Our Blog On-Demand

Content

Knowledge Hub

Knowledge Hub

Photo Credit: Lion Electric

School districts have three months to buy almost $1 billion of clean school buses and infrastructure with federal rebates. Districts will then turn their attention to receiving their electric or alternatively-fueled buses and installing infrastructure — and CPower can help.

CPower helps districts with electric buses reduce their electrification costs, increase their communities’ resiliency and green the grid, through partnerships with EV fleet owners, charging operators and schools across the country.

The U.S. Environmental Protection Agency’s $5 billion Clean School Bus Program, a five-year program, is accelerating the greening of fleets through electrification. In its first round of funding, the EPA awarded a total of $948.8 million in 2022 Clean School Bus rebates to 403 applicants in October.

Selectees have until April 28 to submit payment request forms for eligible zero-emission and low-emission buses and infrastructure to the EPA. The EPA expects the 2022 rebate program to fund approximately 2,500 school bus replacements. Funds come from one of two separate pools, one for Zero-Emission (ZE) Buses and one for Clean School Buses, which can include alternatively-fueled buses in addition to electric buses.

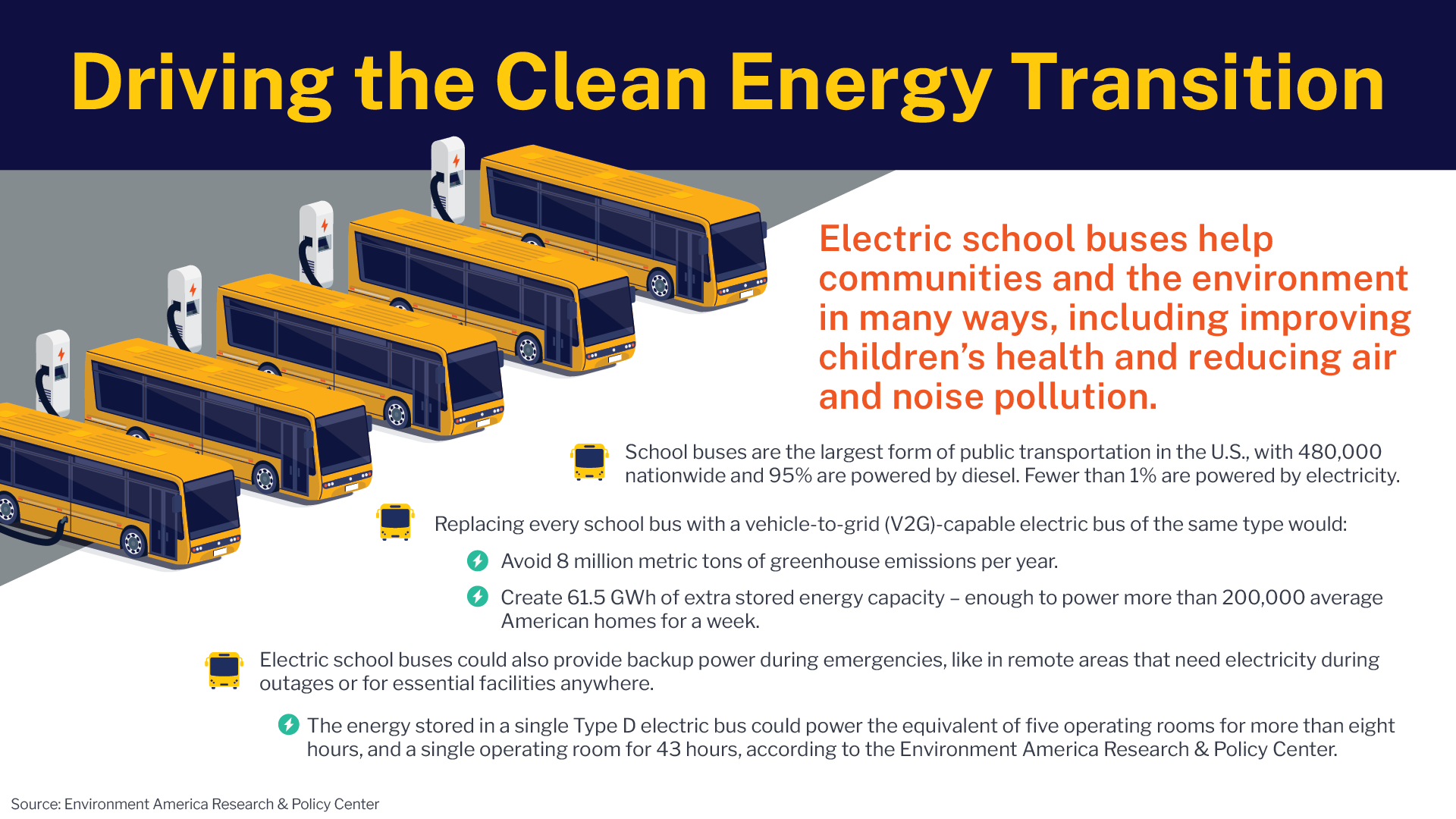

Transitioning to electric school buses helps communities and the environment in many ways, including improving children’s health and reducing air and noise pollution, according to the Environment America Research & Policy Center. Electric school buses equipped with vehicle-to-grid (V2G) technology that enables them to deliver power to buildings and back to the grid provide additional benefits as well.

The Environment America Research & Policy Center notes:

Though the V2G technology that the Environment America Research & Policy Center advocates for is still in its infancy, researchers note, removing adoption barriers through means such as policy changes and program funding could facilitate the transition to electric school buses by making investments in buses and infrastructure financially feasible for districts. The EPA’s Clean School Bus Program is a step forward in that regard, helping to roll out thousands of cleaner, quieter electric school buses in districts nationwide.

Districts have also pushed ahead independently. For example, CPower is turning the country’s largest electric school bus fleet into grid-ready resources by partnering with Highland Electric Fleets and Maryland’s Montgomery County Public Schools (MCPS).

MCPS notes the partnership will deliver cleaner, healthier transportation for students and communities while supporting grid reliability through demand response solutions. Together, the partners will use MCPS’s fleet of EV school buses (EVSBs) to provide grid services and increase reliability for PJM, the largest grid operator in the U.S.

Because school buses run on a consistent daily schedule, electric buses such as those that Highland provides to MCPS are ideal resources to provide grid resiliency services. CPower will ensure that buses are fully charged and ready to run while also allowing Highland to reduce electrical loads when needed, thereby helping to keep the grid in balance.

CPower similarly helps grid operators balance energy demand and supply through a partnership with bp pulse for fleets (formerly AMPLY), which provides fully managed charging services to public sector and commercial businesses with EV fleets. The partnership also drives new revenue opportunities for fleets while offering transmission and distribution grids the flexibility to integrate V2G-ready EV chargers as distributed energy resources (DERs). The Logan Bus Company, the largest school bus provider for the New York City Department of Education, is the first project to leverage this partnership.

As the national leader for grid balancing and reliability solutions, CPower is helping to create a Customer-Powered Grid™ that will enable a flexible, clean and dependable energy future. Helping school districts transition to electric school buses helps bring that future to fruition.

For more information on how we can help your school district unlock the value of your EV school bus fleet to drive energy flexibility, grid reliability and revenue opportunities, call us at 844-276-9371 or visit CPowerEnergy.com/contact to find out.

Brad Widdup

Brad is Director, Distributed Generation at CPower. His 25 years in the energy industry include serving as regional vice president for Oracle’s Utilities Global Business Unit.

CPower customers helped grid operators avoid blackouts by providing over 50 GWh of electricity reduction during Winter Storm Elliott. Customers responded to 197 unique dispatches across three demand response programs in PJM and ISO-NE alone, which together cover all or part of 19 states and Washington, D.C.

In quickly curtailing their loads, CPower customers helped the PJM and ISO-NE regions avoid grid failures as freezing weather caused widespread power outages elsewhere in the country over the two days before Christmas.

“This storm underscores the increasing frequency of significant extreme weather events (the fifth major winter event in the last 11 years) and underscores the need for the electric sector to change its planning scenarios and preparations for extreme events,” NERC President and CEO Jim Robb said, in announcing that FERC, NERC and NERC Regional Entities have launched a joint inquiry into the operations of the bulk power system during Winter Storm Elliott.

With extreme weather events occurring more often, in both winter and summer, regulators and grid operators increasingly look to customer DERs to keep the power on during times of high energy demand. CPower customers, for example, were dispatched a record 1,030 times in 2022.

During Winter Storm Elliott, CPower customers responded to dispatched events in PJM’s Emergency Capacity and Synch Reserves DR programs as well as ISO-NE’s Active-Demand Capacity Reserves (ADCR) program. The PJM Emergency Capacity dispatches were the program’s first winter events since the 2014 Polar Vortex.

PJM dispatched roughly 4,000 MW of DR on Dec. 23 and another 7,000 MW on Dec. 24 as capacity dropped and demand rose. Power demand rose to a peak of 135,000 MW on the evening of Dec. 23 while forced outages reached as high as 34,500 MW. Demand then remained high overnight, thereby preventing some power plants from replenishing their fuel supplies. By the time the morning peak came on Dec. 24, which was the coldest day of the Christmas weekend, PJM was missing approximately 57,000 MW of its generation flee due to winter storm challenges.

Similarly, unexpected generator outages and reductions and lower-than-expected imports led to a shortfall in operating reserves in ISO-NE, prompting the grid operator to dispatch DR twice as part of its efforts to balance supply and demand and maintain reliability on the regional power system during the evening peak hours of Dec. 24. ISO-NE declared a capacity deficiency and implemented measures under Operating Procedure No. 4 (OP-4) after 2,150 MWs of resources scheduled to contribute power during the evening peak became unavailable. Measures included using reserve resources to balance supply and demand and requesting conservation at market participants’ facilities.

Historically, grid operators have called upon customers for load relief in summer months when demand has typically been highest due to extreme heat. However, winter electricity demand has increased in recent years due to extreme cold and heating electrification. For example, industry leaders cited big growth in electric heat as a chief cause of blackouts during Winter Storm Elliott, noting that over the past decade the number of households heated with electricity had surged by about 20% in the hardest hit states of Tennessee, North Carolina and South Carolina.

With heat electrification expanding and severe cold becoming more common and spreading further across the country, customer DERs are important in providing load relief and preventing blackouts during extreme weather events year-round.

CPower is the national leader in unlocking the power of customer DERs, with 6.3 GW of capacity across more than 17,000 sites in the U.S, and its customers are vital in strengthening the grid where and when it’s needed the most, as evidenced by how they provided load relief and energy reduction during Winter Storm Elliott.

Furthermore, CPower has hosted a webinar to help businesses in PJM understand the increasing importance of DERs in providing grid resiliency during winter months and learn how they can get paid for providing load relief to the grid. To watch, please click here.

Dann Price

Dann has specialized in PJM Demand Response for more than 10 years. As CPower’s Executive Director of Market Development for the PJM market, he is responsible for keeping hundreds of customers with thousands of sites up-to-speed on market conditions, energy prices, program particulars, and regulatory issues in the ever-changing PJM demand response market.

Mike Hourihan

Mike is Market Development Director at CPower. He has extensive experience in analyzing and developing market rules in multiple energy markets across North America. His career has focused on advocating for demand side resources participation in the energy markets as a reliable low-cost option compared to traditional generation assets.

The 2022-2023 Winter Reliability Assessment from the North American Electric Reliability Corporation (NERC) warns that a large portion of the North American bulk power system is at risk of having insufficient energy supplies during severe winter weather, including the Midwest, which is one of several regions that NERC oversees to maintain grid reliability. However, many Midwest municipal utilities and electric cooperatives lack a key grid-balancing tool that is common in other parts of the country: demand response (DR).

Midwestern state regulatory commissions, electric cooperatives and municipal electric utilities have long been reluctant to permit aggregators of retail customers (ARCs) to provide DR solutions in regional transmission organization/independent system operator (RTO/ISO) markets and utility programs. As a result, ARCs are not as prevalent in the Midcontinent Independent System Operator, Inc. (MISO) and Southwest Power Pool (SPP) markets as they are in most wholesale electricity markets in North America and throughout the world.

While the reasons that have led to limiting the ability of ARCs to operate in the Midwest are as much historical as regulatory in nature, the operational and financial impacts are here now. When there is not adequate supply to meet resource adequacy needs, clearing prices in capacity markets can soar and grid operators may struggle to maintain reliability.

For example, in MISO’s 2022/23 Planning Resource Auction, the North and Central regions were 1.23 GW short of meeting the Planning Reserve Margin Requirements established for the auction. This resulted in prices in these regions clearing at the cost of new entry, the administratively set price of how much it would cost to build a new generator.

A lack of ARCs could further affect the Midwest in years to come as intermittent energy resources become more common and energy consumption patterns shift more dramatically. New resources are needed to provide the grid flexibility necessary to ensure the long-term reliability of the grid.

If allowed, ARCs could provide more grid flexibility in the Midwest by deploying portfolios of demand response resources to quickly meet resource adequacy requirements and maintain system balance as intermittent supply resources replace traditional generation. Therefore, ARC-enabled demand response could protect the region against immediate threats like the tight generation supply conditions that NERC has warned about for this upcoming winter, as well as help bring about a customer-powered grid that supports a flexible, clean and dependable energy future and helps reduce consumer electricity costs.

Fortunately, relevant electric retail regulatory authorities (RERRAs) in the Midwest could increase demand response participation and more greatly leverage the efficiency and reliability benefits and technology innovation that ARCs bring to electricity markets, while at the same time safeguarding and respecting state commission regulatory jurisdiction and the self-regulation policies of municipal utilities and electric cooperatives.

In what came to be known as the “Opt-Out/Opt-In Rule,” the Federal Energy Regulatory Commission (FERC) issued Order No. 719 in 2008, which gave states the final say about whether ARCs can participate in RTO/ISO DR programs. The opt-out rule has created a stalemate for demand response programs in the Midwest because state regulatory commissions, electric cooperatives and municipal electric utilities have worried whether and to what extent they could regulate ARCs and whether ARC activities would conflict with utility resource planning activities or otherwise interfere with rate regulation and unfairly shift costs to other ratepayers.

However, RERRAs have several avenues for asserting jurisdiction over ARCs and ARC activities pursuant to traditional regulatory authorities under state laws. Furthermore, the Opt-Out/Opt-In Rule itself is a powerful tool for RERRAs to exercise jurisdiction to regulate ARCs authorized under federal law.

State commissions, electric cooperatives and municipal electric utilities interested in exploring new ways to stabilize the grid amidst tightening reserve margins and mounting needs for flexible resources and lower costs can learn more about available options through a new whitepaper from CPower: Regulating Demand Response in the Midwest While Safeguarding Local Jurisdiction: A Guide for State Regulatory Commissions, Electric Cooperatives and Municipal Electric Utilities. The whitepaper outlines a helpful framework for how state regulators in the Midwest can facilitate the benefits that ARCs offer to increase DR participation, while also addressing the basis for state regulation of ARCs and regulators’ primary concerns. Gain insight on how to:

Download this whitepaper to learn more about state regulation of ARCs in the Midwest. We’d welcome the opportunity to discuss this further.

Peter Dotson-Westphalen

As CPower’s Sr. Director Market Development, Peter has advocated to advance DR/DER interests in ISO/RTO stakeholder groups and with state and federal regulatory bodies. He has also managed wholesale and retail demand response portfolios across the CAISO, ERCOT, MISO and NYISO markets. Peter has 15 years of experience in the energy industry, primarily focused on demand response.

Kenneth D. Schisler

Ken leads CPower’s regulatory and government affairs team, having previously served in similar roles at both Vicinity Energy and EnerNOC/Enel. He brings nearly three decades of policy leadership on innovation in clean and advanced energy technologies and collaborates with public officials, regulators, power exchange and system operators, academia and industry peers to unleash the potential of demand-side resources.

Today, I am excited to unveil the next phase in the evolution of our company brand that celebrates you, our customer. As the national leader in providing flexibility and reliability solutions, we are enabling the clean energy transition through a Customer-Powered GridTM.

Our customers have always remained at the core of what motivates us. Together, we have the power to deliver 6.3 GW of capacity across the country.

Our focus as ever remains on how we work alongside our customers to make a better world for us all: creating a Customer-Powered GridTM to enable a flexible, clean and dependable energy future. We know that our customers’ DERs are the solutions to a more resourceful future — one that rewards you for enabling a more-interconnected energy infrastructure that supports community resilience and drives decarbonization:

We’re proud that our modernized brand celebrates you: our customers and how together we are enabling a cleaner, greener and more reliable grid. Thank you for being part of the solution!

Jessica Lim

Jessica brings more than 20 years of experience in marketing, customer experience, product management, operations and digital to CPower as Vice President of Marketing. Prior, she led teams at Southern California Edison (SCE) in building awareness and access to new customer solutions to meet the energy goals of a diverse set of customers to balance the grid and improve the environment.

The benefits of living in the storage decade currently may be greatest in New England, where utility and government programs, and innovations in storage technology, help organizations reach their sustainability goals while improving facility resiliency and decreasing operations, maintenance and energy expenses.

New England facilities can reap energy storage benefits such as on-bill savings and grid services revenue without the costs or responsibilities of ownership by partnering with energy-storage-as-a-service (ESaaS) providers such as CPower. Commercial and industrial organizations can avoid the interconnection engineering, capital investment and O&M responsibilities associated with a battery project by having an ESAS provider design, install and operate the battery on their behalf.

Meanwhile, at a macro level, behind-the-meter storage enables the renewable energy transition from more emission-intensive options while supporting the reliability of the grid, thanks to the foundation of state policies and programs that support battery adoption. For example, Connecticut’s Energy Storage Solutions program offers organizations upfront incentives for installed battery capacity plus performance-based incentives for dispatching the battery capacity to the grid.

Federal incentives available under the Inflation Reduction Act could accelerate the adoption of batteries even more — Bloomberg NEF projects the landmark legislation to drive the development of 111 GWh of energy storage. The IRA includes a stand-alone Investment Tax Credit for energy-storage projects, which effectively reduces a storage project’s costs by 30%.

Battery capacity in the US has already more than tripled since the start of 2021 and Massachusetts has been one of the states where it has grown the fastest. According to Utility Dive, Massachusetts now ranks fifth nationally in battery capacity due to the combination of a state requirement that solar projects of more than 500 kW be paired with energy storage, performance incentives for behind-the-meter active demand reduction, including battery storage, and programs that incentivize time-shifting of clean-energy generation like wind and solar.

On-site behind-the-meter storage can also provide on-bill savings for New England organizations through reduced demand charges on utility bills and reduced capacity tag charges on supply bills. For example, a healthcare facility in Connecticut projects $186,000 in on-bill savings in the first year after installing a battery through CPower. Importantly, these on-bill savings are in addition to the performance incentives paid by utilities and grid operators.

Storage projects can help organizations achieve their sustainability goals as well by cutting regional emissions. A higher education institution in Massachusetts with a 1.3 MW 3-hour battery reduced annual emissions of carbon dioxide (CO2) by nearly 46 metric tons, which is equivalent to not burning 50,364 pounds of coal per year, through targeted charge and dispatch of the battery to maximize energy use from cleaner resources.

As the storage decade continues, solutions like CPower’s artificial-intelligence-driven EnerWiseTM Site Optimization software can help New England organizations maximize the financial return and sustainability benefits of their batteries and other distributed energy resources by analyzing and automatically executing the most efficient demand-side energy management strategies.

To learn more about CPower’s EnerWise Site Optimization solution or energy storage services, call us at 844-276-9371 or visit CPowerEnergy.com/contact.

Darren Hammell

Darren is CPower’s Director of Energy Storage. He is also the former Founder and CEO of Princeton Power Systems as well as a member of the Board of Directors of Andluca Technologies (PV-powered “smart” windows). He was a “Gerhard R. Andlinger Visiting Fellow” at Princeton University’s Andlinger Center for Energy and the Environment where he taught “Energy Innovation and Entrepreneurship.”

Mounting regulatory scrutiny and market pressures make crypto mining increasingly difficult, which makes participating in demand response programs more appealing.

The business case for crypto demand response is strongest when crypto prices are low and electricity prices are high, as they are now. Also, environmental advocates and lawmakers are pushing for environmental policy reforms around crypto mining energy consumption, which could impact miners’ expansion and operations.

Demand response meets miners’ needs on both the policy and business fronts. In participating in demand response, crypto mining organizations receive compensation for curtailing their electric consumption when electric demand on the grid exceeds the grid operator’s ability to supply it or when electricity prices are high. Miners can also show sustainability benefits by tracking exactly how much carbon dioxide pollution their facility prevents in helping the electric grid stay balanced without having to burn fossil fuels to produce electricity.

CPower has seen considerable interest from the crypto mining sector as operators and developers are looking to maximize value and showcase carbon offsets through demand response.

Operational efficiency is key in crypto mining, in which miners earn cryptocurrency by using computers to validate complex blockchain transactions before competitors do. The value of the cryptocurrency that miners earn has dropped while energy expenses have risen.

Already trending lower through most of 2022, crypto prices fell further in early November after FTX, a leading cryptocurrency exchange, collapsed, prompting broader concerns about the industry. Escalating energy costs could push crypto prices even lower as miners try to cover the additional operational expense for running their computers.

With large and growing loads, energy is a primary expense for miners. Small facilities consume 10s of MWs and bigger operations use 100s of MWs to power computers. Mining may be done at any time.

Demand response helps miners reduce their energy costs and increase their returns. Not only can miners save money by mining at less expensive times, but they can also earn significant revenue by quickly curtailing large amounts of electric load without impairing operations. Mining also becomes more profitable when currency is mined with less expensive electricity.

In addition to managing the financial implications of the energy cost of cryptocurrency, many miners are facing concerns about the industry’s environmental impact. Globally, the cryptocurrency market consumes more than 68 terawatt-hours (TWh) per year, continuously running more than 19 coal-fired power plants, according to ENERGY STAR®.

In the US, which hosts about one-third of global crypto-asset operations, miners consume 0.9% to 1.7% of the nation’s electricity usage, or the equivalent of all home computers or residential lighting nationwide, according to a recently released White House study of the climate and energy implications of crypto-assets. Crypto-asset activity accounts for 25 to 50 Mt CO2/y, or 0.4% to 0.8% of total U.S. greenhouse gas emissions, which is similar to emissions from diesel fuel used by the nation’s railroads.

After assessing the impacts of crypto-asset operations, the White House Office of Science and Technology Policy’s (OSTP) recommendations included:

Some members of Congress are looking into the impacts of crypto mining as well. Led by Sen. Elizabeth Warren, D-Mass, seven lawmakers are probing Bitcoin’s impact on the Texas power grid. They asked the state’s grid operator, the Electric Reliability Council of Texas (ERCOT), for information such as energy consumption data for Bitcoin miners and details regarding crypto mining companies’ participation in demand response programs.

In response, The Texas Blockchain Council (TBC), an industry advocacy group, emphasized the environmental benefits that crypto miners have provided by using renewable energy and participating in demand response. TBC noted, for example, that:

Though Texas is the nation’s biggest market for crypto miners, the feasibility of Bitcoin mining as a grid resource is being contested in other states as well. New York has implemented a two-year partial cryptocurrency mining ban, creating the nation’s first temporary pause on new permits for fossil fuel power plants used in proof-of-work mining, which is a process that is used in the mining of some, but not all, cryptocurrency operations. The two plants in New York that currently use fossil fuel for generation can continue to run because they were in operation before the moratorium.

CPower helps crypto miners drive emission reductions, energy-bill savings and revenue by determining how they can best help increase the amount of renewable power available to the grid and reduce their carbon impact.

For example, Digihost won an Environment + Energy Leader (E+E Leader) award for its work in enabling the energy transition by participating in demand response through CPower. Digihost avoided nearly 150 metric tons of marginal CO2, with just 29 hours of demand response participation. In avoiding the equivalent of 5,637 tons of coal burned per hour of demand response participation, Digihost’s site sequestered 182 acres worth of US forests for one year.

CPower has also helped crypto miners leverage their clean energy distributed energy resources (DERs). For example, a renewable energy-powered crypto mining site in the PJM energy market, which is served by the country’s largest grid operator, used CPower’s AI-based EnerWiseTM Site Optimization software to achieve grid revenue and on-bill savings. EnerWise Site Optimization helps DER owners and developers manage and monetize all their DERs across multiple energy markets and utility programs simultaneously by analyzing the latest market and grid conditions.

In integrating EnerWise Site Optimization with Verakari’s crypto mine design, including network components, electrical infrastructure, custom-built software elements, custom demand response hardware components, and innovative operations protocols, CPower helps the company’s Pennsylvania crypto mining site better align with price, demand and marginal emissions signals in PJM Interconnection, the largest grid operator in the U.S. As a result, Verakari will reduce its energy costs while helping to create a more reliable and sustainable grid.

CPower is the U.S. leader in energy flexibility and grid balancing solutions, serving more than 2,000 customers across the country. With 6.3 GW of customer-powered capacity at over 17,000 sites across the US, we unlock the full value of distributed energy resources to strengthen the grid when and where it’s needed most.

To learn more about how CPower helps crypto miners maximize value and show sustainability by participating in demand response programs, call us at 844-276-9371 or visit CPowerEnergy.com/contact to find out.

David Chernis

David is a CPower Account Executive for New York (NYISO). His expertise includes commercial & industrial demand response, distributed energy resources (DERs) and crypto mining demand management. Coming from the worlds of commercial lighting, IoT controls, and automation, the technological advances in battery storage and distributed generation — and the opportunity to monetize them — make the DR world an exciting place for him. He is also skilled in clean energy project and program management of both small business and large-scale commercial installations.

Mike Hourihan

Mike is Market Development Director at CPower. He has extensive experience in analyzing and developing market rules in multiple energy markets across North America. His career has focused on advocating for demand side resources participation in the energy markets as a reliable low-cost option compared to traditional generation assets.

The Minimum Offer Price Rule (MOPR) exists to prohibit new capacity resources from offering into the market below their true, i.e. unsubsidized, costs.

MOPR has garnered its share of controversy since it was enacted a decade ago. The rule was introduced to address the concern about “buyer-side market power.” The concern is that an entity on the load side may have an incentive to offer supply into the capacity market at below-market prices in order to depress clearing prices, thus reducing capacity costs. This may degrade the economics for merchant players to the point where new capacity cannot be attracted when needed and existing resources that are needed for reliability may exit the market prematurely.

States in New England have essentially argued in recent years that MOPR infringes on their rights to determine their generation fuel mixes and unnecessarily keeps renewable resources from clearing the capacity market, requiring consumers to pay twice for capacity–once through a state procurement and a second time to purchase capacity to meet ISO-NE capacity requirements, which the state-procured resources cannot meet due to the MOPR.

In an interview on April 5, 2021, FERC Chairman Richard Glick sided with the states when he noted, “FERC has a responsibility under the Federal Power Act, essentially, to defer to the states, in terms of state decisions about what the generation resource mix should be like. But instead, we’ve implemented these MOPRs, at least in the three Eastern RTOs that have mandatory capacity markets, in a matter that really attempts to block the state clean energy policies or state energy policies in general.”

The issues at stake with MOPR are not going to be solved overnight but ISO-NE has started working on changes this month (June 2021). As part of this effort, ISO-NE intends to eliminate MOPR with Forward Capacity Auction 17 (2026/27 commitment period).

While the elimination of MOPR will help renewable resources to clear the capacity market and earn capacity revenues, without accompanying changes to address the price depressing effect of allowing resources to clear at prices below their true costs, the expectation is that capacity prices will plummet.

With a few thousand MWs of state-procured off-shore wind already on the books, and thousands of MWs yet to come, it is reasonable to expect these MWs will start showing up in Forward Capacity Auctions once the MOPR has been eliminated. That said, a set of contested changes pending at FERC could facilitate off-shore wind’s entry into the market a bit earlier if FERC sides with NEPOOL stakeholders over ISO-NE.

In any case, ISO-NE does feel it is important to make accompanying changes that are geared toward maintaining competitive pricing in the capacity market when MOPR goes away.

On July 13, 2021, ERCOT announced the delivery of its “Roadmap to Improving Grid Reliability,” a 60-item plan that addresses needed improvements to ERCOT’s electric grid with the aim of avoiding future failures like the one experienced this past February when much of the state was left without power and over 200 people died amidst record-setting winter temperatures.

In an official press release announcing the Roadmap’s delivery, ERCOT Board member and Texas Public Utility Chairman claimed the map “puts a clear focus on protecting customers while also ensuring that Texas maintains free-market incentives to bring new generation to the state.”

The notion of the free market is one we at CPower have often discussed in explaining how the ERCOT market differs from others around the country. From its very founding, ERCOT’s energy-only market was designed to let economics, not legislation, drive the action within its marketplace.

In the wake of February’s tragedy–and the harrowing death toll certainly qualifies the event as such–there has been a wealth of debate in Texas and throughout the US on whether ERCOT’s economically driven approach to grid reliability is the best way to avoid future grid failure.

There is one curious item in ERCOT’s 60-item roadmap that is worth pointing out to large consumer and industrial organizations in Texas.

Item 19 concerning the future of distributed generation, energy storage, and demand response speaks to both legislative and financial methods of exacting change on a grid seeking to cross the bridge to energy’s future.

Item 19 of the roadmap reads as follows:

“Eliminate barriers to distributed generation, energy storage, and demand response/ flexibility to allow more resources to participate in the ERCOT market while also maintaining adequate reliability”

With this item, which is “on track” according to the roadmap, we see ERCOT is well on its way to implementing an improvement to its market that is rather similar to the intent of the Federal Energy Regulatory Commission’s Order 2222, which states:

“Order No. 2222 will help usher in the electric grid of the future and promote competition in electric markets by removing the barriers preventing distributed energy resources (DERs) from competing on a level playing field in the organized capacity, energy, and ancillary services markets run by regional grid operators.”

Language like what ERCOT submitted in its roadmap with item 19 wouldn’t raise an eyebrow had it come from any other deregulated US energy market outside of Texas.

That’s because other state and regional energy markets must comply with Order 2222 within FERC’s mandated period of time. ERCOT does not.

Here’s why:

Because its grid is isolated from the surrounding states, ERCOT’s market does not engage in interstate commerce and is therefore not under FERC’s jurisdiction.

Yet ERCOT appears to be on the road to creating a future marketplace that allows its grid to integrate the flexible DERs CPower and other demand-side energy management companies have been touting for years are necessary to maintain a balanced, dependable grid that is evolving to a cleaner future.

Here we have an example of ERCOT agreeing with Federal legislation despite the truth that they are under no legal obligation to do so.

Why?

In the simplest of terms, Order 2222 is a piece of legislation aimed at fostering just and reasonable competition in the wholesale marketplace.

ERCOT’s market is and always has been designed with competition in mind. Look no further than item 19’s language for proof that the future of ERCOT’s grid involves allowing more energy resources to enter the marketplace and compete, not fewer.

ERCOT is expressly stating that it believes more distributed generation, energy storage, and demand response in its marketplace is the best way to ensure a more reliable grid for Texas and more value for its market participants.

As the Supreme Court is fond of saying, it is written. As Texans like to say, let’s get to work and take care of business.

The sweltering heat that raged across thirteen western states from August 14-17, 2020, had a significant impact on the tens of millions of people who experienced record high temperatures well above 100°F. The triple-digit temperatures had an historic effect on California’s electric grid, too. Consider August 17 as a case-in-point in the energy deficiency the state’s grid operator faces.

According to CAISO’s market policy and performance vice president, Mark Rothleder, CAISO had expected the load on its grid to peak near 49,800 MW on August 17 during the 5-6 pm PT hour with available capacity near 46,000 MW, leaving a 3,600 MW shortfall.

By 8 pm PT on the 17th, that gap would grow to more than 4,400 MW as peak load approached 47,428 MW, but capacity had fallen to around 43,000 MW due to solar generation declining with the setting sun.

Faced with more inevitable forced outages on August 17, CAISO’s own CEO, Steve Berberich spoke before the ISO’s Board of Governors and said, “The situation could have been avoided,” and further asserted that the state’s resource adequacy program is “broken and needs to be fixed.”

A proposed decision on the future of resource adequacy in California is due in mid-June 2021.

Lack of Imports During the Heatwave

The scorching temperatures drove a massive demand for energy throughout the western US, resulting in California’s inability to import electricity from neighboring states as it typically does in the evenings when its robust solar resources go offline with the setting sun.

In its official analysis, CAISO detailed a series of events explaining how “realtime imports increased by 3,000 MW and 2,000 MW on August 14 and 15, respectively, when the CAISO declared a Stage 3 Emergency.” but ultimately “the total import level was less than the CAISO typically receives.”

Unable to import needed electricity and hamstrung by rising demand amidst record-high temperatures, the California grid suffered its first blackouts in nineteen years.

The Push to Address Climate Change

Californians, by and large, see the recent wildfires and heat waves that have ravaged the Golden State and wreaked havoc on its grid as events driven by climate change.

The state’s drive toward its energy future subsequently involves not only taking steps toward making its grid resilient but doing so in a way that minimizes its climate impacts.

The state’s three main energy organizations–The California Independent System Operator (CAISO), the California Public Utilities Commission (CPUC), and the state’s energy commission (CEC)–have been closely examining the recent grid failures and have submitted two reports (Preliminary and Final Root Cause Analysis) seeking to establish a root cause for the blackouts .

While they may not agree on any single culprit for California’s grid woes and for the August blackouts, the big three organizations rightfully believe that establishing grid resilience and serving the state’s ratepayers are the priorities.

Balancing Energy, Capacity, and Renewables for Grid Resiliency

California’s renewable energy resources performed as expected in 2020, despite some slanted media coverage that may have tried to pin them with the lion’s share of the blame for the August blackouts in 2020.

California has no intention of veering from the state’s long-traveled path of developing and integrating more renewable energy into its generation mix.

In the wake of the 2020 blackouts, the resource adequacy proceeding in California is looking at how to ensure that the state procures energy sufficiency-–

i.e. electricity needed to serve the state on a day-by-day, moment-to-moment basis–in addition to capacity sufficiency–i.e. reserves that can be called on in the event of an emergency.

The proceeding is trying to establish the optimal balance between energy and capacity that can be procured within state boundaries so it can then be determined just how much reliance should be placed on imports now and in the future.

As is the case with other states in different energy markets around the US, California is at somewhat of a tipping point with so much of its generation mix dependent on renewables with inherent intermittency that renders them unavailable at unpredictable times in the day when the sun isn’t shining or the wind isn’t blowing.

Like many grids facing a similar predicament, California’s grid of today and the future needs to ensure that its load begins to follow its supply, meaning that demand-side resources adopt agile flexibility that can react to sudden disruptions in electricity supply due to intermittency.

Those disruptions and foreboding heatwaves show no signs of diminishing in 2021 and beyond. It’s time for California to shore up its grid’s reliability with an energy marketplace that rewards flexible resources on the demand side.

The grid and the people it serves depend on it.