Our Blog On-Demand

Content

Knowledge Hub

Knowledge Hub

Contrary to what it may seem, artificial intelligence has not taken over the world, or at least not yet. But you can be excused for believing that AI is in control given the buzz surrounding the technology’s rapidly expanding reach into everything, everywhere – and the world of energy is no exception.

Curious as to how AI views the optimization of distributed energy resources, we asked ChatGPT how AI can be used to optimize DERs. Although ChatGPT summarized available information nicely, the popular, AI-powered natural language processing tool stopped short of telling an energy user how they can optimize their DERs and how they would benefit.

Here are four ways that AI can optimize DERs, according to ChatGPT, along with CPower’s comments on each.

1) Optimizing DERs for Demand Response

ChatGPT says: AI can analyze energy consumption patterns and predict demand fluctuations. By considering factors like weather, time of day and user preferences, AI algorithms can optimize the timing and magnitude of energy generation and storage to match demand. This helps balance supply and demand, reducing peak loads and optimizing the utilization of DERs.

CPower adds: Flexible DERs are ideal for balancing supply and demand and avoiding blackouts or brownouts because they can provide a range of valuable grid services. AI can help customers optimize participation in demand response programs for the good of their organization and the grid. For example, in working across multiple DERs, customer sites and DR programs in real-time, CPower’s EnerWise® Site Optimization helps energy users make money, reduce costs or both by providing grid services that improve reliability.

2) Forecasting Energy

ChatGPT says: AI can leverage historical data, weather patterns and other relevant information to accurately predict future energy generation and consumption. This enables proactive planning and scheduling of DERs, allowing for better integration with the grid and avoiding potential imbalances.

CPower adds: Given that the grid often struggles to maintain balance through challenges, like extreme weather or unexpected changes in supply or demand, AI’s ability to forecast accurately is vital in enabling the fast and flexible grid that we need to power the clean energy transition. Real-time insight into demand is increasingly critical as intermittent renewable generation resources, like solar and wind, account for an ever-larger percentage of the nation’s power mix.

3) Allocating Resources

ChatGPT says: AI can optimize the allocation of energy resources in a distributed network. By considering factors like energy prices, load profiles and system constraints, AI algorithms can determine the most efficient distribution of energy generation, storage and consumption across DERs. This leads to better utilization of available resources and reduces energy waste.

CPower adds: The ability to quickly dispatch DERs in response to shifts in supply or demand is essential to keeping the grid balanced. EnerWise helps maintain balance by automatically allocating each asset at a site to available programs on an hourly basis within the constraints of the hardware or associated permitting/ incentive structures.

4) Participating in Energy Markets and Trading

ChatGPT says: AI can facilitate the participation of DER owners in energy markets. By analyzing market conditions, price signals and regulatory requirements, AI algorithms can guide decision-making for optimal energy trading. This enables DER owners to sell excess energy back to the grid or participate in peer-to-peer energy trading platforms, maximizing their economic benefits.

CPower adds: Combining technology with human know-how remains essential to fully unlocking the value of DERs. For example, while EnerWise efficiently enables DER participation across all available on-bill cost avoidance options and grid services programs, CPower’s experts mitigate revenue complexity and minimize risk for customers by managing changes in more than 60 solutions nationwide, including automated DR solutions.

Looking ahead, ChatGPT noted that optimizing DERs with AI enhances their efficiency, reliability and sustainability while unlocking the full potential of renewable energy sources. At CPower, we would add that we are enabling a flexible, clean and dependable energy future by forming the nation’s largest virtual power plant. In aggregating 6.4 GW of flexible DER capacity across more than 24,000 customer sites, we are helping to create the Customer-Powered Grid™ that will smooth the energy transition while helping energy users earn the most value from their resources.

If you would like to learn more about EnerWise or other ways to optimize your energy assets, call us at 844-276-9371 or visit CPowerEnergy.com/contact to find out how we can help you create and implement a DER strategy that works.

Kyle Harbaugh

Senior VP | Technology

Kyle is a results-driven leader with a track record of delivering high-value products that increase revenue, improve organizational productivity and create large-scale cost savings. A motivated executive who desires to lead fast-paced teams through the creative and challenging process of bringing products to life, from whiteboard to launch.

As Senior Vice President at CPower, he is responsible for Information Technology and Product Management. Previously, he held several technology leadership positions at Constellation Energy. He is also an AEE Certified Energy Manager (CEM) and an AEE Certified Demand Side Management professional (CDSM).

Surging capacity prices present swelling opportunities for commercial, industrial and institutional energy consumers willing to shed load in New York.

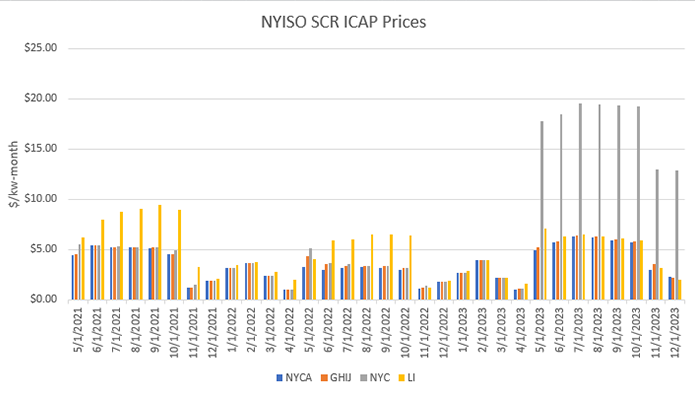

With prices up 300% since 2019, participants in the New York Independent System Operator (NYISO)’s Special Case Resources (SCR) Program can earn revenue while reducing costs—without compromising their operations. Customers can also further boost their financial benefits by capitalizing on demand response programs through the state’s utilities, thereby maximizing revenue streams to lower costs.

Seizing the opportunities available begins with enrolling in the SCR Program. Customers who enroll by the end of the month could begin participating as soon as February and earn three months of revenue in the Winter SCR Program, which spans from November to April. The Summer SCR Program will last from May to October.

Program prices typically average $4 per KW in winter and $6 per KW in summer. At Multiple Intervenors Annual Meeting in October, CPower shared how some industrial customers earn $46,000 per MW of curtailable load for two hours of annual curtailment in SCR.

Customers earn passive revenue in SCR for 10 months out of the year just by being ready to help the grid. Except for a one-hour Summer test commitment in August and a one-hour Winter test commitment in February, customers have not been asked to curtail loads for any grid emergencies in recent years.

Additionally, there are several demand response programs available to C&Is in New York through local utilities, such as the Commercial System Relief Program (CSRP) and Distribution Load Relief Program (DLRP). Customers can reap more revenue by using the same curtailment practices to participate in more than one program because SCR, CSRP and DLRP can be combined, or “stacked.”

The value of demand response programs will likely continue to rise as well. The same factors that have driven prices up in recent years should remain contributors, such as the retirement of electricity-generating power plants amidst increasing demand for electricity due to the electrification of heating and transportation.

Prices will rise further if demand outpaces supply, which can cause brownouts or blackouts. For example, NYISO has warned that a possible 446 MW shortfall threatens grid reliability in New York City for Summer 2025.

If an energy consumer would like to support grid reliability while earning revenue, CPower can project how much revenue a customer could earn through demand response programs based on market conditions. Beginning with the SCR program, the longest-running demand response program in New York, CPower can estimate earnings for any combination of SCR, CSRP and DLRP participation.

If you would like more information, please contact me at 860-371-5518 or at keith.black@cpowerenergy.com.

Keith Black

As CPower’s Regional Vice President and General Manager for the Northeast, Keith has leveraged his unique combination of sales and operations expertise, energy business relationship development, channel development, sales opportunity identification and solutions management, backed by his intrinsic talent for building winning business strategies, to help the company and its customers achieve strong and sustainable financial gains.

In leading CPower’s business and growth strategy for New England and New York, he has helped expand New England’s leading edge of solar, storage, and residential monetization and captured market share in all aspects of the evolving DER landscape in New York. Succeeding in these exciting and cutting-edge DER opportunities has come with a complex array of technologies, controls and partner integrations, as well as a demanding and high touch for his team.

A versatile, high-energy executive, he has extensive experience in leading high-performing teams, at businesses from Fortune 500 organizations through start-ups, and guiding companies to profitable growth. With more than 30 years of experience in the energy industry, he has become a trusted energy advisor to both prospects and customers, enabling them to reduce risk, lower costs and use renewable resources when possible.

The steadily declining costs of solar, wind, batteries, EVs and other key technologies—borne by market forces and big policy initiatives like the Inflation Reduction Act—seem all but certain to transform America’s energy system from one primarily reliant on oil and gas to one that is increasingly electrified and renewable—a process often referred to as the energy transition.

To make this energy transition a smooth one, policymakers are increasingly clamoring for grid flexibility: resources that can quickly respond to rapidly changing conditions to keep the grid in balance. Grid flexibility will continue to come in several forms; but distributed, demand-side solutions—dubbed DERs (distributed energy resources) and VPPs (virtual power plants)—are gathering more and more interest, from town halls and statehouses all the way up to the White House.

And believe it or not, if you are a demand response participant, you are a valuable component of the nation’s fleet of DERs and VPPs.

In a new whitepaper, Mathew Sachs, CPower’s Senior Vice President of Strategic Planning and Business Development, and I break down what is driving this growing need for grid flexibility; what all these new terms mean (in plain English) and how they relate to more-familiar concepts like demand response, capacity and energy; and why this creates significant long-term opportunity for energy users in what we call the Customer-Powered Grid™.

We aimed to keep this short whitepaper informative, constructive to the latest research and policy work, and with your ‘so what?’ in mind. Ultimately, we wrote it to start a conversation with you.

The energy transition is already in motion, but the smoothness or rockiness of this massive shift—compounded by an aging grid and extreme weather—is an open question. It’s a question that CPower wants to work on with customers, policymakers, grid operators, utilities and other key stakeholders to resolve for our common safety and prosperity.

We hope you’ll give the whitepaper a read, and reach out at vpps@cpowerenergymanagment.com with thoughts, comments and questions.

Read our full whitepaper to learn more: Creating the Customer-Powered Grid™: Enabling the Energy Transition with Distributed Energy Resources and Virtual Power Plant.

Ben Pickard

Ben Pickard manages strategic M&A and new growth initiatives for CPower as its Vice President of Corporate Development. Prior, Ben was a Director at National Grid, where he developed and executed strategic applications of venture-backed technology to some of the utility company’s most challenging problems; as well as non-regulated distributed energy investments and partnerships including with EnerNOC, Enbala and Sunrun, and scaled entry into renewable project development via Geronimo Energy.

Earlier roles include infrastructure principal investing with the Macquarie Group, urban climate policy with the Clinton Foundation and distributed energy business creation spanning lighting retrofits, rooftop solar, energy storage, and backup generation. His market and policy analysis on electric utilities has appeared in Greentech Media and the New York Times. Ben is based in New York City and earned an AB magna cum laude in Social Studies from Harvard.

A recent Bloomberg opinion piece contrasted the massive growth in distributed energy resources (DERs), such as rooftop solar and electric vehicles, with sluggish deployment of other clean energy solutions, such as wind power and transmission upgrades, as the world races to reach net zero emissions. While the author was spot on in many respects, the piece failed to account for the role that Virtual Power Plants (VPPs) can play in augmenting the ability of DERs to support the entire grid, and how utility mindsets are shifting.

VPPs aggregate and coordinate distributed energy assets like flexible load assets, rooftop solar, stationary batteries and electric vehicle chargers. This turns these DERs into a reliable block of flexible capacity that can support a variety of grid needs. With VPPs we can harness the rapid expansion of DERs for the benefit of all and continue driving greater decarbonization and energy reliability while we work through longer timelines for other necessary pieces of the new energy economy.

Furthermore, VPPs provide grid benefits at a far lower cost than alternatives. A study released earlier this year found that the net cost to a utility of providing resource adequacy from a VPP is roughly 40% to 60% of the cost of alternatives, which translates into a 60 GW VPP deployment meeting future resource adequacy needs while saving $15 billion to $35 billion.

There is growing public and private support for VPPs. Recently, the day before the opinion piece was published, the U.S. Department of Energy released its Pathways for Commercial Liftoff report for VPPs. The report found that tripling the current scale of VPPs to 80-160 GW by 2030 could expand the U.S. grid’s capacity to reliably support rapid electrification while reducing overall grid costs by $10 billion per year. Not only that, but there are up to $100 Billion in loans available to support VPP deployment.

Utilities can’t afford to ignore these cost savings, and are highly motivated to gain better visibility and control of DERs to maintain the stability of the grid. Therefore, we have many reasons to be optimistic about the rapid growth in VPPs over the next decade. Any forward-looking energy system analysis that doesn’t include VPPs is incomplete.

VPPs can increase the impact of DERs and buy precious time for technologies like wind generation and transmission upgrades to progress. VPPs won’t solve the climate crisis alone, but they are a promising tool to accelerate the clean energy transition. With their flexible capacity, they can bridge the gap created by the sluggish deployment of technologies such as wind power by leveraging existing resources until large-scale renewables can fully deliver.

Michael Smith

Michael Smith is a visionary and innovative leader who brings more than 25 years leadership experience in the energy industry to CPower as its CEO. Michael joined CPower from ForeFront Power, where he was the CEO of the company’s North American solar and energy storage business, responsible for strategy and all business areas across the U.S. and Mexico.

Prior, Michael served as Senior Vice President, Distributed Energy, at Constellation, the retail energy subsidiary of Exelon Corp., where he was responsible for Constellation’s distributed solar, energy efficiency, and energy asset operations businesses across the U.S. He also served as Vice President, Innovation and Strategy Development, for Exelon Generation, and led Constellation Technology Ventures, Exelon’s venture investing organization. Earlier, Michael was Vice President and Assistant General Counsel for Enron Energy Services and a trial lawyer at Bricker & Eckler, LLP.

Photo Credit: New York Independent System Operator

A summer like this year’s could be trouble for New York City in 2025.

Earth’s hottest summer on record lingered into early September in the Big Apple, as the city posted its first official heatwave of the year with three consecutive days of high temperatures exceeding 90 degrees Fahrenheit.

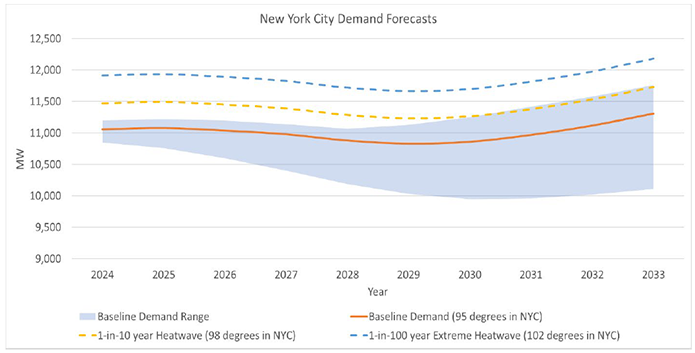

Should the summer two years hence also be especially hot, New York City could grapple with blackouts or brownouts. The New York Independent System Operator (NYISO) has projected a deficit of as much as 446 MW on the peak day during expected weather conditions (95 degrees Fahrenheit).

The baseline summer coincident peak demand forecast for New York City (Zone J) in 2025 increased by 294 MW in the past year, primarily due to the increasing electrification of transportation and buildings, NYISO noted, in identifying a “reliability need” in its Q2 Short-Term Assessment of Reliability (STAR).

Also, NYISO noted, as of May 1, 2023, 1,027 MW of affected peak generation plants have deactivated or limited their operations under the New York State Department of Environmental Conservation’s (DEC’s) “Peaker Rule,” which provides for a phased reduction in emission limits, in 2023 and 2025, during the ozone season (May 1-September 30). An additional 590 MW of peakers are expected to become unavailable for summer 2025, all of which are in New York City, thereby resulting in a total unavailability of 1,617 MW of peaker generation capability.

In terms of possible relief, the DEC regulations include a provision to allow an affected generator to continue to operate for up to two years, with a possible further two-year extension, after the compliance deadline if the generator is designated by the NYISO or by the local transmission owner as needed to resolve a reliability need until a permanent solution is in place. So, at least some of the peaker generation capacity that is currently expected to be unavailable could instead remain available through a two-year extension, and an additional two years thereafter if an additional extension were granted, thus perhaps mitigating the near-term reliability need for New York City.

Also, “The New York City transmission security margin is expected to improve in 2026 if the Champlain Hudson Power Express (CHPE) connection from Hydro Quebec to New York City enters service on schedule in spring 2026, but the margin gradually erodes through time thereafter as expected demand for electricity grows,” according to NYISO’s STAR report.

Looking beyond 2025, NYISO warned that the forecasted reliability margins within New York City may not be sufficient if the opening of the CHPE, which will deliver 1,250 MW of renewable power into the New York metro area, is significantly delayed. Reliability margins also may not be sufficient if additional power plants become unavailable or demand significantly exceeds current forecasts, NYISO noted.

“Without the CHPE project in service or other offsetting changes or solutions, the reliability margins continue to be deficient for the ten-year planning horizon. In addition, while CHPE is expected to contribute to reliability in the summer, the facility is not expected to provide any capacity in the winter,” according to NYISO.

In the meantime, Con Edison, as the Responsible Transmission Owner, is solely responsible for developing a regulated solution to the near-term reliability need that NYISO has identified for summer 2025. NYISO has also solicited market-based solutions.

Per NYISO: “If proposed regulated or market-based solutions are not viable or sufficient to meet the identified reliability need, interim solutions must be in place to keep the grid reliable. One potential outcome could include relying on generators that are subject to the DEC’s Peaker Rule to remain in operation until a permanent solution is in place.”

A reliability need could also drive up capacity prices for New York City in summer 2025, if the possible conditions that NYISO has warned could be created by a combination of escalating demand and the retirement of generators come to fruition.

As this is an emerging and evolving situation, CPower will follow it closely. If you have immediate questions or would like information in the meantime, please contact us online or at 844-276-9371.

Keith Black

As CPower’s Regional Vice President and General Manager for the Northeast, Keith has leveraged his unique combination of sales and operations expertise, energy business relationship development, channel development, sales opportunity identification and solutions management, backed by his intrinsic talent for building winning business strategies, to help the company and its customers achieve strong and sustainable financial gains.

In leading CPower’s business and growth strategy for New England and New York, he has helped in expanding New England’s leading edge of solar, storage, and residential monetization and capturing market share in all aspects of the evolving DER landscape in New York. Succeeding in these exciting and cutting-edge DER opportunities has come with a complex array of technologies, controls and partner integrations, as well as a demanding and high touch for his team.

A versatile, high-energy executive, he has extensive experience in leading high-performing teams, at businesses from Fortune 500 organizations through start-ups, and guiding companies to profitable growth. With more than 30 years of experience in the energy industry, he has become a trusted energy advisor to both prospects and customers, enabling them to reduce risk, lower costs and use renewable resources when possible.

Recently released research shows that mounting reliability risks make demand response (DR) increasingly important as the grid transforms. An aging grid dominated by solar and wind power, battered by storms and fires and struggling to supply new needs like EVs and electric heat pumps, needs the flexibility that DR provides.

“Paradigms for the generation and delivery of electricity are evolving away from a centralized network with predictable power flows toward a distributed and dynamic grid, creating many challenges and opportunities for utilities and other entities involved in the electricity value chain,” according to a new report about grid reliability challenges published by Wood Mackenzie and CPower. “At the heart of these changes is how reliability is assured when the grid is most stressed, like when customer demand peaks during heat waves, natural disasters or extreme weather events.”

Based on insights from analysts at Wood Mackenzie, the report shows that DR programs have proven to be an important resource for ensuring reliability amidst grid challenges in the past, but that such support may not always be available. Analysts explain how low capacity pricing and cumbersome rules on DR participation threaten the future of DR programs and the ability to use distributed energy resources (DERs) to help the grid.

If energy users were to stop participating in DR, analysts note, utilities and grid operators would lose their most reliable resource during emergencies as well as a resource that can provide much-needed flexibility year-round.

Such year-round flexibility is imperative because the proliferation of intermittent renewable resources, the retirement of fossil-fuel generators, and the electrification of vehicles, heating and other key energy needs are straining the grid, making it difficult to balance supply and demand.

“As the grid’s needs continue to evolve, particularly with the growth of other types of distributed energy resources (DERs) besides DR, such as solar generation, battery storage, and electric vehicles, DR is an increasingly important part of the resource stack in energy markets,” according to the report from Wood Mackenzie and CPower.

The North American Reliability Corp. recently issued a similar warning about the importance of flexibility in mitigating risks to grid reliability.

“System operators and planners should ensure that sufficiently flexible ramping/balancing capacity is available to meet the needs of changing patterns of variability and new characteristics of system performance. In future decades, growing storage and demand-side flexibility may help mitigate the concerns for flexibility and attention will turn to multi-day energy concerns, but intraday flexibility remains important during this transition,” according to NERC’s 2023 Electric Reliability Organization (ERO) Reliability Risks Priorities Report.

Today’s tech-enabled DR can play a key role in energy, ancillary services and other flexibility markets. But policymakers must eliminate barriers like unsustainably low pricing and unworkable administrative complexities to unlock the full flexibility of DERs, according to Wood Mackenzie and CPower’s report. To do so, the paper’s authors suggest market reforms such as revising compensation methods for DR resources, fixing capacity accreditation and introducing a price floor for DR.

If you would like to learn more about the research and recommendations from Wood Mackenzie and CPower, you can download a copy of the report here: Ensuring Grid Reliability with DERs.

Kenneth Schisler

Ken leads CPower’s regulatory and government affairs team, having previously served in similar roles at both Vicinity Energy and EnerNOC/Enel. He brings nearly three decades of policy leadership on innovation in clean and advanced energy technologies and collaborates with public officials, regulators, power exchange and system operators, academia and industry peers to unleash the potential of demand-side resources.

Securing funding and structuring a contract may be the hardest parts of developing new distributed energy resource (DER) projects.

Even with the Inflation Reduction Act set to catalyze billions of dollars of investment in renewable energy projects, financial viability – or the perceived lack thereof – has become a bigger barrier to deployment than technology. In a recent survey, microgrid developers ranked funding approval as the most challenging project stage, followed by project sizing and capturing upside monetization opportunities.

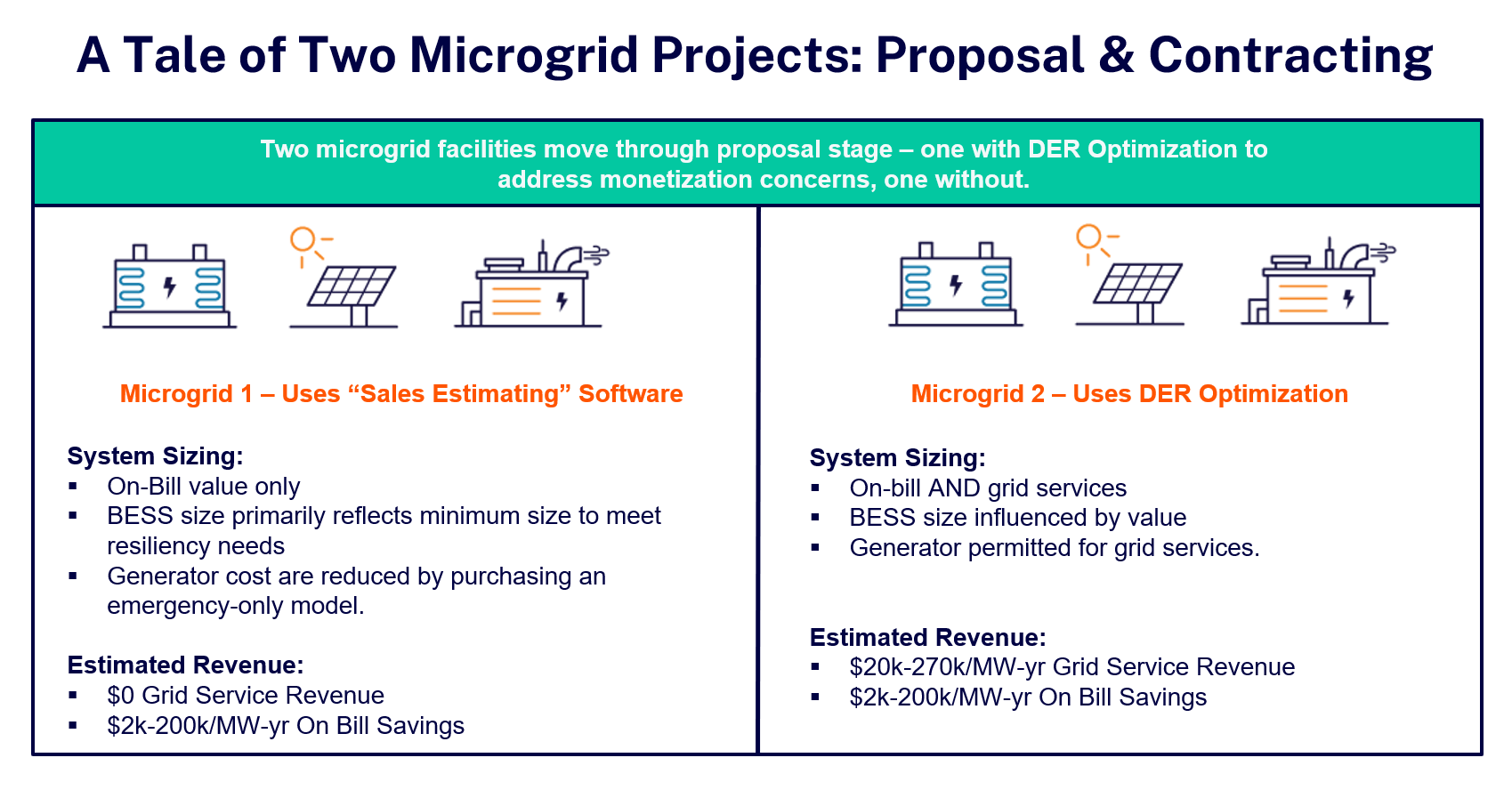

Getting DER projects greenlighted can be challenging because proformas often do not reflect the full value of the investment, or financiers discount project return projections because the tools utilized to estimate returns are not employed to realize value in live operations. Many times, DER owners and developers overlook opportunities to earn grid services revenue or reduce costs or do not realize projects can recognize both. Full visibility into a project’s value stack is essential to both funding and contracting DER projects.

DERs are any assets that use, store, discharge, or generate electricity, like on-site generation, energy storage, electric vehicle chargers, solar panels, or load curtailment. Energy users are installing more DERs but only when they can make the projects pencil financially by connecting them to sufficient value.

Optimizing DERs involves choosing between all available value streams in each day or hour based on which would be most lucrative, and stream values can differ substantially depending on the details of the site and project. Successful DER projects justify investments by creating proformas that account for all possible revenue and savings based on the site and asset constraints and the available value opportunities.

If you are a DER owner/operator trying to fund a project, optimization starts at the proposal stage to enable an accurate view of all the on-bill and grid services value and ensure the asset is sized to optimize that value. Beginning at the proposal stage helps in sizing projects correctly and making even marginal projects pencil by considering all available value streams. Calculating the returns that a project would yield and demonstrating where they will come from and how they will be realized improves your chances of securing financing.

In structuring your proposal and contracting structure for behind-the-meter projects, identifying the type of value and timing of realization of that value can be key to identifying creative contracting structures with the utility-account-holder. For example, monthly or annual lease payments from the utility-account-holder may be possible where on-bill value is the driving value source, or a split of grid service revenue may be a more reasonable approach where grid services are key to the project’s financial health. Identifying and executing on the ideal contract structures stems from a high degree of confidence in what sources of value will be realized post-contract.

Overlooking opportunities at the outset can prevent a customer from accepting your proposal or limit the project’s eventual returns. Consider the returns from two DER projects in ISO New England (ISONE) as examples. One project used DER optimization but the other did not.

This customer developed a microgrid based on the energy user’s resiliency requirements and demand charge management expectations only. Although the project was approved and eventually met the customer’s requirements and expectations, it could have been more rewarding with a larger battery that would have provided incremental resiliency. The customer ultimately left money on the table because it did not consider the full stack of available value streams, and participation in other available programs such as ISONE capacity programs and Connected Solutions was suboptimal.

The participation of the generator was also limited by the lack of DER optimization. The customer invested in a generator that was permitted for emergency-use only and was specifically to address their resiliency requirements. With a DER optimization view and a full picture of all sources of potential value, the customer may have found that they could have contracted instead for a non-emergency-only generator and used that generator for both the resiliency requirements and to earn revenue by providing grid services. The revenue earned from grid services would have more than offset the added cost of a properly permitted non-emergency generator.

Conversely, another customer and benefited more from their project by considering all value streams and the full potential of DER optimization when designing, funding, and contracting their project. Beginning at the conceptual stage, they iterated on key aspects of the battery for a retrofit to a solar array in the PJM area.

Duration was one of the elements evaluated when modelling potential grid services values in PJM. After considering several duration iterations, the project developer decided that a one-hour battery would provide better returns than a multi-hour battery based on anticipated value streams, cost considerations, and warranty constraints. As a result of determining the right size for the battery upfront, the customer increased its projected return and is now set up to take advantage of all revenue streams.

Such potential to benefit from multiple revenue streams is always helpful given that the financiers of DER projects want as many revenue sources as possible. Diversification of project revenue sources and greater returns increase the chances of securing funding.

Securing funding for DER projects may be hard, but DER optimization makes it easier. Considering and pursuing all value streams from the beginning helps projects pencil and increases returns.

If you would like to learn more about why energy users and DER portfolio owners are turning to optimization solutions that evaluate site-specific performance data and energy market options to create project proformas that get projects greenlighted, watch our presentation from the 2023 Microgrid Knowledge conference: The Greatest Bang for Your Buck: Getting Projects Contracted and Funded with DER-Asset Optimization.

You can also call us at 844-276-9371 or visit CPowerEnergy.com/contact to find out how our EnerWise™ Site Optimization solution makes estimating and delivering the value of DER projects easier.

Rob Windle

As CPower’s Vice President, Strategy Planning & Business Development, Rob keeps a curious eye locked on the future. He leads the development and management of innovative solutions that support the proliferation and monetization of distributed energy resources (DERs) such as decentralized generation and energy storage. He has more than 20 years of experience in product development, direct and channel sales development, and management across the Energy, Enterprise Software, and Automation Controls industries. A Certified Energy Manager®, he holds a Bachelor of Science degree in industrial engineering from the University of Cincinnati and lives in Atlanta, Georgia.

Credit: Renewable Energy World (A rooftop solar system)

*This article first appeared on Renewable Energy World on July 28, 2023. Click here to view.

Strained by the double burden of increased demand and more frequent extreme weather events, our grid struggles to provide reliable electricity in many areas of the country – and the challenge will only intensify in the years to come.

The related search for reliable expanded grid capacity has generated buzz about a relatively new term for a solution that has been around for some time: Virtual Power Plants (VPPs). These networks aggregate electricity from customer-owned distributed energy resources (DERs) such as batteries, building management systems, smart home devices, and electric vehicle chargers, then use these assets to help keep the grid balanced by reducing or shifting energy use.

While the term VPP is relatively new, large energy users have been called on to reduce power consumption during times of peak demand for decades. What’s new is the technology advancements enabling greater sophistication and automation, and the exponentially growing base of DERs that can be tapped to expand grid capacity without costly new plants or infrastructure projects. Anything connected to the grid that generates or consumes energy and can respond to a signal can efficiently support grid reliability through VPPs: rooftop solar, smart thermostats, smart water heaters, EV chargers, and more.

A growing body of research has shown that VPPs provide resource adequacy and environmental benefits at a significantly lower price point than other options, such as gas peaker plants and grid-scale battery storage. For instance, a recent Brattle Group study, “Real Reliability: The Value of Virtual Power,” found numerous economic and societal benefits from VPPs. Most notably, the study found that the net cost of VPPs is 40% lower than that of a gas peaker plant, and 60% less than a utility-scale battery storage system. According to the study, VPPs ultimately provide cost savings of $15 billion to $35 billion compared to the alternatives.

Meanwhile, customers enjoy an additional $20 billion in societal benefits over 10 years: faster grid connection, decreased greenhouse gas emissions, increased use of renewable energy, expanded grid capacity for electrification, and greater customer satisfaction. In fact, the study showed that VPPs were the only resource for which societal benefits exceeded cost.

While the benefits of VPPs may seem abstract to the average energy user, VPPs have a very real impact on maintaining energy reliability and customer well-being as extreme weather events become more frequent and severe. For example, a CPower VPP provided more than 50 GWh of load relief during Winter Storm Elliott last December, an amount of energy equivalent to the daily energy use of more than 1.7 million homes, helping grid operators to prevent further blackouts as they managed the impacts of unplanned natural gas generation failures.

VPPs are ready to conquer grid capacity and resiliency challenges faster, more sustainably, and more cost-effectively than ever before – but only if our regulatory frameworks let them.

In many areas, VPP adoption has been hindered by power market regulations that preceded the rise of VPP-compatible technologies. Updating these regulations and resolving questions about how to adequately value these resources and incorporate them into regulatory frameworks would allow customers to play a more active role in cost-effectively managing and optimizing the use of energy resources for greater energy resilience.

What we need now is for regulators and stakeholders to work together on policy, regulatory, and market-based solutions to accelerate the large-scale adoption of VPPs. Regulators can consider modifications to market participation rules that recognize the capacity benefits that VPPs provide to the grid.

One step could be to make it easier for customers to share their data, needed to estimate earnings, monitor performance and finalize payments, with VPP providers. Other solutions include easing aggregation limitations and widening eligibility requirements to reflect the wider spectrum of grid-connected assets available today and updating pricing structures and compensation mechanisms to adequately incentivize VPPs for both DER-owning customers and utilities. Such collaboration between regulators, stakeholders, and customers is the key to achieving a more distributed, flexible, cost-effective, and resilient energy grid.

As the demands of electrification and extreme weather strain the grid, we don’t have to wait to build capacity: we already have the technology and resources to deploy 60 GW of VPPs by 2030, which would meet future resource adequacy needs. VPPs are already helping utilities power through months of heat waves and increased demand—and they could do much more. Regulators can unlock the full potential of VPPs to reduce costs and greenhouse gas emissions while ensuring grid stability when we need it most.

Mathew Sachs is Senior Vice President of Strategic Planning and Business Development at CPower Energy, a national DER monetization and Virtual Power Plant provider.

New CPower CEO Mike Smith may have backed into the energy industry, but he has since helped move it forward. In his more than 25 years in the sector, he has developed a reputation for driving growth and delivering innovation at some of energy’s leading companies.

Now at the helm of the nation’s largest provider of distributed energy resource (DER) monetization opportunities and virtual power plants, Smith is set to guide CPower, its customers and the grid into the future.

“I am thrilled to be joining the team at CPower, a company whose work is essential in ensuring a successful and reliable new energy economy,” Smith stated when CPower announced that he would be CEO following the retirement of previous CEO John Horton.

“The company has a strong foundation and is well-positioned to capitalize on the tremendous opportunities in the rapidly evolving distributed energy space,” Smith continued.

Most recently the CEO of solar and battery storage developer ForeFront Power, Smith discussed his career as a DER and utility leader, his vision of the industry’s future and his expectations for how CPower and its customers will help enable the transition in an interview with The Current.

The Current: How did you get into the energy industry? And why?

Smith: I got into the energy industry very much by accident. I was practicing law in a law firm in Columbus, Ohio, minding my own business as a trial lawyer, and I was in this period of career growth that I call improv. What I mean by improv is that the answer to every question is, “Yes.”

A partner came up to me one day and said, “We’ve got this new client and they’re in a dispute over natural gas trading in the state of West Virginia. Two of their employees are being deposed in this dispute and they need a lawyer to sit with them during the deposition. Would you do it?” And I said, “Sure. Why not?”

It turns out the client was a then little-known company from Houston called Enron. The two guys who were in this dispute weren’t accused of anything, but they needed to be deposed. So, I sat with them in their depositions.

Then Enron, which had a small office in Columbus, decided they wanted to have permanent counsel in the area, and as part of that wanted to have a lawyer be seconded to their Ohio office to learn natural gas trading. Once again, the law firm came to me and said, “Do you want to work with this natural gas trading company called Enron to learn how to do natural gas contracts?” And, again, I said, “Sure. Why not?” So, I ended up working for Enron as a secondment.

The Current: How has the industry evolved during your career?

Smith: In some ways, it hasn’t changed at all. What I mean by that is, yes, we brought in retail choice, and I saw that happen. But the physicality of the electric grid hasn’t changed a bit. We still make most of our electrons in large central-station power generation and put them into a copper wire and sell those electrons to end-use customers.

What we’re seeing now though, is that the physicality is changing. More and more customers are generating more of their energy instead of buying it from the grid. Also, more and more customers are seeking to reduce energy consumption through energy efficiency programs and many more customers are installing energy storage. So, we’re seeing monumental change in the physicality of the grid and how customers interact with the grid, which I think is what’s exciting about what we’re doing here at CPower.

The Current: What attracted you to the role of CEO at CPower?

Smith: We’ve got a whole industry that’s doing things like building on-site solar generation, building on-site storage and doing other DER projects. That’s all going to continue to happen. CPower sits at this unique position in between those end-use customers that have responsive assets, whether they be load, generation or storage, and the grid, which needs access to those responsive assets. We provide a unique and valuable service sitting in the middle. That’s what attracted me to CPower—being at the number one player, with the best team, in the most exciting piece of the energy industry.

The Current: What do you see as some of the most exciting innovations happening in the energy industry to meet the changing needs and demands of customers and the grid?

Smith: The deployment of energy storage is a big piece of that continued penetration of on-site generation assets, particularly solar but also fuel cells. Again, it’s this theme of more and more customers taking control of their energy production and consumption. This is the most exciting thing. Then, of course, we can use CPower to optimize those assets and provide essential grid reliability services in times when the grids are going to be continually more and more stressed with extreme weather events.

The Current: What does the future of the grid look like?

Smith: It’s going to be an evolution. We’re going to continue to have central-station generation, which will be a combination of nuclear and some kind of fossil fleet, including natural gas, and grid-connected renewables. But more and more, the grid will continue to be decentralized and more resources pushed to the edges of the grid in terms of customer-site generation and storage. That trend will continue for the foreseeable future.

The Current: What role will energy users play in the future?

Smith: Energy users will continue to become a much larger part of the equation as they have opportunities to install on-site generation and storage. We also can’t forget about the fact that the fueling of vehicular fleets will move more to the customer as more and more of our customers electrify the fleets that they own. Customers who shop at their places of business or work at their places of business will be seeking to charge their EVs as well. That’s a whole new piece of the infrastructure puzzle that adds demand and that flexibility needs to be well-managed to have a well-functioning grid.

Also, customers who are controlling their energy costs or are on a sustainability journey are becoming more sensitive to what they’re paying and the source of the energy they’re using. That’s driving a lot of the things that CPower can get involved in both in terms of not just responsive load assets, but also optimizing on-site generation and storage.

The Current: What are your biggest priorities for CPower?

Smith: First and foremost, our focus on the customer is a core company value, and that won’t change. CPower will also continue to do the great things we’ve done to bring the company to where it is now. That is to protect, preserve and expand our legacy capacity demand response business where we can, and then build additional flexibility programs that allow us to provide more DER or asset optimization services for more customers nationwide.

The Current: What else do you want customers to know about you and CPower?

Smith: Customers need to know that we can give them valuable ways to monetize their assets. Every customer that has a building has a load asset that has value. We can help them determine that value and extract that value from the market. And, if you add on to that on-site generation assets or storage assets, that provides even more untapped opportunity for these customers.

To learn more about DER monetization and how CPower can help you monetize your energy assets while supporting sustainability, improving grid reliability and increasing energy resiliency, call us at 844-276-9371 or visit CPowerEnergy.com/contact.

Mike Smith

Mike Smith is a visionary and innovative leader who brings more than 25 years leadership experience in the energy industry to CPower as its CEO. Mike joined CPower from ForeFront Power, where he was the CEO of the company’s North American solar and energy storage business, responsible for strategy and all business areas across the U.S. and Mexico.

Prior, Mike served as Senior Vice President, Distributed Energy, at Constellation, the retail energy subsidiary of Exelon Corp., where he was responsible for Constellation’s distributed solar, energy efficiency, and energy asset operations businesses across the U.S. He also served as Vice President, Innovation and Strategy Development, for Exelon Generation, and led Constellation Technology Ventures, Exelon’s venture investing organization. Earlier, Mike was Vice President and Assistant General Counsel for Enron Energy Services and a trial lawyer at Bricker & Eckler, LLP.

Connecticut is at the forefront of the energy storage movement and CPower leads the way in helping customers deploy more batteries.

The state recently recognized CPower as an early adopter of energy storage solutions by giving the company a Green Bank Award. CPower was one of the first Eligible Contractors to submit a storage project to Energy Storage Solutions, which offers incentives to reduce the cost of energy storage systems. The program is overseen by the Public Utilities Regulatory Authority (PURA), is paid for by electric ratepayers, and is administered by the Green Bank, Eversource and United Illuminating.

CPower was awarded almost 40 MW of battery systems for the first tranche of the program, in which a total of 50 MW was awarded. The company has also submitted additional projects for the next stage of the program to help the state meet its energy storage goals.

The second tranche of awards will include up to 100 MW in projects and is accepting applications today. Recognizing the benefits that energy storage has provided for customers and the state, CPower supports efforts to accelerate the awarding of incentives in the next stage of the Energy Storage Solutions program so that batteries spread across Connecticut faster.

Incentives in New England states such as Connecticut help organizations reach their sustainability goals while improving facility resiliency and decreasing operations, maintenance and energy expenses. For example, Connecticut’s Energy Storage Solutions program offers organizations upfront incentives for installed battery capacity plus performance-based incentives for dispatching the battery capacity to the grid. In doing so, the statewide battery program fosters a more reliable and resilient electric distribution system, especially for vulnerable communities.

Commercial and industrial building owners can save money through the Energy Solutions Program by using batteries to reduce peak demand management charges. Incentives for C&I building owners include:

As an example, a healthcare facility in Connecticut projected $186,000 in on-bill savings in the first year after installing a battery through CPower. Importantly, these on-bill savings are in addition to the performance incentives paid by utilities and grid operators.

CPower has the largest dollar amount of C&I projects in the Energy Storage Solutions queue in Connecticut. It also leads all contractors in C&I projects underway. All told, CPower has more than 100 MW of C&I battery projects in the design phase across New England.

CPower provides OnDemand Energy Storage solutions for customers in Connecticut, Rhode Island and Massachusetts. In working with CPower as an energy-storage-as-a-service (ESaaS) provider, New England facilities can reap energy storage benefits such as on-bill savings and grid services revenue without the upfront costs or responsibilities of ownership.

CPower will design, install and operate a battery on an organization’s behalf — and cover all upfront costs, thereby allowing C&I customers to avoid the interconnection engineering, capital investment and O&M responsibilities associated with a battery project.

Energy Storage Solutions projects done by CPower provide customers in Connecticut with a path to more affordable, resilient and greener energy.

To learn more about CPower’s energy storage services, call us at 844-276-9371 or visit CPowerEnergy.com/contact.

Philip Ciulla

As Account Executive for New England for CPower, customers and team members alike look to Phil as a knowledgeable and trusted partner. For Phil, the feeling is definitely mutual. Born and raised in California, Phil now lives in New England.