Our Blog On-Demand

Content

Knowledge Hub

Knowledge Hub

UPDATE March 5: ERCOT announced today that, due to expected record high demand and “historically low” 7.4% expected reserve margin, they have “identified a potential need to call an energy [emergency] alert at various times this summer.” (Emphasis ours.) Alerts allow ERCOT to take advantage of resources available only during scarcity conditions—particularly demand response. ERCOT will release its final summer report in May.

Two significant factors projected for ERCOT — the Electric Reliability Council of Texas—stand to have a noticeable impact on its energy market: Reduced supply and record peak demand. The resulting clash between these two market drivers point to the very real possibility of unexpectedly high prices for organizations participating in ERCOT’s Load Resources (LR) demand response program. Let’s take a look at what’s driving these two important factors, and how this could translate into an opportunity to generate revenue through demand response.

Reserves have dropped dramatically. Since mid-2017, ERCOT has approved the retiring of four coal-fired generation plants responsible for generating more than 4,500 MW in capacity. It’s not just coal generation, though. Since the May 2018 Capacity, Demand, and Reserves (CDR) report, three planned gas-fired projects totaling 1,763 MW and five wind projects totaling 1,069 MW have been canceled. Another 2,485 MW of gas, wind and solar projects have been delayed.

In its December 2018 CDR report, ERCOT projected total available generation capacity for Summer 2019 at 78,555 MWs—an estimate, as it turns out, that’s too low. ERCOT recently learned that it is losing another 470 MWs from the Gibbons Creek coal plant going offline this summer. That drops reserve capacity to 78,085 MWs—a low, low 7.4% reserve margin, just over half of the long-standing target margin of 13.75% of peak electricity demand.

And demand will peak. Last year, ERCOT set an all-time peak demand record of 73,473 MWs on July 19 between 4 and 5 p.m. This year, ERCOT predicts more “record-breaking peak demand usage” for the summer: 74,853 MWs, 1300 MWs higher than last year’s all-time peak.

That leaves a gap of—hold on—just 3,232 MWs. Low supply. High demand. Tight, tight margins. All that adds up to the potential for record high prices in ERCOT’s Load Resources (LR) ancillary services demand response program that ERCOT deploys to maintain sufficient operating reserves.

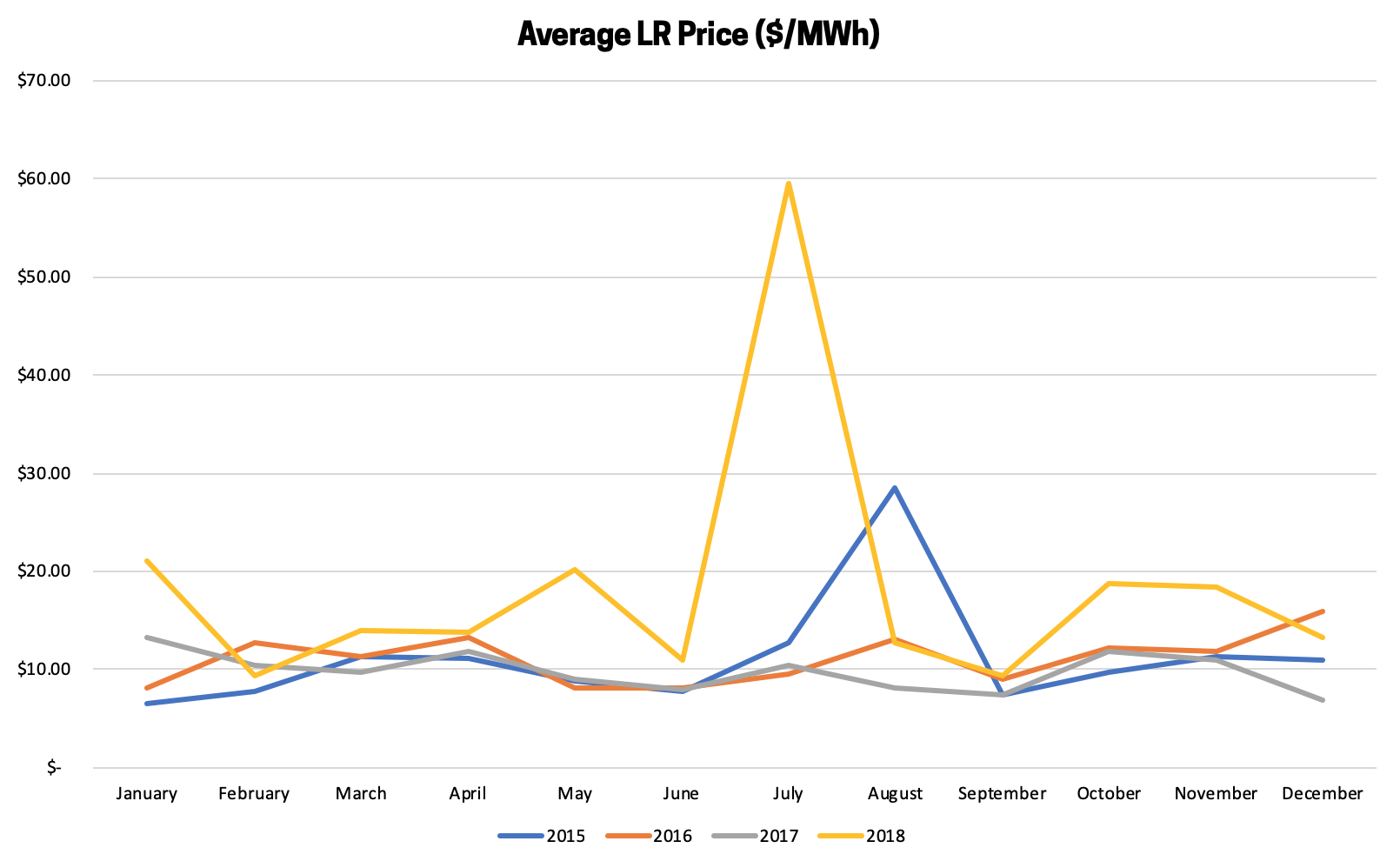

Already, LR prices have increased since the retiring of 4,200 MWs of generation in 2018. (see chart.) Additionally, projected wholesale energy prices in ERCOT for Summer 2019 are some of the highest we have seen. It’s not a stretch to anticipate high, if not record high, LR prices this summer.

High prices in Load Resources mean generous revenue paid to you for your participation in the program which pays businesses for being available to curtail energy on short notice when the grid is stressed. LR has the potential to pay organizations two to three times more than other ERCOT demand response programs.

CPower can help you get the most out of the Load Resources program by working closely with your organization to develop a customized curtailment strategy, including automation, that suits your business objectives and operational considerations. Start the conversation today. Learn how to maximize your curtailment revenue with CPower and ERCOT’s LR program.

Distributed Energy Resources (DER), including storage, are proliferating the world of energy management in a big way. Today, these assets are primarily implemented to provide operational resilience and demand management; however, additional opportunities are rapidly evolving.

As intelligent application of DER assets increases for commercial and government sectors, the opportunity to leverage these same assets into revenue generating channels also increases.

Through programs like demand response, your DER assets become vehicles for saving and earning, which increases ROI, shortens project payback periods or helps fund other energy projects, all while providing greater support for grid reliability.

Join DER and storage experts from CPower Energy Management and Stem and learn about:

The clock has started ticking down on backup generators in California’s demand response programs. On January 1, 2019, the California Public Utilities Commission’s Demand Response Prohibited Resources decision officially takes effect. The decision (officially Decision 16-09-056) mandates that fossil-fueled resources can no longer be used to provide demand response.

The decision doesn’t remove fossil fuel generators from use for backup or for facility power generation, just from demand response (DR). It’s clear, though, that they face near-certain elimination from the California power landscape in the near future. The historic green energy bill signed by Gov. Jerry Brown on September 10th, 2018, specifically requires that 50 percent of California’s electricity be powered by renewable resources by 2026—seven short years away.

Needless to say, this has some profound implications for the future of distributed energy resources (DERs) and DR in the nation’s most populous state (and the world’s fifth largest economy). California’s “bold path” toward 100 percent zero-carbon electricity by 2045 will take it through uncharted territory potentially full of threats to the reliability of its far-flung electrical grid and the costs of the electricity it provides.

Demand response in California, as elsewhere in the country, has been a valuable tool in managing demand-side energy use, protecting the grid, and funding progressive sustainability initiatives. Generators have been a valuable part of DR, providing additional opportunities to save and earn as part of their commitment to a balanced California grid. But California has long been strict on the use of non-emergency generation for demand response, and the green energy bill tightens restrictions to an outright ban.

With fossil-fuel generators permanently pulled from DR participation in California, then, the question facing participants is, “Now what?” There are no easy answers—in a constantly evolving energy universe like California’s, there never are. That said, CPower recommends a couple of steps you can take to ease your transition into a post-fossil fuel world and continue to save and earn.

No Generators? No Problem.

The 2015 court ruling that vacated the EPA’s rule—referred to in the industry as “the Vacatur”—took effect in 2016 and upended DR participation. Hundreds of fossil-fuel backup generators were withdrawn from DR programs in most of the nation’s wholesale energy markets

One water agency, though, found they could still successfully participate in DR without their generators. Virginia’s Lake Gaston Water Supply Pipeline supplies water to Virginia Beach, the state’s most populous city. The Vacatur forced them to withdraw their diesel-powered generators from their DR program. Without the generator to sustain pumping during curtailment as part of DR, they faced the prospect of not being able to curtail the required power during an event, which meant pulling out of DR completely.

Working with CPower, Lake Gaston’s curtailment service provider since 2010, managers were able to research new methods of DR participation without generators. These measures included a full pump shutdown, something they weren’t sure they could do successfully. After a thorough analysis and review of their operations with CPower, it turned out that they could. Read the full story here.

Back to Basics

Before you mourn kilowatts lost, take a moment and consider if there are kilowatts to be found to replace them. Start by asking yourself, “What’s changed since I received my first demand response check?” The answer might be, “Everything,” or something close to it.

How have your day-to-day operations changed in response to changing market conditions? What upgrades have you made to your lighting, HVAC, IT, security, and communications? Is your physical space smaller or bigger? Have you added locations? What’s the state of your building envelope? Is it sufficiently insulated? Has on-site staffing grown or declined?

These are questions to be answered when you have a knowledgeable energy engineer, like those at CPower, conduct a thorough assessment of your facility. Your new “deep dive” assessment forms the foundation for creating a new curtailment action plan, one that matches your available kilowatts to available demand response and demand-side energy management programs. Chances are you’ll find new kilowatts to replace those lost from removed generators, and possibly more.

Dollars for DERs

Now is the perfect time to think beyond the generator and embrace other dispatchable distributed energy resources, or DERs, for your backup power. Behind-the-meter technology like storage batteries—charged by renewable but intermittent resources like sun and wind as well as grid energy—can be enrolled by CPower in California’s demand response programs (Capacity Bidding Program, Base Interruptible Program, and Demand Response Auction Mechanism aka DRAM) as available generation to help when the grid is stressed. You can combine your DER asset with demand response programs to offset kWs lost from generators.

For example: California State University, Dominguez Hills is one of the most sustainability-focused campuses in the state system. In 2017, CSUDH joined with CPower and Stem, provider of the school’s 1 MW intelligent storage system, to create a combined curtailment and storage program. By stacking these technologies, CSUDH significantly reduced their environmental footprint, provided approximately 400 kW of grid relief, and generated revenue that flows back to the school to fund further sustainability initiatives. For their efforts, CSU was also recognized with the 2018 Smart Energy Decisions Innovation Award for Customer Project/Onsite Renewable Energy.

What’s Next?

As California moves toward 100% zero-carbon energy, it’s safe to say that fossil-fuel generation, on both the micro and macro level, will continue to be phased out. Demand response, however, will continue to have an important role in California’s energy re-imagining. Demand response continues to fulfill its primary role, protecting the grid of the world’s fifth largest economy. Look for thought leaders and decision makers to find new and better ways to integrate renewables and dispatchable renewable energy resources into statewide demand-side energy management programs. And look for CPower to continue to advocate on behalf of our customers to ensure their ability to save and earn while protecting the grid.

In this white paper, we’ll explore the various forms that demand-side energy management takes. We’ll look at how one university seized the opportunity to generate significant revenue from demand response participation and succeeded spectacularly. Finally, we’ll examine distributed energy resources and how another university found an innovative way to both optimize their energy program and maximize their revenue with intelligent storage.

Virginia Beach, VA – Faced with the prospect of losing hundreds of thousands of dollars in demand response revenue, this Virginia Beach site discovered a way to keep the money flowing without interruption.

THE CUSTOMER: LAKE GASTON WATER SUPPLY PIPELINE

The Lake Gaston Water Supply Pipeline, also known simply as Lake Gaston, is at the heart of the economic vitality of the City of Virginia Beach (see our City of Virginia Beach case study). Located west of the city, on the North Carolina border, Lake Gaston employs six vertical-turbine centrifugal pumps, each with a nominal capacity of 10 million gallons per day, to supply Virginia Beach with the 30 million-plus gallons of treated drinking water that its residents consume each day. (The high-capacity pumps give the station the flexibility to increase pumping up to 60 million gallons per day.) The water flows through a 76-mile-long pipeline (which includes six overhead river crossings) from the lake to facilities in nearby Norfolk for treatment.

Since 2010, Lake Gaston has participated in the demand response program offered by CPower through Virginia’s Department of Mines, Minerals and Energy (DMME). This program pays government entities market rates for curtailing their electricity usage during times of high demand on the grid. Participants save on their energy costs and earn revenue that can be reinvested in upgrades, energy efficiency projects, and more. Lake Gaston’s participation has earned them nearly half a million dollars since 2011 (see chart below).

Steven Poe, the city’s Water Master Planner, assumed management of Lake Gaston in 2015. At the time, Lake Gaston had already earned more than $221,000 in DR participation, and Steve understood he could count on a continuing and beneficial revenue stream. Unfortunately, he hadn’t counted on a court ruling that dramatically changed the role of emergency generation in demand response.

THE CHALLENGE: CONFRONTING THE VACATUR

In 2013, the federal Environmental Protection Agency (EPA) issued emission standard exemptions that permitted emergency generators to operate up to 100 hours a year for “emergency demand response.” Lawsuits from environmental groups, state governments, and commercial power generation groups challenged the EPA’s ruling, saying it would hurt air quality and grid reliability. In May, 2015, the United States Court of Appeals for the DC Circuit vacated the 100-hour rule (on procedural grounds). This vacating ruling, dubbed “the Vacatur,” would take effect on May 1, 2016.

The Vacatur threatened to have a disastrous impact on Lake Gaston’s DR participation—and earned revenue. Lake Gaston was designed to pump continuously and could not do so without the use of its diesel engine generator.

The Vacatur left Steve no choice but to withdraw his diesel-powered generator from the DR program. Without it, he not only faced loss of revenue from its participation, but potentially the loss of all DR revenue. If the generator could not be used to sustain pumping during curtailment, then Lake Gaston would not be able to curtail the required power during a called event without jeopardizing Virginia Beach’s water supply. The pumps, then, would also have to be pulled from the program, essentially shutting down the lucrative revenue stream.

Or would they?

Steve felt that the financial benefits of DR participation warranted a closer look for a creative solution. “When we realized we couldn’t curtail anymore with our generator, we didn’t want to miss out on the incentives,” he says.

But to reach their target, they would have to conduct a full shutdown. Could they shut the pumps down—and bring them back up—without damaging both pumps and pipelines? And if they could, would that be enough to continue in DR without damaging their savings and earnings?

THE STRATEGY: SHUT ‘EM DOWN

Full shutdowns are rare in nearly all industrial settings, but Lake Gaston had a precedent. In 2014, a 39-ton coal ash spill on one of the lake’s tributaries forced the pump station to shut down for about two months. This was the first extended shutdown of the pump station in its history and caused a great deal of concern. Lake Gaston was designed to maintain a minimum sustainable pumping rate of eight million gallons per day flowing through the pipeline to maintain water quality and prevent issues with start-up. When pumping resumed, Virginia Beach learned that the pipeline was resilient and could recover with minimal effort.

Using that experience, Steve and his team are able to shutdown the major energy consuming equipment at the pump station – including the pumps and industrial HVAC system – within one and a half hours of being notified of a DR event. They’ve learned that participation without their generator is worth the extra effort of executing full shutdown and start up procedures, which requires monitoring the SCADA system and gradual reduction and startup of pumps to prevent water hammer.

THE CPOWERED SOLUTION: DMME + CPOWER DEMAND RESPONSE

Steve and his team had proven that pumps could be shut all the way down and brought all the way back up, on demand, with no damage to pumps and pipelines. He could curtail his assets enough to continue to participate in DR. The question remained, though: Would it be enough? “We were worried,” Steve says, “that if we didn’t cooperate or couldn’t participate in the test or event, there would be a penalty.” That could erase any financial benefit.

Fortunately for Steve, he had Leigh Anne Ratliff, CPower Account Executive, working with him. Leigh Anne has been with DMME since the inception of the joint DR program, and with Lake Gaston since they enrolled in the program in 2010. (She also works extensively with the City of Virginia Beach.) No one is as familiar with the DR program and Lake Gaston’s participation than Leigh Anne.

Leigh Anne told Steve that, because Lake Gaston (and the City of Virginia Beach) participate through DMME’s demand response program, there would be no consequences for not participating in a test or event. “The great thing about the DMME contract with CPower,” Leigh Anne explains, is that you really cannot be penalized. You’ll never owe anything. The worst that can happen is you’ll earn zero dollars for that test or event.”

THE RESULT: $400,000+ AND COUNTING

With penalties off the table and a successful pump shutdown protocol established, Steve continued Lake Gaston’s enrollment in the DMME DR program. He has yet to see zero dollars earned.

“We’re committed to saving money and being good stewards of public resources,” Steve says. “CPower is very supportive and encouraging for us to participate, to meet our commitments. When I first stepped into this position and informed my supervisors about the program, we all thought it was just too good to be true. But it has really worked out, and we are happy to continue participation.”

| Lake Gaston Water Supply Pipeline—Demand Response Earnings | ||

| Delivery year | kWs submitted | Earnings in $ |

| 2010/11 | 1843 | $ 99,676.00 |

| 2011/12 | 1557 | $ 53,311.00 |

| 2012/13 | 1759 | $ 30,685.00 |

| 2013/14 | 620 | $ 10,670.00 |

| 2014/15 | 1548 | $ 27,137.00 |

| 2015/16 | 1661 | $ 61,267.00 |

| 2016/17 | 1337 | $ 24,353.75 |

| 2017/18 | 1340 | $ 44,085.73 |

| 2018/19 | 1258 | $ 58,536.69 |

| Totals to date | 12,923 | $ 409,722.17 |

Data centers are in demand.

The growth of cloud computing and the subsequent challenge of powering big data has led to a data center construction boom.

A 2018 industry profile by Dun & Bradstreet predicts data center space to grow to 1.94 billion square feet worldwide in 2018. Much of the industry’s new construction aims to continue the trend toward energy-efficient buildings, shedding the label of “comatose power drains” issued by the New York Times in a 2012 article that claimed, “data centers can waste 90% or more of the electricity they pull off the grid.”

Since the early 2000’s, data-hosting organizations have sought to discard their profligate reputation by making their buildings more efficient and (if at all possible) environmentally responsible.

While more efficient than their early 21st century iterations, data centers continue to use a lot of electricity–up to 50 times more than standard office spaces—and subsequently face the high expense of large-scale electricity consumption.

Green data centers–those which are environmentally responsible and resource-efficient–aim to lower costs and create a more sustainable operation through improved design and by using more efficient equipment. According to the London-based research organization Technavio, the green data center market is expected to grow at a compound annual rate of about 15% by 2021.

Data hosting organizations that have upgraded their existing facilities to be more energy efficient may be eligible to earn money for the permanent reduction of their electric demand.

That’s because the data center industry’s recent push toward a more efficient and sustainable future comes at a serendipitous time when energy markets around the country are working to reduce demand via energy efficiency investments and to integrate distributed energy resources (DERs) onto their energy grids in an attempt to diversify their fuel mixes.

Right now and for the foreseeable future, grid operators and electric utilities in each of the nation’s six deregulated energy markets have created a wealth of incentive programs to encourage commercial and industrial organizations to invest in energy efficiency and to monetize their generation capacity.

Energy Efficiency: Earn money for permanently reducing demand

Organizations that have recently upgraded their data center facilities by way of installing high-efficiency HVAC equipment, investing in more energy efficient IT technologies, improving airflow or data management and more may be eligible to earn money for their energy-reducing efforts.

Energy Efficiency (EE) is the permanent reduction of electrical demand through the installation of efficient systems, including improvements or upgrades to building infrastructure, mechanical systems, existing equipment or new devices.

In some energy markets in the US (PJM and New England, for example) organizations can earn money for these permanent reductions in demand by partnering with a licensed demand-side management company who can offer these “negawatts” (capacity from conservation rather than power generation) into the Independent System Operator’s (ISO) forward capacity market.

Many electric utilities offer incentives to organizations that have permanently reduced demand through energy efficiency projects. These opportunities create another revenue stream to either decrease project paybacks or allow for reinvestment for future projects.

Demand Response & DERs: earn money for helping the grid

Most data centers are powered by electricity from the grid, which is susceptible to outages due to the demand for energy outpacing the grid’s ability to supply it.

Data centers can’t afford to be down due to a brownout or blackout for a single second, lest they risk losing their customers forever.

The use of on-site power generation is, therefore, a ubiquitous practice amongst data centers. While primarily seen as a reliability resource of paramount importance, a data center’s generation capacity can also be a revenue-generating asset for organizations that participate in demand-side energy management, particularly demand response.

When the grid is stressed and demand for electricity exceeds supply, the grid operator must work to restore the balance.

Instead of calling for the generation of more energy at great expense to consumers and the environment, the grid operator can offset the imbalance by calling on commercial and industrial organizations to reduce the amount of electricity being consumed from the grid when demand exceeds supply.

That’s demand response–programs that pay organizations to reduce electricity usage during times of grid stress or high energy prices.

For data centers with on-site backup generation, earning money through demand response participation is possible without sacrificing service to customers. That’s because a properly permitted backup generator can play a starring role in an energy curtailment strategy that can lead to significant earnings for data centers.

Read to learn more: “Leveraging Your Generation Assets to Generate Revenue”

When selecting a company to guide your demand-side energy management, it’s important to consider the company’s scope of demand-side expertise. Do they serve the markets where your properties reside? Does the company specialize in one type of demand-side energy management, or is it equally skilled in a wide range of energy asset monetization practices?

Most importantly, a demand-side energy management partner should earn your trust in every aspect of the relationship your organizations share.

Demand-side energy management is not a one-size-fits-all exercise. No two buildings are alike and every data center organization is unique in its complexities.

Like your business, your demand-side energy management strategy should evolve and refine over time, forever in pursuit of perfection as energy markets continue to change and your needs as an organization evolve.

Learn more about CPower’s extensive experience in the data industry.

Read the entirety of “Monetizing Energy Assets in the Data Center Industry: A Complete Guide for Earning Revenue with demand-side energy management”.

A complete guide for earning revenue with demand-side energy management

The data center industry’s recent push toward a more efficient and sustainable future comes at a serendipitous time when energy markets around the country are working to reduce demand via energy efficiency investments and to integrate distributed energy resources (DERs) onto their energy grids in an attempt to diversify their fuel mixes.

Data Centers with distributed resources at their facilities like backup generators are in prime position to reap significant financial benefits by working with a properly licensed company that can help them monetize their existing energy assets.

This paper offers a detailed explanation of how a data center can monetize its existing energy assets with demand-side energy management.

programs and practices that comprise it. In this explanation, we’ll take a close look at the evolving energy industry in the US with an emphasis on the growth of DERs and the role they play and will continue to play in North America’s fuel mix of today and tomorrow.

The recent and rapid adoption of distributed energy resources (DER) such as solar PV, energy efficiency, energy storage, and generator sets offers a new set of challenges to aggregation and demand-side energy management. This white paper provides background on the new technologies, highlights major integration issues, and offers recommendations to DR customers looking to monetize their DER assets.

Virginia Beach, Virginia – Energy Manager’s determined pursuit of energy efficiency savings earned the city tens of thousands of dollars in rebates in just a few short years. (Download this case study as a PDF)

Located where the Chesapeake Bay meets the Atlantic Ocean, the City of Virginia Beach is anything but a sleepy resort town. It is the most populous city in the Commonwealth of Virginia, and boasts an economy comprising tourism, national and international corporate headquarters, advanced manufacturing, military bases, and agribusiness.

Besides the beach (the longest pleasure beach in the world, according to the Guinness Book of Records), visitors are drawn year-round to Virginia Beach’s many renowned attractions, including:

Keeping the Convention Center, the Aquarium, and 350+ city buildings running in top shape uses a great deal of energy. That means, Virginia Beach is a city that understands the value of world-class demand-side energy management in municipal operations.

Virginia Beach’s city government serves its citizens and visitors from more than 350 facilities citywide. By 2010, constant increases in energy costs incurred at these facilities had risen to $20 million a year, a total plagued with “lost” buildings and meter reading errors in the hundreds of thousands of dollars.

To address this and other issues, including utility billing, Virginia Beach created the position of Energy Manager and hired Lori Herrick, MBA, LEED Accredited Professional, to lead its energy initiatives and manage municipal energy expenditures. With $5 million from the city, an unexpected $4 million windfall from the U.S. Dept. of Energy, and a mandate to conquer the city’s energy challenges—Ms. Herrick went to work.

Energy efficiency (EE) projects result in permanent energy reductions, which the city recognizes as arguably the cheapest, most abundant, and most underutilized resource available to local government. With this in mind, Ms. Herrick sought to find out more about an energy program being offered through DMME, the state’s Division of Mines, Minerals and Energy. The program in question promoted energy performance contracts (EPC) to significantly reduce energy costs through energy efficiency measures that meet a guaranteed level of energy savings.

Ms. Herrick began the process of enrolling city facilities in DMME’s EPC programs, but was soon faced with the complex challenges of identifying what facilities, and how many kilowatts, to enroll. Fortunately, she received another windfall. She was introduced to CPower’s champion of Virginia demand-side energy management, Leigh Anne Ratliff.

Ms. Ratliff has worked with DMME since 2007 to offer integrated demand response services on a performance basis with no set up costs to the state. Demand response programs pay organizations such as government agencies for curtailing, or reducing, their electricity usage during times of high demand. Government entities who participate in demand response both save costs on reduced electricity use and earn revenue for their trouble.

As Ms. Herrick soon found out, CPower has an additional strength: the ability to provide complete measurement & verification (M&V) services for energy efficiency projects, necessary to receive utility rebates and credits. More importantly, CPower has unmatched experience in finding additional kilowatts (kWs) all too easily overlooked in already completed energy efficiency projects—and successfully submitting those kWs for even greater returns on the city’s investments.

Because the permanent energy reductions resulting from energy efficiency projects can pay dividends for up to four years after completion, Ms. Herrick and Ms. Ratliff set about the task of unearthing four years’ worth of city files to find buried EE gold – kilowatts that others missed. Looking back, Ms. Herrick says, “We were determined… it was kind of a no-brainer, to go through the files of projects we’ve done and submit the information. We were analyzing these projects to make sure the payback was there… They gave us a lot of data that Leigh Anne could use to calculate our benefit to the grid and then give us a check for it.”

From the outset, Ms. Herrick considered no project too big to tackle, working to help the Virginia Beach Convention Center earn its LEED® Gold certification (see below). She also considered no project too small to enroll, at one point submitting a 7kW project. As Ms. Ratliff explains, “If she had it, she sent it. One building got a credit for $52 in 2017. We’re learning on the cost-benefit element of this, but Lori is always looking further, to get every bit out of it that she can. In that way, she’s revolutionized what people put into energy efficiency.”

The Virginia Beach Convention Center (VBCC) is the crown jewel among the city’s facilities. It was the first convention center in the state to receive certification from Virginia Green, the Commonwealth’s voluntary campaign to promote environmentally friendly practices in Virginia’s tourism and hospitality industries. As noted above, it is also the nation’s first convention center to earn LEED® Gold certification as an existing building from the U.S. Green Building Council. These certifications are increasingly important in the competitive convention planning industry, where the VBCC competes nationally. Customer awareness of, and insistence on, “sustainable destinations” plays a greater and greater role in siting conventions.

The VBCC is also a shining example of how state-ofthe-art EE projects can enhance a city’s energy budget as well as its national reputation. Nearly all lighting in the convention center is LED lighting, and the HVAC is controlled through a state-of-the-art Direct Digital Control (DDC) system that incorporates an automated demand response program to control spikes in peak electricity demand. The automation limits any impact to convention-goers and still saves energy dollars.

It’s also a shining example of how the city and CPower Engineering worked together to successfully address one of the biggest challenges facing active convention centers: controlling peak demand electricity and total kilowatt usage. Event load-ins and load-outs at VBCC can be particularly problematic because the bay doors open directly from the loading dock into conditioned exhibit space.

“The Convention Center was a very cool energy project, because people in that space change every day,” Ms. Ratliff explains. “Bay doors are open for hours at a time, a lot of bodies and boxes moving in and out. The open bay doors are a significant source of heating and cooling loss. So how do we control that without disrupting loadins and other convention-goers already onsite?”

The first step was to analyze the status of the bay doors during times of peak demand. The Center’s zoned DDC system, which controls the Center’s HVAC, was programmed to prevent the air conditioning from running in the exhibit halls if the bay doors were open. In addition, the DDC system receives power pulses from the electricity switch gears throughout the day. In the next phase, an automated demand response program was integrated into the DDC system. When the system reads that the Center’s demand is getting ready to peak, it automatically implements one of three phases. Phase 1 changes back-of-house temperatures by one degree. If demand continues to peak, it implements Phase 2, which changes back-of-house temperatures by two degrees, all the way to three degrees at Phase 3. This automated program reduces the demand on VBCC’s chillers, which in turn reduces peak electricity demand.

“Our CPower engineers worked with VBCC’s staff to understand how the bay doors and events taking place in the building impact peak demand and usage,” Ms. Ratliff says. “Together, we developed a process to systematically go through the building to reduce demand with the least impact on customer events.”

With its DDC system program finalized and firmly in place, the Convention Center was able to ease demand on the grid, with near-zero disruption to its customers’ activities. In fact, the Center saved an astonishing 15 percent off their peak during its first year. And since the price of electricity peaks along with demand, this translated into significant cost savings that they otherwise would not have been able to attain.

CPower is instrumental in helping the City of Virginia Beach navigate the complexities of PJM energy efficiency credits and paybacks. CPower submitted the uncovered EE data to PJM and earned the city both savings and revenue. For the delivery years 2017 through 2022, earnings from PJM for the city will reach just over $87,000 (see chart), with the VBCC earning $40,000 alone. And the city’s just getting started. “We just got another big round of funding,” Ms. Herrick says, “so Leigh Anne’s going to be hearing a lot from us.”

In November, 2017, the Commonwealth of Virginia retained CPower through 2020 to continue to offer integrated demand response (DR) services to state agencies and departments through DMME. Ms. Herrick worked with Ms. Ratliff to identify five city sites they believe could be the most eligible for DR: Judicial and correctional facilities, the Convention Center, the Aquarium, and the central plant. The Convention Center currently participates in CPower’s DR program and earns revenue. The remaining facilities are undergoing audits to better understand their suitability. “DR involves curtailment, and we have to be careful when and how we curtail,” Ms. Herrick says. “That’s especially true of the aquarium. I want to earn revenue for the city, but we also don’t want to be responsible for a fish fry.” There’s no doubt, though, that Ms. Herrick will find a way to make it work. Above all else, she and the city are determined.

CPower will support their energy goals at every turn, with an energy strategy custom-made to meet their unique requirements.

Projects include lighting and green building. Sites include Aquarium, Boardwalk, Convention Center, library, maintenance garages, recreation centers, fire stations, police stations, EMS administrative and training center, and arts center.

City of Virginia Beach |

|||

|---|---|---|---|

| PROJECTS | ESTIMATED DR (kW) | FORECASTED GROSS $ | |

| 2017/2018 | 14 | 185.67 | $14,820.89 |

| 2018/2019 | 13 | 173.24 | $17,869.86 |

| 2019/2020 | 11 | 170.24 | $9,283.28 |

| 2020/2021 | 7 | 87.17 | $2,434.65 |

| 2021/2022 | 2 | 38.36 | $1,865.51 |

| Total | 654.68 | $46,274.19 | |

Virginia Beach Convention Center |

|||

|---|---|---|---|

| PROJECTS | ESTIMATED DR (kW) | FORECASTED GROSS $ | |

| 2017/2018 | 2 | 172.52 | $13,781.49 |

| 2018/2019 | 2 | 172.52 | $16,374.31 |

| 2019/2020 | 2 | 172.52 | $9,497.01 |

| 2020/2021 | 1 | 40.95 | $1,143.73 |

| Total | 7 | 558.51 | $40,796.54 |

Combined Totals |

|||

|---|---|---|---|

| PROJECTS | ESTIMATED DR (kW) | FORECASTED GROSS $ | |

| Total | 54 | 1,213.19 | $87,069.73 |