The Push for Renewables in New York

One of the Reforming Energy Vision’s primary goals includes renewable sources generating 70% of the state’s electricity by 2030. To do that, the New York grid seeks to implement distributed energy resources into its fuel mix.

How might New York’s energy market be redesigned to incorporate DERs like solar, energy storage, and others?

NYISO’s proposed changes meet opposition

In 2018, the NYISO proposed changes to the ICAP Capacity Market for how long a resource must be able to run to be eligible to be paid the full value of capacity.

Using the results of a study on energy-limited resources by GE Consulting (GE), the NYISO initially proposed that resources would need to be able to run for 8-hours in order to obtain full capacity value. The NYSIO then proposed it would allow resources that can perform for shorter durations to be paid a fractional portion of the capacity value as follows:

8-hrs=100%

6-hrs = 75%

4-hrs = 50%,

2-hrs =25%

A group of demand response and energy storage providers, including CPower, challenged the GE study’s findings.

A formal review of the GE study by Astrapé Consulting revealed “several flaws in the assumptions and methodology that influenced the study results to show a decreased capacity value for shorter-duration resources than would likely be expected.”

Skepticism of the GE study’s results quickly spread among key New York energy stakeholders, including DR providers, energy storage developers, C&I customers, environmental groups and various trade associations.

These stakeholders submitted a joint letter to the NYISO executive team and board of directors requesting “all market design changes relating to the GE Study results (including any changes to the SCR program) be removed from the DER Roadmap.”

So where does that leave New York?

Potential changes in the New York Energy Market

While there is an ongoing debate about the future of New York’s capacity market, there are no major regulations or market design changes yet announced to take effect in 2019. That could change pending the outcome of an April vote (more than a month away as of this writing) among New York’s energy stakeholders.

That means, for example, the Special Case Resource (SCR) demand response program will continue to operate under its current parameters, including a four-hour duration requirement.

As far as the DER wholesale market goes, New York is in wait-and-see mode. DERs, especially battery storage, and renewable energy sources are a key component of the REV’s drive toward New York’s energy future.

New York, like several other US energy markets, is faced with the question of how to value distributed energy resources in its marketplace.

The question of DER valuation is being debated by the NYISO and various energy stakeholders in the state. As of this writing, there is no definitive timetable for when the debate will conclude and regulations for DER valuation will be enacted.

Energy Storage

New York has taken its place alongside California, New Jersey, and Massachusetts as a first-mover in establishing energy storage targets.

In June 2018, Governor Cuomo announced an energy storage roadmap that set New York’s storage target for 1,500 MW by 2025. According to the roadmap, that ambitious goal could elevate to 3,000 MW by 2030.

At the state level, New York has recognized the need to fund storage projects instead of subsidizing them. Last June, Governor Cuomo committed $200 million from the New York Green Bank to fund storage investments that will help integrate renewable energy onto New York’s grid.

Funding opportunities for storage abound with plenty of state money being made available for storage development.

But without certainty on the wholesale market side and established rules concerning dual participation between markets, meeting the state’s ambitious storage goals will continue to have its challenges.

The key energy players in New York will need to resolve these issues before any substantial investment from the private sector will take a position on energy storage. The NYISO is targeting April 17, 2019, for a vote on market design to accommodate DER integration into its wholesale markets.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

New York City: high capacity prices, many demand-side energy management options

When it comes to capacity prices in New York state, the story changes depending on the geographic region.

Capacity prices are historically low right now in upstate New York but increase through the Lower Hudson Valley toward New York City, due to transmission constraints.

The announced retirement of Indian Point nuclear facility scheduled for 2020 and 2021 leaves New York with 2,000 MW to be replaced just outside of New York City.

NYISO points to new natural gas generation and other renewable generation scheduled to come online as reasons for Indian Point’s retirement. Still, capacity prices in New York City heading into Summer 2019 are comparatively high compared with the rest of the state.

Where there are high capacity prices, there are opportunities to earn revenue for wisely using energy.

Many of these opportunities exist at both the utility and NYISO level.

Con Ed’s Demand Management Program (DMP)

Con Ed provides financial incentives for organizations that help the grid lower its peak demand on New York’s hottest days.

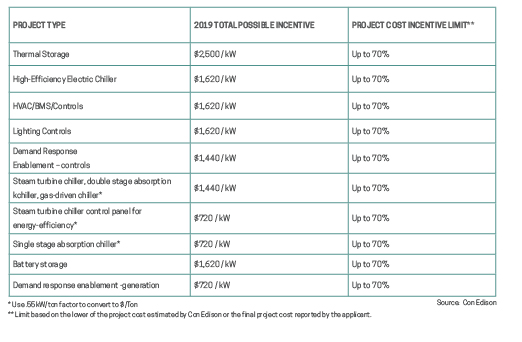

The DMP is a rebate-based program that rewards Con Edison and New York Power Authority (NYPA) customers in New York City and Westchester for installing energy-saving technologies, thereby permanently reducing their overall demand.

Eligible projects include:

Demand Response in New York

In 2016, several New York Utilities began offering two new demand response programs in conjunction with the REV:

- Commercial System Relief Program (CSRP)

- Distribution Load Relief Program (DLRP)

ConEd has been offering CSRP and DLRP since 2009/2010. The programs will continue to run in 2019.

NYISO’s Special Case Resource (SCR) program, the longest running demand response program in NY, will also run in 2019 along with NYISO’s economic programs: the Day-Ahead Demand Response Program (DADRP) and the Demand-Side Ancillary Services Program (DSASP)

Currently, there are 17 demand response programs being offered to commercial and Industrial organizations in New York. That number may change in 2019/20 as several New York Utilities consider removing DLRP or CSRP.

Natural Gas Demand Response

Con Ed is poised to continue leading New York utilities’ push for demand response.

Building on its 20-year experience administering DR programs, the utility is exploring ways to use natural gas demand response as a “non-pipe solution” to alleviate potential grid stress brought on by growing natural gas demand and pipeline constraints into New York City.

Con Ed’s natural gas DR program is currently in pilot phase. If successful, expect other New York utilities adopt it into similar programs of their own where gas pipeline constraints exist.

Non-Wires Solutions

Non-wires solutions (NWS) are investments in the electric utility system that can defer or replace altogether the need for specific transmission and/or distribution projects.

NWS help to provide a cost-effective reduction of transmission congestion or distribution system constraints at times of peak demand.

New York is looking to implement several non-wires solutions, including fast-acting demand response with dispatch notices as short as five minutes and curtailment durations that last as long as 12 hours.

Organizations wishing to participate in such programs will likely need to accommodate the short dispatch notice with technology that facilitates automated DR.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

2019 State of Demand-Side Energy Management in North America

The 2019 State of Demand-Side Energy Management in North America is a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

Green Buildings Attract Happy Tenants and Bring Green Earnings to the Commercial Real Estate Industry

The following is an excerpt from “Monetizing Energy Assets in the Commercial Real Estate Industry: A Complete Guide for Earning Revenue with demand-side energy management” by CPower:

For the past several years, the economic and policy climate of North America has created an impetus for green and sustainable energy-efficient buildings. The commercial real estate (CRE) industry has contributed to this momentum.

Keeping the supreme goal of providing a great tenant experience at the forefront of their operations, commercial real estate facility managers and executives are increasing their focus on energy management plans rooted in a sustainable building philosophy based on cost-effectiveness and energy-optimization.

The CRE industry’s current push toward a more efficient and sustainable future comes at a serendipitous time when energy markets around the country are working to integrate distributed energy resources (DERs) onto their energy grids in an attempt to diversify their fuel mixes.

Right now and for the foreseeable future, grid operators and electric utilities in each of the nation’s six deregulated energy markets have created a wealth of incentive programs to encourage commercial and industrial organizations to help integrate their grids with distributed energy.

CRE organizations with distributed resources at their facilities like backup generators, solar photovoltaic cells, fuel cells, energy storage and more are therefore in a position to reap significant financial benefits by working with a properly licensed company that can help them monetize their existing energy assets.

The Importance of Tenant Experience

No two commercial buildings are alike and every commercial real estate organization is unique. One trait CRE organization’s share, however, is the unwavering desire to provide a great experience for their tenants.

More and more commercial real estate companies are realizing that sound demand-side energy management–the practice of modifying consumer demand for energy–can play an integral part in providing a great tenant experience.

Without satisfied tenants, of course, the CRE industry wouldn’t exist. That’s why every measure a CRE organization explores concerning energy management should be examined through the tenant-experience lens.

Demand for Green Buildings

Utility costs related to energy, water, and waste have a significant impact on a CRE organization’s profits. For decades, CRE organizations have sought to reduce these impacts by making their buildings more efficient and (if at all possible) environmentally friendly.

Green buildings–those which are environmentally responsible and resource-efficient–are estimated to consume 30-50% less energy than non-green buildings. Green buildings also use an average of 40% less water, emit 30-40% less carbon-dioxide, and produce 70% less solid waste.

Green Buildings, Happy Tenants

In the last several years, CRE organizations across North America have recognized the direct correlation between green buildings and tenant attraction.

The increasing popularity of green leases, which include an up-front establishment of sustainability goals and allocation of implementation responsibilities between the owner and the tenant, is proof that the notion of sustainability is a value shared between CRE organizations and the tenants they serve.

Since the Great Recession, many tenants’ business performance has been and continues to be evaluated by customers and investors looking at aspects beyond the strictly-financial. Tenants want to tell the story of their operating in a green building that actively pursues sustainability efforts with a positive effect on the community and the environment.

CRE organizations who oblige will not only provide a superior tenant experience, they’ll also be in a position to monetize their efforts through demand-side energy management.

Energy Assets in the CRE Industry

CRE Organizations that have made their buildings more energy efficient–whether by lighting upgrades, HVAC improvement, or any other measure, may be eligible to earn money for the permanent reduction of their electric demand.

They may already possess energy assets like back-up generators, energy storage, solar generation, and more that can also earn revenue through demand-side energy management.

Getting started

When selecting a company to guide your demand-side energy management, it’s important to consider the company’s scope of demand-side expertise. Do they serve the markets where your properties reside? Does the company specialize in one type of demand-side energy management, or is it equally skilled in a wide range of energy asset monetization practices?

Most importantly, a demand-side energy management partner should earn your trust in every aspect of the relationship your organizations share.

Demand-side energy management is not a one-size-fits-all exercise. No two buildings are alike and every CRE organization is unique in its complexities.

Like your business, your demand-side energy management strategy should evolve and refine over time, forever in pursuit of perfection as energy markets continue to change and your needs as an organization evolve.

Visit https://cpowerenergy.com/commercial-reit-lp to learn more about CPower’s extensive experience in the commercial real estate industry, including how Tishman Speyer Commercial Real Estate earned more than $1.4 million through demand-side management with CPower as their guide.

To read the entirety of “Monetizing Energy Assets in the Commercial Real Estate Industry: A Complete Guide for Earning Revenue with demand-side energy management” click HERE.

Tishman Speyer: Improving Tenant Experience through Demand-Side Energy Management

Stand anywhere between Fifth Avenue and the Avenue of the Americas from 48th to 51st Street in Midtown Manhattan and you’re bound to see hundreds of passersby gazing at the iconic sights of Rockefeller Center. If Gregg Fischer is one of them, however, he probably won’t be goggling at the usual tourist highlights—Radio City Music Hall, Christie’s Auction House, the skating rink, or NBC’s broadcast studios. He’ll be heading into one of the center’s ten Art Deco buildings to speak face-to-face with a tenant.

To Gregg, the tenant’s experience is everything.

As the Director of Energy Systems for Tishman Speyer Real Estate, Gregg is personally responsible for managing sixty commercial complexes nationwide. The 8.8 million square feet that comprise Rockefeller Center is just a piece of the more than fifty-million square feet of class-A commercial office space and luxury residential properties Gregg oversees.

“Have you ever seen a circus performer who simultaneously spins ten plates on his feet and arms and head? That’s what I feel like every day of my life,” Gregg says, describing his daily mindset in balancing his company’s needs with those of his tenants. “I make sure all the plates don’t crash.”

For Gregg, every day is filled with minute-by-minute communication with both his tenants and their operation, procurement, and accounting staffs and the departments within Tishman Speyer, from his own team in design and construction to property management as well as the company’s partners and investors.

“The more we innovate on the demand-side, the more the grid, our community, and our tenants win.”

—Gregg Fischer, P.E., Director of Energy Systems, Tishman Speyer Commercial Real Estate

A leading owner, developer, operator and fund manager of first-class real estate worldwide, Tishman Speyer believes sound demand-side energy management—the practice of modifying consumer demand for energy—is crucial to providing a stellar tenant experience. “The more we innovate on the demand-side,” Gregg says, “the more the grid, our community, and our tenants win.”

Gregg is quick to point out the fallacy that Class-A tenants breed Class-A headaches. He would know, since the vast majority of Tishman Speyer’s portfolio consists of Class-A commercial office space that houses high-profile tenants and guests on a daily basis. Informing and educating tenants about the types of demand-side energy management their buildings participate in and the benefit their participation has on the grid, environment, and community helps tenants not only cope with the shifts in energy use but embrace them. “Our tenants spend a lot of time at work,” he says. “The more they learn about our energy management practices the more connected they feel to the building. It makes for a better experience.”

Communication and education are the cornerstones of transparency in the commercial real estate industry. While his preferred method of tenant communication is face-to-face and one-on-one, Gregg also employs a host of mixed media approaches to explain why buildings participate in demand-side programs. “We offer free walking tours of our buildings. We do lobby info-graphic signs. We do elevator screen messages. We even have a tenant smartphone application. Communication is the building block to trust and the key to making [demand-side energy management] work.”

Before Tishman Speyer considers any demand-side energy project, Gregg evaluates the project’s potential for tenant and community disturbance and impact, the potential change the project may bring to the building’s asset value, and other aspects that can affect the project such as leasing and contracts as well as incentive programs.

“CPower has experts in every market to help distill down the key details for our national customers. That’s our job.”

–Michael Mindell, Sr. Account Manager, CPower Demand-Side Energy Management

When it comes to introducing and executing demand-side energy management projects at his company’s properties in New York and elsewhere in the country, Gregg isn’t the only one spinning multiple sets of plates. CPower and its team of energy experts are by his side, juggling platefuls of responsibility and communication to help optimize Tishman Speyer’s tenant experience.

A demand-side energy management company that serves more than 1,300 commercial and industrial organizations nationwide, CPower provides customized solutions that combine demand response, demand management, and distributed energy resources tailored to serve the specific needs of a given organization’s facilities. CPower’s creed centers on the conviction that no two buildings are alike and every organization is unique.

Among CPower’s national team is Michael Mindell, a veteran account executive who’s been involved in the demand response industry since 2001, two years after the New York energy market was deregulated by the Federal Energy Regulatory Commission. Michael serves as the primary contact for Gregg Fischer and coordinates with CPower’s teams in the various energy markets where Tishman Speyer participates in demand-side energy management to help present to Gregg the key information necessary to make informed decisions in a timely manner.

“The energy industry is highly complex,” Michael says. “Each energy market is different in their regulations and ways they operate their programs. CPower has experts in every market, including regulatory advisors and engineers with experience in hundreds of commercial real estate facilities to help distill down the key details for our national customers. That’s our job.”

“CPower does a great job of understanding things for us in a short amount of time. Then they come to the table with ideas and solutions.” Gregg says of the demand-side energy management company. “Michael and his team are an honest sounding board that helps me see things in a fresh and different way. Our relationship is such that they can offer very upfront opinions that make the case for doing something either weaker or stronger.”

That CPower operates in all six of the country’s deregulated energy markets and has extensive knowledge of the programs and regulations associated with each market is a big advantage when the time comes to evaluate demand-side strategies for Tishman Speyer’s buildings. “I don’t have the time to go through the fine print and evaluate each and every program. I rely on CPower for that. Michael and his team do a great job of digesting the details and explaining which programs in which markets we should be participating in and what the various impacts might be.”

In 2017, its first year working with CPower, Tishman Speyer had 34 commercial properties participating in demand-side programs in two energy markets: New York, where 25% of the company’s global portfolio resides and PJM, home of the world’s largest wholesale energy market. Through demand response programs, which pay organizations for using less energy when the grid is stressed, Tishman Speyer earned nearly $1 million in curtailment revenue during its first year while earnings in PJM approached $400,000.

In 2018, Tishman Speyer will expand its demand-side energy management participation to include the New England market. For Gregg Fischer, the expansion is about more than improving his company’s bottom line. “It’s my responsibility and Tishman Speyer’s responsibility to leverage the benefits of our demand-side energy management into an experience that tenants, visitors, and guests have never seen before.”

To Tishman Speyer, it’s all about the tenant experience.

White Paper: Leveraging Your Generation Assets To Generate Revenue

NY CSRP NGRID

National Grid NY Demand Response

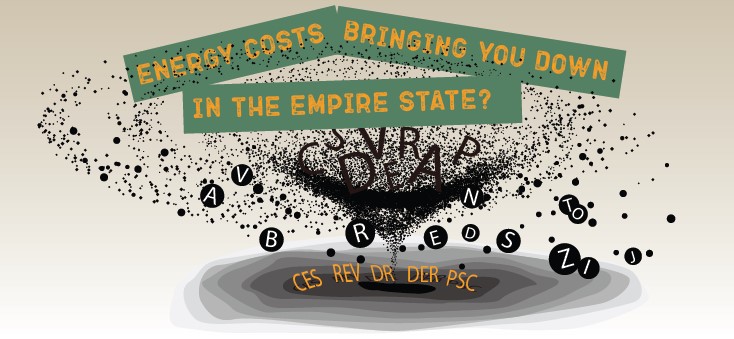

Managing Rising Costs Amidst the Alphabet Soup of NY Energy Initiatives

If you’re a mid- to large-sized energy user in New York, you’ve likely come across a veritable alphabet soup of acronyms: REV, CES, DR, DER…the list goes on. Many of you who run commercial and industrial (C&I) businesses know that you can actively leverage Demand Response (DR) programs and earn revenue by curtailing load when called upon to do so during emergencies to support grid reliability. Granted, some years have been more rewarding than others since capacity prices ebb and flow in New York just like in other energy markets. Of course, capacity prices have risen substantially since 2012, resulting in increased earnings from DR participation in New York. So what can DR participants across New York expect in 2017 and beyond?

First, a bit of context on REV and CES:

In 2012, Hurricane Sandy hit the East Coast, causing devastation and leaving millions without power. Shortly thereafter, working with the New York governor’s office, New York Power Authority and other state agencies, the Public Service Commission (PSC) launched the landmark Reforming the Energy Vision regulatory proceeding. Now commonly referred to as REV, its goal is to make the power system cleaner, resilient and more affordable. Regulators aim to transform traditional utilities into platform providers — entities that facilitate the deployment of distributed energy resources (DERs) and use them instead of traditional infrastructure. And Demand Response is poised to continue to play a vital role as this initiative evolves.

In simplest terms, the Clean Energy Standard (CES) mandates New York to acquire 50% of its energy from clean resources by 2030. As part of this, it seeks to further that goal by providing zero-emission credits (ZEC) to support upstate nuclear plants that were in danger of closing. In late 2016, the PSC fended off numerous challenges to its adoption of the CES and its subsidy for nuclear power generators. Keep an eye on this space, however, as the PSC’s order doesn’t mean this is finalized (as of this writing in Feb 2017, two court challenges remain pending). Generators and some environmental advocates said the ZEC program — which critics say will cost over $7 billion over its 12-year lifespan — goes beyond the authority granted to the PSC by state law.

Impact on your bottom line:

In the near term at least, REV and CES, while noble causes, are going to lead to increased fixed costs (~$4/MWh) on mid- to large-sized energy consumers. This scenario, however, also presents additional opportunities and specific actions you can take today to offset these costs:

- Increased DR participation especially in new distribution utility programs, and

- Capacity tag management.

New DR Programs: Both the NYISO and New York Electric Utilities offer demand response programs that pay businesses like yours for using less energy when the grid is stressed. Many commercial and industrial businesses in New York aren’t aware of the new summer-only local utility programs available to them via an authorized DR services provider. These programs offer another revenue stream in addition to the NYISO DR program that they may have been enrolled in for years. In 2016 for example, the New York Public Service Commission mandated that local utilities provide a Commercial System Relief Program (CSRP) throughout their entire service territory as part of a statewide effort to develop a new regulatory framework which includes incentives to leverage the deployment of distributed energy resources such as demand response.

Capacity Tag Management: Additionally, there are demand management services that can help significantly lower your capacity charge which make up 20-40% of the total supply portion on your monthly utility bill. The capacity charge is based on your individual capacity tag which, in New York, is determined by your facility’s usage when the NYISO sets its single annual peak hourly demand across the whole system. CPower sends an advanced day ahead demand management notification to reduce your usage when it is likely the NYISO will hit its hourly peak demand, thus reducing your capacity tag and capacity charges for the following year.

In the end, it’s all about implementing smarter techniques to manage your overall energy spend. The NYREV was launched 3+ years ago but it’s more relevant now than ever to survive as a large C&I energy user, as it will certainly change how energy is transacted in the future. At CPower, our job is to stay abreast of these developments and keep you informed about their potential impact. To get started, check out the various programs available in NY and informational videos to learn more on how you can offset rising energy costs in 2017 and beyond.

White Paper: The Evolving New York Energy Market

In this white paper, CPower’s Mike Hourihan aims to explain how recent events have played a role in shaping both the New York Energy Market’s current state and its evolution. He’ll also attempt to predict what might be in store for the market and how he believes New York businesses can position themselves to better manage their energy today and in the future.