One trait CRE organization’s share, however, is the unwavering desire to provide a great experience for their tenants.

More and more commercial real estate companies are realizing that sound demand-side energy management–the practice of modifying consumer demand for energy–can play an integral part in providing a great tenant experience.

Without satisfied tenants, of course, the CRE industry wouldn’t exist. That’s why every measure a CRE organization explores concerning energy management should be examined through the tenant-experience lens.

Demand for Green Buildings

Utility costs related to energy, water, and waste have a significant impact on a CRE organization’s profits. For decades, CRE organizations have sought to reduce these impacts by making their buildings more efficient and (if at all possible) environmentally friendly.

Green buildings–those which are environmentally responsible and resource-efficient–are estimated to consume 30-50% less energy than non-green buildings. Green buildings also use an average of 40% less water, emit 30-40% less carbon-dioxide, and produce 70% less solid waste.

Green Buildings, Happy Tenants

In the last several years, CRE organizations across North America have recognized the direct correlation between green buildings and tenant attraction.

The increasing popularity of green leases, which include an up-front establishment of sustainability goals and allocation of implementation responsibilities between the owner and the tenant, is proof that the notion of sustainability is a value shared between CRE organizations and the tenants they serve.

Since the Great Recession, many tenants’ business performance has been and continues to be evaluated by customers and investors looking at aspects beyond the strictly-financial. Tenants want to tell the story of their operating in a green building that actively pursues sustainability efforts with a positive effect on the community and the environment.

CRE organizations who oblige will not only provide a superior tenant experience, they’ll also be in a position to monetize their efforts through demand-side energy management.

Energy Assets in the CRE Industry

CRE Organizations that have made their buildings more energy efficient–whether by lighting upgrades, HVAC improvement, or any other measure, may be eligible to earn money for the permanent reduction of their electric demand.

They may already possess energy assets like back-up generators, energy storage, solar generation, and more that can also earn revenue through demand-side energy management.

Getting started

When selecting a company to guide your demand-side energy management, it’s important to consider the company’s scope of demand-side expertise. Do they serve the markets where your properties reside? Does the company specialize in one type of demand-side energy management, or is it equally skilled in a wide range of energy asset monetization practices?

Most importantly, a demand-side energy management partner should earn your trust in every aspect of the relationship your organizations share.

Demand-side energy management is not a one-size-fits-all exercise. No two buildings are alike and every CRE organization is unique in its complexities.

Like your business, your demand-side energy management strategy should evolve and refine over time, forever in pursuit of perfection as energy markets continue to change and your needs as an organization evolve.

Visit https://cpowerenergy.com/commercial-reit-lp to learn more about CPower’s extensive experience in the commercial real estate industry, including how Tishman Speyer Commercial Real Estate earned more than $1.4 million through demand-side management with CPower as their guide.

To read the entirety of “Monetizing Energy Assets in the Commercial Real Estate Industry: A Complete Guide for Earning Revenue with demand-side energy management” click HERE.

White Paper: Leveraging Your Generation Assets To Generate Revenue

ERCOT’s Capacity Reserve is Dropping. Here’s What Your Business Should Know.

The Electric Reliability Council of Texas (ERCOT) and independent market analysts agree on at least one thing: there will be about 4,200 MW less fossil fuel capacity in the Lone Star State in 2018, a decrease that can be attributed to the approved retiring of three coal-fired generation plants–Monticello, Sandow, and Big Brown.

Exactly how the decreased capacity reserves will affect the Texas market is less agreeable, at least for now.

ERCOT maintains a capacity reserve margin target of 13.75% of peak electricity demand so the grid operator may serve electric needs in the case of unexpectedly high demand or levels of generation plant outages.

Analysts like Potomac Economics, an independent market monitor for ERCOT, predict the retiring generation plants in Texas will lead to the grid’s capacity reserves dipping below ERCOT’s margin target.

Potomac’s prediction is at odds with ERCOT’s official forecast for capacity reserves in 2018, at least now.

Last May, ERCOT released its bi-yearly Capacity, Demand, and Reserves (CDR) Report, which projected the grid’s reserve margins to be above 18% until 2022 when the margin falls to 16.8%. The report, however, was published several months before the recently announced coal retirements.

After doing the math and subtracting the capacity associated with the retiring units from the 2017 CDR report’s forecast, a breach of ERCOT’s target reserve margin seems possible.

So ERCOT’s capacity reserve may drop below the 13.75% target. What does that mean?

We’ll likely learn the official answer in mid-December 2017 when ERCOT releases an updated CDR report to address what the loss of capacity from retired generation plants will mean to the grid.

Until then, we can make a few educated guesses on how the Texas market will react to decreased capacity based on the market’s recent history.

In the last 10 years, ERCOT’s reserve margin projections have dropped to single digits 10 times, reaching a recent low of 5.8% in 2012. The market has repeatedly bounced back from low projections. It’s worth noting, however, what happens when ERCOT’s capacity reserves actually fall below the grid operator’s target reserve margin.

That last happened in 2011, which was also the last time ERCOT’s scarcity pricing mechanism was triggered.

Scarcity pricing introduces a price floor and price cap to the market when an electricity supply emergency causes concerns of forced power cuts (called emergency load shedding) throughout Texas. When ERCOT’s reserves hit 2,000 MW as they last did in 2011, scarcity pricing sets an automatic cap at $9,000 per MWh.

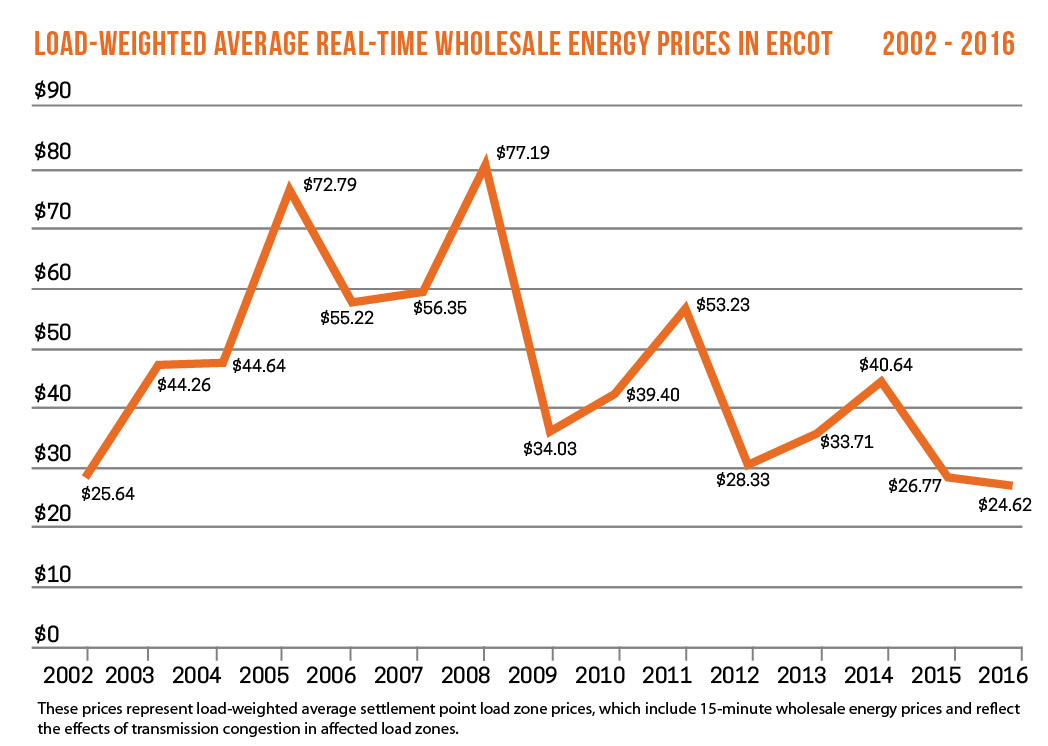

Now let’s analyze who benefits from scarcity pricing. The short answer is generators. In an energy-only market like Texas, generators make money when the price of electricity spikes. Over the last several years, demand for electricity in Texas has set numerous peak load records, including new monthly highs in July and August 2017.

Power prices in Texas, however, have remained relatively stable. In fact, ERCOT reported that 2016 saw average wholesale prices in its real-time market hit an all-time low (see chart below). Increased wind production, which accounted for less than 1% of ERCOT’s power in 2003 rose to 15% in 2016, continues to put downward pressure on prices, as does cheap natural gas supply.

The drop in capacity reserve in 2018 may lead to the kind of price spikes that generators have been waiting for, but generators will not be the only beneficiaries if wholesale prices see a significant rise.

If triggered, scarcity prices will be translated into ERCOT’s day-ahead ancillary services capacity procurements. That could mean financial opportunity for businesses who participate in ERCOT’s Load Resource demand response program, which pays businesses to be on call to curtail their energy use on short notice when the grid is stressed or electricity prices are exceptionally high.

Load Resource, ERCOT’s go-to ancillary service demand response program, already has the potential to pay businesses 2-3 times more than reliability-based demand response programs in Texas like the Emergency Response Service (ERS) program.

If scarcity pricing triggers in 2018, that potential payoff may be a lot bigger in Texas.

Part 1, “ERCOT Fundamentals: DR 101,” introduces you to DR in ERCOT and covers topics ranging from market structure to participating with automation and emergency generators.

Part 2, “Strategies for Maximized Results,” takes your DR knowledge to the next level and shares some important out-of-the-box methods for maximizing your value.

Both webinars are FREE and now open for registration.

ERCOT DR

What ERCOT’s Seasonal Demand Predictions Mean for Demand Response in Texas this Summer

ERCOT is ready to meet summer demand.

On May 3, 2016, ERCOT released seasonal and 10-year outlooks that anticipate adequate generation capacity for upcoming electricity demands in Texas. According to the ERCOT’s Director of System Planning, Warren Lasher, the ISO expects to have ample generation to serve its customer’s needs this summer. “However,” according to Mr. Lasher, “hotter-than-normal weather combined with low-wind conditions or high generation outage rates could cause operating reserves to drop below target levels, making it necessary to take additional actions to maintain grid reliability.”

ERCOT is not expected to see any significant pricing fluctuations this summer.

Response Reserve Service (RRS) pricing, determined by the Day-Ahead Market, has the potential for price spikes. However, such spikes seem unlikely given the low natural gas prices and high wind generation capacity working to suppress current clearing prices set by power generators.

An event like the one mentioned in the ERCOT’s press release could lead to a price spike in the Day-Ahead or Real-Time Markets. Such an event could also trigger emergency operational procedures, potentially resulting in the dispatch of Load Resources or Emergency Reserve Service. However, unless we realize more formidable weather conditions, we can expect prices to remain where they are this summer.

Localized dispatch of Load Resources (LR) is a possibility in certain ERCOT regions.

Last fall ERCOT called a LR event in the Rio Grande Valley due to congestion in the region. While there is no cause to anticipate a similar event being called this summer, the region could be one that experiences the kind of “hotter than normal” weather the ISO has warned of and should be on alert for dispatch.

ERCOT has made a change to how they procure Ancillary Services that will affect the summer season.

ERCOT has made a change to how they procure the RRS Ancillary Service. They have removed the Reserve Discount Factor, which served to reduce a generator’s available capacity during periods of likely higher temperatures across the grid, from the calculation. Instead, ERCOT will now procure an additional 200 MW of RRS during Hours Ending 15-18 during July and August of 2016 only.

To find out more about what you can do to prepare for the summer season in ERCOT, contact Peter or anyone on CPower’s ERCOT team.