CPower Awarded 2022 Green Bank Award, Recognized as Early Adopter for Energy Storage Solutions

CPower Wins 2023 Edison Award

DER Monetization the Key to Enabling the Energy Transition

When the grid is stressed, would you rather turn on a fossil-fuel-powered peaker plant or tap into existing resources to reduce our electricity consumption? For us, it’s a simple choice for the community and our planet.

The Customer-Powered Grid™ is the answer. In aggregating customers’ distributed energy resources (DERs) and collectively using them to help the grid when and where it’s needed the most, we can create a flexible, clean and dependable future.

Peaker plants are major emitters of greenhouse gases and have a negative impact on air quality and public health. By leveraging DERs that are already available, like demand response, we can help reduce carbon emissions and other pollutants to help mitigate the impacts of climate change.

DERs Counter Climate Change Impact

Customers recognize the potential of DERs, which are assets or devices that consume, store or generate power and can respond to a signal, as well. Sustainability is the second-most-common reason for implementing DERs, with one in three customers citing it as a motivation, according to CPower’s 2023 Customer-Powered Grid Survey.

The grid needs more clean energy, which DERs can supply reliably and affordably, and that need for flexibility is growing:

-

- Annual additions of renewable power capacity globally must grow three times the current level by 2030 to limit global warming to 1.5°C or less per the Paris Agreement, according to the International Renewable Energy Agency (IRENA). This would require investing $35 trillion in energy transition technologies worldwide by 2030, IRENA estimates.

- The clean energy transition must accelerate for the U.S. to avoid the worst climate impacts, according to the Business Council for Sustainable Energy (BCSE), which noted that 2022 was the third most costly climate disaster year on record with 18 climate-related disasters causing at least $1 billion in damage each. The country needs modernized and expanded infrastructure to accelerate the deployment of clean energy and energy efficiency solutions, BCSE says.

- The U.S. is only halfway to its emissions reduction goal for 2025 and slightly more than a quarter to its target for 2030. It must double the share of electricity generated by non-carbon-emitting sources by 2030 to achieve net-zero carbon emissions by 2050.

We won’t be able to ensure grid stability through this rapid transition and beyond without DERs. DERs such as demand response and energy efficiency support greater deployments of clean, renewable energy resources by filling gaps in variable generation. Given their flexibility, DERs can quickly respond to changing grid needs at any time, like if renewable generation unexpectedly drops due to a decrease in the availability of sun, wind or gas.

DERs also reduce the need to build new generation capacity, which is crucial because we must quickly replace coal-fired power plants like the peaker plants that have historically provided flexibility to the grid. The U.S. is on track to close half of its coal generation capacity by 2026 and cut coal consumption by the power sector in half by 2030, all of which could affect the stability of the grid.

CPower envisions a flexible, clean and dependable energy future enabled by The Customer-Powered Grid™.

DER Monetization Supports Sustainability.

Energy users benefit from investing in DERs and by monetizing them through grid services. More than 88% of CPower customers say that DER Monetization has helped their business. In addition to saving money by curtailing their loads when the grid is stressed, these energy users can take the revenue generated from their participation in wholesale market or utility grid programs to improve or invest in operational or sustainability initiatives for their organization.

Energy users are also under significant pressure to reduce emissions, make ESG investments and counter the impacts of climate change. DER Monetization helps an organization achieve its clean energy goals by allowing it to use less electricity and reduce associated emissions.

We are proud to have helped our customers avoid more than 280,000 metric tons of CO2, equivalent to not burning more than 317 million pounds of coal, in a single year alone. We know that the work we do is essential in making our vision of a flexible, clean and dependable energy future enabled by The Customer-Powered Grid a reality.

This year, we are also supporting sustainability as an organization through our internal initiatives as well as by donating to EarthDay.org, whose mission is to diversify, educate and activate the environmental movement worldwide.

Clean energy commitments by companies — and the pressure others face to keep up — are becoming watershed moments for the energy transition. From technology and manufacturing companies to real estate and big-box retailers, companies are committing to decarbonization.

By investing in clean energy, using less electricity and participating in utility and energy market grid services, energy users can help fill the role now played by gas generators from central systems. That is, why burn fuel to power a peaker plant when you can use DERs to balance the grid when it’s stressed?

The answer is obvious to us. How about you?

Join us on the journey to the Customer-Powered Grid — and the flexible, clean and dependable energy future that it will enable. Call us at 844-276-9371 or visit CPowerEnergy.com/contact to learn how we can help you most effectively invest in DERs to support sustainability, improve grid reliability and increase energy resiliency.

Shelley Schopp

As Senior Vice President, Customer Fulfillment & Human Resources, Shelley leads CPower’s Operations team. With over 25 years of experience in the energy industry, she helps the company share its collective wisdom through every touchpoint CPower offers.

Grid Reliability a Growing Concern: Customer-Powered GridTM Survey

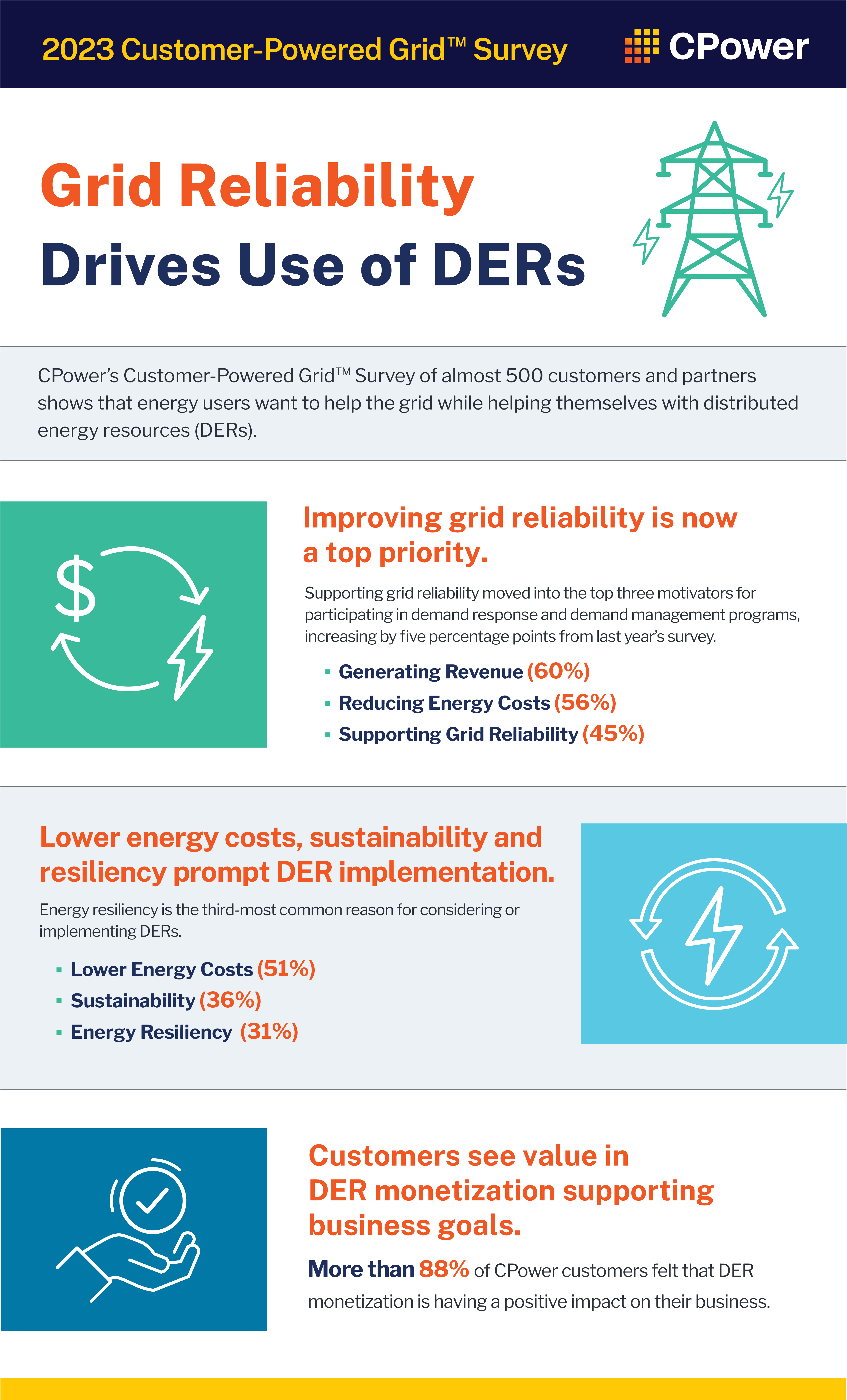

Grid reliability has become one of the primary reasons that energy users participate in distributed energy resources (DER) monetization, ranking among the top three motivators for the first time in CPower’s annual Customer-Powered Grid™ Survey.

Nearly half (45%) of the almost 500 customers and partners surveyed cited supporting grid reliability as motivation for participating in grid services. Only generating revenue (60%) and reducing energy costs (56%) were cited more often.

Energy users worry about grid disruptions and scarcity events caused by factors such as more power outages from extreme weather and shifting demand patterns due to electrification and other issues.

Electricity peak demand and energy growth rates in North America are both increasing, the North American Electric Reliability Corporation warned in its most recent long-term reliability assessment, noting that the 10-year summer and winter peak demand growth projections showed the largest percentage increase in recent years.

Customers can help balance the grid when and where it’s needed the most through grid services programs that pay them for using less electricity when the grid is stressed.

More than 88% of the CPower customers survey confirmed that DER monetization has helped their business as well. Customers often use the revenue generated from their participation in wholesale market or utility grid programs to improve or invest in operational or sustainability initiatives for their organization.

Sustainability was the second largest motivation for implementing DERs (36%), followed by energy resiliency (31%). By using DERs for themselves and monetizing them through grid services, customers can improve operational reliability while contributing to a cleaner and more reliable energy grid for their community.

To learn more about how DER monetization supports grid reliability and improves energy resiliency, call us at 844-276-9371 or visit CPowerEnergy.com/contact.

Glenn Bogarde

Since becoming CPower’s Senior Vice President of Sales and Marketing, Glenn has led the company’s sales team on a nationwide mission to help customers get the most from their DER monetization participation. Glenn brings to CPower more than 20 years of sales experience in the enterprise software and energy industries.

Grid Reliability an Increasing Motivation in CPower’s 2023 Customer-Powered Grid™ Survey

Decarbonizing Data Centers Gives Grid Flexibility

When it comes to energy, data centers are mostly known for how much they consume—but they can give as well as take.

Globally, data centers consumed 220 to 320 TWh of electricity in 2021, or 0.9% to 1.3% of total electricity demand. Within the U.S., they account for about 2% of total electricity use, consuming 10 to 50 times the energy per floor space of a typical commercial office building.

However, rising demand for both data centers and sustainable solutions is causing the industry to shift its approach to tackling both issues. Data centers are driving the renewable energy transition by deploying grid-scale, carbon-free energy.

With companies like Google and Microsoft leading the charge in pledges to reduce their emissions and run data centers 24 hours a day, 7 days a week, 365 days a year on clean energy, we can expect progress by way of industry emissions reductions. Even so, there is far more that can be done for data centers across the board in terms of using energy more responsibly to drive decarbonization.

As data centers look towards a bright future with an eye on growth, efficiency and sustainability, they can join Virtual Power Plants (VPPs) to service their local communities and support the grid by optimizing distributed energy resources (DERs). CPower’s VPP Marketplace, for example, simplifies how data centers communicate, control, and optimize performance of their DERs, rewarding them for reducing their energy while meeting the demands of the grid. This approach will also increase data center sustainability and profitability while increasing community resiliency.

Leveraging Data Centers’ DERs to Achieve Resilience and Reliability

As more front-of-the-meter clean energy resources are integrated with the grid, operators and utilities beg the flexibility of behind-the-meter DERs. Data centers with DERs can complement renewable intermittency to balance supply and demand as well as support the grid in the face of climate change.

Unfortunately, extreme weather events are growing in frequency, threatening a number of the nation’s already ailing electric grids, including across PJM during Winter Storm Elliott in December and throughout the country during a record-breaking summer last year.

There were, however, demonstrations of what’s possible, when energy user DERs helped the grid during those events as well as when Texas data centers contributed curtailment of their power usage from the grid via ERCOT’s demand response program in February 2021, to ensure the grid maintained the necessary frequency to remain online during Winter Storm Uri.

Data centers can leverage demand response programs to optimize idle DERs, including energy efficiency, generator sets, uninterruptible power supplies and solar PV, to maintain reliability during extreme weather or grid stress. In doing so, a data center’s campus can act as a VPP by serving as a flexible resource capable of balancing the grid and ensuring 24/7/365 uptime to a site’s operations as well as its customers’ businesses, in addition to increasing resilience for homes and businesses in the community it serves.

Delivering Community-level Sustainability

Businesses are under increased scrutiny from customers and consumers to act sustainably, investors have recognized long-term gains associated with carbon neutrality and regulators are advancing laws that reflect and address society’s shift towards a clean energy future. The convergence of these factors has created a timely opportunity for data centers to deliver clean and sustainable flexible energy.

For perspective, that lone MW of permanently reduced demand would spare the ozone the GHG equivalent of more than 8.9 million miles driven by an average internal combustion passenger vehicle. By shifting energy usage to a time when the grid mix is cleaner—during the middle of the day when the sun is shining and solar is more prevalent than coal, for example—organizations can lower their overall emissions. When the sun sets, or when DERs go offline, demand-side resources from data centers can help keep the grid balanced and avoid having to fire up costly, dirty peaker plants.

Turning Your Efficient Data Center into a Money Center

While the environmental benefits of energy efficiency projects are substantial for participating data centers, the financial earnings are worth quantifying, too. As an example, when monetized in the PJM capacity market, organizations can achieve permanent load reduction resulting from energy efficiency projects they have completed or will complete in the future.

Increased participation in demand response programs at the ISO and utility levels across the United States offer new tools for grid operators to balance their needs while supporting a cleaner generation mix. Data centers are the ideal candidate to earn revenue through demand response and enable an uninterrupted power supply.

Given the need to be up and always running, data centers utilize N+1 redundancy and are equipped with excess generator capacity which exceeds the center’s total peak demand. Such high-capacity emergency generation systems put data centers in prime position to earn significant revenue with demand response, money that can be used, among other things, to offset a participating organization’s hefty electricity bill, fund equipment or infrastructure upgrades or to pass along to customers in the form of lower rates.

Conclusion

Like the grid, data centers across the world are positioning themselves for a more sustainable tomorrow. The sheer size of the industry alone is large enough to drive meaningful emissions reductions simply by reducing its power demand. As grid operators and technology companies alike work towards a cleaner and more dependable energy future, measuring the impact of demand-side management programs offers a clear path for data centers to further demonstrate their commitment to sustainability.

Most U.S. data centers have energy assets that can help the grid transition to a clean, flexible and dependable future. Call us at 844-276-9371 or visit CPowerEnergy.com/contact to explore how you can use your data center’s energy assets to earn revenue for helping the grid and improving the world’s sustainability.

Nate Soles

As CPower’s Vice President of National Accounts, Nate manages dozens of data center clients and strategies across North America.

CPower Joins Industry Leading “Virtual Power Plant Partnership” Initiative

Four Energy Regulatory Trends to Drive Grid Improvements in 2023

This year’s top energy regulatory trends will include an emphasis on improving grid flexibility, reliability and resiliency to better handle extreme weather and demand peaks. Stakeholders want to maintain access to affordable, reliable electricity as the industry transitions to intermittent renewable resources and adapts to evolving consumption and demand patterns that strain the grid.

“Energy systems and the electricity grid are undergoing unprecedented change on a scope, scale, and speed that challenges the ability to foresee—and design for—their future states,” North American Electric Reliability Corp. (NERC) researchers wrote in NERC’s 2022 Long-Term Reliability Assessment.

“The energy and capacity risks identified in this assessment underscore the need for reliability to be a top priority for the resource and system planning community of stakeholders. Planning and operating the grid must increasingly account for different characteristics and performance in electricity resources as the energy transition continues,” according to NERC.

NERC’s recommendations to industry and policymakers for addressing the reliability risks described in its assessment include:

-

- Incorporating extreme weather scenarios in resource and system planning

- Increasing focus on distributed energy resources (DERs) as they are deployed at increasingly impactful levels

- Considering electrification’s impact on future electricity demand and infrastructure

Like NERC, regulators ranging from the local to federal levels have recognized the need to prioritize grid improvements and have responded accordingly. The following efforts will be among the top energy regulatory trends in 2023.

1. Leveraging Demand Response Aggregators in Traditionally Regulated States

About a decade ago, regulators in several traditionally regulated states restricted DR aggregators from representing customers’ demand response resources in wholesale electricity markets for a variety of reasons. Several states are reevaluating the restriction and considering how to leverage DR aggregator participation consistent with state regulatory policies and practices.

The restriction has served to limit participation of highly flexible demand resources due to constraints on regulated utilities’ ability to offer custom arrangements. Among the reasons regulators are revisiting the restrictions is a desire to increase DR participation to reduce costs, improve reliability and leverage flexible demand resources as a tool to help reduce carbon emissions.

Other drivers include rising costs of capacity to meet resource adequacy needs, and concerns about capacity shortfalls during extreme conditions or emergencies. In addition, the concerns about incompatibility with traditional regulatory models that prompted adoption of the restrictions have proven unfounded in several traditionally regulated states that allow DR aggregators.

In recent examples of states removing restrictions, Minnesota and Michigan have recently adopted proposals to permit DR aggregators to work with utilities to offer customers more options. Missouri is also reviewing its policies toward DR aggregators, and other states can be expected to follow suit.

2. Acknowledging the Importance of Capacity/Availability

Within the last couple of years, several reliability events have demonstrated the need for capacity markets to keep the lights on during grid emergencies. Sky-high energy prices were not enough to curb demand.

Most recently, energy prices shot up during Winter Storm Elliott in late December as generation resources failed amidst surging demand, prompting PJM and ISO-NE to dispatch DR to get customers to curtail their loads and avoid grid failures during the holiday period. Winter Storm Uri in 2021 similarly strained the grid in Texas to being within minutes of going into rolling blackouts that would have kept the state in blackouts for weeks. Unprecedented DR participation helped prevent a catastrophe then as the load shed reached 20,000 MW during the event and lasted for 70 hours.

In both events, grid operators turned to DR when high energy prices alone were not enough to avoid emergencies. Even when energy prices reach multiple thousands of dollars, as they did during Winter Storm Uri, customers may not reduce loads because they do not see the prices.

Indeed, researchers for NERA Economic Consulting have found that merely hoping that energy prices alone will incentivize market users to curtail demand during peaks is not good enough, and that successful recruitment of demand-side resources for help is “substantially enhanced by the presence of availability payments.”

In analyzing participation rates for more than 900 demand-side programs, researchers concluded that there is a continued need for availability payments. Demand-side resources represent a potential source of cost-saving and reliability enhancement for any electric system and programs that make availability payments have “much higher participation rates” than dynamic pricing programs that depend on consumers to base their consumption on market prices, researchers noted.

However, low capacity prices can reduce participation rates, and, therefore, harm energy users and grid operators. In addition to reducing availability, if capacity prices are too low for too long, energy prices can rise, and investors may not build more capacity resources (including DR, generation and energy efficiency).

CPower experts expect stakeholders to look for ways to eliminate pricing and regulatory impediments to DR participation this year because increasing DR participation would improve grid flexibility and help create the Customer-Powered Grid™ that would enable a flexible, clean and dependable energy future.

3. Increasing Non-wires Alternatives for Grid Relief

Utilities, regulators, municipal cooperatives and public power utilities are seeking non-wires alternatives (NWAs) to expand their distribution networks because NWAs can reduce costs, decrease the reliance on traditional infrastructure investment and address the dual challenges of vehicle electrification and renewable resources. NWAs can also help the environment by using clean energy and can provide flexibility and resilience by deploying DERs locally.

In leveraging the flexibility of DERs, NWAs allow utilities to alleviate grid stress at peak times without building distribution wires. The benefits of this more cost-effective approach will multiply as utilities meet the surging demand brought about by the rapidly rising usage of electric vehicles.

NWAs also provide utilities with increased visibility into the presence and usage of behind-the-meter DERs. Furthermore, customers can help bring down energy costs and improve reliability and the environment in the communities where they work and live. Customers get the benefit of tapping additional revenue streams for their resources as well.

More states are likely to pursue the implementation of NWAs this year to help utilities achieve cost savings and improve reliability at low cost.

4. Accessing Federal Funding Programs for Utilities

Utilities may be able to implement NWAs with federal assistance. The U.S. Department of Energy’s Grid Deployment Office is administering a $10.5 billion Grid Resilience and Innovation Partnerships (GRIP) Program to “enhance grid flexibility and improve the resilience of the power system against growing threats of extreme weather and climate change,” as part of the Bipartisan Infrastructure Law.

“These programs will accelerate the deployment of transformative projects that will help to ensure the reliability of the power sector’s infrastructure, so all American communities have access to affordable, reliable, clean electricity anytime, anywhere,” according to the Grid Deployment Office.

There are three programs in all.

-

- Grid Resilience Utility and Industry Grants ($2.5 billion) support grid modernization efforts to reduce impacts due to extreme weather and natural disasters.

- Smart Grid Grants ($3 billion) focus on projects that increase the flexibility, efficiency, and reliability of the grid.

- Grid Innovation Program ($5 billion) funding prioritizes projects that enhance grid resilience and reliability through innovative approaches to transmission, storage and distribution infrastructure.

The application process for the first round of funding for the GRIP Program, which totals $3.8 billion for federal fiscal years 2022 and 2023, is underway now.

Whether it’s at the federal, state or local level, stakeholders want to improve grid flexibility, reliability and resiliency. Therefore, preparing the grid to better handle extreme weather and demand peaks will be among this year’s top energy regulatory trends.

Subscribe to The Current to stay ahead of the energy curve. Or contact us to learn more about how CPower can help you stay atop energy regulatory trends.

Kenneth Schisler

Ken leads CPower’s regulatory and government affairs team, having previously served in similar roles at both Vicinity Energy and EnerNOC/Enel. He brings nearly three decades of policy leadership on innovation in clean and advanced energy technologies and collaborates with public officials, regulators, power exchange and system operators, academia and industry peers to unleash the potential of demand-side resources.