CPower Makes Vertical Commercial Agriculture More Cost Effective through Distributed Energy Resource Optimization

CPower and Sunnova Named Top Project by Environment + Energy Leader

What the Electric Grid’s Future and the Internet’s Past Have in Common

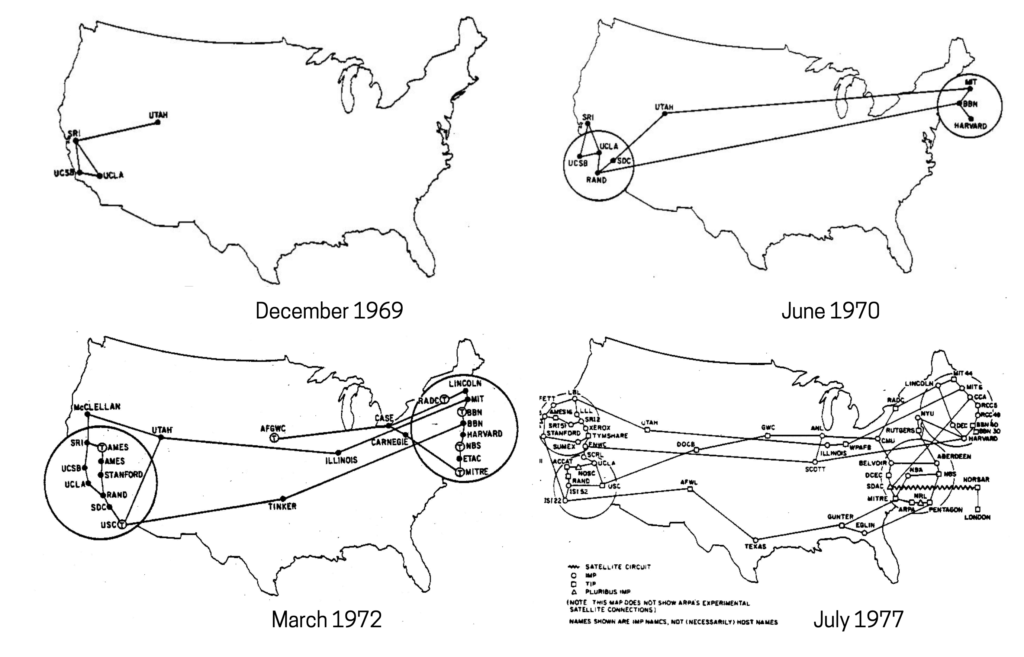

In the mid-1960s, a new method for effectively transmitting electronic data over a computer network was born, and with it came one of the quintessential building blocks of what would become the modern internet.

In simple terms, “packet switching” is a routing method whereby data transmitted across a network takes different routes along the network to arrive at its destination. Packet switching allowed for computer networks to become decentralized, ultimately giving rise to the internet and the global connectivity it provides today.

Just as packet switching would help computer networking explode into the future, so too will a similar decentralization usher the electric grid from what it was for the previous century to a more efficient interaction that connects consumers in a cleaner and more collectively beneficial way.

Like most revolutionary ideas, packet switching was not embraced by the established community of experts that presided over the nascent field of computer networking in 1965. That changed, however, when the Advanced Research Projects Agency Network (ARPANET) embraced packet switching as a means to allow multiple computers to communicate on a single network.

Originally funded by the US Department of Defense and widely considered among historians as the first working prototype of the internet, ARPANET would adopt the internet protocol suite TCP/IP on New Year’s Day in 1983, and begin assembling the network that would become the modern internet.

Since its inception, the grid has grown and evolved to become a modern network on the cusp of transitioning to a more efficient future. To get there, the electric grid may borrow a page from the information superhighway and follow a few key transformational lessons.

Consider how information travels on the internet in 2021.

On the internet, every user is a consumer, producer, and storer of information. Send an email from the Northeast US today, and it might route through Canada on its way to a final destination. Send an email to the same person tomorrow, and it might take an entirely different path through a server in New York.

In essence, this is packet switching on steroids.

The pathways that allow for information to travel on the internet are omnidirectional, which has allowed that network to rapidly grow over the last two decades to serve billions of users worldwide.

That was not always the case if you consider how, prior to packet switching, the original computer networks were constructed as a network dominated by central mainframe servers that pushed information and data to users connected at terminal locations.

The electric grid has a similar history to the internet’s in that the grid’s network was centralized from the outset, with large generation sources (power plants) essentially pushing electricity to consumers via transmission and distribution.

The centralized grid conceived by the likes of Thomas Edison and erected by moguls like George Westinghouse served its users well for the better part of the century.

Like the internet, however, the electric grid has evolved to embrace decentralization as it transitions to an omnidirectional network in which generation and distribution are spurred by the very users for whom the grid exists to serve.

Today, for example, the electricity you use to charge, say, your mobile phone may come from the bulk grid. Tomorrow it could come from another consumer on your distribution grid who is not using their own excess generation.

As grid operators and utilities adopt new technologies to enhance their flexibility and optimize the delivery of electricity, the grid will start to follow a similar path the internet embraced in its evolution to the modern wonder it is today. The result will be an energy system whose connectivity drives its efficiency and sustainability for decades to come.

It’s an exciting time for the grid and its users, rife with possibility and opportunity.

Achieving Carbon Emission Goals with Demand-Side Energy Management

A convergence of pressures in recent years has caused organizations across North America to examine how their energy use can be managed to help achieve their carbon reduction goals.

These converging pressures originate from customers, who desire to do business with sustainability-minded companies; investors, who realize the inherent value associated with an organization being carbon neutral; and regulators, who are introducing laws that reflect and address society’s move toward a cleaner energy future.

Since these pressures show no signs of waning, the question of how exactly demand-side energy management can be optimized to achieve carbon goals is becoming a popular discussion in the industry today.

Some of the best practices for carbon-reducing with demand-side energy management are more obvious than others. Adopting energy efficiency measures or installing on-site renewable energy sources like solar are examples of strategies that have been around for decades.

Let’s examine, then, some of the newer concepts on the topic of achieving carbon goals with demand-side tactics.

Consider the drive toward a carbon-neutral future from the grid operator’s perspective. Across the US, grids face the same converging pressures as organizations and have worked to increasingly shift their generation mixes away from fossil fuels and toward renewable sources like wind and solar.

Of course, wind and solar energy sources are inherently intermittent and can subsequently cease generating if the wind stops blowing or the sun stops shining.

But the immutable truth that some days are overcast and others windless doesn’t ease the pressure on the grid and those who run it to drive toward carbon- neutrality! Nor does inescapable intermittency suffice as an acceptable reason for grid operators to sacrifice reliability in the name of sustainability.

So what’s a grid operator to do?

Here is where commercial and industrial organizations can fill the gap from the demand side and help the US electrical grid find its way to the clean and efficient energy future that everyone desires.

That the grid needs flexible resources which can be dispatched quickly to serve load when it’s needed due to wind and solar generation being unavailable is a central point readers of this book should be quite familiar with, given it’s been examined in detail within these pages over the last three years.

The same is true of the role demand response plays in providing that flexibility to the grid.

What’s becoming more apparent is how increased participation in demand response programs at the ISO and utility levels across the US is providing new tools for grid operators to harmonize their grids’ reliability with their drive toward a future of cleaner generation fuel mixes.

In effect, this demand-side participation enables the firming of renewable energy sources, allowing grids to transition toward cleaner fuel mixes. While demand response participation doesn’t directly help individual organizations achieve their own carbon reduction goals, the cumulative effect of all the organizations’ participation does help our society achieve its desired emission goals.

The pressures organizations face from outside entities that we discussed earlier play a role in driving a given company’s carbon-reduction goals.

Unfortunately, in a reward-based world dominated by measurable metrics, there isn’t a practical way to note just how effective a given organization’s demand response participation is in helping contribute to carbon and greenhouse gas reduction.

That’s starting to change.

Organizations like the non-profit WattTime are searching for and establishing ways to help companies receive measurable recognition for doing their part with demand response to help the grid maintain reliability during its transition to the future.

Naturally, how an organization uses energy can have a large impact on carbon emissions, but when energy is consumed can move the carbon reduction needle, too. By shifting energy usage to a time when the grid mix is cleaner—during the middle of the day when solar is more prevalent compared with coal, for example—overall emissions are lowered.

An increasing number of organizations and cities have sought to eliminate their emissions in the time period when they consume electricity, often in hour-by-hour increments. This is a practice called 24/7 Clean Energy.

The more generation mixes shift toward renewable sources and as more DERs integrate into the grid with help of regulations like FERC Order 2222, the more the 24/7 clean energy effect should increase. That is, an increase in peak renewable generation will likely result in a larger potential emission reduction due to the load having been shifted.

Companies, regulators, and markets are in the early stages of ascribing value to 24/7 clean energy practices.

Consider the New York market, where Local Law 97 (LL97) seeks to reduce carbon emissions in the city’s building stock by 80% by 2050. An estimated 50,000 buildings in New York City stand to be affected by the law, with many in the commercial sector currently above the law’s emission requirements. Retrofits are one means of achieving compliance with LL97. Load shifting may be another, albeit one that will require a tangible means of assigning value to the practice.

Here we have an example of a regulation (LL97) creating a need for a possible market incentive (the value assigned to load shifting) as a means to achieve the societal goal of lowering carbon emissions in a densely populated city.

Absent a concrete policy on climate change at the national level, the market is responding. Throughout each of the deregulated energy markets in the US, demand response programs are growing at the ISO and utility level. The markets are becoming more sophisticated with how they incorporate DERs, and they’re doing all of this at the behest of state legislatures as well as the citizens who the market and grid ultimately serves.

Demand-side resources deliver carbon benefits. They always have, but today more opportunities are emerging to earn revenue with these resources.

For years we’ve touted how flexible resources will help drive the US electric grid to a cleaner future. While the ways organizations that provide those resources will be publicly credited are still undecided, the ways they’ll be financially rewarded are apparent.

This post was excerpted from The State of Demand-Side Energy Management in North America Volume III, a market-by-market analysis of the issues and trends the experts at CPower feel organizations like yours need to know to make better decisions about your energy use and spend.

CPower has taken the pain out of painstaking detail, leaving a comprehensive but easy-to-understand bed of insights and ideas to help you make sense of demand-side energy’s quickly evolving landscape.

CPower Grows Distributed Energy Managed Capacity to 4.3 GW

CPower Issues State of Demand-Side Energy Management in North America

CPower clears approximately 30 percent of demand response capacity commitments in PJM Capacity Auction

CPower Accelerates Distributed Energy Resource Innovation With New Executive Hire

CPower Expands Distributed Energy Resource Integration with AMPLY Power

Demand Response Has Been Part of America’s Energy Plan for 40 Years. Why Should the next 40 be any Different?

The idea that reducing a watt of energy on the demand side can be just as valuable as generating one on the supply side in a time of grid stress is hardly new. Nor is the idea that such a solution helps thwart both energy-related and environmental crises.

The origin of demand response can be traced to roughly forty years ago when both the US and the world grappled with many of the same energy and environmental issues we are still trying to solve today.

Let’s take a trip back to the mid-late 1970s and see if a few things don’t look and sound familiar.

The oil crisis of 1973 sent shockwaves throughout the world, raising concerns on the security of electricity supply in the US while pointing to a need to diversify the nation’s power generation mix away from a fossil fuel dependency and toward a mix with a greater share of renewable and clean energy sources.

Global environmental awareness had grown to a movement large enough to be seized upon by newly-elected American president Jimmy Carter who, within a month of taking office, donned a cardigan sweater, sat before a roaring White House fire, and urged Americans to join him in conserving energy in a nationally-televised fireside chat.

During that broadcast on February 2, 1977, the president related how a particularly harsh winter had depleted the domestic supply of natural gas and fuel oil. He warned of dark consequences that awaited the most powerful country on earth if we as a nation failed to devise a sound energy plan for the future.

Sound familiar?

The 39th POTUS didn’t outright cite demand response as a means to a profitable and sustainable end that night in 1977, but he did allude to the Public Utility Regulatory Policies Act (PURPA), a piece of legislation that would be enacted in 1978 to promote more competitive energy markets in the US by allowing “non-utility generators” to participate in them.

The act would prove to be a landmark piece of legislation, setting the country on the road to conservation and the development of clean and renewable energy sources. It would also open the door to demand response as a viable solution to keeping both the electric grid and the environment in balance.

That open door paved the way for the deregulated, competitive energy markets we have today to replace the vertically-dominated regulatory ones that had existed for most of the 20th century. It also would prove to be the seed that would soon mature and bear the lucrative fruit of modern demand response.

Fast forward back to the present. Federal legislation is still working to ensure energy markets remain competitive with clean and renewable energy sources securing a just and reasonable position place in them.

Order 2222 from the Federal Energy Regulatory Commission (FERC) is a case-in-point. The Order is the latest in a series of directives aimed to create a fair balance between traditional generators on the supply-side and distributed energy resources seeking to enter markets on the demand side.

Issued in September 2020, Order 2222 calls for the removal of “barriers preventing distributed energy resources (DERs) from competing on a level playing field in the organized capacity, energy, and ancillary services markets run by regional grid operators.”

Order 2222, widely hailed as a landmark achievement in the history of the energy industry is about more than just creating more competitive markets. By allowing DERs, including demand response, their just seat in the marketplace, Order 2222 enables the US electric grid to take a giant leap toward a cleaner future.

Consider this recent data on demand response performance in the US:

In 2019, the most recent year for which the data is available, the combined wholesale demand response capacity of all regional system operators in the US grew to 27,000 MW.

How much environmental pollution did all that demand response save the country in 2019 by providing a resource that would have otherwise been supplied by a traditional “peaker” plant?

According to the EPA, the 27,000 MW of capacity from all commercial DR participation in the US in 2019 prevented the greenhouse gas emission equivalent of what an average passenger vehicle would produce were it to drive a little more than 142 million miles.

That same total of reduced load roughly converts to the carbon dioxide emission equivalent of 63 million pounds of coal being burned.

In 2020, CPower’s more than 1,700 customers contributed more than 4,000 MWs of capacity to demand response, effectively reducing the energy equivalent of 7 million pounds of coal that would otherwise have been burned and released into the environment.

Helping the grid stay balanced and keeping the air clean aren’t the only benefits to demand response.

The global demand response market is projected to value at USD $24.71 billion by 2022, an increase from the $5.7 billion valuation of the same market in 2014, according to a recent report published by Million Insights market research firm.

Much has been made in this publication and others in the energy industry about the evolving electric grid and demand response’s role in helping to bridge past, present, and future.

As you read these words, energy markets and electric utilities across America are refining their demand response programs and introducing new ones, providing organizations with a lucrative and socially responsible way to use their energy assets to support grid reliability in this critical time of transition.

America opened the door for demand response nearly forty years ago. Closing it now (even just a little bit) would be a step toward the past in a time when the country should be crossing the bridge to energy’s future.