Our Blog On-Demand

Content

Knowledge Hub

Knowledge Hub

Mounting regulatory scrutiny and market pressures make crypto mining increasingly difficult, which makes participating in demand response programs more appealing.

The business case for crypto demand response is strongest when crypto prices are low and electricity prices are high, as they are now. Also, environmental advocates and lawmakers are pushing for environmental policy reforms around crypto mining energy consumption, which could impact miners’ expansion and operations.

Demand response meets miners’ needs on both the policy and business fronts. In participating in demand response, crypto mining organizations receive compensation for curtailing their electric consumption when electric demand on the grid exceeds the grid operator’s ability to supply it or when electricity prices are high. Miners can also show sustainability benefits by tracking exactly how much carbon dioxide pollution their facility prevents in helping the electric grid stay balanced without having to burn fossil fuels to produce electricity.

CPower has seen considerable interest from the crypto mining sector as operators and developers are looking to maximize value and showcase carbon offsets through demand response.

Operational efficiency is key in crypto mining, in which miners earn cryptocurrency by using computers to validate complex blockchain transactions before competitors do. The value of the cryptocurrency that miners earn has dropped while energy expenses have risen.

Already trending lower through most of 2022, crypto prices fell further in early November after FTX, a leading cryptocurrency exchange, collapsed, prompting broader concerns about the industry. Escalating energy costs could push crypto prices even lower as miners try to cover the additional operational expense for running their computers.

With large and growing loads, energy is a primary expense for miners. Small facilities consume 10s of MWs and bigger operations use 100s of MWs to power computers. Mining may be done at any time.

Demand response helps miners reduce their energy costs and increase their returns. Not only can miners save money by mining at less expensive times, but they can also earn significant revenue by quickly curtailing large amounts of electric load without impairing operations. Mining also becomes more profitable when currency is mined with less expensive electricity.

In addition to managing the financial implications of the energy cost of cryptocurrency, many miners are facing concerns about the industry’s environmental impact. Globally, the cryptocurrency market consumes more than 68 terawatt-hours (TWh) per year, continuously running more than 19 coal-fired power plants, according to ENERGY STAR®.

In the US, which hosts about one-third of global crypto-asset operations, miners consume 0.9% to 1.7% of the nation’s electricity usage, or the equivalent of all home computers or residential lighting nationwide, according to a recently released White House study of the climate and energy implications of crypto-assets. Crypto-asset activity accounts for 25 to 50 Mt CO2/y, or 0.4% to 0.8% of total U.S. greenhouse gas emissions, which is similar to emissions from diesel fuel used by the nation’s railroads.

After assessing the impacts of crypto-asset operations, the White House Office of Science and Technology Policy’s (OSTP) recommendations included:

Some members of Congress are looking into the impacts of crypto mining as well. Led by Sen. Elizabeth Warren, D-Mass, seven lawmakers are probing Bitcoin’s impact on the Texas power grid. They asked the state’s grid operator, the Electric Reliability Council of Texas (ERCOT), for information such as energy consumption data for Bitcoin miners and details regarding crypto mining companies’ participation in demand response programs.

In response, The Texas Blockchain Council (TBC), an industry advocacy group, emphasized the environmental benefits that crypto miners have provided by using renewable energy and participating in demand response. TBC noted, for example, that:

Though Texas is the nation’s biggest market for crypto miners, the feasibility of Bitcoin mining as a grid resource is being contested in other states as well. New York has implemented a two-year partial cryptocurrency mining ban, creating the nation’s first temporary pause on new permits for fossil fuel power plants used in proof-of-work mining, which is a process that is used in the mining of some, but not all, cryptocurrency operations. The two plants in New York that currently use fossil fuel for generation can continue to run because they were in operation before the moratorium.

CPower helps crypto miners drive emission reductions, energy-bill savings and revenue by determining how they can best help increase the amount of renewable power available to the grid and reduce their carbon impact.

For example, Digihost won an Environment + Energy Leader (E+E Leader) award for its work in enabling the energy transition by participating in demand response through CPower. Digihost avoided nearly 150 metric tons of marginal CO2, with just 29 hours of demand response participation. In avoiding the equivalent of 5,637 tons of coal burned per hour of demand response participation, Digihost’s site sequestered 182 acres worth of US forests for one year.

CPower has also helped crypto miners leverage their clean energy distributed energy resources (DERs). For example, a renewable energy-powered crypto mining site in the PJM energy market, which is served by the country’s largest grid operator, used CPower’s AI-based EnerWiseTM Site Optimization software to achieve grid revenue and on-bill savings. EnerWise Site Optimization helps DER owners and developers manage and monetize all their DERs across multiple energy markets and utility programs simultaneously by analyzing the latest market and grid conditions.

In integrating EnerWise Site Optimization with Verakari’s crypto mine design, including network components, electrical infrastructure, custom-built software elements, custom demand response hardware components, and innovative operations protocols, CPower helps the company’s Pennsylvania crypto mining site better align with price, demand and marginal emissions signals in PJM Interconnection, the largest grid operator in the U.S. As a result, Verakari will reduce its energy costs while helping to create a more reliable and sustainable grid.

CPower is the U.S. leader in energy flexibility and grid balancing solutions, serving more than 2,000 customers across the country. With 6.3 GW of customer-powered capacity at over 17,000 sites across the US, we unlock the full value of distributed energy resources to strengthen the grid when and where it’s needed most.

To learn more about how CPower helps crypto miners maximize value and show sustainability by participating in demand response programs, call us at 844-276-9371 or visit CPowerEnergy.com/contact to find out.

David Chernis

David is a CPower Account Executive for New York (NYISO). His expertise includes commercial & industrial demand response, distributed energy resources (DERs) and crypto mining demand management. Coming from the worlds of commercial lighting, IoT controls, and automation, the technological advances in battery storage and distributed generation — and the opportunity to monetize them — make the DR world an exciting place for him. He is also skilled in clean energy project and program management of both small business and large-scale commercial installations.

Mike Hourihan

Mike is Market Development Director at CPower. He has extensive experience in analyzing and developing market rules in multiple energy markets across North America. His career has focused on advocating for demand side resources participation in the energy markets as a reliable low-cost option compared to traditional generation assets.

The Minimum Offer Price Rule (MOPR) exists to prohibit new capacity resources from offering into the market below their true, i.e. unsubsidized, costs.

MOPR has garnered its share of controversy since it was enacted a decade ago. The rule was introduced to address the concern about “buyer-side market power.” The concern is that an entity on the load side may have an incentive to offer supply into the capacity market at below-market prices in order to depress clearing prices, thus reducing capacity costs. This may degrade the economics for merchant players to the point where new capacity cannot be attracted when needed and existing resources that are needed for reliability may exit the market prematurely.

States in New England have essentially argued in recent years that MOPR infringes on their rights to determine their generation fuel mixes and unnecessarily keeps renewable resources from clearing the capacity market, requiring consumers to pay twice for capacity–once through a state procurement and a second time to purchase capacity to meet ISO-NE capacity requirements, which the state-procured resources cannot meet due to the MOPR.

In an interview on April 5, 2021, FERC Chairman Richard Glick sided with the states when he noted, “FERC has a responsibility under the Federal Power Act, essentially, to defer to the states, in terms of state decisions about what the generation resource mix should be like. But instead, we’ve implemented these MOPRs, at least in the three Eastern RTOs that have mandatory capacity markets, in a matter that really attempts to block the state clean energy policies or state energy policies in general.”

The issues at stake with MOPR are not going to be solved overnight but ISO-NE has started working on changes this month (June 2021). As part of this effort, ISO-NE intends to eliminate MOPR with Forward Capacity Auction 17 (2026/27 commitment period).

While the elimination of MOPR will help renewable resources to clear the capacity market and earn capacity revenues, without accompanying changes to address the price depressing effect of allowing resources to clear at prices below their true costs, the expectation is that capacity prices will plummet.

With a few thousand MWs of state-procured off-shore wind already on the books, and thousands of MWs yet to come, it is reasonable to expect these MWs will start showing up in Forward Capacity Auctions once the MOPR has been eliminated. That said, a set of contested changes pending at FERC could facilitate off-shore wind’s entry into the market a bit earlier if FERC sides with NEPOOL stakeholders over ISO-NE.

In any case, ISO-NE does feel it is important to make accompanying changes that are geared toward maintaining competitive pricing in the capacity market when MOPR goes away.

On July 13, 2021, ERCOT announced the delivery of its “Roadmap to Improving Grid Reliability,” a 60-item plan that addresses needed improvements to ERCOT’s electric grid with the aim of avoiding future failures like the one experienced this past February when much of the state was left without power and over 200 people died amidst record-setting winter temperatures.

In an official press release announcing the Roadmap’s delivery, ERCOT Board member and Texas Public Utility Chairman claimed the map “puts a clear focus on protecting customers while also ensuring that Texas maintains free-market incentives to bring new generation to the state.”

The notion of the free market is one we at CPower have often discussed in explaining how the ERCOT market differs from others around the country. From its very founding, ERCOT’s energy-only market was designed to let economics, not legislation, drive the action within its marketplace.

In the wake of February’s tragedy–and the harrowing death toll certainly qualifies the event as such–there has been a wealth of debate in Texas and throughout the US on whether ERCOT’s economically driven approach to grid reliability is the best way to avoid future grid failure.

There is one curious item in ERCOT’s 60-item roadmap that is worth pointing out to large consumer and industrial organizations in Texas.

Item 19 concerning the future of distributed generation, energy storage, and demand response speaks to both legislative and financial methods of exacting change on a grid seeking to cross the bridge to energy’s future.

Item 19 of the roadmap reads as follows:

“Eliminate barriers to distributed generation, energy storage, and demand response/ flexibility to allow more resources to participate in the ERCOT market while also maintaining adequate reliability”

With this item, which is “on track” according to the roadmap, we see ERCOT is well on its way to implementing an improvement to its market that is rather similar to the intent of the Federal Energy Regulatory Commission’s Order 2222, which states:

“Order No. 2222 will help usher in the electric grid of the future and promote competition in electric markets by removing the barriers preventing distributed energy resources (DERs) from competing on a level playing field in the organized capacity, energy, and ancillary services markets run by regional grid operators.”

Language like what ERCOT submitted in its roadmap with item 19 wouldn’t raise an eyebrow had it come from any other deregulated US energy market outside of Texas.

That’s because other state and regional energy markets must comply with Order 2222 within FERC’s mandated period of time. ERCOT does not.

Here’s why:

Because its grid is isolated from the surrounding states, ERCOT’s market does not engage in interstate commerce and is therefore not under FERC’s jurisdiction.

Yet ERCOT appears to be on the road to creating a future marketplace that allows its grid to integrate the flexible DERs CPower and other demand-side energy management companies have been touting for years are necessary to maintain a balanced, dependable grid that is evolving to a cleaner future.

Here we have an example of ERCOT agreeing with Federal legislation despite the truth that they are under no legal obligation to do so.

Why?

In the simplest of terms, Order 2222 is a piece of legislation aimed at fostering just and reasonable competition in the wholesale marketplace.

ERCOT’s market is and always has been designed with competition in mind. Look no further than item 19’s language for proof that the future of ERCOT’s grid involves allowing more energy resources to enter the marketplace and compete, not fewer.

ERCOT is expressly stating that it believes more distributed generation, energy storage, and demand response in its marketplace is the best way to ensure a more reliable grid for Texas and more value for its market participants.

As the Supreme Court is fond of saying, it is written. As Texans like to say, let’s get to work and take care of business.

The sweltering heat that raged across thirteen western states from August 14-17, 2020, had a significant impact on the tens of millions of people who experienced record high temperatures well above 100°F. The triple-digit temperatures had an historic effect on California’s electric grid, too. Consider August 17 as a case-in-point in the energy deficiency the state’s grid operator faces.

According to CAISO’s market policy and performance vice president, Mark Rothleder, CAISO had expected the load on its grid to peak near 49,800 MW on August 17 during the 5-6 pm PT hour with available capacity near 46,000 MW, leaving a 3,600 MW shortfall.

By 8 pm PT on the 17th, that gap would grow to more than 4,400 MW as peak load approached 47,428 MW, but capacity had fallen to around 43,000 MW due to solar generation declining with the setting sun.

Faced with more inevitable forced outages on August 17, CAISO’s own CEO, Steve Berberich spoke before the ISO’s Board of Governors and said, “The situation could have been avoided,” and further asserted that the state’s resource adequacy program is “broken and needs to be fixed.”

A proposed decision on the future of resource adequacy in California is due in mid-June 2021.

Lack of Imports During the Heatwave

The scorching temperatures drove a massive demand for energy throughout the western US, resulting in California’s inability to import electricity from neighboring states as it typically does in the evenings when its robust solar resources go offline with the setting sun.

In its official analysis, CAISO detailed a series of events explaining how “realtime imports increased by 3,000 MW and 2,000 MW on August 14 and 15, respectively, when the CAISO declared a Stage 3 Emergency.” but ultimately “the total import level was less than the CAISO typically receives.”

Unable to import needed electricity and hamstrung by rising demand amidst record-high temperatures, the California grid suffered its first blackouts in nineteen years.

The Push to Address Climate Change

Californians, by and large, see the recent wildfires and heat waves that have ravaged the Golden State and wreaked havoc on its grid as events driven by climate change.

The state’s drive toward its energy future subsequently involves not only taking steps toward making its grid resilient but doing so in a way that minimizes its climate impacts.

The state’s three main energy organizations–The California Independent System Operator (CAISO), the California Public Utilities Commission (CPUC), and the state’s energy commission (CEC)–have been closely examining the recent grid failures and have submitted two reports (Preliminary and Final Root Cause Analysis) seeking to establish a root cause for the blackouts .

While they may not agree on any single culprit for California’s grid woes and for the August blackouts, the big three organizations rightfully believe that establishing grid resilience and serving the state’s ratepayers are the priorities.

Balancing Energy, Capacity, and Renewables for Grid Resiliency

California’s renewable energy resources performed as expected in 2020, despite some slanted media coverage that may have tried to pin them with the lion’s share of the blame for the August blackouts in 2020.

California has no intention of veering from the state’s long-traveled path of developing and integrating more renewable energy into its generation mix.

In the wake of the 2020 blackouts, the resource adequacy proceeding in California is looking at how to ensure that the state procures energy sufficiency-–

i.e. electricity needed to serve the state on a day-by-day, moment-to-moment basis–in addition to capacity sufficiency–i.e. reserves that can be called on in the event of an emergency.

The proceeding is trying to establish the optimal balance between energy and capacity that can be procured within state boundaries so it can then be determined just how much reliance should be placed on imports now and in the future.

As is the case with other states in different energy markets around the US, California is at somewhat of a tipping point with so much of its generation mix dependent on renewables with inherent intermittency that renders them unavailable at unpredictable times in the day when the sun isn’t shining or the wind isn’t blowing.

Like many grids facing a similar predicament, California’s grid of today and the future needs to ensure that its load begins to follow its supply, meaning that demand-side resources adopt agile flexibility that can react to sudden disruptions in electricity supply due to intermittency.

Those disruptions and foreboding heatwaves show no signs of diminishing in 2021 and beyond. It’s time for California to shore up its grid’s reliability with an energy marketplace that rewards flexible resources on the demand side.

The grid and the people it serves depend on it.

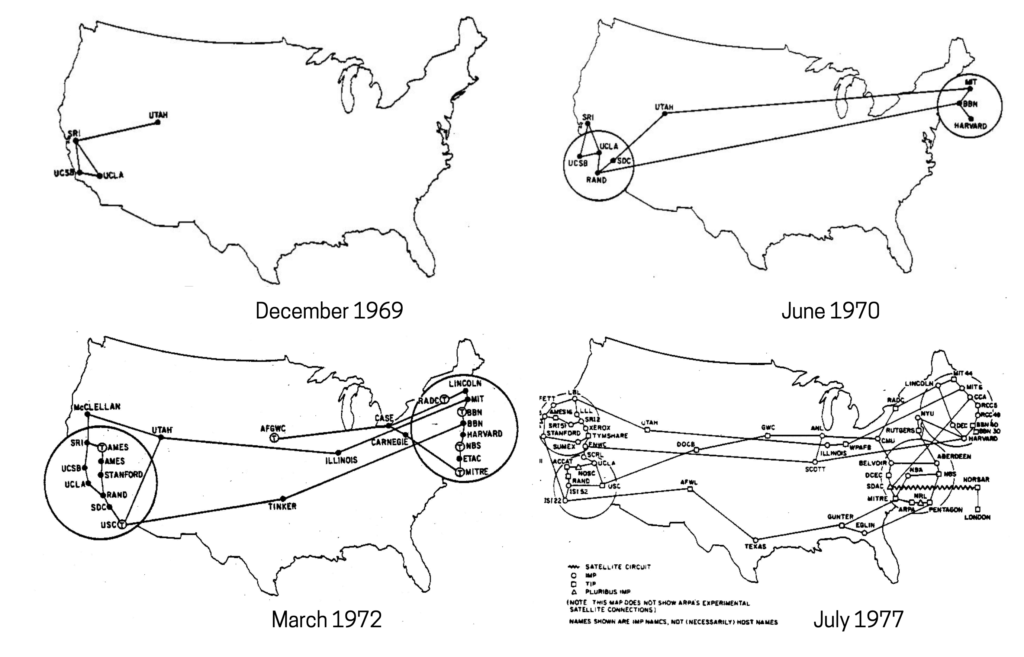

In the mid-1960s, a new method for effectively transmitting electronic data over a computer network was born, and with it came one of the quintessential building blocks of what would become the modern internet.

In simple terms, “packet switching” is a routing method whereby data transmitted across a network takes different routes along the network to arrive at its destination. Packet switching allowed for computer networks to become decentralized, ultimately giving rise to the internet and the global connectivity it provides today.

Just as packet switching would help computer networking explode into the future, so too will a similar decentralization usher the electric grid from what it was for the previous century to a more efficient interaction that connects consumers in a cleaner and more collectively beneficial way.

Like most revolutionary ideas, packet switching was not embraced by the established community of experts that presided over the nascent field of computer networking in 1965. That changed, however, when the Advanced Research Projects Agency Network (ARPANET) embraced packet switching as a means to allow multiple computers to communicate on a single network.

Originally funded by the US Department of Defense and widely considered among historians as the first working prototype of the internet, ARPANET would adopt the internet protocol suite TCP/IP on New Year’s Day in 1983, and begin assembling the network that would become the modern internet.

Since its inception, the grid has grown and evolved to become a modern network on the cusp of transitioning to a more efficient future. To get there, the electric grid may borrow a page from the information superhighway and follow a few key transformational lessons.

Consider how information travels on the internet in 2021.

On the internet, every user is a consumer, producer, and storer of information. Send an email from the Northeast US today, and it might route through Canada on its way to a final destination. Send an email to the same person tomorrow, and it might take an entirely different path through a server in New York.

In essence, this is packet switching on steroids.

The pathways that allow for information to travel on the internet are omnidirectional, which has allowed that network to rapidly grow over the last two decades to serve billions of users worldwide.

That was not always the case if you consider how, prior to packet switching, the original computer networks were constructed as a network dominated by central mainframe servers that pushed information and data to users connected at terminal locations.

The electric grid has a similar history to the internet’s in that the grid’s network was centralized from the outset, with large generation sources (power plants) essentially pushing electricity to consumers via transmission and distribution.

The centralized grid conceived by the likes of Thomas Edison and erected by moguls like George Westinghouse served its users well for the better part of the century.

Like the internet, however, the electric grid has evolved to embrace decentralization as it transitions to an omnidirectional network in which generation and distribution are spurred by the very users for whom the grid exists to serve.

Today, for example, the electricity you use to charge, say, your mobile phone may come from the bulk grid. Tomorrow it could come from another consumer on your distribution grid who is not using their own excess generation.

As grid operators and utilities adopt new technologies to enhance their flexibility and optimize the delivery of electricity, the grid will start to follow a similar path the internet embraced in its evolution to the modern wonder it is today. The result will be an energy system whose connectivity drives its efficiency and sustainability for decades to come.

It’s an exciting time for the grid and its users, rife with possibility and opportunity.

A convergence of pressures in recent years has caused organizations across North America to examine how their energy use can be managed to help achieve their carbon reduction goals.

These converging pressures originate from customers, who desire to do business with sustainability-minded companies; investors, who realize the inherent value associated with an organization being carbon neutral; and regulators, who are introducing laws that reflect and address society’s move toward a cleaner energy future.

Since these pressures show no signs of waning, the question of how exactly demand-side energy management can be optimized to achieve carbon goals is becoming a popular discussion in the industry today.

Some of the best practices for carbon-reducing with demand-side energy management are more obvious than others. Adopting energy efficiency measures or installing on-site renewable energy sources like solar are examples of strategies that have been around for decades.

Let’s examine, then, some of the newer concepts on the topic of achieving carbon goals with demand-side tactics.

Consider the drive toward a carbon-neutral future from the grid operator’s perspective. Across the US, grids face the same converging pressures as organizations and have worked to increasingly shift their generation mixes away from fossil fuels and toward renewable sources like wind and solar.

Of course, wind and solar energy sources are inherently intermittent and can subsequently cease generating if the wind stops blowing or the sun stops shining.

But the immutable truth that some days are overcast and others windless doesn’t ease the pressure on the grid and those who run it to drive toward carbon- neutrality! Nor does inescapable intermittency suffice as an acceptable reason for grid operators to sacrifice reliability in the name of sustainability.

So what’s a grid operator to do?

Here is where commercial and industrial organizations can fill the gap from the demand side and help the US electrical grid find its way to the clean and efficient energy future that everyone desires.

That the grid needs flexible resources which can be dispatched quickly to serve load when it’s needed due to wind and solar generation being unavailable is a central point readers of this book should be quite familiar with, given it’s been examined in detail within these pages over the last three years.

The same is true of the role demand response plays in providing that flexibility to the grid.

What’s becoming more apparent is how increased participation in demand response programs at the ISO and utility levels across the US is providing new tools for grid operators to harmonize their grids’ reliability with their drive toward a future of cleaner generation fuel mixes.

In effect, this demand-side participation enables the firming of renewable energy sources, allowing grids to transition toward cleaner fuel mixes. While demand response participation doesn’t directly help individual organizations achieve their own carbon reduction goals, the cumulative effect of all the organizations’ participation does help our society achieve its desired emission goals.

The pressures organizations face from outside entities that we discussed earlier play a role in driving a given company’s carbon-reduction goals.

Unfortunately, in a reward-based world dominated by measurable metrics, there isn’t a practical way to note just how effective a given organization’s demand response participation is in helping contribute to carbon and greenhouse gas reduction.

That’s starting to change.

Organizations like the non-profit WattTime are searching for and establishing ways to help companies receive measurable recognition for doing their part with demand response to help the grid maintain reliability during its transition to the future.

Naturally, how an organization uses energy can have a large impact on carbon emissions, but when energy is consumed can move the carbon reduction needle, too. By shifting energy usage to a time when the grid mix is cleaner—during the middle of the day when solar is more prevalent compared with coal, for example—overall emissions are lowered.

An increasing number of organizations and cities have sought to eliminate their emissions in the time period when they consume electricity, often in hour-by-hour increments. This is a practice called 24/7 Clean Energy.

The more generation mixes shift toward renewable sources and as more DERs integrate into the grid with help of regulations like FERC Order 2222, the more the 24/7 clean energy effect should increase. That is, an increase in peak renewable generation will likely result in a larger potential emission reduction due to the load having been shifted.

Companies, regulators, and markets are in the early stages of ascribing value to 24/7 clean energy practices.

Consider the New York market, where Local Law 97 (LL97) seeks to reduce carbon emissions in the city’s building stock by 80% by 2050. An estimated 50,000 buildings in New York City stand to be affected by the law, with many in the commercial sector currently above the law’s emission requirements. Retrofits are one means of achieving compliance with LL97. Load shifting may be another, albeit one that will require a tangible means of assigning value to the practice.

Here we have an example of a regulation (LL97) creating a need for a possible market incentive (the value assigned to load shifting) as a means to achieve the societal goal of lowering carbon emissions in a densely populated city.

Absent a concrete policy on climate change at the national level, the market is responding. Throughout each of the deregulated energy markets in the US, demand response programs are growing at the ISO and utility level. The markets are becoming more sophisticated with how they incorporate DERs, and they’re doing all of this at the behest of state legislatures as well as the citizens who the market and grid ultimately serves.

Demand-side resources deliver carbon benefits. They always have, but today more opportunities are emerging to earn revenue with these resources.

For years we’ve touted how flexible resources will help drive the US electric grid to a cleaner future. While the ways organizations that provide those resources will be publicly credited are still undecided, the ways they’ll be financially rewarded are apparent.

This post was excerpted from The State of Demand-Side Energy Management in North America Volume III, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly evolving landscape.

The idea that reducing a watt of energy on the demand side can be just as valuable as generating one on the supply side in a time of grid stress is hardly new. Nor is the idea that such a solution helps thwart both energy-related and environmental crises.

The origin of demand response can be traced to roughly forty years ago when both the US and the world grappled with many of the same energy and environmental issues we are still trying to solve today.

Let’s take a trip back to the mid-late 1970s and see if a few things don’t look and sound familiar.

The oil crisis of 1973 sent shockwaves throughout the world, raising concerns on the security of electricity supply in the US while pointing to a need to diversify the nation’s power generation mix away from a fossil fuel dependency and toward a mix with a greater share of renewable and clean energy sources.

Global environmental awareness had grown to a movement large enough to be seized upon by newly-elected American president Jimmy Carter who, within a month of taking office, donned a cardigan sweater, sat before a roaring White House fire, and urged Americans to join him in conserving energy in a nationally-televised fireside chat.

During that broadcast on February 2, 1977, the president related how a particularly harsh winter had depleted the domestic supply of natural gas and fuel oil. He warned of dark consequences that awaited the most powerful country on earth if we as a nation failed to devise a sound energy plan for the future.

Sound familiar?

The 39th POTUS didn’t outright cite demand response as a means to a profitable and sustainable end that night in 1977, but he did allude to the Public Utility Regulatory Policies Act (PURPA), a piece of legislation that would be enacted in 1978 to promote more competitive energy markets in the US by allowing “non-utility generators” to participate in them.

The act would prove to be a landmark piece of legislation, setting the country on the road to conservation and the development of clean and renewable energy sources. It would also open the door to demand response as a viable solution to keeping both the electric grid and the environment in balance.

That open door paved the way for the deregulated, competitive energy markets we have today to replace the vertically-dominated regulatory ones that had existed for most of the 20th century. It also would prove to be the seed that would soon mature and bear the lucrative fruit of modern demand response.

Fast forward back to the present. Federal legislation is still working to ensure energy markets remain competitive with clean and renewable energy sources securing a just and reasonable position place in them.

Order 2222 from the Federal Energy Regulatory Commission (FERC) is a case-in-point. The Order is the latest in a series of directives aimed to create a fair balance between traditional generators on the supply-side and distributed energy resources seeking to enter markets on the demand side.

Issued in September 2020, Order 2222 calls for the removal of “barriers preventing distributed energy resources (DERs) from competing on a level playing field in the organized capacity, energy, and ancillary services markets run by regional grid operators.”

Order 2222, widely hailed as a landmark achievement in the history of the energy industry is about more than just creating more competitive markets. By allowing DERs, including demand response, their just seat in the marketplace, Order 2222 enables the US electric grid to take a giant leap toward a cleaner future.

Consider this recent data on demand response performance in the US:

In 2019, the most recent year for which the data is available, the combined wholesale demand response capacity of all regional system operators in the US grew to 27,000 MW.

How much environmental pollution did all that demand response save the country in 2019 by providing a resource that would have otherwise been supplied by a traditional “peaker” plant?

According to the EPA, the 27,000 MW of capacity from all commercial DR participation in the US in 2019 prevented the greenhouse gas emission equivalent of what an average passenger vehicle would produce were it to drive a little more than 142 million miles.

That same total of reduced load roughly converts to the carbon dioxide emission equivalent of 63 million pounds of coal being burned.

In 2020, CPower’s more than 1,700 customers contributed more than 4,000 MWs of capacity to demand response, effectively reducing the energy equivalent of 7 million pounds of coal that would otherwise have been burned and released into the environment.

Helping the grid stay balanced and keeping the air clean aren’t the only benefits to demand response.

The global demand response market is projected to value at USD $24.71 billion by 2022, an increase from the $5.7 billion valuation of the same market in 2014, according to a recent report published by Million Insights market research firm.

Much has been made in this publication and others in the energy industry about the evolving electric grid and demand response’s role in helping to bridge past, present, and future.

As you read these words, energy markets and electric utilities across America are refining their demand response programs and introducing new ones, providing organizations with a lucrative and socially responsible way to use their energy assets to support grid reliability in this critical time of transition.

America opened the door for demand response nearly forty years ago. Closing it now (even just a little bit) would be a step toward the past in a time when the country should be crossing the bridge to energy’s future.

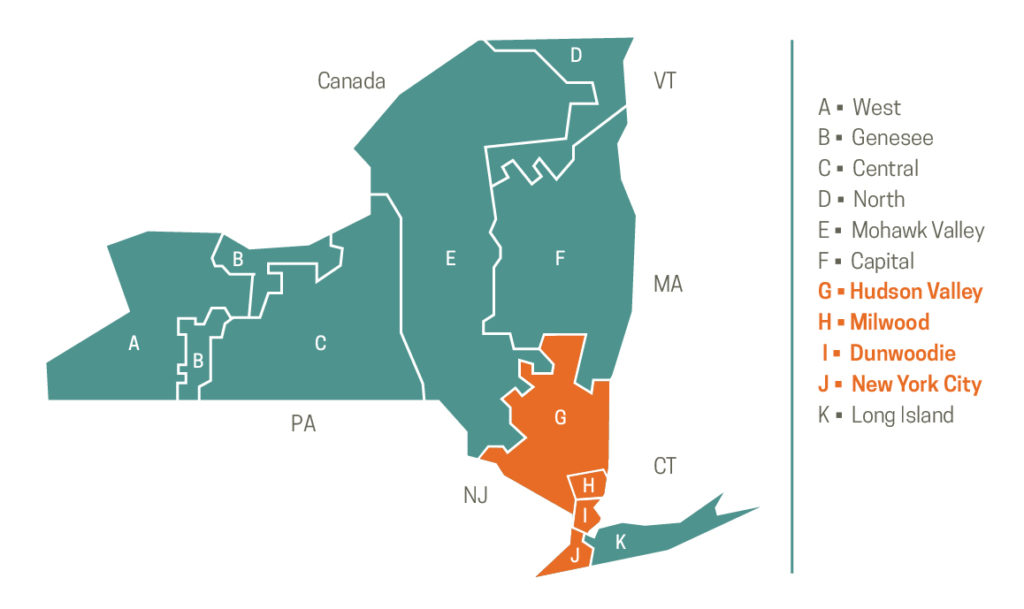

Good news on the regulatory front for new demand response resources from New York’s zones G-J entering NYISO’s Installed Capacity Market.

On February 18, 2021, the Federal Energy Regulatory Commission (FERC) issued an Order that overturned a portion of its previously issued Oct. 7, 2020 Order in the paper hearing on whether utility demand response programs Commercial System Relief Program (CSRP) and Distribution Load Relief Program (DLRP) are intended to provide benefits solely to the distribution system (i.e. not for providing similar services to wholesale capacity) and whether the revenues from such programs should be included in new Special Case Resources (SCR) entering the market in New York’s ‘Mitigated Capacity Zones’ G-J Offer Floor calculations as part of Buyer-Side Mitigation (BSM).

FERC’s Feb. 18 Order excludes CSRP revenues (in addition to DLRP revenues as the Oct. 7 Order did), making it much more feasible for most new SCRs to pass the Offer Floor test and not have to sell into New York’s installed capacity (ICAP) market at a price point that is unlikely to clear.

Customers located in Mitigated Capacity Zones who are new to the NYISO SCR program are now significantly less likely to 1) be subject to Buyer-Side Mitigation (BSM) and 2) be required to offer to sell capacity at or above an offer floor price that may not clear in the market.

Rather than run the risk of being found subject to buyer-side mitigation and have an offer floor applied (that carries with the Resource until it clears in at least 12, not necessarily consecutive, monthly Spot Auctions), DR participants will no longer need to choose between retail and wholesale markets to provide DR.

Resources capable of providing different types of DR services will be able to realize the full value, benefiting both the bulk power and distribution system operations.

The order helps to unlock the full value stack of wholesale and retail demand response values to participating customers. Subsequently, new demand response customers no longer need to choose between retail and wholesale markets in which to provide demand response resources.

What is Buyer-Side Mitigation?

Buyer-Side Mitigation (BSM) helps maintain the New York energy market’s integrity by preventing power providers from exerting market power by offering into the capacity market at an artificially low price.

BSM helps ensure both energy providers and generators are not able to exercise unfair buyer-side market power—a form of monopoly control over a market.

For example, energy providers that receive “out-of-market” payments such as state subsidies could have an unfair advantage over other power providers who do not receive out-of-market payments when it comes to offering in New York’s capacity market since the subsidized resources could offer into the market at a price that is lower than that of unsubsidized resources.

Allowing subsidized resources to offer into the capacity market at an artificially low price would distort the actual cost and the resulting market price of capacity when power providers compete fairly in the free market.

What is the Offer Floor Test?

Without getting overly complicated with details, the Offer Floor test is used to determine if a given resource is either subject to or exempt from Buyer-Side Mitigation.

NYISO defines the Offer Floor Test’s calculation for new SCRs as follows:

The Offer Floor for a Special Case Resource shall be equal to the minimum monthly payment for providing Installed Capacity payable by its Responsible Interface Party, plus the monthly value of any payments or other benefits the Special Case Resource receives from a third party for providing Installed Capacity, or that is received by the Responsible Interface Party (RIP) for the provision of Installed Capacity by the Special Case Resource, except that it shall exclude the monthly value of any payments or other benefits the Special Case Resource receives from a retail-level demand response program designed to address distribution-level reliability needs that the Commission has, on a program-specific basis, determined should be excluded.

A Brief History of Buyer-Side Mitigation and Special Case Resource in New York

The preceding article’s timeline begins in February 2021 with FERC overturning its October 2020 order. Let’s review how the issue has evolved over the previous thirteen years.

Much of the following has been paraphrased from Section II of Docket No. EL16-92-001-NY Public Service Commission v. NY Independent System Operator

Special Case Resources have been subject to NYISO’s Buyer-Side Mitigation since September 2008. In May 2010, FERC approved an Order that excluded certain payments that an SCR may receive from state-regulated, distribution-level demand response programs.

In March 2015, FERC clarified that it did NOT intend to grant an “exemption for all state programs that subsidize demand response” and further explained that a state “may seek an exemption from the Commission [FERC] pursuant to section 206 of the Federal Power Act if it believes that the inclusion in the SCR Offer Floor of rebates and other benefits under a state program interferes with a legitimate state objective.”

On June 24, 2016, the NYSPSC, the New York Power Authority, the Long Island Power Authority, NYSERDA, the City of New York, AEMA, and NRDC filed the Complaint against NYISO, challenging NYISO’s imposition of BSM on SCRs on the grounds that they interfere with legitimate state objectives. The parties requested a blanket exemption from BSM for all SCRs receiving payments pursuant to a “utility-administered distribution-level Demand Response program.”

The parties requested that the Commission approve an exemption for each of the individual utility-administered, distribution-level programs discussed in the Complaint.

On February 3, 2017, FERC ordered a blanket exemption for all new SCRs, explaining that SCRs had no incentive or ability to affect wholesale market rates. FERC also stated that existing SCRs currently subject to mitigation would not be eligible for the exemption, due to the FERC’s “long-standing practice” of not adjusting mitigation measures after a resource enters the market.

On March 6, 2017, Independent Power Producers of New York, Inc. (IPPNY) filed a request for rehearing, arguing that the SCRs, considered in aggregate, could affect wholesale market rates.

In February 2020, FERC issued an Order revoking the blanket exemption granted in the February 2017 Order.17 FERC also ordered the initiation of a “paper hearing” to determine if any specific New York programs to support SCRs should be exempted.

Peter Dotson-Westphalen coordinated AEMA support on the issue of Buyer-Side Mitigation and Special Case Resources following FERC’s February 2020 ruling and coordinated multiple comment filings with staff from NYPSC, NYSERDA, City of New York, NRDC, and Energy Spectrum. He contributed heavily to the drafting work to the joint comments, as well as the testimony of Katherine Hamilton (on behalf of AEMA) in the paper hearing.

Ohio House Bill 6 had the kind of year that, if it hadn’t taken place during 2020, might have garnered national headlines and caught the attention of Hollywood.

Before we succumb to the temptation of divulging exploitative details–which include outcries of scandal, bribery, corruption, and racketeering–let’s cover the fundamentals of the bill and what they mean to organizations in the Buckeye State looking to monetize their energy efficiency (EE) projects in 2021 and beyond.

HB 6 was enacted into law on Oct. 19, 2019, and requires all energy efficiency (EE) programs offered by electric utilities in Ohio to end by December 31, 2020.

That utility EE programs are no longer offered in 2021 means any rebate rewards offered by utilities are no longer available to organizations who complete or have completed, EE projects.

But that DOES NOT mean that organizations and EE project developers in Ohio who help the electric grid by permanently reducing electric demand are shut out from earning revenue for their efforts.

When one door closes…

In Ohio, organizations and EE project developers can, with the help of a licensed curtailment service provider (CSP), offer their permanently reduced demand (“negawatts”) into PJM’s capacity market, the Reliability Pricing Model.

Once the reduced load is accepted into the market, the organization will earn revenue from PJM for four years after the project was completed.

To learn more about monetizing energy efficiency projects in PJM in the wake of Ohio House Bill 6’s enactment, click here.

To learn more about the wild ride House Bill 6 had, Google it and pick from any number of vitriol-laced articles that show up on the first page.

Fun as it may be to shine a light on the mudslinging around HB 6, it’s not our place at The Current to feed the political maelstrom. We’re here to inform, so you can make educated energy management decisions.

That said, you might want to make sure you do your reading on HB 6 indoors and away from the windows. There is a lot of lightning out there right now.