Why doesn’t Texas have a Capacity Market?

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America.

To get a breakdown of the February 2021 Winter Event in Texas, click here.

When the Electric Reliability Council of Texas (ERCOT) established Texas’ deregulated energy market in 1999, it had several very Texan ideals in mind.

For starters, the market’s architects sought good old-fashioned economic competition to keep electricity prices stable and the state’s grid reliable.

They also settled on another battle-tested Texan value concerning its energy market: They wanted to be completely different from New York…and California, New England, and PJM for that matter.

And so it came to be that Texas would establish an energy-only market without a forward capacity market. In doing so, ERCOT became the only deregulated energy market in the US that is NOT overseen by the Federal Energy Regulatory Commission (FERC).

In the two-plus decades since ERCOT’s formation, naysayers in and out of Texas have been watching the Lone Star State with skeptical eyes, waiting for the perfect storm when a lack of forward-procured capacity proves fatal to grid stability.

Every time the reckoning seems imminent (as it did in the Summer of 2018) the ERCOT market holds strong, bending at times but never breaking. Now, many former naysayers around the US are wondering if perhaps instead of messing with Texas, other deregulated energy markets should be learning from the Lone Star State.

That Texas doesn’t have a forward capacity market is one of the market’s signature design features.

Consider a market like the Pennsylvania-Jersey-Maryland (PJM) Interconnection. To keep its grid reliable, PJM maintains a forward capacity market (the largest in the world) whereby the capacity needed to meet peak demand is procured three years in advance of its delivery day.

Using this model, PJM procured a comfortable reserve of about 21% above its reserve target in its latest capacity auction. The onus of paying for this surplus of capacity falls to ratepayers in the market, who pay for PJM’s reserve margin with higher capacity prices/demand charges.

The ERCOT market, in contrast, aims to keep costs incurred by its ratepayers at a minimum by avoiding what they see as an unnecessary surplus of capacity.

Instead of a capacity market, ERCOT maintains a capacity reserve margin, calculated by subtracting the projected peak demand on the grid from the total capacity generation available in Texas.

ERCOT’s target reserve margin hovers around 13.75%, lower than PJM’s 15.8%–considerably cheaper for Texan ratepayers, too.

Back to the original question of why doesn’t ERCOT have a capacity market. The answer is simple and decidedly Texan: Economics. Economics. Economics. (and a little desire to be different).

The Summer of 2018: ERCOT’s Proving Ground

For years, skeptics have watched the ERCOT grid, wondering when the right set of circumstances would finally expose Texas’s lack of capacity market for its inability to maintain grid reliability.

Last summer, it looked like the skeptics would finally have their day.

A shrinking reserve margin, record-setting peak demand, and a near-record heat wave pushed the ERCOT grid to its limits, but the grid held.

In September 2018, the Public Utility Commission (PUC) of Texas issued a 45-page Review of Summer 2018 ERCOT Performance, officially summarizing how the grid functioned against daunting conditions.

That the lights stayed on in Texas last summer boosts ERCOT’s belief that an energy-only market relying on economic competition as opposed to government mandate can maintain sufficient resources to keep the grid stable and avoid turning to emergency, out-of-market measures.

Much of the energy industry has taken note, too.

The R Street Institute, a public policy research organization based in Washington D.C., noted “the Texas market is working, as consumers and producers find innovative ways to reduce costs and enhance service quality.”

Demand Side Management to the Rescue

The PUC’s performance review also noted the integral role demand-side and distributed energy resources (DERs) played in keeping ERCOT’s grid reliable during the Summer of 2018. There were no rolling outages or blackouts.

Despite not experiencing a demand response event during this past summer, ERCOT’s ongoing investment in ancillary services and recent updates on how they are procured and dispatched have paid off.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly evolving landscape.

Demand Response in New England: The more things change…

ISO-NE’s implementation of its price-responsive demand construct has led to several changes in its demand response programs.

Three key changes for 2019:

- DR programs are now dispatched based on economic (instead of emergency) conditions.

- DR is now considered fast-acting DR and must be dispatched within 30 minutes of the grid’s call for curtailment.

- DR resources can be offered into both day-ahead and real-time energy markets.

It may seem like the market has changed drastically and therefore demand response participation in New England will also be strikingly different than it was in the past.

While the former may be the case, the latter really isn’t.

The fundamentals of demand response participation in New England have not changed that much from the customer’s perspective. Here’s why:

- DR programs are still dispatched with a 30-minute notification window.

- Because the economic conditions that trigger DR under PRD tend to coincide with emergency conditions, there isn’t expected to be an increase in the number of events called in 2019 under the new construct compared with previous years.

- Audits (tests) proving performance are the same as they were in 2018.

Capacity prices in New England have been trending downward in recent years.

While lower capacity prices mean lower payments for DR curtailments, they are also a sign that New England has procured adequate capacity resources. This means it is probable that there will be fewer events called in the coming years and that those events are not likely to last as long as events in previous years when capacity prices in New England were higher.

Demand Response Programs in New England

ISO-NE offers the following demand response programs:

Active Demand Capacity Resource (ADCR) is a demand response program in which participating loads are dispatched when wholesale electricity prices in New England are exceptionally high.

Launched in June 2018 as part of ISO-NE’s price-responsive demand construct, ADCR replaced the Real-Time Demand Response Program (RTDR).

Passive [On-Peak] Demand Response rewards participating organizations for making permanent load reductions.

Unlike active resources, On-Peak resources are passive, non-dispatchable, and only participate in ISO-NE’s Forward Capacity Market. Eligible behind-the-meter resources include solar, fuel cells, co-generation systems, combined heat and power systems (CHP), and more.

Passive Demand Response participants offer their reduced electricity consumption into the market during both the summer and winter peak hours.

Utility Demand Response Programs

Connected Solutions–National Grid, Eversource, and Unitil are working to lower the amount of total energy our community uses during the summer months when demand for electricity on the grid is at its highest (peak demand).

To help keep their grids healthy and reliable, these utilities now offer the Connected Solutions demand response program that pays businesses to use less energy during peak demand periods.

The rules may be changing in the New England energy market, but for the commercial and industrial organization gearing up for the summer season…demand response is the same sport as it has always been.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

New England’s Emerging Hybrid Grid

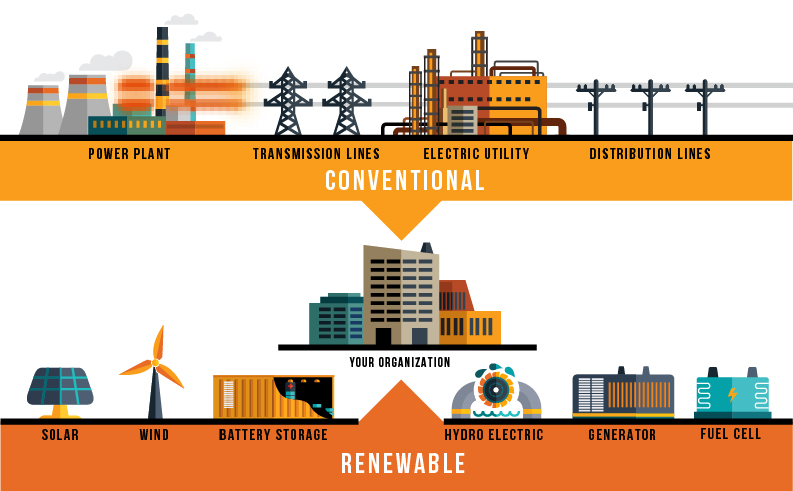

Currently, there are two developmental shifts taking place in New England concerning the electricity grid.

- The grid is shifting from conventional generation to renewable energy.

- The grid is also shifting from centrally dispatched generation to distributed energy resources.

What was formerly a traditional power system is becoming a hybrid system with electricity needs met by both conventional resources (natural gas-fired generators dependent on just-in-time deliveries of fuel) and large-scale renewable resources (weather-dependent wind and solar) connected to the regional transmission system.

New England’s hybrid system will also include thousands of small resources connected directly to retail customers or local distribution companies.

As this new hybrid grid emerges, maintaining reliable power system operations will become more complex due to new resources facing familiar constraints on energy production.

The Significance of New England’s Changing Fuel Mix and Evolving Energy Policies

In its State of the Grid 2019 presentation, ISO-NE provided a concise take-a-way statement:

“[The] Grid is holding steady on a strong power foundation, but the power system is changing and vulnerabilities are growing.”

Let’s first examine the grid’s strong fundamentals that have led to reliable power being supplied to the region over the last two decades.

ISO-NE has identified four key ingredients for the grid’s continuous reliability:

- Reliable Operations–Record cold, heat, demand, and major equipment outages have tested the grid in recent years. The grid has held.

- Robust transmission system–Big investments in system upgrades have increased grid efficiency and enhanced competition.

- Resource adequacy–New England’s Forward Capacity Market continues to attract and retain the capacity required to meet demand.

- Established, collaborative decision-making process–The ongoing collaboration between the ISO, market participants, state officials, and consumer advocates over the last 20 years has found and will continue to find solutions to the region’s energy challenges.

Now, let’s examine the grid’s potential vulnerabilities. ISO-NE has identified two areas of concern:

- Energy security risk–As the NE fleet shifts from power plants with stored fuels to resources that depend on weather or just-in-time fuel deliveries, there is growing concern that adequate capacity will be available throughout the region on a year-round basis.

- Shifting policy priorities are challenging competition in the market--NE’s competitive market has delivered reliable energy at fair market prices for the last 20 years. Competition has helped lower wholesale electricity prices while spurning investments of more than $16 billion in cleaner power plants and resources that reduce demand.

That said, the region’s individual state initiatives and mandates aiming toward clean energy goals have created a need for markets to be adapted to sustain the benefits of competition.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

PJM: A Look Ahead to Summer ’19 and Beyond

Summer 2019 is right around the corner, which means another season of PJM’s Emergency Capacity demand response (DR) program is set to kick off. This 2019/2020 marks an important pivot point for DR in PJM. With DR enrollment underway, let’s take a look at some things to expect this summer.

2019 Summer Outlook

Weather-wise, early indications point to the PJM region experiencing normal to mild summer temperatures. That’s good news for DR customers in Emergency Capacity but may be challenging for peak shavers to accurately predict PJM’s 5 CP (Coincident Peak) hours. The weak El Nino climate is not expected to have much of an impact, although there’s a good chance that the historically wet 2018 season will carry over to 2019. So don’t put away those rain slickers just yet!

Capacity-wise, PJM forecasts summer peak load of 151,358 MWs. Unlike in Texas, where the grid operator ERCOT (Electric Reliability Council of Texas) is forecasting a reserves situation that make summer emergency events likely, the PJM region at this point seems to have adequate reserves. As we learned during the 2014 Polar Vortex, though, nothing is completely certain when it comes to expected supply and demand. Here’s hoping the summer weather forecast proves to be right.

Goodbye Base and Summer Capacity, Hello Capacity Performance— and Seasonal Aggregations

June 2019 will mark the final season of PJM’s summer-only DR programs. PJM retired the Limited and Summer Extended DR programs after the 2017/18 delivery year, and now will retire the Base Capacity program at the conclusion of the 2019/20 delivery year.

This will usher in the long-talked-about Capacity Performance (CP) DR program as the lone DR program available, starting next year for the 2020/21 delivery year. As you probably know (and as we discussed in last year’s white paper on the myths around CP), the CP program required DR participation and compliance year-round, not just during the summer. As originally designed, CP DR customers would have to participate with one load reduction value for the entire year. To many, this has caused far more problems than it solved, as many DR customers feared having their participation levels drastically reduced — or even dropped from the program entirely — due to concerns over their inability to participate and comply in the winter.

Fortunately, PJM and the FERC (with a little help from CPower Market Development and others, advocating on our customers’ behalf) may have found a way to put those concerns to rest.

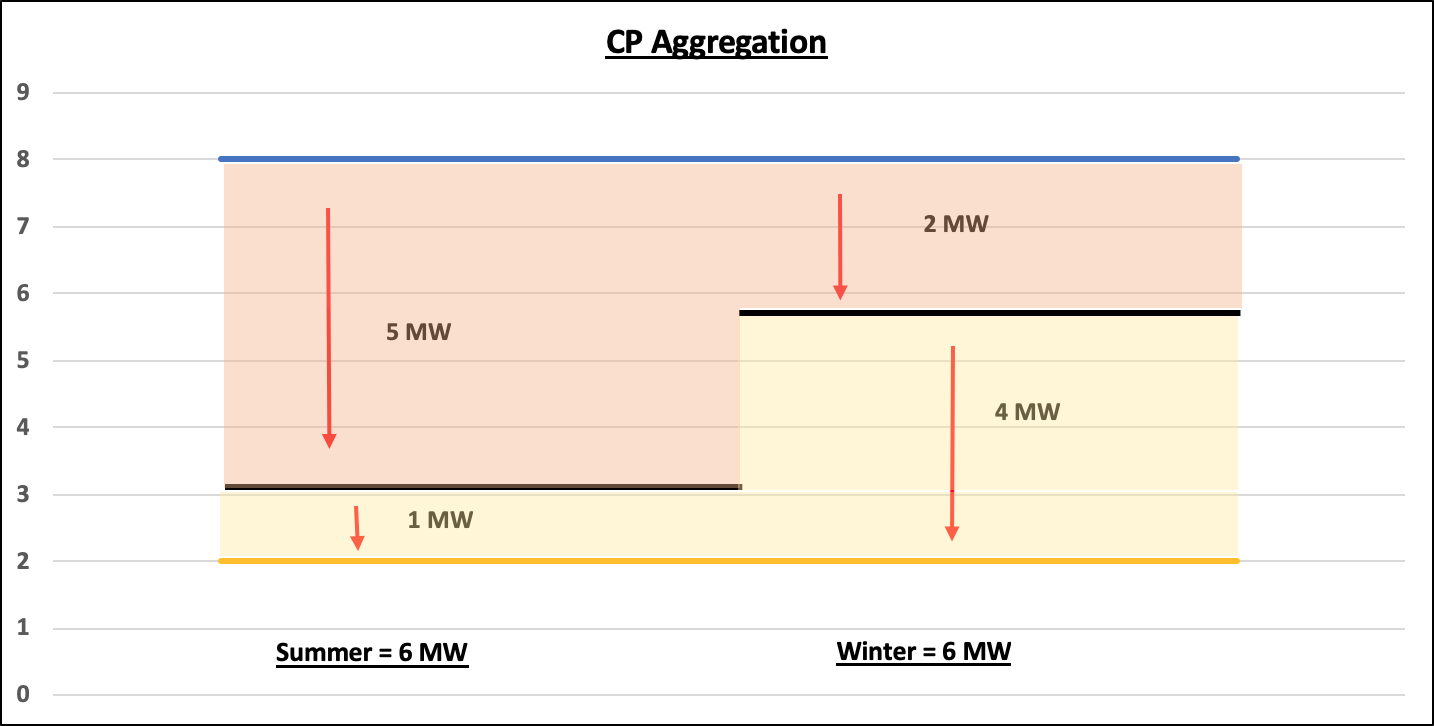

The FERC (Federal Energy Regulatory Commission) recently approved a PJM filing that will now allow DR customers to participate in CP with two different summer and winter seasonal load reduction values. Of course, there’s a catch. Participating with separate summer and winter values is contingent upon the customer’s curtailment service provider (CSP, i.e., CPower) being able to offset its seasonal load to create “CP Aggregations.”

How does that work? Let’s take two customers, Alpha Amalgamated Alloys and Beta Better Ball Bearings. Each has participated in summer-only DR for years. Now, however, they have to make year-round commitments, and they’re stuck.

Enter the new rule and their CSP, CPower. CPower works with each to determine what each can contribute for summer and, separately, for winter. Alpha determines that they can reduce 5 MW in the summer but only 2 MWs in the winter. Beta determines that they can reduce 1 MW in the summer but 4 MWs in the winter. And they’re both in the same utility zone within PJM.

Under the rule as originally created, Alpha would be faced with having to curtail only 2 MWs in the summer, when they used to be able to curtail—and monetize—5 MWs. Meanwhile, Beta would be unable to monetize their additional 3 MWs of now-required load in the winter. That could change the desire to participate in Emergency Capacity DR for these two long-time customers.

The new rule, however, allows their CSP to aggregate (or combine) their reductions to create a CP zonal aggregation of 6 MWs year-round. Their combined summer reductions and winter reductions balance each other out and comply with the new CP requirements. Each continues to benefit from DR participation in PJM.

This program rule change, thankfully, allows more flexibility and opportunity for PJM’s DR customers to participate as Emergency Capacity resources (which PJM always needs). This assumes, however, that their CSP has the market position and a diverse portfolio to successfully manage these DR CP programs.

Shameless plug: CPower, of course, has the capability to generate zonal CP aggregations across all PJM zones and all customer types. We’ve worked hard to not only build ourselves into the top curtailment aggregator in PJM; we’ve also advocated tirelessly before PJM to create this opportunity for our customers to ensure that CP doesn’t negatively impact PJM’s vital electric reserves. In this way, barriers become opportunities, and everyone wins.

What to Look Out For

PJM has pushed back their next Base Residual Auction (BRA) for the 2022/23 delivery year from May, 2019, to August, 2019 and the possibility still remains that it could get pushed back again until early Spring 2020. This will allow for some RPM rule changes to be implemented. If you’re interested in future capacity prices and DR availability, stay tuned, as the results for that auction won’t be known for a few more months.

PJM stakeholders are discussing potential changes to the mandatory DR test even that occurs each summer if there is no actual emergency event called. Some topics of discussion are: increasing the test event to longer than one hour; compensating test event compliance with emergency energy payments; PJM scheduling the test event instead of the CSPs; and possibly a mandatory winter testing provision. Nothing’s set in concrete yet, and CPower will keep you up-to-date as the discussions move forward.

Just Released: 2019 State of the Market

Finally, CPower has released, “2019 State of Demand-Side Energy Management in North America.” This is an invaluable resource filled with analysis and commentary from CPower’s market experts (including yours truly). It covers all regions served and supported by CPower in the U.S. and Canada and will be an important source of information for DR customers and partners regionally and nationally. Download your guide here.

If you have any questions about goings-on in PJM now and in the future. don’t hesitate to reach out to the PJM team. As always, we’re here to help.

What has PJM learned from the Polar Vortex?

On January 2, 2014, a sudden stratospheric warming caused a breakdown of the polar vortex, a semi-permanent low-pressure system of cold polar air that helps the jet stream maintain a roughly circular path as it travels around the globe.

A healthy polar vortex keeps the jet stream in line, which in turn keeps the cold air up north and the warm air down south.

An unhealthy polar vortex allows the jet stream to break apart, allowing the Arctic’s frigid air to escape southward as it did in 2014. The 2014 Polar Vortex (officially the 2014 North American Cold Wave) led to record low temperatures in the US and caused PJM’s grid to face dire reliability concerns.

In the wake of the 2014 Polar Vortex, PJM established a new market design to better procure resources when the grid is stressed due to extreme weather.

Five years later, the PJM grid would again be challenged when a weak polar vortex led to temperatures in the US plummeting to record lows, including -23 degrees in Chicago in late January 2019.

That the PJM grid maintained its reliability in the winter of 2018/19 is a sign that recent market changes are working as designed.

Let’s examine those changes with an eye on how commercial and industrial organizations in the region can leverage their existing energy assets and achieve demand-side energy management success.

What did Winter 2014 Teach PJM?

On January 14, the coldest day of winter in 2014, 22% of PJM’s generation was unavailable to meet consumer demand. PJM knew they had to take action to ensure the grid had enough capacity in the future to meet the most daunting and coldest circumstances.

“To ensure reliability, we’re doing everything humanly possible. If the lights aren’t on, nothing else matters.”

–Terry Boston, PJM President and CEO

2014 PJM Annual Report

To guard against future outages like the ones experienced in 2014, PJM proposed to the Federal Energy Regulatory Commission (FERC) a redesign of the region’s Reliability Pricing Model (RPM), the capacity market that ensures long-term grid reliability by securing the appropriate amount of power supply resources needed to meet predicted energy demand three years in the future.

PJM’s Transition to Year-Round Demand Response (DR)

One of the more significant changes PJM implemented involves a transition to demand response programs that require year-round participation.

PJM’s two emergency capacity demand response programs available in 2019, Base Capacity and Capacity Performance, each reward year-round participation from its participants.

Base Capacity, however, differs from Capacity Performance in that it requires performance in the summer months of June through September, but can also reward for responding to dispatch throughout the year. 2019 will be the final year PJM offers Base Capacity.

These new programs replaced the legacy DR programs PJM previously offered until the end of the 2017/2018 program–Limited DR, Summer Extended DR, and Annual DR.

How has Capacity Performance affected grid reliability?

The short answer is PJM’s grid is doing just fine having shifted to Capacity Performance.

In an analysis on its system performance during the “bomb cyclone” cold snap from Dec. 28, 2017, through January 7, 2018 (the region’s coldest stretch since 2014), PJM confirmed its grid performed well, with excess resources available on days when temperatures were the most frigid.

But that doesn’t mean PJM doesn’t see room for improvement in 2019.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

Is Peak Shaving more Lucrative than Demand Response in PJM?

Peak-shaving, essentially the practice of an organization reducing its demand during times of peak grid stress to lower its capacity charges, is part of what the Federal Energy Regulatory Commission is considering as the agency examines PJM’s annual capacity construct.

In a June 2018 proposal, PJM stated it hoped to reduce its capacity market demand curve by including peak shaving among the variables it considers when developing its load forecast.

To do this, PJM would have to adjust its current forecasting model, which involves identifying gross load for a delivery year and establishing a forecast that includes economic, weather, and end-user changes, but excludes peak shaving as a variable.

PJM believes their proposed model will provide a more holistic view of the grid and its potential need for resources to maintain the balance between supply and demand.

Opponents are concerned whether PJM’s proposed methods for integrating peak shaving as a variable in forecasting its load are underdeveloped and will ultimately provide an accurate forecast.

They may have a point.

PJM’s proposal states among its outstanding issues that accounting for existing peak shaving activity relies on entities providing PJM with historical peak shaving activity and that currently there is no established best practice for obtaining this crucial data.

Is Peak Shaving Right for Your Organization?

Given all this uncertainty around peak-shaving in PJM, it’s a fair question to ask if the practice is right for your organization.

Since no two organizations are alike, the answer to that question will naturally vary from one organization to the next.

Consider that an organization involved in peak shaving will likely curtail for about 30 hours in a single summer in an attempt to time their curtailment with the hours PJM’s grid is at peak system load.

Is the organization better off curtailing for that long and realizing the savings in subsequent peak charges? Or would the organization be better off participating in demand response, which, if not called for an emergency event, only involves just one test hour during the summer?

It’s best for a given organization to consult a licensed curtailment service provider that has the ability to evaluate all of an organization’s energy assets and explain how they may best be leveraged in PJM’s existing markets to optimize savings and earnings through demand-side energy management.

This post was excerpted from the 2019 State of Demand-Side Energy Management in North America, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly-evolving landscape.

Dirty Power: The Story Behind UFR and ERCOT’s LR Demand Response

In our last ERCOT blog post, we laid out the record high demand/historically low supply scenario facing ERCOT and its customers this summer. As we reported, ERCOT acknowledges that this situation could result in emergency energy alerts. This will more than likely result in high electricity prices, perhaps record high prices. If you participate in ERCOT’s Load Resource (LR) demand response program, those high prices will mean generous revenue paid to you for participating in LR.

In the rush to enroll in LR and capitalize on some Texas-sized payouts before the summer enrollment deadline, though, a lot of commercial and industrial customers have encountered an unexpected ERCOT roadblock: UFR. And they want to know: What’s a UFR? What’s it got to do with LR DR? Why do I need it? And how do I get it?

To answer these questions and get everyone on the path to significant summer revenue, we have to start with dirty power.

Dirty power is a term used to describe electricity that is affected by abnormalities such as power surges, excessive line noise, and fluctuating frequency. It usually describes power intended for delivery through the electrical grid, and that’s how we’ll use it here. It can have several causes, but the end result is almost always the same: damage to your equipment and infrastructure that can cripple your daily operations.

You probably don’t think of electrical power as “dirty.” It’s hard to imagine, perhaps because you can’t see, smell or touch it. You can see, touch or smell dirty water and dirty air. Same with work clothes, office windows, and motor oil.

But electric power can in fact be “clean” or “dirty.” Unlike the examples above, though, dirty power stays dirty. You can’t clean it, at least not easily. The abnormalities that make it “dirty” are usually generated at the source and can flow to the farthest reaches of the grid almost instantly.

Wind is a major source of dirty power. Ironically, it’s also the current centerpiece of Texas’s nation-leading embrace of “clean” renewable energy. The Lone Star State’s drive to incorporate more renewable energy sources to power the grid has established Texas as the largest producer of wind power in the U.S. ERCOT says wind accounted for 17.4 percent of electricity generated in its service area (roughly 90 percent of Texas) in 2017.

But this intermittent source of power generation is also a major source of “harmonics” — a distortion of the underlying sinusoid of a signal, referred to as over or under frequency events. That’s dirty power. West Texas, where there are a lot of wind generators, is dramatically affected by frequency changes. As the wind increases or decreases, the generation created by wind turbines flows onto and off the grid, causing frequency changes as the load drops and rises. At the least, these frequencies can cause overheating and premature equipment failure.

That brings us to UFR. UFR stands for Under Frequency Relay. According to IEEE, UFRs are used to automatically shed a certain amount of load whenever the system frequency falls below an acceptable level for grid stability. Think of it as an industrial-strength circuit breaker that protects the grid — and your business — from shorting out.

So, why does ERCOT require that LR participants have UFRs installed? Because UFRs help them fulfill their mission to maintain the security and reliability of the ERCOT system. That includes helping the grid stabilize autonomously by stopping the spread of Under Frequency.

As the number of wind turbines dotting the windswept Texas plains has increased, so has the possibility of frequent under frequency conditions. So has the need to stop the spread of UFR throughout the grid. (The oil and gas communities across West Texas were among the first to adopt UFRs in the fields, largely to protect their machinery.)

To do that, they need you. Customers that can meet certain performance requirements can be qualified to provide operating reserves as a Load Resource and be eligible for a capacity payment. In short, LR DR. And that requires that an Under Frequency Relay be installed that opens the load feeder breaker on automatic detection of an under frequency condition.

As we noted above, dirty power can spread easily and rapidly across the state and affect every organization attached to the grid, especially commercial and industrial concerns. And we also noted that to be considered a Load Resource and receive capacity payments, you have to be available as needed. A great way to knock out an available Load Resource is dirty power in the form of an under-frequency condition. UFRs assure that your availability will not be affected by this particularly spreadable form of dirty power.

If you want to enroll in LR and don’t have a UFR, CPower can help. We work with world-class third-party resource vendors and partners who can design and install UFRs to the exact specifications of the CPower curtailment plan developed for your facility. By working with the best, we assure you of the best opportunity to save and earn.

You don’t need a UFR to go about your daily business. But you do need it to receive the financial benefits of being a Load Resource available to provide invaluable operating reserves as needed. Considering that the growth of renewables, especially wind, shows no signs of abating in Texas, and with it the threat of under frequency conditions, having a UFR might just be a good idea, period.

ERCOT Summer 2019: Supply, Demand, and Red-Hot Energy Prices

UPDATE March 5: ERCOT announced today that, due to expected record high demand and “historically low” 7.4% expected reserve margin, they have “identified a potential need to call an energy [emergency] alert at various times this summer.” (Emphasis ours.) Alerts allow ERCOT to take advantage of resources available only during scarcity conditions—particularly demand response. ERCOT will release its final summer report in May.

Two significant factors projected for ERCOT — the Electric Reliability Council of Texas—stand to have a noticeable impact on its energy market: Reduced supply and record peak demand. The resulting clash between these two market drivers point to the very real possibility of unexpectedly high prices for organizations participating in ERCOT’s Load Resources (LR) demand response program. Let’s take a look at what’s driving these two important factors, and how this could translate into an opportunity to generate revenue through demand response.

Reserves have dropped dramatically. Since mid-2017, ERCOT has approved the retiring of four coal-fired generation plants responsible for generating more than 4,500 MW in capacity. It’s not just coal generation, though. Since the May 2018 Capacity, Demand, and Reserves (CDR) report, three planned gas-fired projects totaling 1,763 MW and five wind projects totaling 1,069 MW have been canceled. Another 2,485 MW of gas, wind and solar projects have been delayed.

In its December 2018 CDR report, ERCOT projected total available generation capacity for Summer 2019 at 78,555 MWs—an estimate, as it turns out, that’s too low. ERCOT recently learned that it is losing another 470 MWs from the Gibbons Creek coal plant going offline this summer. That drops reserve capacity to 78,085 MWs—a low, low 7.4% reserve margin, just over half of the long-standing target margin of 13.75% of peak electricity demand.

And demand will peak. Last year, ERCOT set an all-time peak demand record of 73,473 MWs on July 19 between 4 and 5 p.m. This year, ERCOT predicts more “record-breaking peak demand usage” for the summer: 74,853 MWs, 1300 MWs higher than last year’s all-time peak.

That leaves a gap of—hold on—just 3,232 MWs. Low supply. High demand. Tight, tight margins. All that adds up to the potential for record high prices in ERCOT’s Load Resources (LR) ancillary services demand response program that ERCOT deploys to maintain sufficient operating reserves.

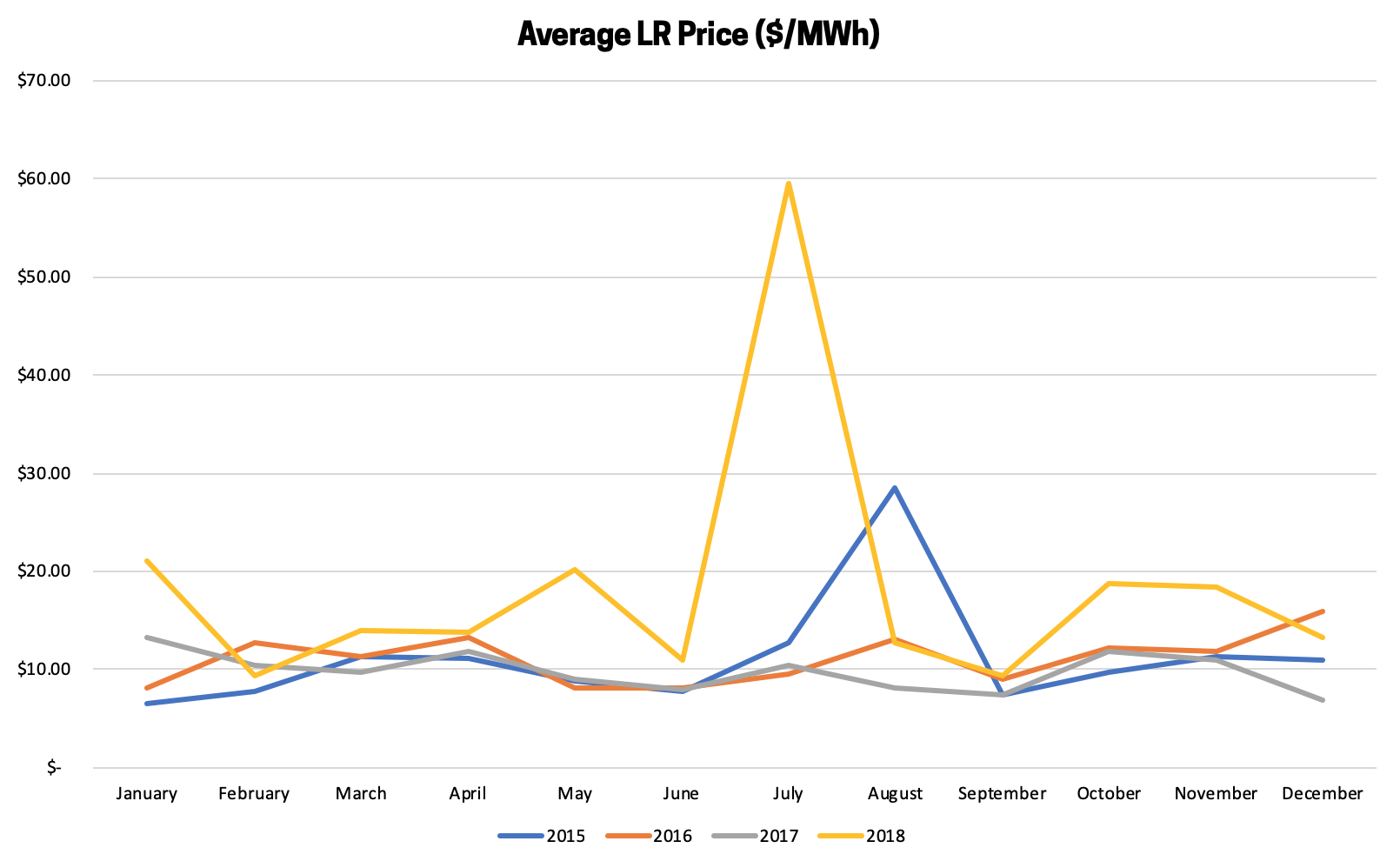

Already, LR prices have increased since the retiring of 4,200 MWs of generation in 2018. (see chart.) Additionally, projected wholesale energy prices in ERCOT for Summer 2019 are some of the highest we have seen. It’s not a stretch to anticipate high, if not record high, LR prices this summer.

High prices in Load Resources mean generous revenue paid to you for your participation in the program which pays businesses for being available to curtail energy on short notice when the grid is stressed. LR has the potential to pay organizations two to three times more than other ERCOT demand response programs.

CPower can help you get the most out of the Load Resources program by working closely with your organization to develop a customized curtailment strategy, including automation, that suits your business objectives and operational considerations. Start the conversation today. Learn how to maximize your curtailment revenue with CPower and ERCOT’s LR program.

New England Connected Solutions

Webinar (2/14/2019): Dispatchable Dollars: How Demand Response Creates Revenue Opportunities For DER

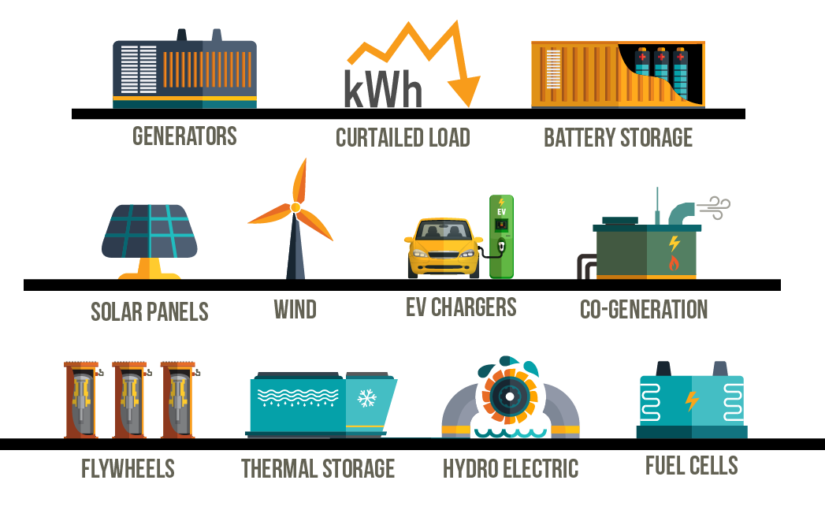

Distributed Energy Resources (DER), including storage, are proliferating the world of energy management in a big way. Today, these assets are primarily implemented to provide operational resilience and demand management; however, additional opportunities are rapidly evolving.

As intelligent application of DER assets increases for commercial and government sectors, the opportunity to leverage these same assets into revenue generating channels also increases.

Through programs like demand response, your DER assets become vehicles for saving and earning, which increases ROI, shortens project payback periods or helps fund other energy projects, all while providing greater support for grid reliability.

Join DER and storage experts from CPower Energy Management and Stem and learn about:

- The evolution of DER as a mainstream asset

- Market drivers for DER growth and opportunity

- Planning intelligent DER and Demand Response integration

- How commercial orgs have added 30-50% to the value of DER projects by using flexible infrastructure, such as storage, to participate in DR programs like DRAM in California