Executive Management Team

CPower Announces “Customer-Powered Grid™ Award” Winners during GridFuture 2024 Conference

ChatGPT on Optimizing DERs: What It Got Right and What We Would Add

Contrary to what it may seem, artificial intelligence has not taken over the world, or at least not yet. But you can be excused for believing that AI is in control given the buzz surrounding the technology’s rapidly expanding reach into everything, everywhere – and the world of energy is no exception.

Curious as to how AI views the optimization of distributed energy resources, we asked ChatGPT how AI can be used to optimize DERs. Although ChatGPT summarized available information nicely, the popular, AI-powered natural language processing tool stopped short of telling an energy user how they can optimize their DERs and how they would benefit.

Here are four ways that AI can optimize DERs, according to ChatGPT, along with CPower’s comments on each.

1) Optimizing DERs for Demand Response

ChatGPT says: AI can analyze energy consumption patterns and predict demand fluctuations. By considering factors like weather, time of day and user preferences, AI algorithms can optimize the timing and magnitude of energy generation and storage to match demand. This helps balance supply and demand, reducing peak loads and optimizing the utilization of DERs.

CPower adds: Flexible DERs are ideal for balancing supply and demand and avoiding blackouts or brownouts because they can provide a range of valuable grid services. AI can help customers optimize participation in demand response programs for the good of their organization and the grid. For example, in working across multiple DERs, customer sites and DR programs in real-time, CPower’s EnerWise® Site Optimization helps energy users make money, reduce costs or both by providing grid services that improve reliability.

2) Forecasting Energy

ChatGPT says: AI can leverage historical data, weather patterns and other relevant information to accurately predict future energy generation and consumption. This enables proactive planning and scheduling of DERs, allowing for better integration with the grid and avoiding potential imbalances.

CPower adds: Given that the grid often struggles to maintain balance through challenges, like extreme weather or unexpected changes in supply or demand, AI’s ability to forecast accurately is vital in enabling the fast and flexible grid that we need to power the clean energy transition. Real-time insight into demand is increasingly critical as intermittent renewable generation resources, like solar and wind, account for an ever-larger percentage of the nation’s power mix.

3) Allocating Resources

ChatGPT says: AI can optimize the allocation of energy resources in a distributed network. By considering factors like energy prices, load profiles and system constraints, AI algorithms can determine the most efficient distribution of energy generation, storage and consumption across DERs. This leads to better utilization of available resources and reduces energy waste.

CPower adds: The ability to quickly dispatch DERs in response to shifts in supply or demand is essential to keeping the grid balanced. EnerWise helps maintain balance by automatically allocating each asset at a site to available programs on an hourly basis within the constraints of the hardware or associated permitting/ incentive structures.

4) Participating in Energy Markets and Trading

ChatGPT says: AI can facilitate the participation of DER owners in energy markets. By analyzing market conditions, price signals and regulatory requirements, AI algorithms can guide decision-making for optimal energy trading. This enables DER owners to sell excess energy back to the grid or participate in peer-to-peer energy trading platforms, maximizing their economic benefits.

CPower adds: Combining technology with human know-how remains essential to fully unlocking the value of DERs. For example, while EnerWise efficiently enables DER participation across all available on-bill cost avoidance options and grid services programs, CPower’s experts mitigate revenue complexity and minimize risk for customers by managing changes in more than 60 solutions nationwide, including automated DR solutions.

Looking ahead, ChatGPT noted that optimizing DERs with AI enhances their efficiency, reliability and sustainability while unlocking the full potential of renewable energy sources. At CPower, we would add that we are enabling a flexible, clean and dependable energy future by forming the nation’s largest virtual power plant. In aggregating 6.4 GW of flexible DER capacity across more than 24,000 customer sites, we are helping to create the Customer-Powered Grid™ that will smooth the energy transition while helping energy users earn the most value from their resources.

If you would like to learn more about EnerWise or other ways to optimize your energy assets, call us at 844-276-9371 or visit CPowerEnergy.com/contact to find out how we can help you create and implement a DER strategy that works.

Kyle Harbaugh

Senior VP | Technology

Kyle is a results-driven leader with a track record of delivering high-value products that increase revenue, improve organizational productivity and create large-scale cost savings. A motivated executive who desires to lead fast-paced teams through the creative and challenging process of bringing products to life, from whiteboard to launch.

As Senior Vice President at CPower, he is responsible for Information Technology and Product Management. Previously, he held several technology leadership positions at Constellation Energy. He is also an AEE Certified Energy Manager (CEM) and an AEE Certified Demand Side Management professional (CDSM).

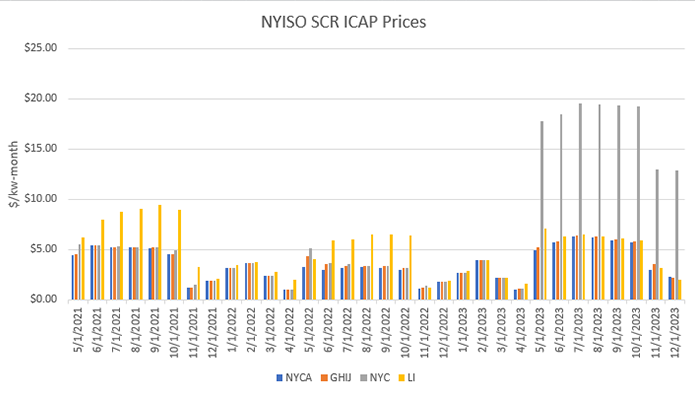

Rising Capacity Prices Boosting Demand Response Earnings in New York

Surging capacity prices present swelling opportunities for commercial, industrial and institutional energy consumers willing to shed load in New York.

With prices up 300% since 2019, participants in the New York Independent System Operator (NYISO)’s Special Case Resources (SCR) Program can earn revenue while reducing costs—without compromising their operations. Customers can also further boost their financial benefits by capitalizing on demand response programs through the state’s utilities, thereby maximizing revenue streams to lower costs.

Seizing the opportunities available begins with enrolling in the SCR Program. Customers who enroll by the end of the month could begin participating as soon as February and earn three months of revenue in the Winter SCR Program, which spans from November to April. The Summer SCR Program will last from May to October.

Program prices typically average $4 per KW in winter and $6 per KW in summer. At Multiple Intervenors Annual Meeting in October, CPower shared how some industrial customers earn $46,000 per MW of curtailable load for two hours of annual curtailment in SCR.

Customers earn passive revenue in SCR for 10 months out of the year just by being ready to help the grid. Except for a one-hour Summer test commitment in August and a one-hour Winter test commitment in February, customers have not been asked to curtail loads for any grid emergencies in recent years.

Additionally, there are several demand response programs available to C&Is in New York through local utilities, such as the Commercial System Relief Program (CSRP) and Distribution Load Relief Program (DLRP). Customers can reap more revenue by using the same curtailment practices to participate in more than one program because SCR, CSRP and DLRP can be combined, or “stacked.”

The value of demand response programs will likely continue to rise as well. The same factors that have driven prices up in recent years should remain contributors, such as the retirement of electricity-generating power plants amidst increasing demand for electricity due to the electrification of heating and transportation.

Prices will rise further if demand outpaces supply, which can cause brownouts or blackouts. For example, NYISO has warned that a possible 446 MW shortfall threatens grid reliability in New York City for Summer 2025.

If an energy consumer would like to support grid reliability while earning revenue, CPower can project how much revenue a customer could earn through demand response programs based on market conditions. Beginning with the SCR program, the longest-running demand response program in New York, CPower can estimate earnings for any combination of SCR, CSRP and DLRP participation.

If you would like more information, please contact me at 860-371-5518 or at keith.black@cpowerenergy.com.

Keith Black

As CPower’s Regional Vice President and General Manager for the Northeast, Keith has leveraged his unique combination of sales and operations expertise, energy business relationship development, channel development, sales opportunity identification and solutions management, backed by his intrinsic talent for building winning business strategies, to help the company and its customers achieve strong and sustainable financial gains.

In leading CPower’s business and growth strategy for New England and New York, he has helped expand New England’s leading edge of solar, storage, and residential monetization and captured market share in all aspects of the evolving DER landscape in New York. Succeeding in these exciting and cutting-edge DER opportunities has come with a complex array of technologies, controls and partner integrations, as well as a demanding and high touch for his team.

A versatile, high-energy executive, he has extensive experience in leading high-performing teams, at businesses from Fortune 500 organizations through start-ups, and guiding companies to profitable growth. With more than 30 years of experience in the energy industry, he has become a trusted energy advisor to both prospects and customers, enabling them to reduce risk, lower costs and use renewable resources when possible.

Acrohash Partners with CPower to Support Grid Reliability

New Report Validates DERs and VPPs are Key to Smooth Energy Transition

The steadily declining costs of solar, wind, batteries, EVs and other key technologies—borne by market forces and big policy initiatives like the Inflation Reduction Act—seem all but certain to transform America’s energy system from one primarily reliant on oil and gas to one that is increasingly electrified and renewable—a process often referred to as the energy transition.

To make this energy transition a smooth one, policymakers are increasingly clamoring for grid flexibility: resources that can quickly respond to rapidly changing conditions to keep the grid in balance. Grid flexibility will continue to come in several forms; but distributed, demand-side solutions—dubbed DERs (distributed energy resources) and VPPs (virtual power plants)—are gathering more and more interest, from town halls and statehouses all the way up to the White House.

And believe it or not, if you are a demand response participant, you are a valuable component of the nation’s fleet of DERs and VPPs.

In a new whitepaper, Mathew Sachs, CPower’s Senior Vice President of Strategic Planning and Business Development, and I break down what is driving this growing need for grid flexibility; what all these new terms mean (in plain English) and how they relate to more-familiar concepts like demand response, capacity and energy; and why this creates significant long-term opportunity for energy users in what we call the Customer-Powered Grid™.

We aimed to keep this short whitepaper informative, constructive to the latest research and policy work, and with your ‘so what?’ in mind. Ultimately, we wrote it to start a conversation with you.

The energy transition is already in motion, but the smoothness or rockiness of this massive shift—compounded by an aging grid and extreme weather—is an open question. It’s a question that CPower wants to work on with customers, policymakers, grid operators, utilities and other key stakeholders to resolve for our common safety and prosperity.

We hope you’ll give the whitepaper a read, and reach out at vpps@cpowerenergymanagment.com with thoughts, comments and questions.

Read our full whitepaper to learn more: Creating the Customer-Powered Grid™: Enabling the Energy Transition with Distributed Energy Resources and Virtual Power Plant.

Ben Pickard

Ben Pickard manages strategic M&A and new growth initiatives for CPower as its Vice President of Corporate Development. Prior, Ben was a Director at National Grid, where he developed and executed strategic applications of venture-backed technology to some of the utility company’s most challenging problems; as well as non-regulated distributed energy investments and partnerships including with EnerNOC, Enbala and Sunrun, and scaled entry into renewable project development via Geronimo Energy.

Earlier roles include infrastructure principal investing with the Macquarie Group, urban climate policy with the Clinton Foundation and distributed energy business creation spanning lighting retrofits, rooftop solar, energy storage, and backup generation. His market and policy analysis on electric utilities has appeared in Greentech Media and the New York Times. Ben is based in New York City and earned an AB magna cum laude in Social Studies from Harvard.

CPower Commends Missouri Public Service Commission for Expanding Access to Virtual Power Plants

The Booming Potential of Virtual Power Plants

A recent Bloomberg opinion piece contrasted the massive growth in distributed energy resources (DERs), such as rooftop solar and electric vehicles, with sluggish deployment of other clean energy solutions, such as wind power and transmission upgrades, as the world races to reach net zero emissions. While the author was spot on in many respects, the piece failed to account for the role that Virtual Power Plants (VPPs) can play in augmenting the ability of DERs to support the entire grid, and how utility mindsets are shifting.

VPPs aggregate and coordinate distributed energy assets like flexible load assets, rooftop solar, stationary batteries and electric vehicle chargers. This turns these DERs into a reliable block of flexible capacity that can support a variety of grid needs. With VPPs we can harness the rapid expansion of DERs for the benefit of all and continue driving greater decarbonization and energy reliability while we work through longer timelines for other necessary pieces of the new energy economy.

Furthermore, VPPs provide grid benefits at a far lower cost than alternatives. A study released earlier this year found that the net cost to a utility of providing resource adequacy from a VPP is roughly 40% to 60% of the cost of alternatives, which translates into a 60 GW VPP deployment meeting future resource adequacy needs while saving $15 billion to $35 billion.

There is growing public and private support for VPPs. Recently, the day before the opinion piece was published, the U.S. Department of Energy released its Pathways for Commercial Liftoff report for VPPs. The report found that tripling the current scale of VPPs to 80-160 GW by 2030 could expand the U.S. grid’s capacity to reliably support rapid electrification while reducing overall grid costs by $10 billion per year. Not only that, but there are up to $100 Billion in loans available to support VPP deployment.

Utilities can’t afford to ignore these cost savings, and are highly motivated to gain better visibility and control of DERs to maintain the stability of the grid. Therefore, we have many reasons to be optimistic about the rapid growth in VPPs over the next decade. Any forward-looking energy system analysis that doesn’t include VPPs is incomplete.

VPPs can increase the impact of DERs and buy precious time for technologies like wind generation and transmission upgrades to progress. VPPs won’t solve the climate crisis alone, but they are a promising tool to accelerate the clean energy transition. With their flexible capacity, they can bridge the gap created by the sluggish deployment of technologies such as wind power by leveraging existing resources until large-scale renewables can fully deliver.

Michael Smith

Michael Smith is a visionary and innovative leader who brings more than 25 years leadership experience in the energy industry to CPower as its CEO. Michael joined CPower from ForeFront Power, where he was the CEO of the company’s North American solar and energy storage business, responsible for strategy and all business areas across the U.S. and Mexico.

Prior, Michael served as Senior Vice President, Distributed Energy, at Constellation, the retail energy subsidiary of Exelon Corp., where he was responsible for Constellation’s distributed solar, energy efficiency, and energy asset operations businesses across the U.S. He also served as Vice President, Innovation and Strategy Development, for Exelon Generation, and led Constellation Technology Ventures, Exelon’s venture investing organization. Earlier, Michael was Vice President and Assistant General Counsel for Enron Energy Services and a trial lawyer at Bricker & Eckler, LLP.

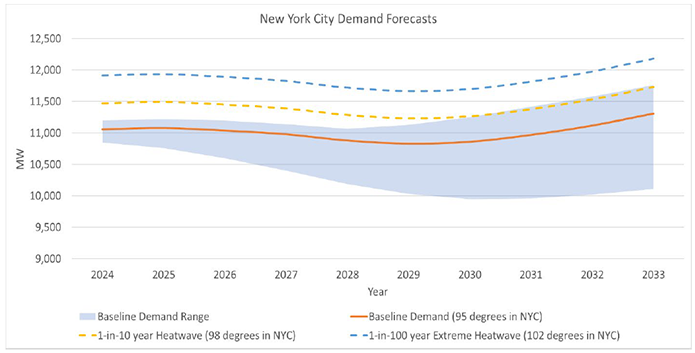

Possible 446 MW Shortfall Threatens Grid Reliability in NYC for Summer 2025

Photo Credit: New York Independent System Operator

A summer like this year’s could be trouble for New York City in 2025.

Earth’s hottest summer on record lingered into early September in the Big Apple, as the city posted its first official heatwave of the year with three consecutive days of high temperatures exceeding 90 degrees Fahrenheit.

Should the summer two years hence also be especially hot, New York City could grapple with blackouts or brownouts. The New York Independent System Operator (NYISO) has projected a deficit of as much as 446 MW on the peak day during expected weather conditions (95 degrees Fahrenheit).

The baseline summer coincident peak demand forecast for New York City (Zone J) in 2025 increased by 294 MW in the past year, primarily due to the increasing electrification of transportation and buildings, NYISO noted, in identifying a “reliability need” in its Q2 Short-Term Assessment of Reliability (STAR).

Also, NYISO noted, as of May 1, 2023, 1,027 MW of affected peak generation plants have deactivated or limited their operations under the New York State Department of Environmental Conservation’s (DEC’s) “Peaker Rule,” which provides for a phased reduction in emission limits, in 2023 and 2025, during the ozone season (May 1-September 30). An additional 590 MW of peakers are expected to become unavailable for summer 2025, all of which are in New York City, thereby resulting in a total unavailability of 1,617 MW of peaker generation capability.

In terms of possible relief, the DEC regulations include a provision to allow an affected generator to continue to operate for up to two years, with a possible further two-year extension, after the compliance deadline if the generator is designated by the NYISO or by the local transmission owner as needed to resolve a reliability need until a permanent solution is in place. So, at least some of the peaker generation capacity that is currently expected to be unavailable could instead remain available through a two-year extension, and an additional two years thereafter if an additional extension were granted, thus perhaps mitigating the near-term reliability need for New York City.

Also, “The New York City transmission security margin is expected to improve in 2026 if the Champlain Hudson Power Express (CHPE) connection from Hydro Quebec to New York City enters service on schedule in spring 2026, but the margin gradually erodes through time thereafter as expected demand for electricity grows,” according to NYISO’s STAR report.

Looking beyond 2025, NYISO warned that the forecasted reliability margins within New York City may not be sufficient if the opening of the CHPE, which will deliver 1,250 MW of renewable power into the New York metro area, is significantly delayed. Reliability margins also may not be sufficient if additional power plants become unavailable or demand significantly exceeds current forecasts, NYISO noted.

“Without the CHPE project in service or other offsetting changes or solutions, the reliability margins continue to be deficient for the ten-year planning horizon. In addition, while CHPE is expected to contribute to reliability in the summer, the facility is not expected to provide any capacity in the winter,” according to NYISO.

In the meantime, Con Edison, as the Responsible Transmission Owner, is solely responsible for developing a regulated solution to the near-term reliability need that NYISO has identified for summer 2025. NYISO has also solicited market-based solutions.

Per NYISO: “If proposed regulated or market-based solutions are not viable or sufficient to meet the identified reliability need, interim solutions must be in place to keep the grid reliable. One potential outcome could include relying on generators that are subject to the DEC’s Peaker Rule to remain in operation until a permanent solution is in place.”

A reliability need could also drive up capacity prices for New York City in summer 2025, if the possible conditions that NYISO has warned could be created by a combination of escalating demand and the retirement of generators come to fruition.

As this is an emerging and evolving situation, CPower will follow it closely. If you have immediate questions or would like information in the meantime, please contact us online or at 844-276-9371.

Keith Black

As CPower’s Regional Vice President and General Manager for the Northeast, Keith has leveraged his unique combination of sales and operations expertise, energy business relationship development, channel development, sales opportunity identification and solutions management, backed by his intrinsic talent for building winning business strategies, to help the company and its customers achieve strong and sustainable financial gains.

In leading CPower’s business and growth strategy for New England and New York, he has helped in expanding New England’s leading edge of solar, storage, and residential monetization and capturing market share in all aspects of the evolving DER landscape in New York. Succeeding in these exciting and cutting-edge DER opportunities has come with a complex array of technologies, controls and partner integrations, as well as a demanding and high touch for his team.

A versatile, high-energy executive, he has extensive experience in leading high-performing teams, at businesses from Fortune 500 organizations through start-ups, and guiding companies to profitable growth. With more than 30 years of experience in the energy industry, he has become a trusted energy advisor to both prospects and customers, enabling them to reduce risk, lower costs and use renewable resources when possible.

Report: Demand response is critical to enabling the energy transition and ensuring a reliable grid

Recently released research shows that mounting reliability risks make demand response (DR) increasingly important as the grid transforms. An aging grid dominated by solar and wind power, battered by storms and fires and struggling to supply new needs like EVs and electric heat pumps, needs the flexibility that DR provides.

“Paradigms for the generation and delivery of electricity are evolving away from a centralized network with predictable power flows toward a distributed and dynamic grid, creating many challenges and opportunities for utilities and other entities involved in the electricity value chain,” according to a new report about grid reliability challenges published by Wood Mackenzie and CPower. “At the heart of these changes is how reliability is assured when the grid is most stressed, like when customer demand peaks during heat waves, natural disasters or extreme weather events.”

Based on insights from analysts at Wood Mackenzie, the report shows that DR programs have proven to be an important resource for ensuring reliability amidst grid challenges in the past, but that such support may not always be available. Analysts explain how low capacity pricing and cumbersome rules on DR participation threaten the future of DR programs and the ability to use distributed energy resources (DERs) to help the grid.

If energy users were to stop participating in DR, analysts note, utilities and grid operators would lose their most reliable resource during emergencies as well as a resource that can provide much-needed flexibility year-round.

Such year-round flexibility is imperative because the proliferation of intermittent renewable resources, the retirement of fossil-fuel generators, and the electrification of vehicles, heating and other key energy needs are straining the grid, making it difficult to balance supply and demand.

“As the grid’s needs continue to evolve, particularly with the growth of other types of distributed energy resources (DERs) besides DR, such as solar generation, battery storage, and electric vehicles, DR is an increasingly important part of the resource stack in energy markets,” according to the report from Wood Mackenzie and CPower.

The North American Reliability Corp. recently issued a similar warning about the importance of flexibility in mitigating risks to grid reliability.

“System operators and planners should ensure that sufficiently flexible ramping/balancing capacity is available to meet the needs of changing patterns of variability and new characteristics of system performance. In future decades, growing storage and demand-side flexibility may help mitigate the concerns for flexibility and attention will turn to multi-day energy concerns, but intraday flexibility remains important during this transition,” according to NERC’s 2023 Electric Reliability Organization (ERO) Reliability Risks Priorities Report.

Today’s tech-enabled DR can play a key role in energy, ancillary services and other flexibility markets. But policymakers must eliminate barriers like unsustainably low pricing and unworkable administrative complexities to unlock the full flexibility of DERs, according to Wood Mackenzie and CPower’s report. To do so, the paper’s authors suggest market reforms such as revising compensation methods for DR resources, fixing capacity accreditation and introducing a price floor for DR.

If you would like to learn more about the research and recommendations from Wood Mackenzie and CPower, you can download a copy of the report here: Ensuring Grid Reliability with DERs.

Kenneth Schisler

Ken leads CPower’s regulatory and government affairs team, having previously served in similar roles at both Vicinity Energy and EnerNOC/Enel. He brings nearly three decades of policy leadership on innovation in clean and advanced energy technologies and collaborates with public officials, regulators, power exchange and system operators, academia and industry peers to unleash the potential of demand-side resources.