Our Blog On-Demand

Content

Knowledge Hub

Knowledge Hub

One of the Reforming Energy Vision’s primary goals includes renewable sources generating 70% of the state’s electricity by 2030. To do that, the New York grid seeks to implement distributed energy resources into its fuel mix.

How might New York’s energy market be redesigned to incorporate DERs like solar, energy storage, and others?

NYISO’s proposed changes meet opposition

In 2018, the NYISO proposed changes to the ICAP Capacity Market for how long a resource must be able to run to be eligible to be paid the full value of capacity.

Using the results of a study on energy-limited resources by GE Consulting (GE), the NYISO initially proposed that resources would need to be able to run for 8-hours in order to obtain full capacity value. The NYSIO then proposed it would allow resources that can perform for shorter durations to be paid a fractional portion of the capacity value as follows:

8-hrs=100%

6-hrs = 75%

4-hrs = 50%,

2-hrs =25%

A group of demand response and energy storage providers, including CPower, challenged the GE study’s findings.

A formal review of the GE study by Astrapé Consulting revealed “several flaws in the assumptions and methodology that influenced the study results to show a decreased capacity value for shorter-duration resources than would likely be expected.”

Skepticism of the GE study’s results quickly spread among key New York energy stakeholders, including DR providers, energy storage developers, C&I customers, environmental groups and various trade associations.

These stakeholders submitted a joint letter to the NYISO executive team and board of directors requesting “all market design changes relating to the GE Study results (including any changes to the SCR program) be removed from the DER Roadmap.”

So where does that leave New York?

Potential changes in the New York Energy Market

While there is an ongoing debate about the future of New York’s capacity market, there are no major regulations or market design changes yet announced to take effect in 2019. That could change pending the outcome of an April vote (more than a month away as of this writing) among New York’s energy stakeholders.

That means, for example, the Special Case Resource (SCR) demand response program will continue to operate under its current parameters, including a four-hour duration requirement.

As far as the DER wholesale market goes, New York is in wait-and-see mode. DERs, especially battery storage, and renewable energy sources are a key component of the REV’s drive toward New York’s energy future.

New York, like several other US energy markets, is faced with the question of how to value distributed energy resources in its marketplace.

The question of DER valuation is being debated by the NYISO and various energy stakeholders in the state. As of this writing, there is no definitive timetable for when the debate will conclude and regulations for DER valuation will be enacted.

Energy Storage

New York has taken its place alongside California, New Jersey, and Massachusetts as a first-mover in establishing energy storage targets.

In June 2018, Governor Cuomo announced an energy storage roadmap that set New York’s storage target for 1,500 MW by 2025. According to the roadmap, that ambitious goal could elevate to 3,000 MW by 2030.

At the state level, New York has recognized the need to fund storage projects instead of subsidizing them. Last June, Governor Cuomo committed $200 million from the New York Green Bank to fund storage investments that will help integrate renewable energy onto New York’s grid.

Funding opportunities for storage abound with plenty of state money being made available for storage development.

But without certainty on the wholesale market side and established rules concerning dual participation between markets, meeting the state’s ambitious storage goals will continue to have its challenges.

The key energy players in New York will need to resolve these issues before any substantial investment from the private sector will take a position on energy storage. The NYISO is targeting April 17, 2019, for a vote on market design to accommodate DER integration into its wholesale markets.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

When it comes to capacity prices in New York state, the story changes depending on the geographic region.

Capacity prices are historically low right now in upstate New York but increase through the Lower Hudson Valley toward New York City, due to transmission constraints.

The announced retirement of Indian Point nuclear facility scheduled for 2020 and 2021 leaves New York with 2,000 MW to be replaced just outside of New York City.

NYISO points to new natural gas generation and other renewable generation scheduled to come online as reasons for Indian Point’s retirement. Still, capacity prices in New York City heading into Summer 2019 are comparatively high compared with the rest of the state.

Where there are high capacity prices, there are opportunities to earn revenue for wisely using energy.

Many of these opportunities exist at both the utility and NYISO level.

Con Ed’s Demand Management Program (DMP)

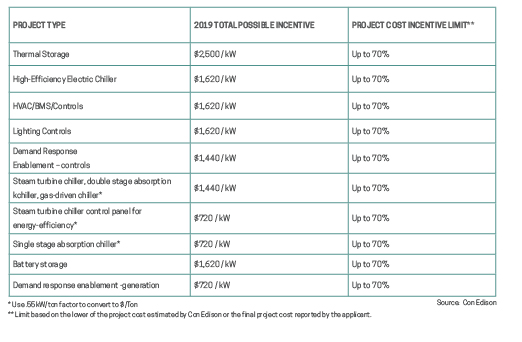

Con Ed provides financial incentives for organizations that help the grid lower its peak demand on New York’s hottest days.

The DMP is a rebate-based program that rewards Con Edison and New York Power Authority (NYPA) customers in New York City and Westchester for installing energy-saving technologies, thereby permanently reducing their overall demand.

Eligible projects include:

Demand Response in New York

In 2016, several New York Utilities began offering two new demand response programs in conjunction with the REV:

ConEd has been offering CSRP and DLRP since 2009/2010. The programs will continue to run in 2019.

NYISO’s Special Case Resource (SCR) program, the longest running demand response program in NY, will also run in 2019 along with NYISO’s economic programs: the Day-Ahead Demand Response Program (DADRP) and the Demand-Side Ancillary Services Program (DSASP)

Currently, there are 17 demand response programs being offered to commercial and Industrial organizations in New York. That number may change in 2019/20 as several New York Utilities consider removing DLRP or CSRP.

Natural Gas Demand Response

Con Ed is poised to continue leading New York utilities’ push for demand response.

Building on its 20-year experience administering DR programs, the utility is exploring ways to use natural gas demand response as a “non-pipe solution” to alleviate potential grid stress brought on by growing natural gas demand and pipeline constraints into New York City.

Con Ed’s natural gas DR program is currently in pilot phase. If successful, expect other New York utilities adopt it into similar programs of their own where gas pipeline constraints exist.

Non-Wires Solutions

Non-wires solutions (NWS) are investments in the electric utility system that can defer or replace altogether the need for specific transmission and/or distribution projects.

NWS help to provide a cost-effective reduction of transmission congestion or distribution system constraints at times of peak demand.

New York is looking to implement several non-wires solutions, including fast-acting demand response with dispatch notices as short as five minutes and curtailment durations that last as long as 12 hours.

Organizations wishing to participate in such programs will likely need to accommodate the short dispatch notice with technology that facilitates automated DR.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

In the near future, organizations with flexible resources at their disposal will have an advantage when it comes to earning money for helping the grid.

California is committed to integrating renewables into its electrical grid. The load-shift product is set to launch in November 2019. In its wake, expect a series of flexible resource products to be proposed, reviewed, and eventually launched.

The next generation load shift product and any subsequent flexible resource products will likely be technology-neutral, meaning customer loads will be able to participate as long as customers can curtail on-demand and respond to short-term curtailment windows.

When it comes to demand-side energy planning, California’s legislative arm is forward-thinking, investing in the infrastructure and systems needed to reach the state’s ambitious goals.

For now, commercial and industrial customers are a different story.

Many organizations simply have not yet made the kind of investments in specialized equipment or automation needed to optimize their participation in the kind of programs California is looking to introduce.

Whether or not to embark on a system upgrade is a cost/benefit analysis large California organizations would be wise to consider.

In the very near future, there is going to be a potentially significant earning opportunity for organizations that can quickly dispatch flexible resources when the grid is stressed or market prices are exceedingly high.

Organizations that are open to automation and have made the right investments their systems are going to be the ones capable of performing and will reap the rewards for keeping the California grid reliable.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

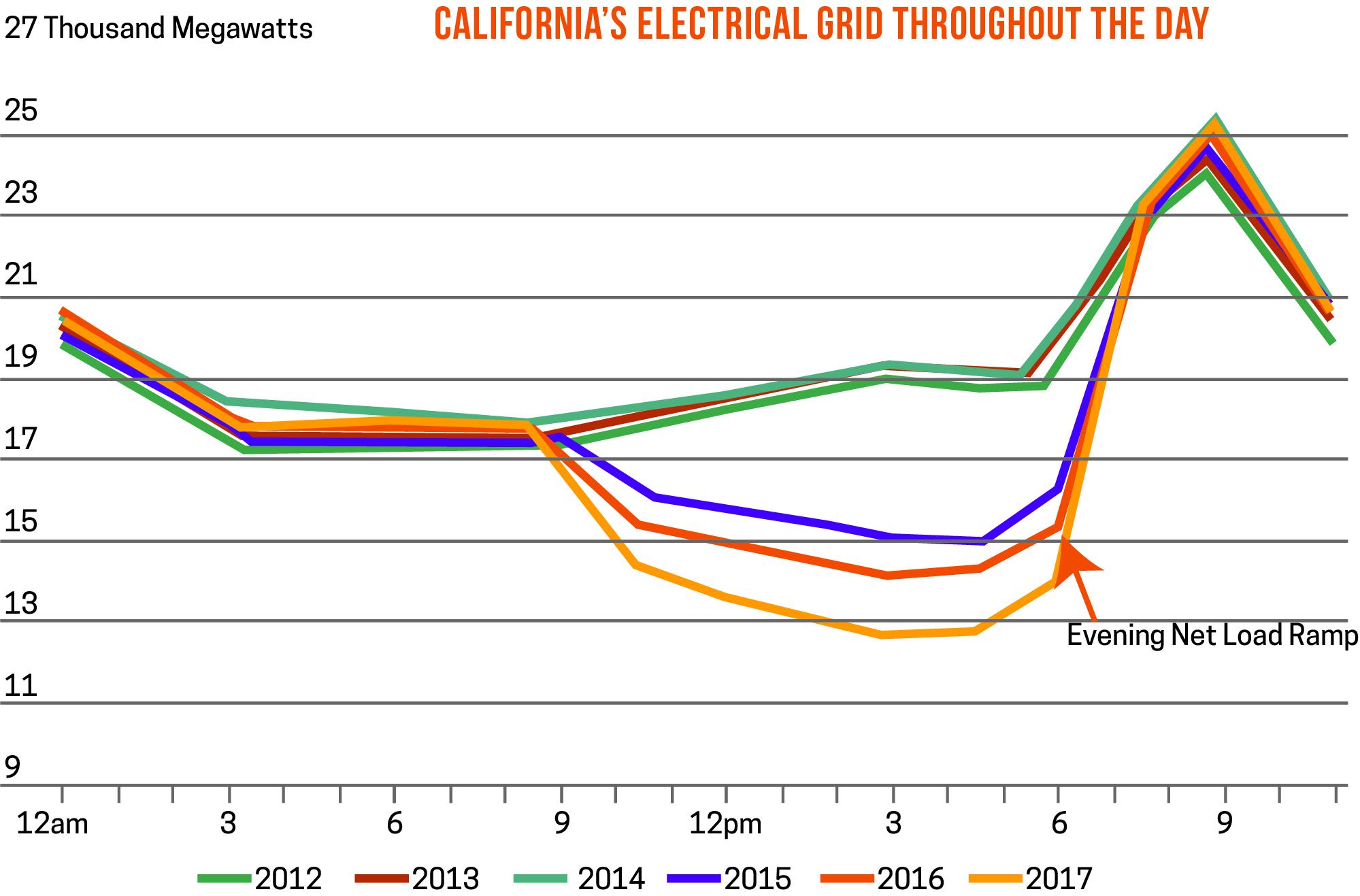

California experiences a daily spike in energy demand in the early evening when renewable sources like solar go offline and residents come home from work and increase their energy consumption by flipping on their air conditioning, turning on their lighting, doing laundry, charging electronic devices, and engaging in other energy-consuming activities.

When charted on a graph (see picture), the shape of California’s daily electrical consumption resembles a duck. Analysts have noted the duck’s belly is getting fatter with each passing year, meaning the evening net load ramp when flexible resources are needed to account for the spike is becoming more extreme.

A Steady Diet of Storage

The duck’s belly may not get fatter in 2019, but it’s still going to be heavy.

To help alleviate grid stress associated with evening load ramp, CAISO is developing a load-shifting product under the third phase of CAISO’s Energy Storage Distributed Energy Resource (ESDER) that would be the state’s first product that will pay a resource to consume energy to soak up excess generation during negative pricing periods.

CAISO’s load-shift program embodies California’s desire to bring clean resources to the forefront of grid reliability by storing excess clean energy and making it available for future use.

The program, championed by the California Energy Storage Alliance (CESA) among other energy storage companies, also aims to reduce the number of solar curtailments needed to offset the ill effects of negative pricing caused by a large solar surplus on CAISO’s system.

The two big questions on the minds of organizations that have implemented or are thinking of implementing energy storage are:

The short answer to the first question is the program is currently going through the FERC approval process and is scheduled to go into effect in November 2020.

As far as how storage will be valued in the wholesale market? It’s too early to tell right now, but expect California to continue to work to provide value for all the services storage can provide.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

The Global Adjustment was introduced in 2006 to help Ontario cover the difference between electricity’s market rate and the contractually higher rates the provincial government had agreed to pay new generators in an attempt to stimulate private investment in Ontario’s generation system.

All Ontario electricity customers pay global adjustment to cover the cost of the province’s new electricity infrastructure and conservation programs, which ensure adequate long-term electricity supply.

With the passing of the Green Energy Act in 2009, GA charges spiked and have been on the rise ever since.

A 2015 report by auditor-general Bonnie Lysyk concluded that Ontario ratepayers had paid $37 billion more than necessary from 2006 and 2014 and will spend an additional $133 billion by 2032 due to inflated GA charges.

Whether GA charges are necessary is a hot topic of a debate whose arguments tend to fall, like most public squabbles on energy policy in Ontario, along the lines of political party loyalty.

What’s not up for debate is the fact that GA charges can account for up to 80% of an organization’s electricity bill.

The Industrial Conservation Initiative (ICI)

Introduced by the Government of Ontario in 2011, the Industrial Conservation Initiative (ICI) is a form of demand management that allows organizations to reduce their GA costs by reducing their demand during the five periods when total demand on the Ontario grid is at its peak.

Although all electricity consumers pay Global Adjustment, only Class A customers–those with an average monthly peak demand greater than 1 MW (or with 500 kW if the company has NAICS codes commencing with the digits “31”, “32”, “33” or “1114”) during an annual base period from May 1 to April 30–can participate in the ICI.

In April 2017, the ICI threshold was lowered to its current requirement (Ontario Regulation 429/04). Previously, the threshold had been much higher (minimum 5 MW in 2016), which excluded large manufacturing and industrial sectors from participating.

This 2017 change, which increased the number of large consumers who could participate in the ICI and therefore reduce GA charges, has impacted electricity prices significantly in Ontario.

The ICI’s unintentional cost shift

According to the Ontario Energy Board (OEB), the Global Adjustment has grown from CA$700 million in 2006 (8% of the province’s total electricity supply costs) to CA$11.9 billion in 2017, accounting for 80% of Ontario’s electricity supply costs.

During this time of GA growth, peak demand in Ontario has dropped due in large part to ICI participants reducing peak load contributions, decreasing their GA charges in the process.

In 2017, when the ICI drastically lowered its minimum peak load requirements, participants reduced their consumption by 42% during peak conditions.

While reduced peak demand brought through the ICI has proven to be healthy for the grid, the initiative has also given birth to an unintended consequence Ontario policymakers realize must be addressed.

In its report, the OEB concluded that the ICI has brought about an unintended shift of electricity costs recovered through the GA from large volume consumers to households and small businesses.

The burden of costs the GA was established to alleviate, it turns out, has hardly been alleviated. Instead, the costs have merely been shifted from large consumers to small.

In 2017 alone, the OEB asserts that the ICI shifted CA$1.2 billion in electricity costs to households and small businesses, thereby increasing the cost of electricity for households and small businesses by 10%.

The OEB concluded that the ICI as currently structured “is a complicated and non-transparent means of recovering costs, with limited efficiency benefits.” The initiative “does not allocate costs fairly in the sense of assigning.”

Like much of Ontario’s energy policy, the future of the ICI is not yet set. There are talks for and against a flat rate for GA to be paid all consumers. There are debates on a new restructuring of the ICI altogether.

Expect the new government to have its hands full examining what, if anything, can be done about GA charges and the ICI in 2019 and beyond.

Organizations, large or small, looking toward offsetting high GA costs in the future would be wise to keep abreast of any changes to the ICI, because they may have a profound impact on demand-side energy management strategies currently in the works.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

By the early-1990s, Ontario’s energy grid faced dire reliability and economic concerns.

Many of the nuclear generation plants powering the province had been built in the 1970s and were starting to prematurely show their age, declining in efficiency and reliability.

More recently-built nuclear stations had riddled Ontario Hydro (Ontario’s then publicly-owned and lone electric utility) with enormous debt.

In 1992, the situation worsened when a downturn in the Canadian economy and falling demand caused electricity rates in the province to rise by 40%.

The following year, the Ontario government stepped in, freezing energy prices. They would remain frozen for the next 10 years.

In 1999, Ontario’s energy market took its initial steps into deregulation. That April, Ontario Hydro was restructured into five separate companies, including the Independent Market Operator (later named the Independent Electricity System Operator or IESO, which still serves as Ontario’s grid operator today.)

On August 14th, 2003 the lights went out across Ontario when the Northeast Blackout caused more than 50 million people in southeastern Canada and eight northeastern states to lose power for two days.

It was the largest blackout in North American history.

One year after the blackout, the Ontario Power Authority (OPA) was established and immediately tasked with assessing the long-term adequacy of the grid’s resources. The OPA, which would eventually merge with the IESO in 2012, was also mandated with removing coal from the province’s supply mix.

In an attempt to stimulate private investment in new generation beginning in 2005, Ontario began offering long-term, fixed-price contracts at above-market rates to new generators.

To cover the difference between electricity’s market rate and the contractually higher rates being paid to new generators, Ontario introduced the Global Adjustment in 2006. That same year, the Renewable Energy Standard Offer was established, offering fixed-rate 20-year feed-in tariffs (FITs) for solar, hydro-electric, wind, and biomass renewable projects.

The Green Energy Act was passed in 2009 with the aim of attracting new investment, creating green jobs and providing Ontario with clean, renewable energy.

To help consumers shoulder the costs of Ontario’s transition to a greener, modern electricity system, the government introduced the Ontario Clean Energy Benefit (OCEB) in 2010. The benefit provided eligible consumers a 10% rebate on applicable electricity charges and taxes.

The OCEB ended in 2015. That fall, the Ontario Energy Board raised electricity prices, burdening Ontario ratepayers with electricity bills that were among the highest in Canada.

In 2018, while campaigning for the Progressive Conservative party, current Ontario Premier Doug Ford promised to reduce energy prices in Ontario by 12%.

As of this writing, Premier Ford has yet to present an official energy plan outlining an approach to keeping his campaign promise. The provincial government has announced the cancellation of 758 renewable energy contracts awarded by the previous assembly.

What does this history tell us about the Ontario energy future? We examine that question in this article about the future of Global Adjustment in the province.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

Of the demand response programs that ERCOT offers, Load Resource offers the most lucrative potential–particularly during the summer months when demand on the grid is at or near its peak.

Simply put, ERCOT’s tight reserve margin is brought about by diminished supply and growing electrical demand, which in turn causes high energy prices in Texas during the summer.

These high prices are welcomed by participants in the Load Resource program, which pays organizations for being available to curtail their energy loads when called on by the grid operator.

The LR program attracts a lot of interest, so ERCOT places a cap on the total amount of Load Resource it buys, typically ranging from 1,400-1,750 MW.

Suppose the cap is projected to be 1,500 MW.

If more than 1,500 MW of Load Resource offer into the market, ERCOT prorates ALL of the MWs down to its 1,500 MW threshold.

Suppose 3,000 MW offer into the market as part of the LR program. ERCOT can only buy 1,500 MW of load resource. In this case, an organization that could otherwise curtail 10 MW would only be awarded five and be paid for those 5 MW. Another organization that could contribute 4 MW will only be awarded two and so forth until the total sum of all LR participants is 1,500 MW. This example illustrates 50% proration.

Historically, LR proration in the ERCOT market hovered around 90%, meaning a 10 MW offering is prorated down to 9 MW.

That started to change in 2017 when proration worsened as more resources sought to enter the market. In 2018, proration averaged about 50%, irritating many participating organizations accustomed to earning more revenue for being available to curtail if needed.

Fixed vs Index Load Resource Offerings

The standard Load Resource offering is indexed based on dynamics in the market, grid conditions, and weather conditions.

These conditions vary in their extremism and therefore cause the price ERCOT pays for load resources to fluctuate.

Historically (at least before 2018) the Load Resource program has offered participants a potential windfall to be available when the grid was most in need.

Now, proration is threatening that windfall for a lot of LR participants.

That there are a lot of participants in the LR program is the reason why proration is rising and earnings in the program are diluted.

Enter fixed LR.

Fixed LR takes proration out of the picture for participants by locking in an average, weighted return for a specified period of time. Locking into a fixed LR contract can guarantee a more attractive rate of return than the historical indexed LR average.

The averaged indexed LR return was between $6 and $7 per MW/hour in 2017 and around $9.50 in 2018. Heading into the 2019 summer season, fixed LR offerings are being secured with a 20-30% return above the indexed average.

To Fix or not to Fix?

Fixed LR tends to appeal to the more risk-averse participant compared with standard indexed LR. The former is more stable, the latter essentially a bet that the summer will include a couple of days when LRs driving contributors present a blowout scenario.

As any wise investor will attest, a balanced portfolio has the best chance to succeed.

Consider breaking your load into increments and determine a strategy to hedge against those different scenarios with a combination of fixed and indexed LR.

Lock in certain rates above the historical averages with fixed LR and position yourself for a nice reward during the few scorching days during the summer and extremely cold days during the winter with indexed LR.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America.

To get a breakdown of the February 2021 Winter Event in Texas, click here.

When the Electric Reliability Council of Texas (ERCOT) established Texas’ deregulated energy market in 1999, it had several very Texan ideals in mind.

For starters, the market’s architects sought good old-fashioned economic competition to keep electricity prices stable and the state’s grid reliable.

They also settled on another battle-tested Texan value concerning its energy market: They wanted to be completely different from New York…and California, New England, and PJM for that matter.

And so it came to be that Texas would establish an energy-only market without a forward capacity market. In doing so, ERCOT became the only deregulated energy market in the US that is NOT overseen by the Federal Energy Regulatory Commission (FERC).

In the two-plus decades since ERCOT’s formation, naysayers in and out of Texas have been watching the Lone Star State with skeptical eyes, waiting for the perfect storm when a lack of forward-procured capacity proves fatal to grid stability.

Every time the reckoning seems imminent (as it did in the Summer of 2018) the ERCOT market holds strong, bending at times but never breaking. Now, many former naysayers around the US are wondering if perhaps instead of messing with Texas, other deregulated energy markets should be learning from the Lone Star State.

That Texas doesn’t have a forward capacity market is one of the market’s signature design features.

Consider a market like the Pennsylvania-Jersey-Maryland (PJM) Interconnection. To keep its grid reliable, PJM maintains a forward capacity market (the largest in the world) whereby the capacity needed to meet peak demand is procured three years in advance of its delivery day.

Using this model, PJM procured a comfortable reserve of about 21% above its reserve target in its latest capacity auction. The onus of paying for this surplus of capacity falls to ratepayers in the market, who pay for PJM’s reserve margin with higher capacity prices/demand charges.

The ERCOT market, in contrast, aims to keep costs incurred by its ratepayers at a minimum by avoiding what they see as an unnecessary surplus of capacity.

Instead of a capacity market, ERCOT maintains a capacity reserve margin, calculated by subtracting the projected peak demand on the grid from the total capacity generation available in Texas.

ERCOT’s target reserve margin hovers around 13.75%, lower than PJM’s 15.8%–considerably cheaper for Texan ratepayers, too.

Back to the original question of why doesn’t ERCOT have a capacity market. The answer is simple and decidedly Texan: Economics. Economics. Economics. (and a little desire to be different).

The Summer of 2018: ERCOT’s Proving Ground

For years, skeptics have watched the ERCOT grid, wondering when the right set of circumstances would finally expose Texas’s lack of capacity market for its inability to maintain grid reliability.

Last summer, it looked like the skeptics would finally have their day.

A shrinking reserve margin, record-setting peak demand, and a near-record heat wave pushed the ERCOT grid to its limits, but the grid held.

In September 2018, the Public Utility Commission (PUC) of Texas issued a 45-page Review of Summer 2018 ERCOT Performance, officially summarizing how the grid functioned against daunting conditions.

That the lights stayed on in Texas last summer boosts ERCOT’s belief that an energy-only market relying on economic competition as opposed to government mandate can maintain sufficient resources to keep the grid stable and avoid turning to emergency, out-of-market measures.

Much of the energy industry has taken note, too.

The R Street Institute, a public policy research organization based in Washington D.C., noted “the Texas market is working, as consumers and producers find innovative ways to reduce costs and enhance service quality.”

Demand Side Management to the Rescue

The PUC’s performance review also noted the integral role demand-side and distributed energy resources (DERs) played in keeping ERCOT’s grid reliable during the Summer of 2018. There were no rolling outages or blackouts.

Despite not experiencing a demand response event during this past summer, ERCOT’s ongoing investment in ancillary services and recent updates on how they are procured and dispatched have paid off.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly evolving landscape.

ISO-NE’s implementation of its price-responsive demand construct has led to several changes in its demand response programs.

Three key changes for 2019:

It may seem like the market has changed drastically and therefore demand response participation in New England will also be strikingly different than it was in the past.

While the former may be the case, the latter really isn’t.

The fundamentals of demand response participation in New England have not changed that much from the customer’s perspective. Here’s why:

Capacity prices in New England have been trending downward in recent years.

While lower capacity prices mean lower payments for DR curtailments, they are also a sign that New England has procured adequate capacity resources. This means it is probable that there will be fewer events called in the coming years and that those events are not likely to last as long as events in previous years when capacity prices in New England were higher.

Demand Response Programs in New England

ISO-NE offers the following demand response programs:

Active Demand Capacity Resource (ADCR) is a demand response program in which participating loads are dispatched when wholesale electricity prices in New England are exceptionally high.

Launched in June 2018 as part of ISO-NE’s price-responsive demand construct, ADCR replaced the Real-Time Demand Response Program (RTDR).

Passive [On-Peak] Demand Response rewards participating organizations for making permanent load reductions.

Unlike active resources, On-Peak resources are passive, non-dispatchable, and only participate in ISO-NE’s Forward Capacity Market. Eligible behind-the-meter resources include solar, fuel cells, co-generation systems, combined heat and power systems (CHP), and more.

Passive Demand Response participants offer their reduced electricity consumption into the market during both the summer and winter peak hours.

Utility Demand Response Programs

Connected Solutions–National Grid, Eversource, and Unitil are working to lower the amount of total energy our community uses during the summer months when demand for electricity on the grid is at its highest (peak demand).

To help keep their grids healthy and reliable, these utilities now offer the Connected Solutions demand response program that pays businesses to use less energy during peak demand periods.

The rules may be changing in the New England energy market, but for the commercial and industrial organization gearing up for the summer season…demand response is the same sport as it has always been.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.